Gold is known for its rarity and reliability. However, the usefulness of gold has not ceased to evolve over the last few centuries. Both an object of desire and speculation, gold has experienced several panics synonymous with crashes or price explosions.

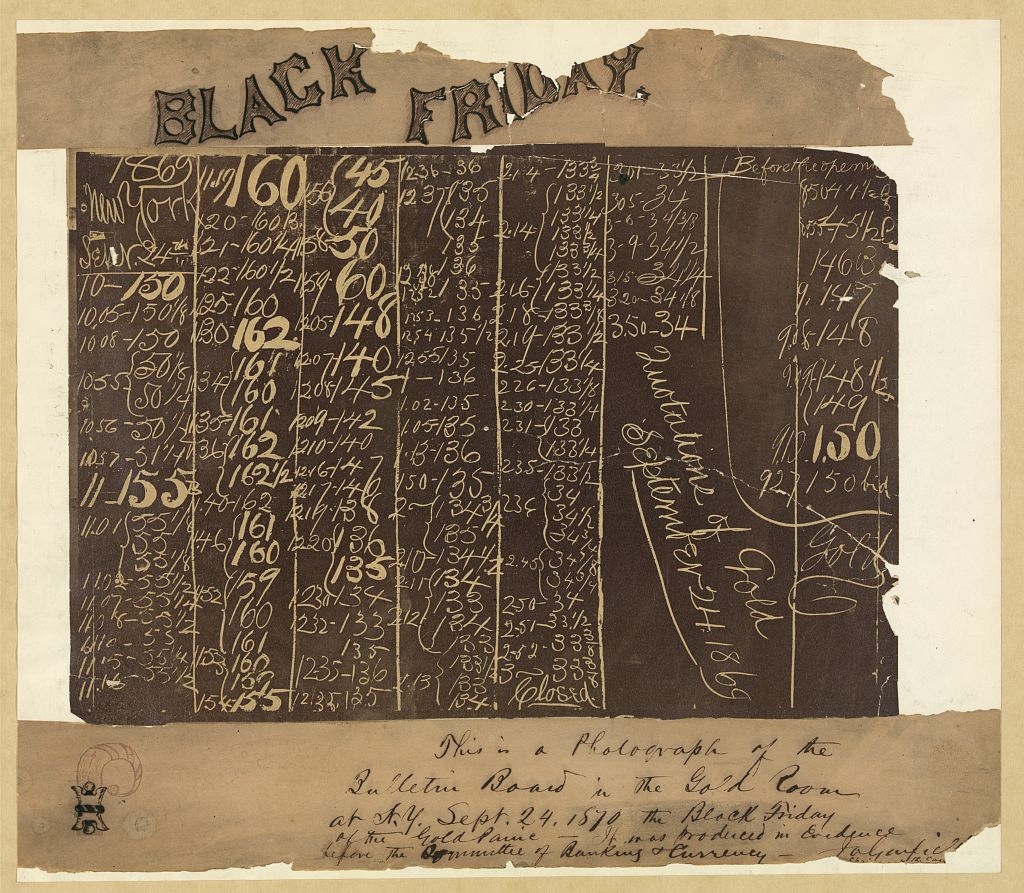

In the 19th century, financial markets were largely deregulated and manipulation practices were widespread. In 1869, this allowed two speculators, Jay Gould and James Fisk, to organize a vast project to manipulate the price of gold. Thus, on September 24, 1869, the price of gold collapsed by nearly 20%, going from $162 to just over $130 per ounce in the space of a few hours.

Black Friday, September 24th, 1869

Black Friday is a term used to describe the panic on Wall Street over the price of gold on September 24, 1869. This day has been remembered as a day of panic on Wall Street when the government went so far as to deploy militias to suppress the crowd that attacked the banks and the dozen or so brokerage houses that went bankrupt. Since then, the term "black" has been used for many crashes, including Black Thursday in 1929.

The two financiers behind the speculation, Jay Gould and James Fisk, had notably colluded with the brother-in-law of Ulysses Grant, the American President at the time. The complicity of the president's family gave the two speculators a hand in the Treasury's gold. The Treasury had become a key position as the government sought to bring the national debt under control. In order to reduce the public debt, the Treasury began selling gold for Treasury bills, which would allow the public debt to shrink by $50 million before the crisis of 1869.

James Fisk and Jay Gould plotting the Great Gold Ring of 1869

Then Jay Gould and James Fisk began buying the equivalent of $1.5 million in gold on September 1 under the names of Butterfield and Corbin. The market had no idea, as the price of an ounce quickly soared to $137 on September 6. On September 7 and 8, the two speculators were unable to overcome a wave of supply. Despite losing almost all of their gains to this selling pressure, Gould and Fisk did not surrender in their manipulation. Beginning on September 12, when President Ulysses Grant was not thrilled with the Treasury's gold sales policy, Jay Gould encouraged the Treasury to stop selling gold. While Jay Gould tried to reduce the Treasury's selling pressure, he continued his accumulation of purchases.

