Dan Popescu for Goldbroker.com

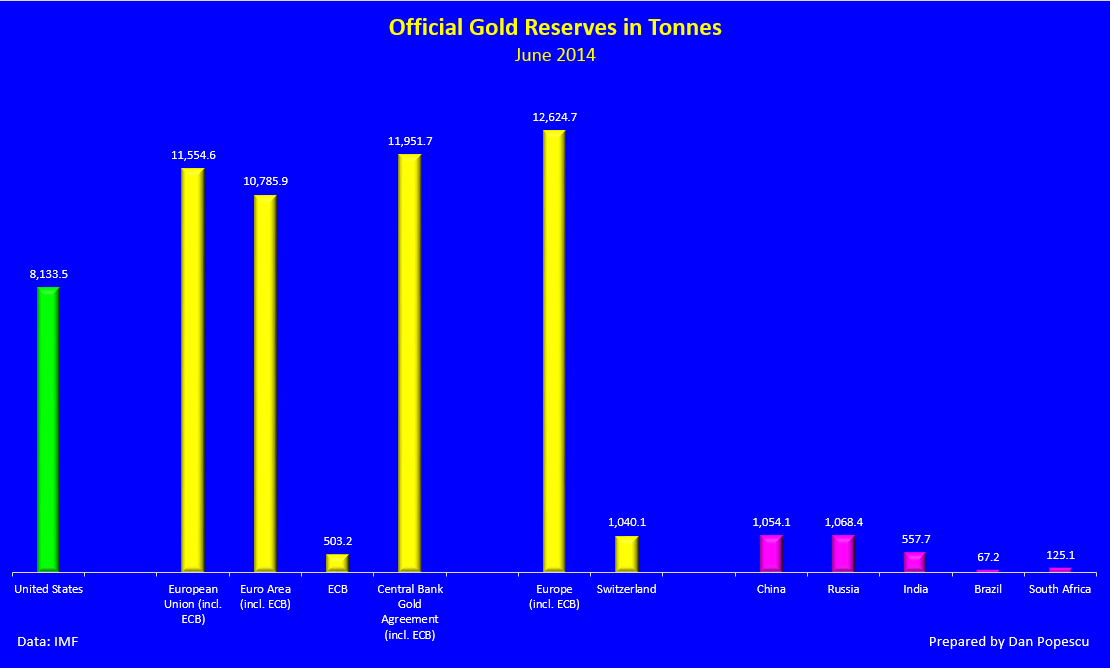

The European Union (EU) is an economic and political union of 28 European member States. The Eurozone, officially called the Euro Area (EA), is an economic and monetary union (EMU) of 18 European Union member States that have adopted the euro (€ or EUR) as their common currency and sole legal tender. The Euro Area holds most of the official gold reserves in continental Europe. As we can see in chart #1, the Euro Area holds 85.4% of all the continental Europe’s gold reserves (excluding European ex-Soviet Union countries but including the Baltic Countries). It also represents 93.3% of all the European Union’s gold reserves and 90.2% of the Central Bank Gold Agreement (CBGA) countries’ gold reserves. It is evident then that the Euro Area controls most of the European official gold reserves.

Graph #1: Official Gold Reserves in Tonnes

United States vs Europe vs BRICS countries

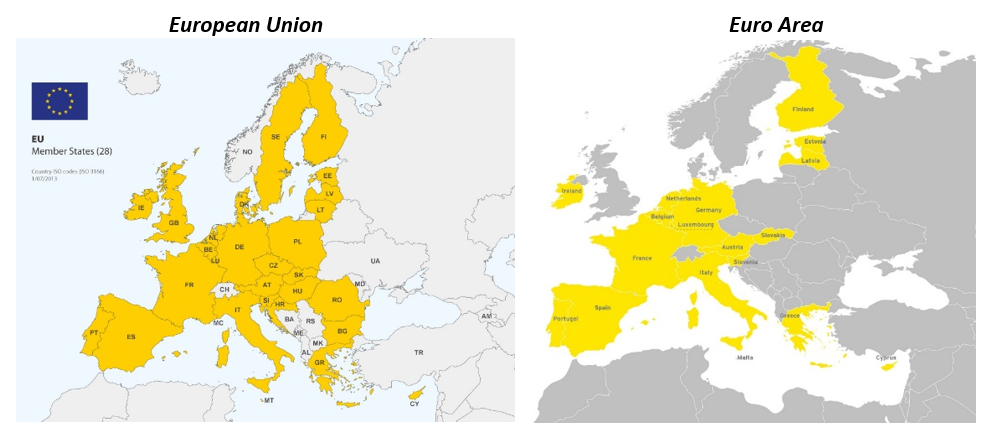

The two maps below show that the Euro Area comprises most of the European Union countries, and there is very strong indication that most of the recent members from Eastern Europe wish and will join in time the Euro Area.

