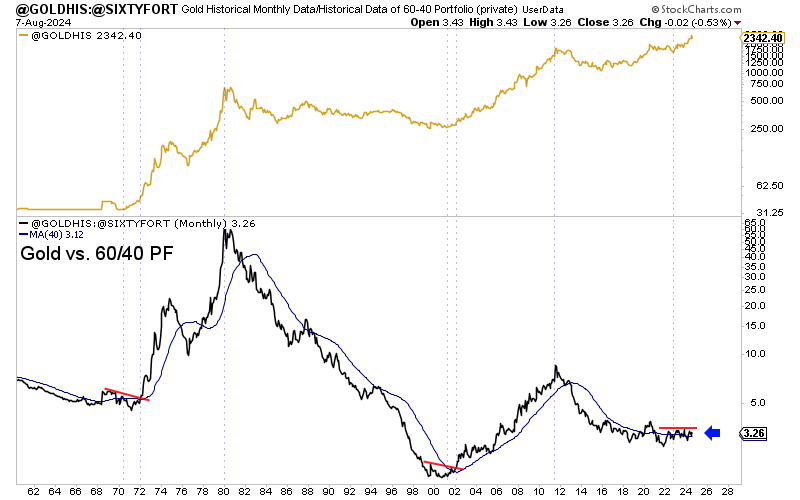

In August 2024, gold sent a strong buy signal by outperforming the 60/40 portfolio, a classic asset management model allocating 60% to equities and 40% to bonds:

In my bulletin from the month of August, I wrote:

“Since 1980, gold has never really managed to outperform a conventional portfolio composed of 60% bonds and 40% equities. The period 2000-2011 is an exception. Since Volcker's intervention in interest rates in 1980, gold has systematically underperformed this 60/40 investment strategy, which has enriched two generations of asset managers. Why invest in gold when such a simple, world-renowned strategy works so well?

Only when this chart breaks to the upside will gold become a must-have for Western investors. Gold will be favored provided it manages to outperform the classic strategy that has prevailed since 1980.

For this phenomenon to become a reality, there will first have to be a real surge in demand for gold in the West.

For the moment, this demand (at an all-time high) is mainly driven by central banks and Asian demand (China and India) for physical metal”.

Seven months later, the chart of gold versus the 60/40 portfolio has not only validated its 2024 breakout, but shows an unprecedented rise. Gold has gone from being the best alternative to the traditional 60/40 strategy to an alternative investment that cannot be ignored.

The same scenario is currently unfolding for silver metal, which has just broken a 12-year uptrend. Like gold in 2024, silver now stands out as a better-performing alternative to the 60/40 portfolio, marking a major turning point for investors seeking tangible assets in the face of traditional strategies.

Is silver on the way to becoming a must-have asset, like gold today?

The silver market is under increasing pressure, and the imbalances between COMEX and LBMA are becoming glaringly apparent. These two marketplaces, which are supposed to complement each other thanks to the EFPs (Exchange for Physical) mechanism, normally enable a trader to convert a futures position on COMEX into physical silver delivered via LBMA. In theory, this system guarantees a smooth transition between the paper and physical markets, providing banks and investors with an efficient means of managing their positions. Today, however, this mechanism seems to have seized up, and for good reason: there's a shortage of metal.

An increasing number of transactions via EFPs are now settled in cash rather than physical silver. This indicates that stocks available at the LBMA are dwindling, while the silver market is increasingly based on paper finance, disconnected from physical metal reserves. In concrete terms, banks and institutions continue to use the COMEX to sell futures contracts, but they are no longer able to supply the metal to buyers who actually demand it. This disconnect between the paper market and physical reality continues to worsen, and the accumulating signals suggest that a major breakdown is imminent.

The problem is not simply a shortage of physical silver; it concerns an entire price management system, based on a fragile balance between long and short positions between the COMEX and the LBMA. The alleged price manipulation scheme works as follows: banks flood the COMEX with massive sales of futures contracts, thus artificially increasing supply on the paper market and causing prices to fall. Since COMEX prices serve as a global benchmark for the silver market, this downward pressure prevents prices from rising, despite growing demand for the metal.

