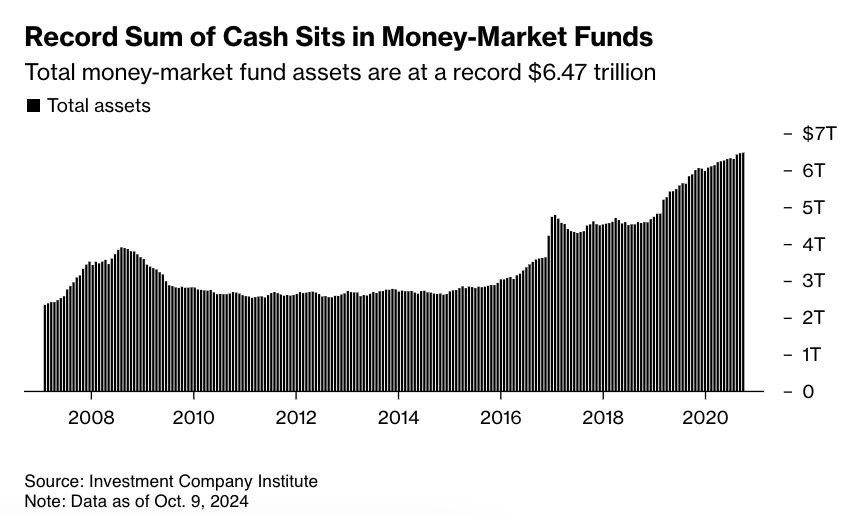

$6.47 trillion stashed under the mattress: the mountain of cash in money market funds is at an all-time high.

This absolute record reflects investors' state of alert, while revealing a latent force ready to shake up the markets.

Is this avalanche of liquidity a sign of enduring mistrust, or the prelude to a massive redeployment?

This notable increase marks a sharp rise since 2020, amplified by the COVID-19 crisis and global economic uncertainties.

Money market funds are often seen as safe havens in volatile times, offering security and liquidity.

The reserve of available money is at an all-time high, just as markets are hitting new highs.

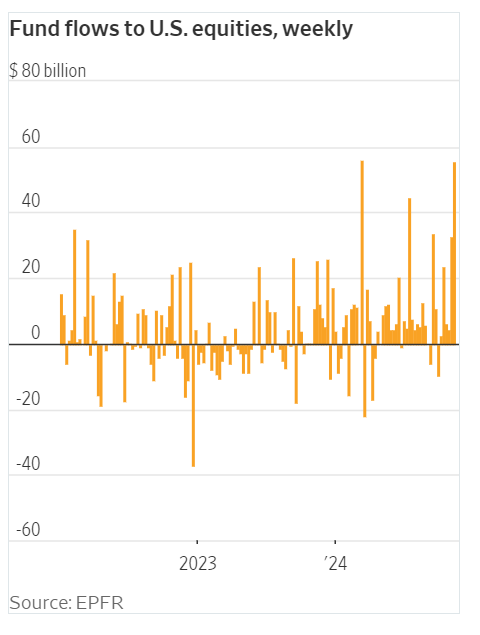

In recent weeks, US ETFs have seen unprecedented liquidity inflows:

US markets continue to attract investors from all over the world, with a growing focus on NVIDIA and cryptocurrencies.

The flagship stock of the AI bubble has tripled its market capitalization in the space of a year, while other companies in the sector have risen by just 22%:

It has to be said that NVIDIA continues to impress every quarter.

The company far surpassed expectations with sales of $35.1 billion, well above the anticipated $33 billion, an increase of 94% year-on-year. Earnings per share came to $0.81, exceeding the $0.74 forecast, with a year-on-year increase of 103%. The company beats quarterly forecasts by $2 billion and anticipates $37 billion in fourth-quarter revenues.