The major European central banks signed the Central Bank Gold Agreement (CBGA) in 1999, limiting the amount of gold that signatories can collectively sell in any one year. On May 19, 2014, the Euro Area, Sweden, Switzerland central banks and the European Central Bank (ECB) announced the fourth Central Bank Gold Agreement, that clarifies their intentions with respect to their gold holdings by stating, “Gold remains an important element of global monetary reserves.”(1) This agreement, which applies as of September 27, 2014, will last for five years and the signatories have stated that they currently do not have any plans to sell significant amounts of gold.

No one argues that the founders of the Eurozone intended to create a monetary regime that in some respects resembles the Gold Standard ; yet, amazingly, that is what they achieved. Nobel Economics Laureate Robert Mundell, who worked to lay the foundation for the euro, the common european currency, said, “… define the euro in terms of gold, and make euros redeemable in the yellow metal. If so, the euro’s staying power and eventual rise to pre-eminence among currencies would almost be assured. Strong money that is stable in value is much demanded as a ticket used to exchange real wealth, and if the euro had a stable definition, it would quickly trump the dollar.”(2)

So many people believe the European Union project started only in the ‘90s, but two great visionaries started the original work long before that, right after the Second World War: France’s president General Charles de Gaulle and Germany’s chancellor Konrad Adenauer. In 1959 in Strasbourg, France, General de Gaulle was expressing his vision of Europe's future when he said, “Yes, it is Europe, from the Atlantic to the Urals, it is Europe, it is the whole of Europe that will decide the fate of the world.”(3) I still remember my parents, listening to the speech on the radio, behind the Iron Curtain in Romania, saying that it will never happen. For them it was a great dream but an impossible one. General de Gaulle’s vision has become a reality, but it took 40 years and the work is still not over. Europe is still a work in progress.

General de Gaulle also stated in a 1965 speech that:

“The time has come to establish the international monetary system on an unquestionable basis that does not bear the stamp of any country in particular. On which basis? Truly, it is hard to imagine that it could be any other standard than gold.

Yes, gold whose nature does not alter, which may be formed equally into ingots, bars or coins; which has no nationality and which has, eternally and universally, been regarded as the unalterable currency par excellence.”(4)

He is also at the origin of the collapse of the London Gold Pool, when he demanded gold in exchange for US dollars. Soon after, other countries followed France and, when even the United Kingdom showed up to exchange their US dollars for gold, then-US president Richard Nixon chose to close the gold window and delinked the dollar from gold. It was the end of the gold exchange standard and the beginning of the US dollar standard.

This year, Mario Draghi, the ECB president, surprised many, including myself, when he stated without hesitation, “For central banks this [gold] is a reserve of safety, it’s viewed by the country as such. In the case of non-dollar countries it gives them value protection against fluctuations with the dollar.”(5) It was a very direct, unambiguous and strong pro-gold statement, and it came from a central banker. He was responding to a question without hesitation, which contrasted with US Federal Reserve chairman Ben Bernanke’s uneasiness when answering similar questions on gold.

