The year 2024 begins with a return to volatility. The VIX rises by +10% in the first few hours of trading, and technology stock volatility reaches its October peak in a very short space of time:

However, this rise in volatility is far less significant than the turbulence we experienced during the previous banking crisis of 2023.

Looking at the long-term volatility index, this first peak of the year is barely noticeable:

It has to be said that we have recently experienced a period of unprecedented euphoria on the markets. The Nasdaq closed 2023 with a gain of +53%, recording its best performance since 1999.

Bearish investors were wiped out in the final weeks of the year.

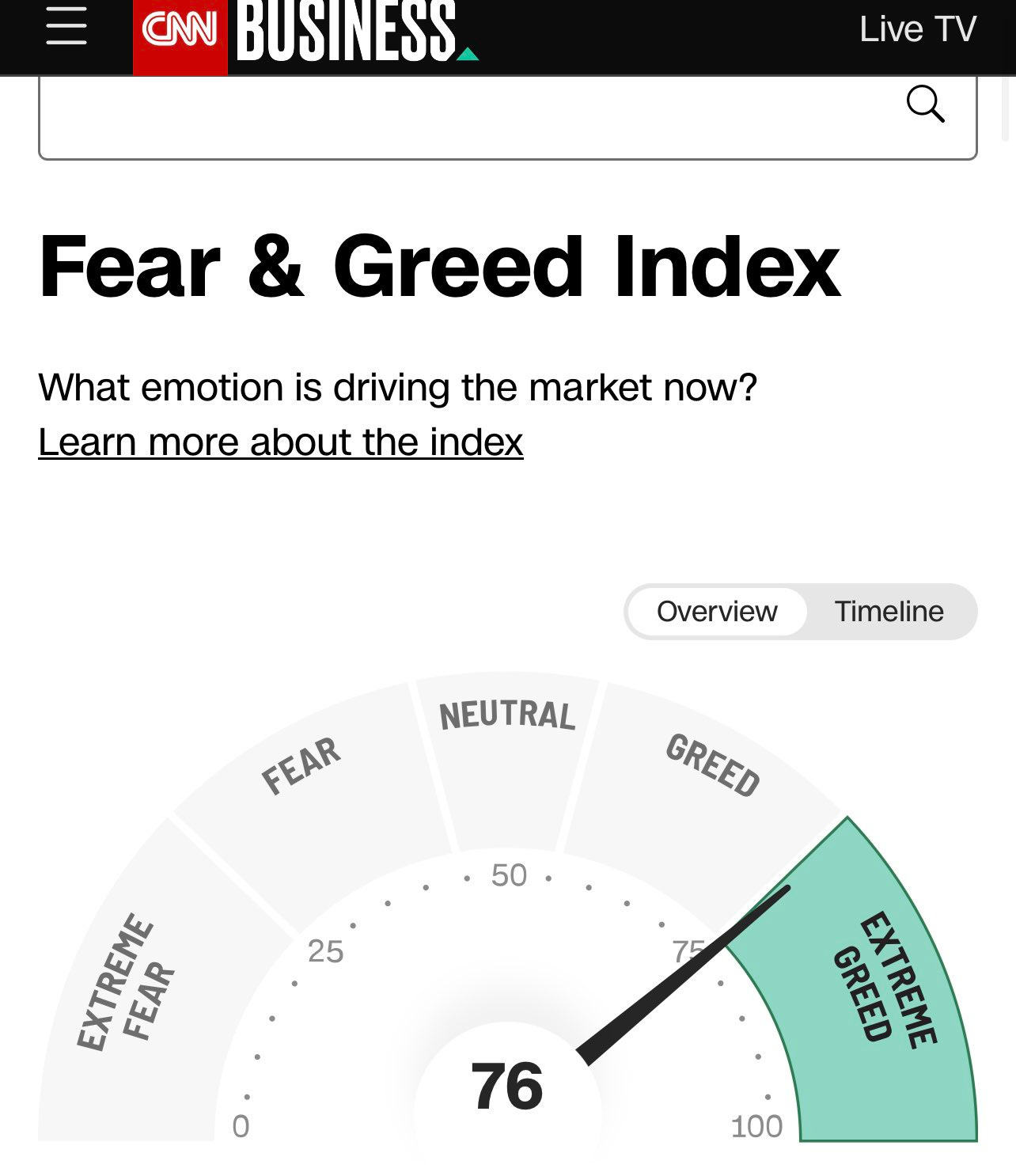

Market sentiment is currently extremely optimistic:

Last spring's banking crisis has been forgotten.

The market underestimated the power of the Fed's intervention in the wake of this banking crisis. It finally realized, with some delay, that the injection of liquidity into the system and the monetary and fiscal support measures would be highly beneficial for the US economy, particularly for the banking sector.

The US banking sector is showing renewed vitality at the start of 2024, with JP Morgan reaching all-time highs. The bank even surpassed its previous closing record set in 2021:

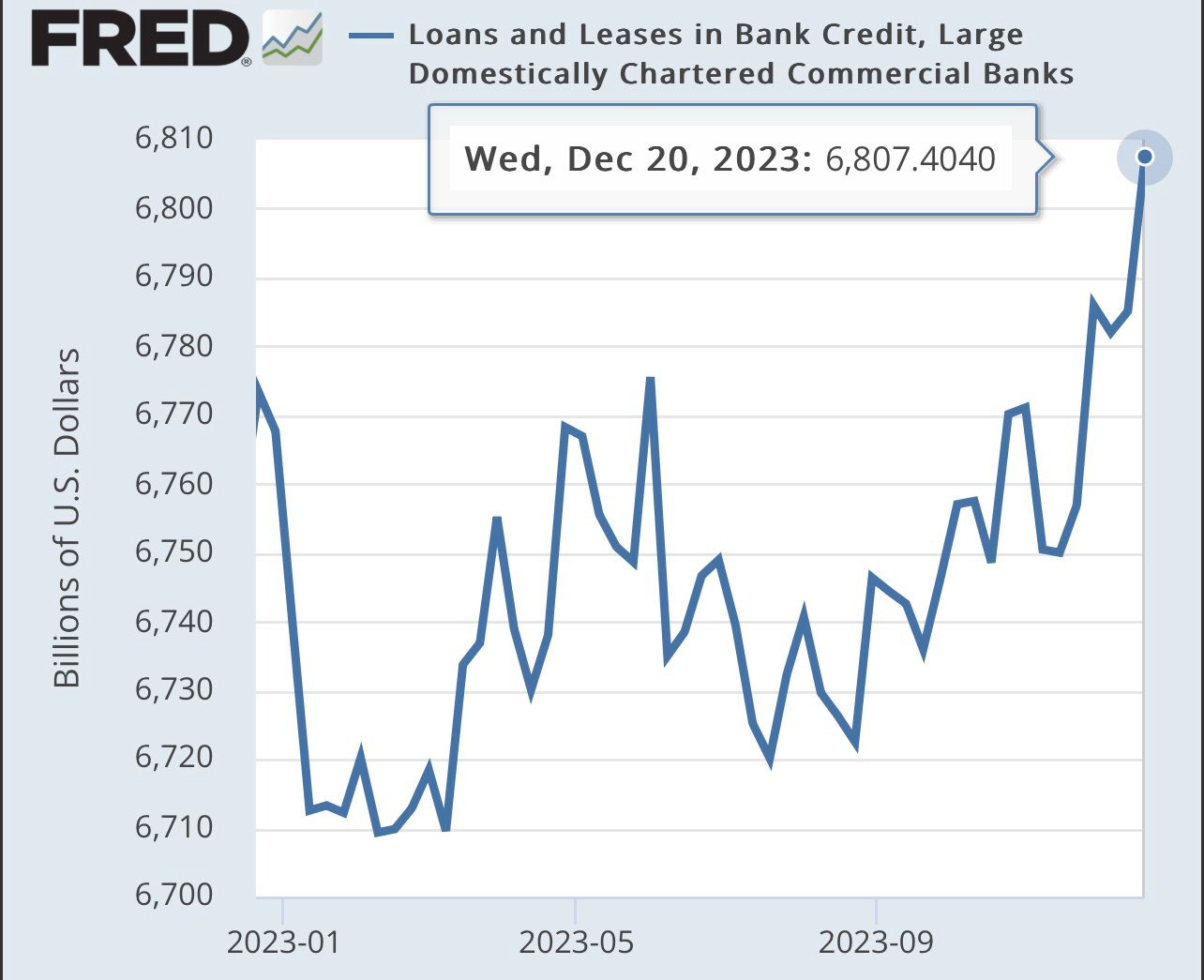

Favourable conditions in the banking sector stimulated a pick-up in commercial lending activity by US banking institutions in the final weeks of 2023:

The upturn in bank lending activity seems at odds with a short-term recession forecast. The possibility of a rate hike-related credit event has been postponed indefinitely, as bank losses have once again been transferred to the Fed's balance sheet, reviving optimism in the markets.

The US economic recovery, which was unexpected only a year ago, is based primarily on the oil and gas sector. In just a few months, the United States has become the world's leading exporter of these resources. By revitalizing the oil and gas sector, the Americans hope to reduce their double deficit, thereby helping to increase their exports while reducing their energy dependency and cutting their import bill.

Interestingly, this dynamism in the US energy sector coincides with the economic challenges facing Germany in the field of renewable energies. European purchases of American liquefied natural gas (LNG), replacing Russian gas, are helping to reduce the US deficit and highlight the economic consequences of Germany's energy gamble, which seems to be taking a disastrous turn.

Despite all the talk of energy transition, the US administration has actively promoted the revival of a sector vital to the country's economy. Record LNG exports have been a real boon to the economy, and the revival of oil production has proved to be a major ally of the Biden administration in its fight against inflation.

In 2023, the USA became the world's leading LNG exporter for the first time, mainly thanks to its new European client. US oil exports have also reached record levels, helping to stabilize crude prices in recent months.