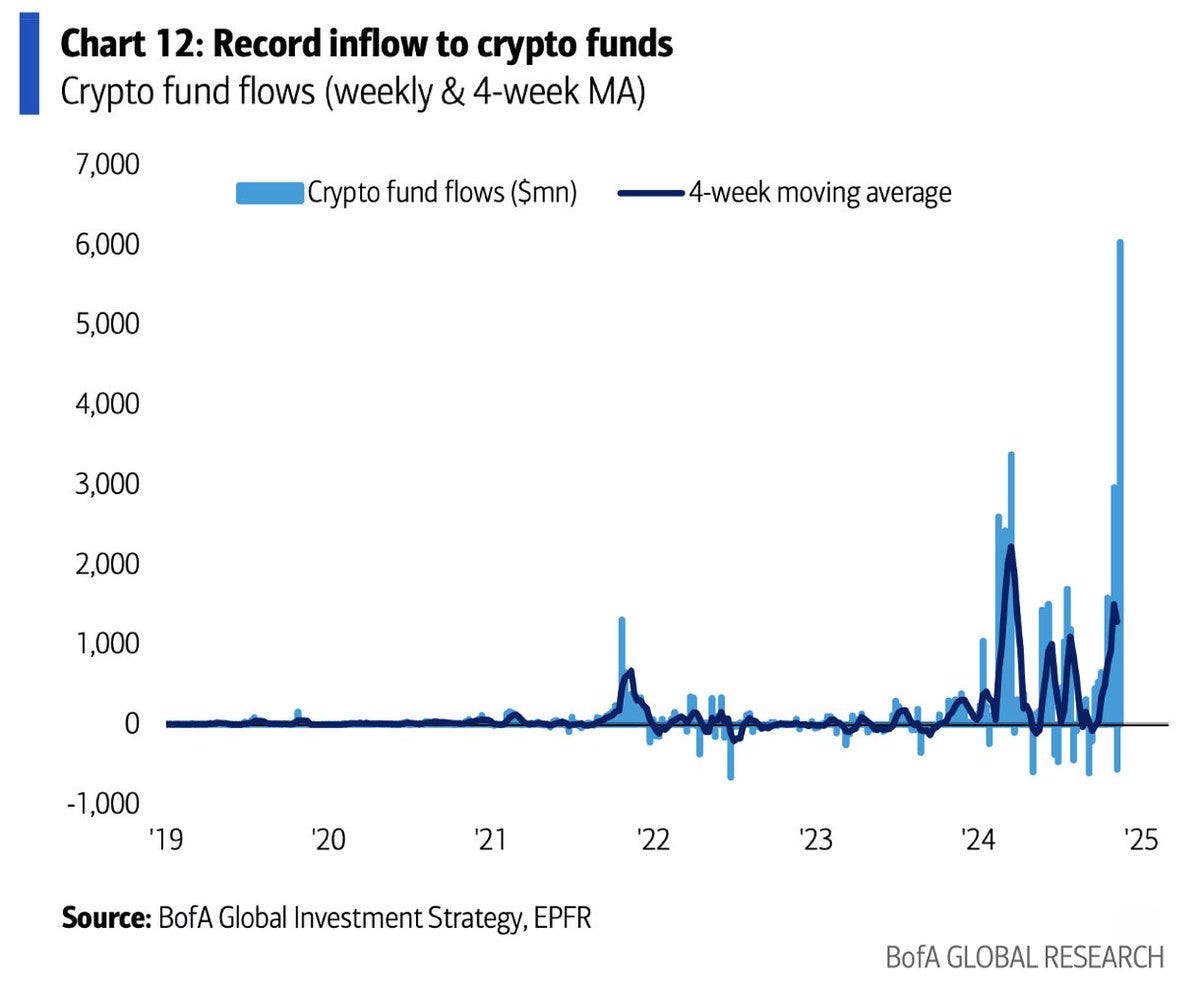

The cryptocurrency sector is also benefiting from an unprecedented craze since Trump's election. Crypto funds registered record inflows:

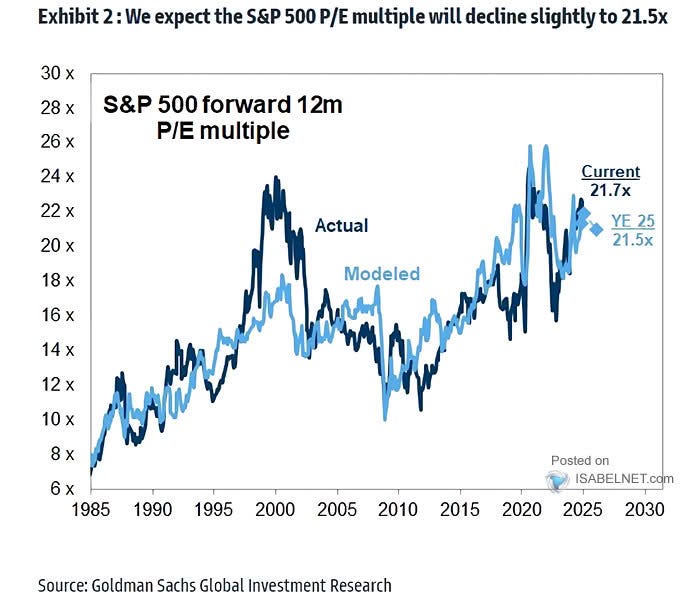

The S&P 500's forward-looking P/E ratio, currently at 21.7x, indicates a historically high valuation, well above its long-term average of around 16x:

Although Goldman Sachs forecasts a slight decline to 21.5x by the end of 2025, the market remains expensive, buoyed by persistent optimism and solid earnings prospects.

However, this situation could be undermined by a rise in interest rates or a slowdown in earnings, increasing the risk of a correction.

This high level of valuation requires robust, sustained economic growth to avoid abrupt market adjustments. In other words, the slightest downward correction in the now giant NVIDIA's forecasts over the coming months could generate a significant risk of readjustment on a market already at historically high levels.

The latest results from US companies give us a new perspective.

The valuation of financial assets is increasingly based on service activities, relegating industry to a secondary role. This structural transition is particularly evident in the dynamics of US financial markets, where the stock market continues to post solid performances. This dynamism is due not to an increase in industrial creation, but to the economy's ability to increase the value of services, now at the heart of the growth of major companies.

Apple's recent results (AAPL) are a perfect illustration. With a market capitalization of $3.43 trillion and annual net earnings of $94 billion for fiscal 2024, the company has a price/earnings (P/E) ratio of 34x.

This high valuation contrasts with the absence of significant growth. In fact, Apple's physical product sales have been contracting, and it is only revenues from services that have been able to offset this decline.

This emblematic case illustrates a profound change in the drivers of corporate value creation: services, particularly digital and recurring ones, are becoming the central pillar of modern business models. However, this phenomenon raises questions about the sustainability of these valuation levels, particularly in a context where real revenue growth is stagnating.

The increasing dependence of major technology companies on services, to the detriment of material or industrial innovation, could ultimately redefine market equilibria and alter investor expectations.