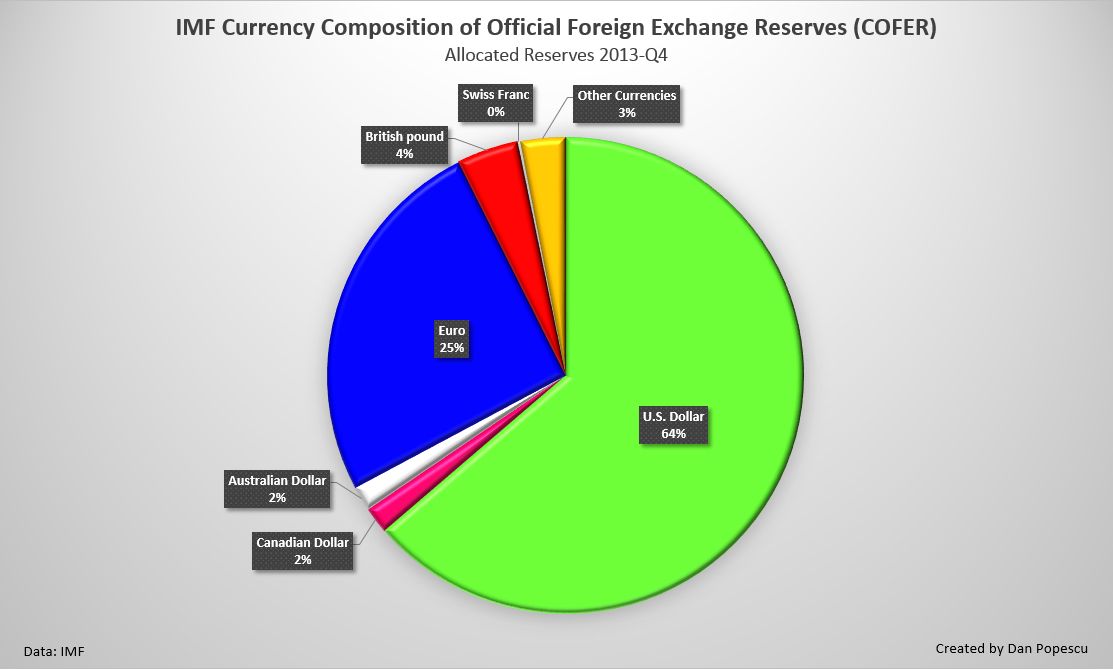

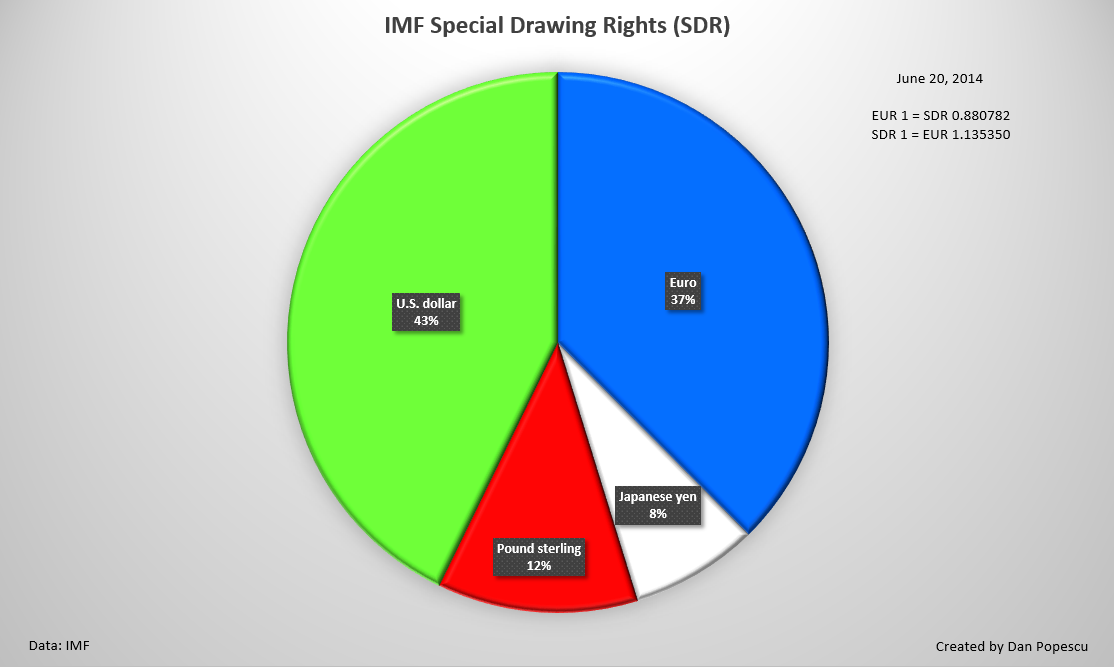

The euro is an international currency (graph #1) and, more specifically, a reserve currency, and is part of the IMF’s Special Drawing Rights (SDR) (graph #2). According to a report by The Centre for European Policy Studies, “Macroeconomic instability and, more importantly, the perceived increasing risk of a breakup of the monetary union, would significantly affect the demand for alternative reserve assets by central banks, namely dollars and gold.”(6) “In the present reserve system, the dollar is the dominant currency while the euro plays a second-fiddle role, without ever substantially threatening the supremacy of the dollar.”(6) At least for now and in the short-term, but that, I guarantee you, will change. As you can see in charts #2 and #3, after the US dollar, the euro is the largest component of official foreign exchange reserves. However, in the composition of the Special Drawing Rights (SDR), it is almost equal to the US dollar with 37% versus 43% for the US.

Graph #2: IMF Currency Composition of Official Foreign Exchange Reserves

Graph #3: IMF’s Special Drawing Rights (SDR)

Gold and the euro seem to move together in the same direction as an alternative to the US dollar. However, make no mistake: gold is as much anti-euro as it is an anti-dollar. In the short term, when money runs out of the dollar, it can go into the euro, gold, or both. However, in a major global monetary crisis of fiat money, as we are now in, gold outperforms against all fiat currencies, not just the US dollar, and that includes also the euro. Gold is the only financial asset with no counterparty risk. In the long term gold has outperformed all paper currencies, including the euro and the dollar. Gold is hard money and money “in extremis”.