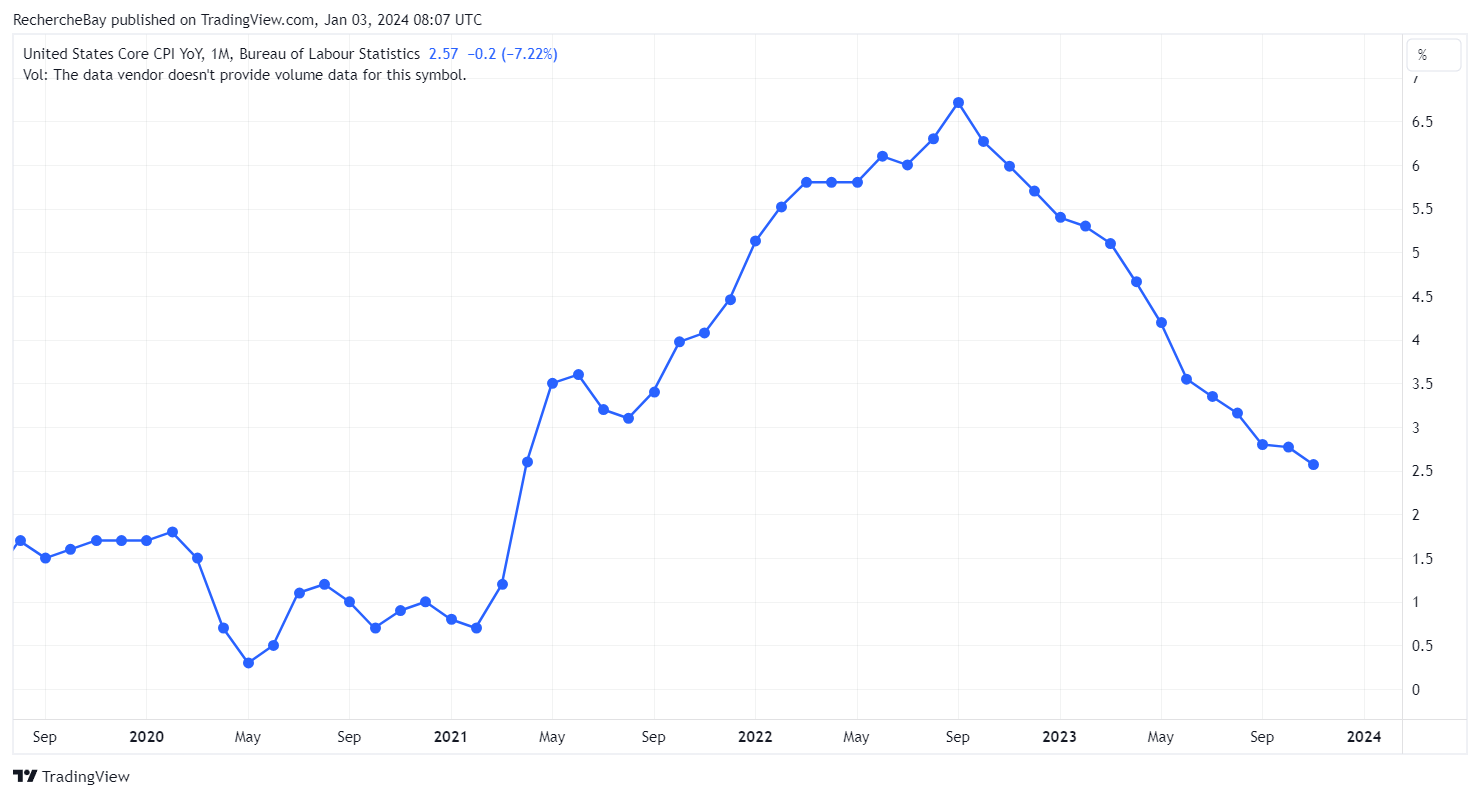

An examination of the correlation between the oil price graph and that of the Consumer Price Index (CPI) reveals the significant impact of US stimulus policy in the oil sector on US inflation levels:

Increased oil and gas production have therefore had a beneficial effect on easing inflationary pressure. The fall in fuel prices, which accompanied the drop in oil prices, proved to be one of the main drivers of the reduction in inflation in the United States.