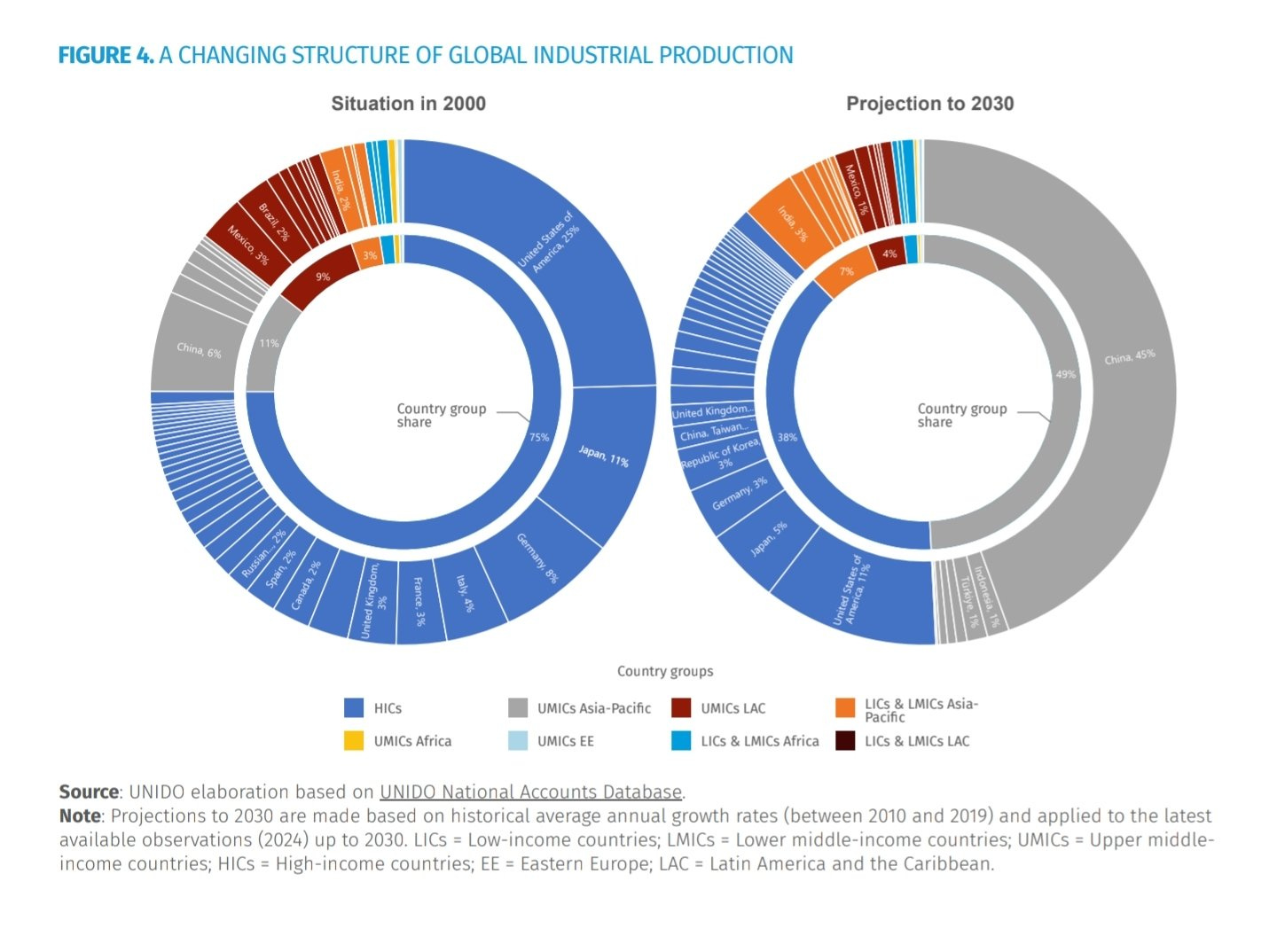

In 30 years, the share of Western industrial production will have been halved, while the dollar value of the region's assets has reached record levels:

This chart illustrates the profound change in the distribution of global industrial production between 2000 and 2030. In 2000, high-income countries (HICs) accounted for 75% of production, with leaders such as the USA (23%), Japan (11%) and Germany (6%). By 2030, the HICs' share is set to fall to 49%, with emerging countries, particularly China, taking a dominant role. China alone is expected to account for 45% of global industrial production, marking a historic economic shift.

This upheaval is part of a broader de-dollarization dynamic. In 2023, China's CIPS interbank payment system processed over 6.6 million transactions with a total value of 123 trillion RMB (around $17 trillion), an increase of 50.3% on the previous year. This rise reflects not only China's growing economic weight, but also a strategic desire to reduce its dependence on the US dollar.

In a world where industrial production is increasingly concentrated in China, the global economic balance is shifting away from the old powers and towards Asia.

There has never been so much money in circulation. Never have markets had so much liquidity to pursue assets at such high valuations, underpinned mainly by their ability to generate growth via the services associated with the goods and offers they provide.

However, this excessive market valuation raises a fundamental question: have we taken into account the fact that price/earnings (P/E) ratios, traditionally used to assess market valuation, may no longer be relevant in a world where the money supply is growing at 7% a year?

Hasn't the money printing of recent years radically altered our perception of asset valuation on the stock market?

The abundance of liquidity injected into the financial system artificially reduces the cost of capital, inflates asset valuations and propels share prices, irrespective of real economic fundamentals.

In such a context, P/E ratios, based on forecast corporate earnings, risk being disconnected from reality.

Instead of reflecting true corporate performance, P/E ratios could be further influenced by this unprecedented monetary expansion.

Those who thought that monetary policies would have no impact on asset prices were very much mistaken.

Monetary authorities continue to print money relentlessly, fuelling a rapid expansion of the money supply.

The BRICS central banks are reacting logically to this policy by continuing to buy gold.

Under these conditions, every downturn in gold prices triggers a new wave of buying, as seen this week:

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.