Graph #4: Gold price in Euros

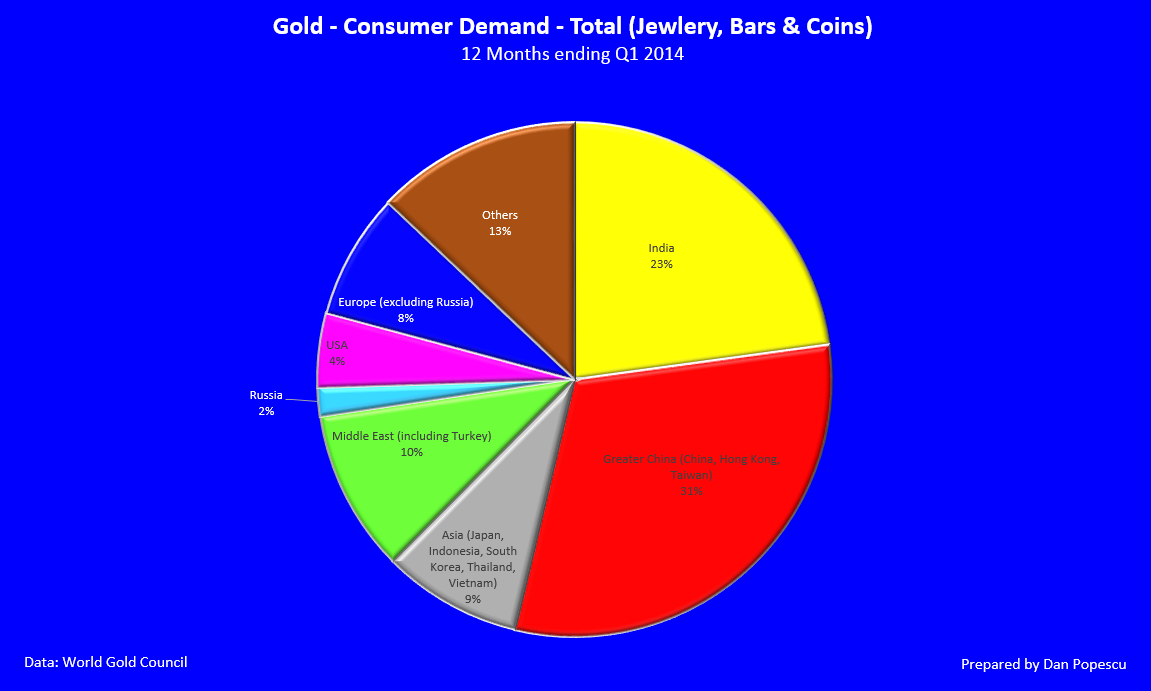

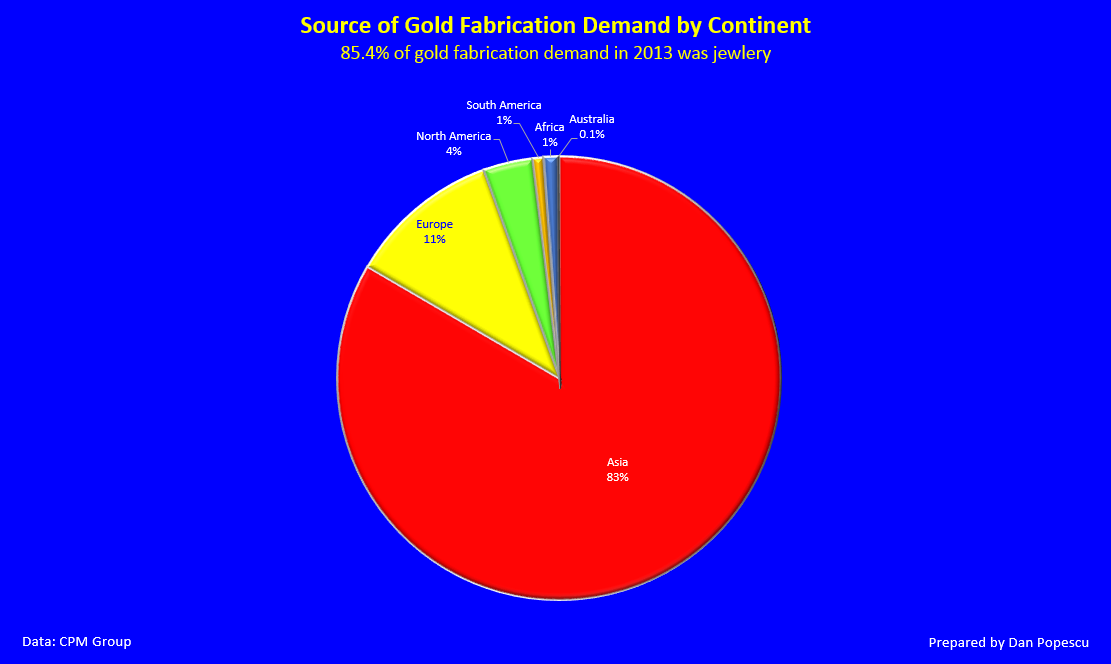

As we can see in graph #5, consumer demand for gold in Europe is twice that of the United States, even if it is still far from that of India and China. In graph #6, we can observe also that fabrication demand (which is mostly jewelry, 85.4%) is very high in Europe. Even though eight times less than the Asian demand, it still is almost three times more than the North American demand.

Graph #5: Total Consumer Demand (Jewelry, Bars and Coins)

Graph #6: Source of Gold Fabrication Demand by Continent

Even after all the attacks, mostly from Anglo-Saxon educated economic academia who consider gold a relic of the past that has no “fundamental value”, gold consumption demand in Europe is still very high. One of the largest countries in Europe, Germany, is among the ten largest consumers per capita of gold in the world, while the US is not even one of the twenty largest consumers. It is true that gold ownership was not restricted in Europe as it was in the United States for 40 years (1933-1973), except for the short war period. Gold was restricted in Europe only during the Second World War. Hitler said, "Gold in the hands of the people is an enemy of the state."(7) Gold private ownership was banned by Hitler during the war, and continued to be banned after the war in Eastern Europe and the Soviet Union, but it became free to be purchased in Western Europe. Constant threats of inflation, high taxation, political instability and the Cold War encouraged Europeans to buy gold, while in North America prosperity and political stability made North Americans ignore gold until the inflationary years of the ‘70s.

Graph #7: Gold Consumption per Capita

During the ‘90s, European central banks followed, some would say under pressure, the leadership of the US war against gold and sold part of their gold reserves, the largest seller being the United Kingdom, creating what has become known as the “Brown bottom”. It takes its name after Gordon Brown, then UK Chancellor of the Exchequer, who later became Prime Minister, who sold more than half of Britain’s precious gold bullion at the bottom of the market just before the price of gold started a decade of almost uninterrupted growth. Gordon Brown’s government sold 395 tonnes of UK gold, about 58% of UK’s total reserves of 715 tonnes.