At the same time, these same banks take long positions in the LBMA market by purchasing silver in the form of unallocated accounts. This type of account means that the silver is not physically held by the buyer, but is simply a claim on a theoretical quantity of metal.

However, these unallocated accounts are used on a fractional basis, meaning that there are far more open long positions on the LBMA than there is metal actually available. This mechanism dilutes the upward pressure on the spot market price, preventing silver from soaring as physical stocks dwindle.

This arbitrage between COMEX and LBMA enables banks to take advantage of price differentials between the two markets, while maintaining pressure on world silver prices. In theory, if physical demand were to increase significantly, these mechanisms would collapse, leading to a sharp rise in prices. But as long as these banks can use EFPs to transfer positions from one market to another and settle in cash instead of delivering metal, they can continue to maintain the illusion of a balanced market.

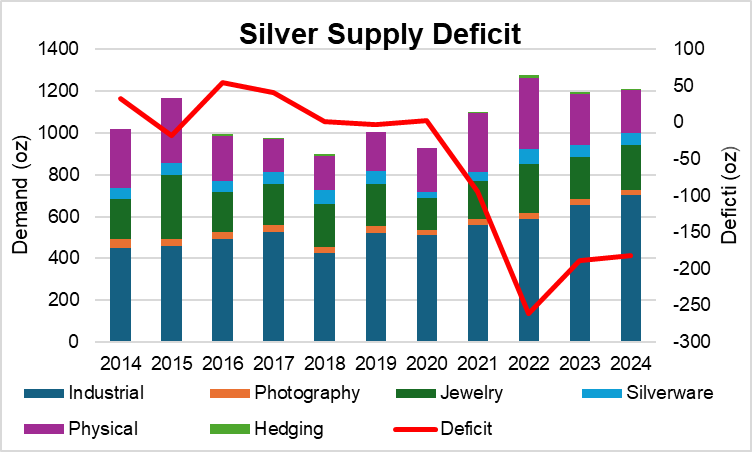

Except there's a problem: physical silver deficits have been building up for several years now:

According to data from the Silver Institute, the silver market recorded a deficit of 237.7 million ounces in 2022, followed by an estimated deficit of 260 million ounces in 2023. This deficit is mainly the result of record demand for the physical metal, particularly in Asia and from central banks, which are hoarding silver in anticipation of future price rises.