The price of gold rose to $141 on September 22. The next day, Jay Gould discovered that President Ulysses Grant had become aware of their manipulation of the gold price, and that he would give the order to sell Treasury gold on Friday, September 24. On that Friday the 24th, the Treasury sold the equivalent of $4 million, which prompted Gould to sell his gold at the last minute. Soon, the price of gold went from $162 to $133 on the same day. The deal would have netted him $12 million (20,000 to 25,000 times his average salary). The collapse of the gold price caused a panic attack that resulted in a drop in the price of wheat by more than 30%, causing a heavy loss of income for the country's millions of farmers.

Photograph of the blackboard in the New York Gold Room, September 24, 1869, showing the collapse of the price of gold.

The Origins of the Gold Crisis

At that time, the population growth of the country reached one of the highest rates ever recorded. The population of the United States was 38 million in 1870. To give you an idea, the salary of a carpenter was about $500 to $600 per year. It was in 1861 that the United States underwent a serious political crisis. The Civil War opposed the Southern States, mainly democrats and slavers, to the Northern States, republicans and anti-slavery. This war was to have a lasting effect on public spending, which amounted to nearly 3.4 billion dollars between 1861 and 1865.

The public debt of the United States, which had been almost nil before the Civil War, rose from 65 million dollars in 1860 to 2.8 billion dollars in 1866. The first income tax was enacted for this purpose, in 1862. This favored a destabilization of the price system. But then how come gold would reach the price of $162 per ounce when it was only $35 per ounce in 1971?

Before the war, the government used gold and silver coins as currency. To finance the Civil War, the government was forced to issue "greenbacks," redeemable in gold. Initially issued to finance government expenditures, greenbacks soon became a common currency not redeemable in gold by the Legal Tender Act in 1862. In all, nearly $400 million was issued in greenbacks. Inflation rose rapidly from 14% in 1862 to nearly 25% in 1863 and 1864. $1 of gold was then worth $1.5 of greenback. It was in this context that gold speculation was born, driven by the volatility of public finances and the devaluation of the dollar.

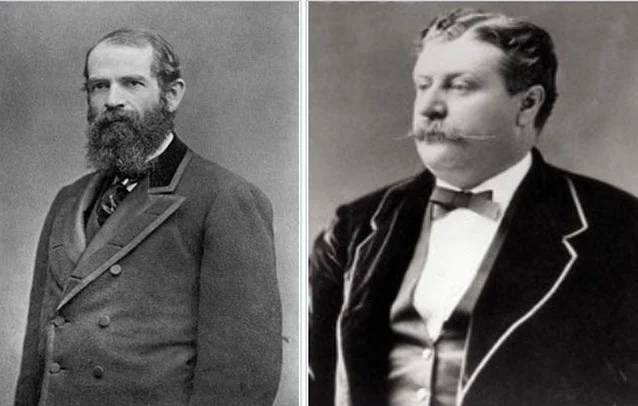

Jay Gould and James Fisk, Two Relentless Speculators

Jay Gould was born in 1836 and began his career in a tannery business, quickly earning a reputation as a con man. In 1857, Jay Gould joined the Board of Directors of the Erie Railroad, where he met James Fisk and the old speculator Daniel Drew. James Fisk was only one year older than his future accomplice, Jay Gould. The three executives, Gould, Fisk, and Drew, quickly agreed to quietly issue stock in the company, earning several million dollars while countering the speculation of businessman Cornelius Vanderbilt.

During the Civil War, Jay Gould again became rich as a cotton smuggler. In 1880, Jay Gould owned four railroad companies that covered 16,000 km of the country. In 1869, he undertook a vast manipulation of the price of gold.

Jay Gould and James Fisk

Gold Crises... Valid Today?

Gold has suffered many other crises, including the famous panic of 1857. At that time, the sinking of the SS Central America, which was in charge of transporting large quantities of gold to New York banks, was one of the triggers of the crisis that followed. The predominant role of gold in the 19th century shows how gold has different uses. Many of the known gold crises, until the last major one in 1971, were the result of mismanagement by governments.

The debate about free trade in gold is therefore central to investors and can provide some security. Roosevelt's confiscation of gold in 1933, which is still very much in the minds of gold enthusiasts in the United States, reflects the uncertainty caused by a centralized gold market. In any case, the crisis of 1869 is a landmark period in the American nineteenth century and to some extent foreshadowed the crisis in the silver market that would follow in 1873.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.