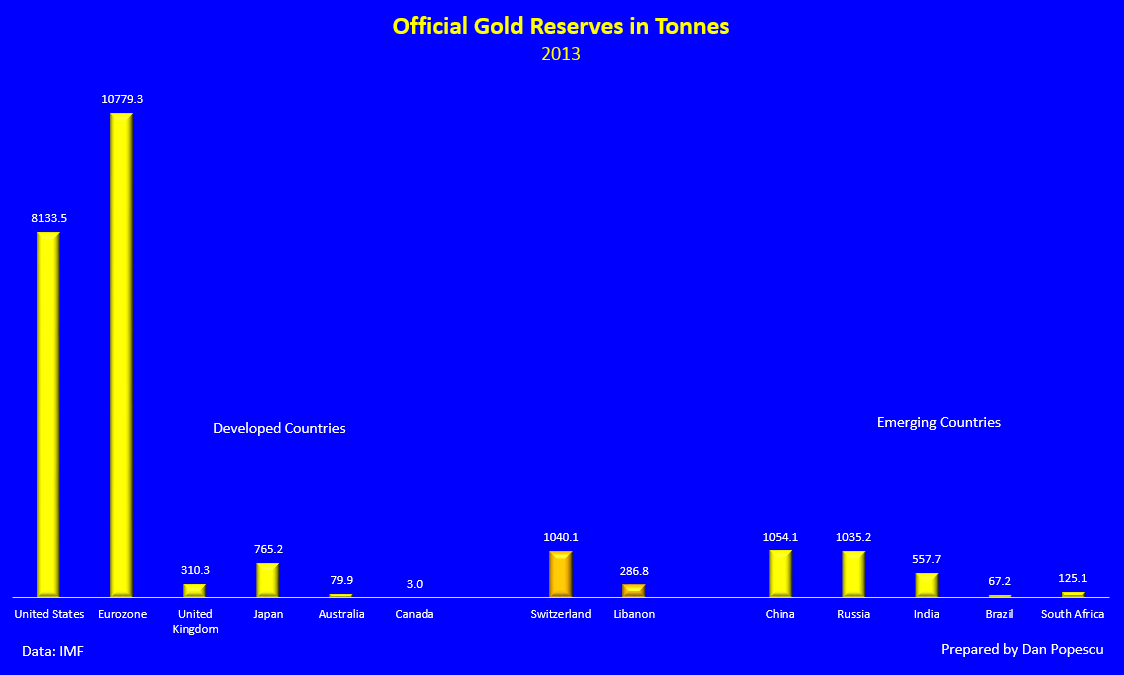

If we look at the Euro Area official gold reserves and compare them with those of United States, we observe that they are larger by approximately 25%. Both the United States and Euro Area largely dominate as the largest gold reserves holders, far from those of the emerging countries. However, we have to be cautious with those numbers. Some speculation has it that the western countries like the US and the Eurozone do not have as much gold as they officially state.

Graph #8: Official Gold Reserves in Tonnes

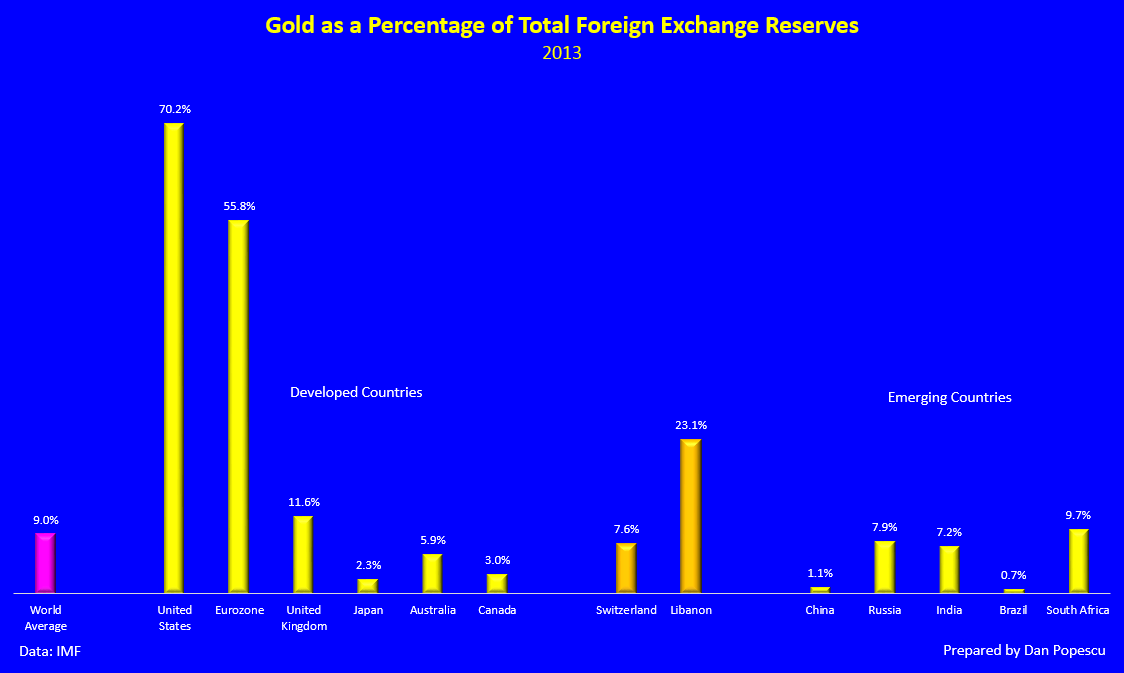

As a percentage of total foreign exchange reserves, the Euro Area holds 55.8% in gold versus the United States’ 70.2%, while the world average is around 9%. Some recent large buys from the emerging countries could have increased substantially this number for the emerging countries. Both China and Saudi Arabia have not made public their most recent numbers and it is speculated that many other countries like Russia under-report their reserves.