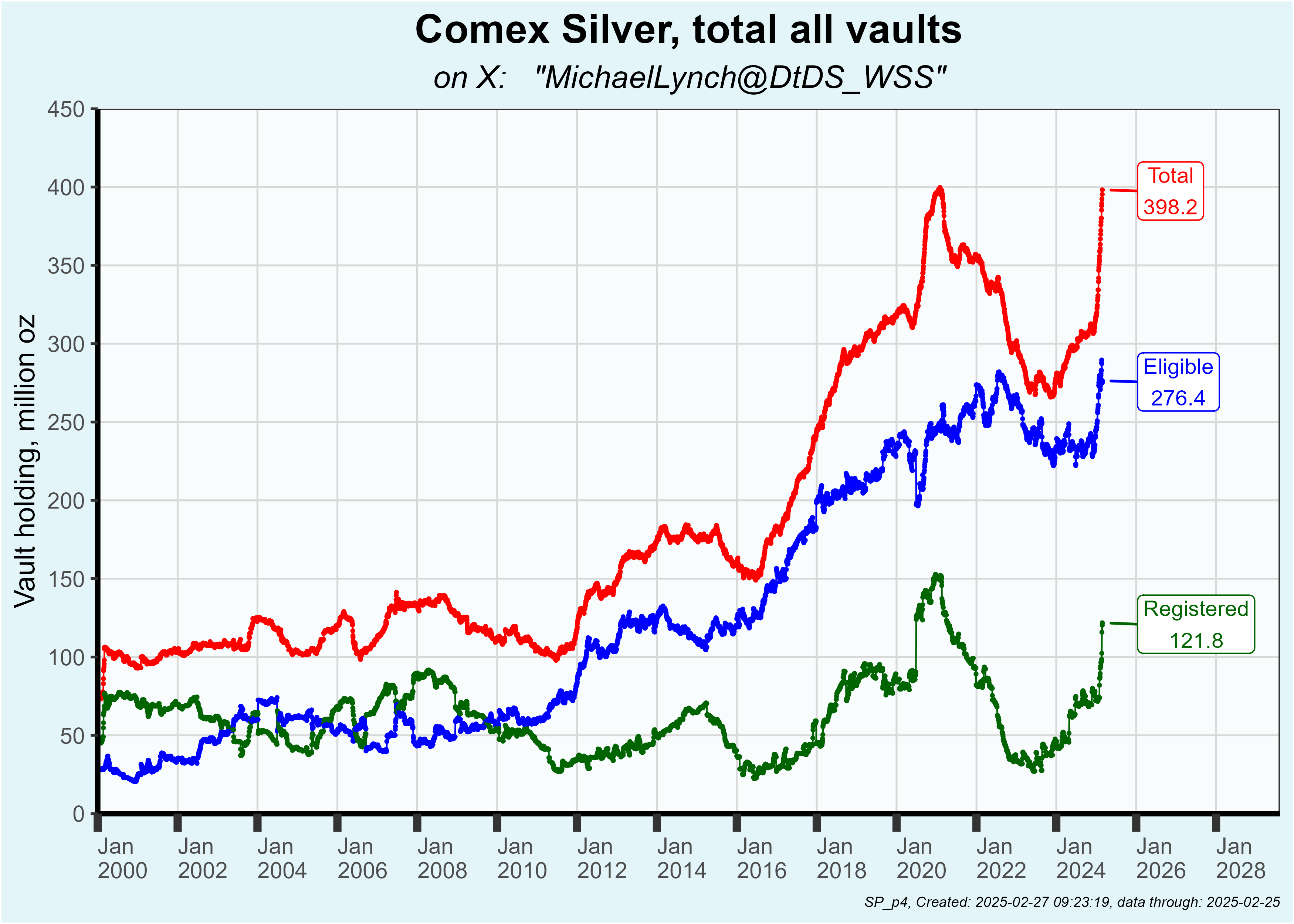

At the same time, silver stocks on the COMEX have undergone a sudden upheaval in recent weeks, reminiscent of the recent gold rush on the same futures market:

In recent years, these inventories have been in freefall. In 2021, the COMEX held around 400 million registered ounces of silver (i.e. available for delivery). By 2024, this figure had fallen below 280 million ounces, a drop of over 30% in less than three years.

Since the beginning of the year, the trend has reversed, with a sudden rebound in COMEX silver stocks.