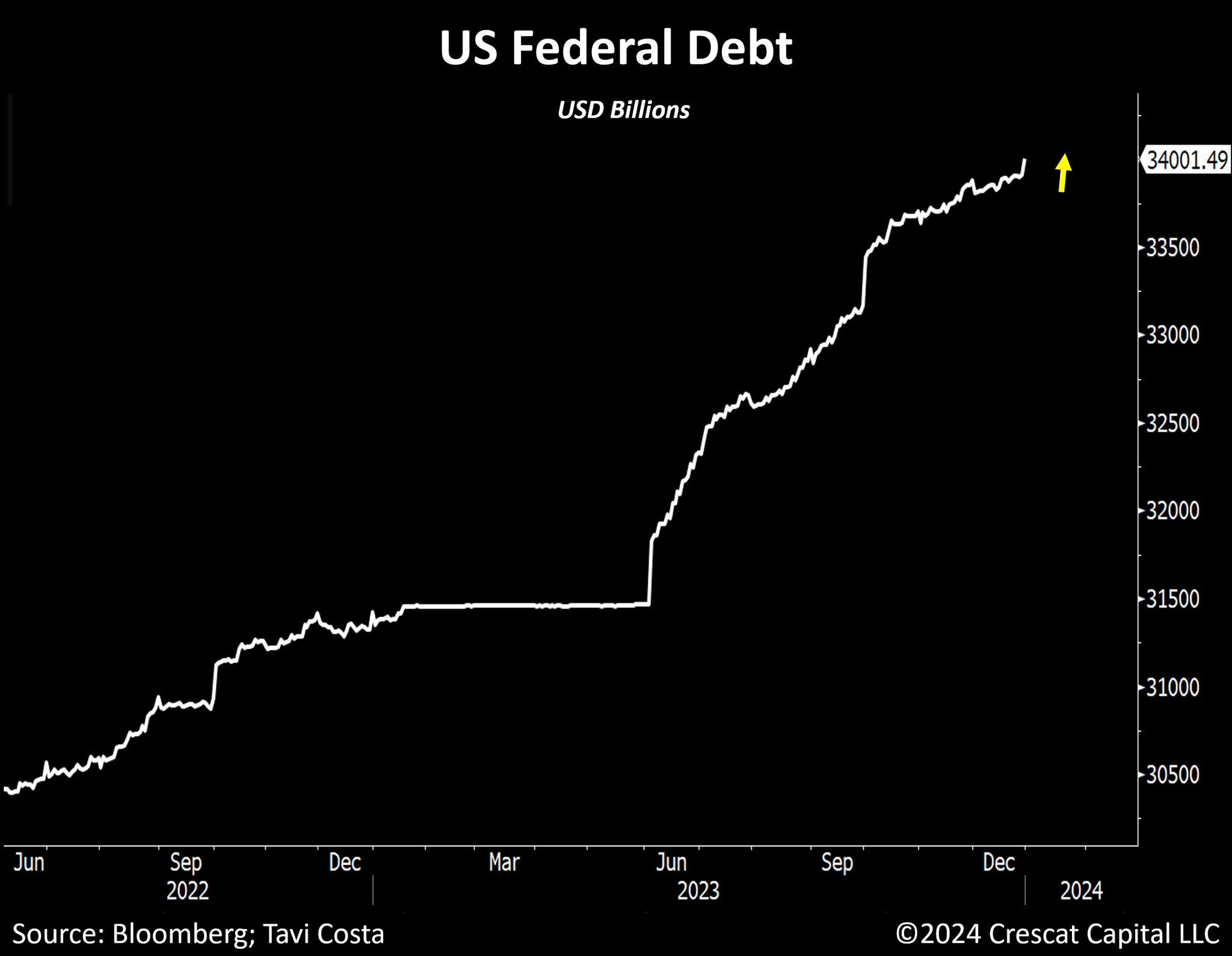

Despite the rise in exports, the US deficit has not fallen significantly. Rising interest rates on US debt are putting pressure on public finances, and the current economic recovery does not appear to be sufficient to offset rising refinancing costs.

The year 2024 is likely to reveal this mathematical reality: debt has an effect on the US deficit. US debt has just passed the $34 trillion mark for the first time:

The prospect of a rate cut in 2024 may not materialize quickly enough to avoid a serious US debt refinancing crisis. We may well see a debt refinancing crisis, and anticipating how we might overcome this impasse is difficult, given the uncertainty surrounding the potential intervention of central banks in the face of this debt wall.

The resumption of volatility seen at the start of 2024, as well as gold's new record closing price in Shanghai, hint at the uncertainties to come.

I would have wished you a remarkably calm and pleasantly routine year. However, this year should instead be characterized by profound turmoil, both on the markets and geopolitically.

The gold price is unlikely to be spared this volatility, being caught between deflationary and hyperinflationary forecasts, and shaken by possible interventions by BIS and central banks.

The physical market for precious metals (and non-ferrous metals) could continue to tighten, especially if demand takes off again in Western countries.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.