Graph #9: Gold as a Percentage of Total Foreign Exchange Reserves

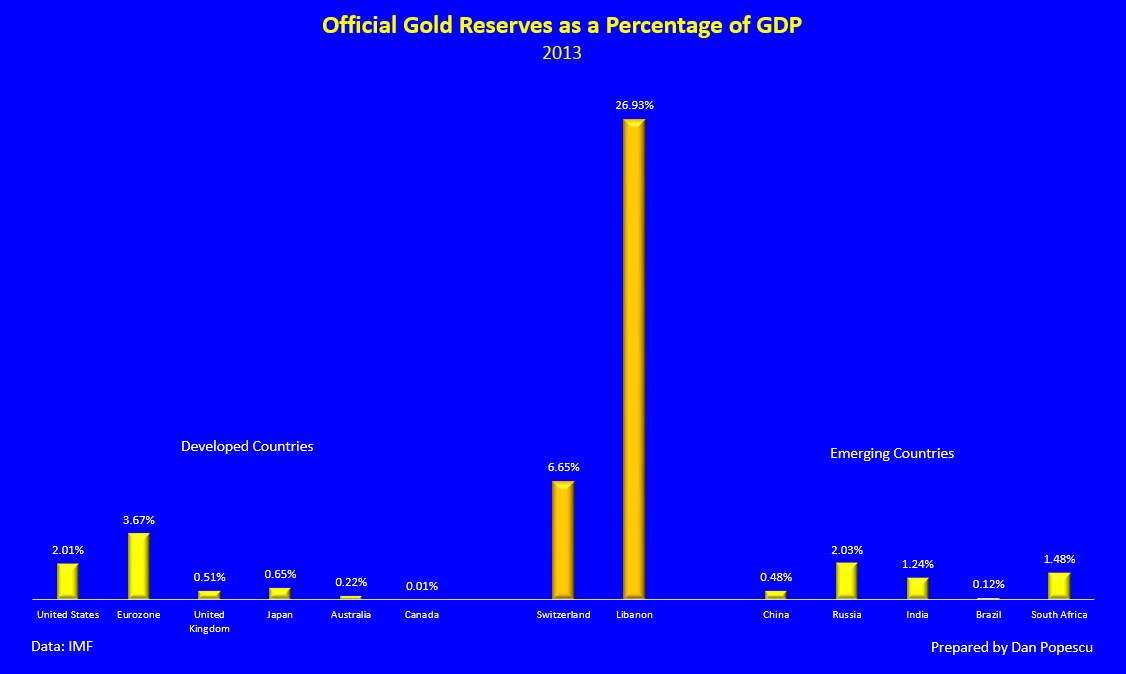

If we look at the gold reserves as a percentage of GDP, as in graph #10, we see that the Euro Area has 45% more gold reserves than the United States. This definitely indicates a friendlier attitude towards gold, even in the official circles.

Graph #10: Official Gold Reserves as a Percentage of GDP

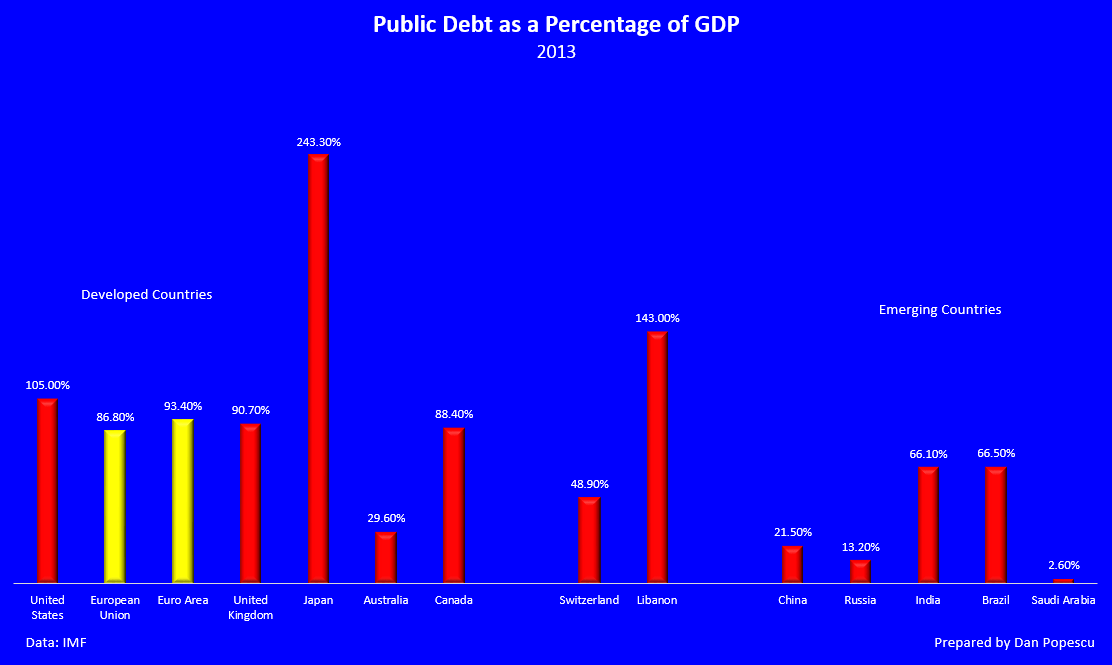

To understand why gold is coming back in the international monetary system, you cannot do it if you do not understand the importance of public debt in this environment. Both the Euro Area and the United States are heavily in debt compared with emerging markets, but with the US slightly higher by 11.6% than the Euro Area. People fear both Europe and, especially, the US, will monetize this debt by devaluing the currency.

Graph #11: Public Debt as a Percentage of GDP

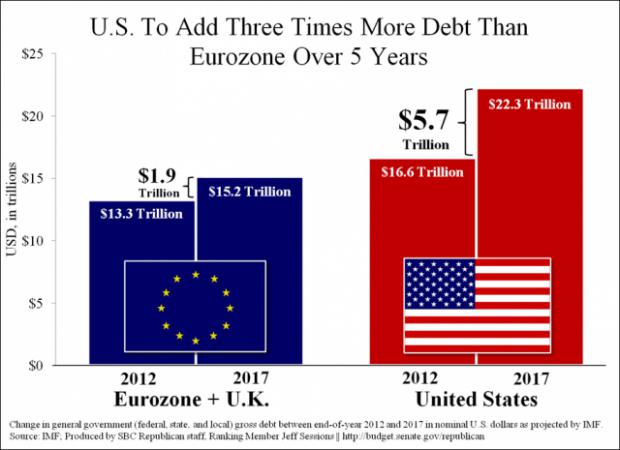

However, if we look at the projections in graph #12, the US is supposed to add three times more debt than the Euro Area over the next five years, as of 2012. The culture of using debt is still much stronger in the US than in Europe, but both have increased debt to unsustainable levels in the recent years. I think the US is still in denial and refuses to think it has a debt problem. Since 1971, when the US dollar was delinked from gold, the world has been on a US dollar standard and, therefore, a collapse of the US dollar will definitely affect all fiat currencies, including the euro.

In 2000 in an excellent book on gold, The Power of Gold, Peter Bernstein, a gold sceptic, said, “Gold may again serve as the ultimate hedge in chaotic conditions. Its return to its traditional role as universal money is unlikely, however, unless the time should come when the dollar, the euro, and the yen all failed to function as acceptable means of payment across international borders.”(8) (emphasis is mine). It is evident that what he has feared, but did not expect to happen, has happened, and we will soon have a major monetary reset, and gold will be part of the new monetary system that will emerge.

Graph #12: United States vs Euro Area Debt Projection

The use of gold as quasi money has been traced back to more than 6,000 years ago, when the Egyptians used gold bars of a set weight as a medium of exchange. The oldest European gold objects were found in Varna, Bulgaria, and date back to 6,264 years ago and the oldest gold coin is 2,614 years old and was found in Lydia (Western Turkey).

6,300-year history of gold jewelry

Gold Treasure, 4250 BC, Varna, Bulgaria

2600 years of gold coin history in Europe

First Stamped Gold Coin Lydia (Western Turkey) 600 BC and European Area’s Austrian Euro Gold Coin 2014

With such a large quantity of gold, it is evident that the Euro Area will play a major role in any reset of the international monetary system that will involve gold. It is generally assumed that the Euro Area will follow the United States and that they view gold in the same way, but that is a big mistake. As we have seen, both European citizens and government officials have a different relationship with gold than the US has. We observe it not only in their statements and attitude towards gold, but also in their concrete actions. Europeans (governments and individuals) own a lot more gold than Americans do. It would be a big mistake to conclude that Europe who, in a way, started the original attack against the US dollar and its “exorbitant privilege” in the late ‘60s, will side with the US in any reset of the international monetary system. Europe has its own agenda and it sometimes conflicts with that of the US. We have seen it several times in the past.

I expect to see an escalation of the war for the possession of gold but not only by China and Russia, but also by western countries like the European Union. Do not be surprised if you hear that the Eurozone and Switzerland have decided to exchange their dollars for gold by purchasing it on the open market. The wind has changed, especially after the 2008 financial crisis, and it definitely blows in gold’s favor and against the US dollar. Europe’s attitude towards gold is not anti-gold but on the contrary as “ value protection against fluctuations of the dollar” as Mario Draghi, ECB president, said it. (5)

Bibliography:

-

ECB and other central banks announce the fourth Central Bank Gold Agreement

-

The Emerging New Monetarism: Gold Convertibility To Save The Euro

-

De Gaulle predicted the dollar crisis in 1965 and advocates the gold standard

-

ECB Head Mario Draghi On Gold & Banking - Tekoa Da Silva

-

The Future of the Eurozone and Gold, Cinzia Alcidi, Paul De Grauwe, Daniel Gros, Yonghyup Oh

-

The Power of Gold, Peter L. Bernstein

-

Euro18 area and EU28 government debt up to 93.4% and 86.8% of GDP

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.