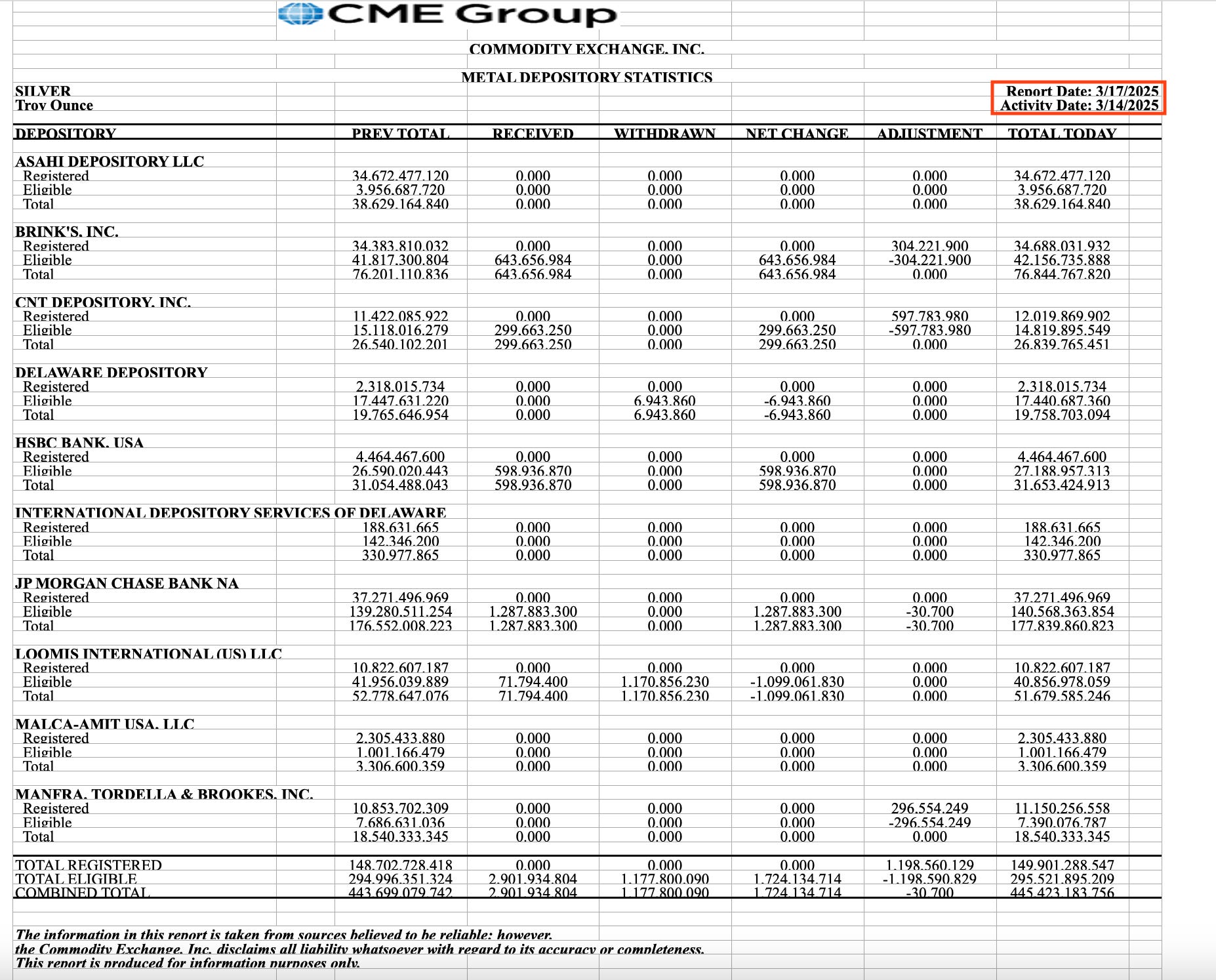

The latest CME silver inventory update reveals a massive deposit of 18.26 million ounces (approximately 568 metric tons) in just five days last week. If this influx is impressive, what's even more so is the speed with which the metal is being redistributed. By Friday, 1.17 million ounces had been withdrawn from Loomis vaults:

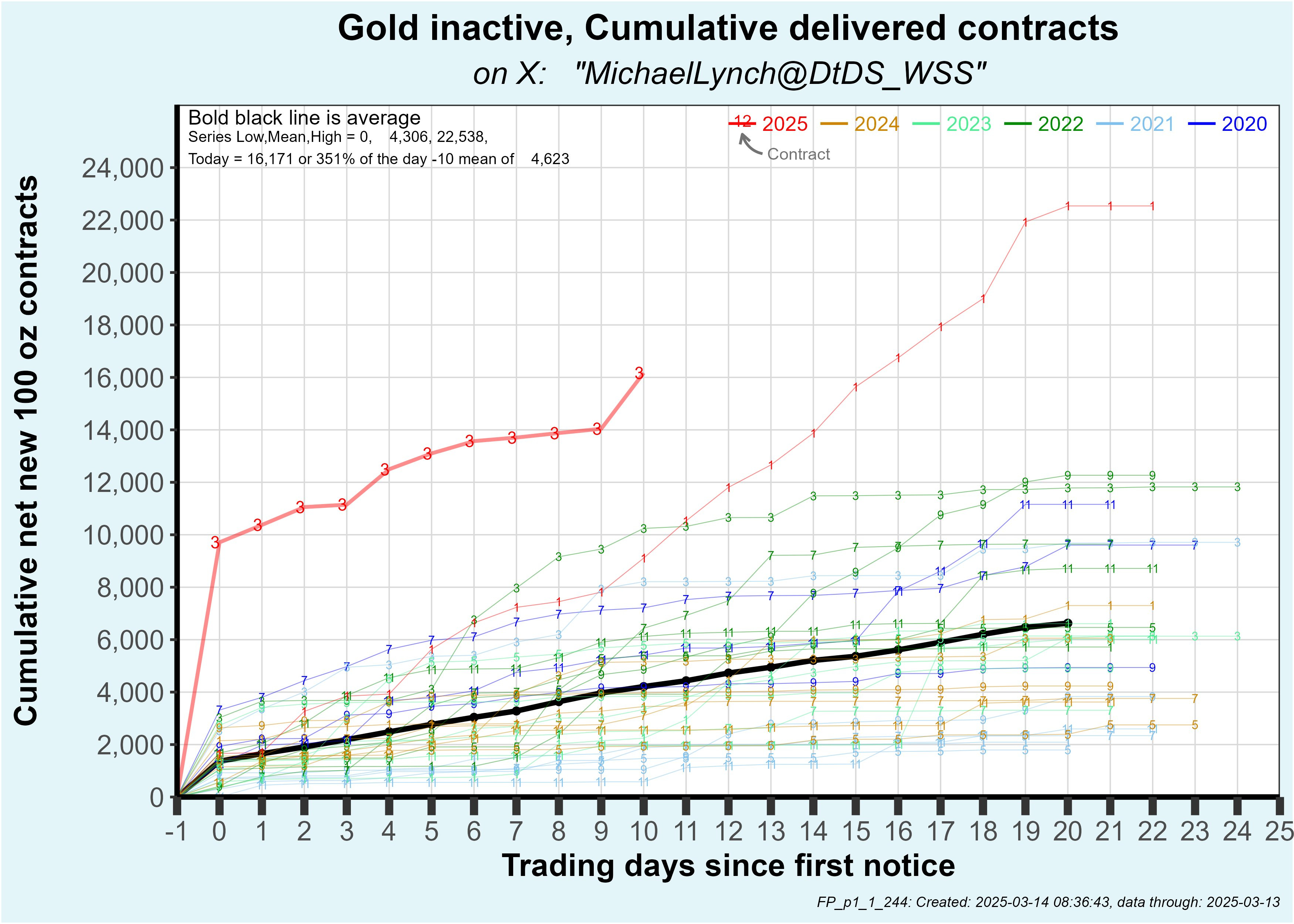

We'll be keeping a close eye on developments over the next few days. The COMEX is currently experiencing a gold rush, with the number of contracts delivered reaching levels never seen before:

It's entirely possible that we'll also see a rush to COMEX physical silver in the months ahead.

The COMEX, originally conceived as a hedging market, is now operating at full capacity as a physical delivery market, reflecting growing demand for the real metal.

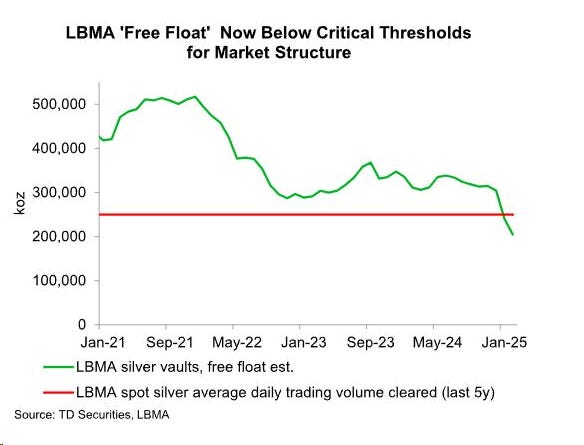

On the LBMA side, the situation is equally worrying. The latest data show that silver stocks stored in London are steadily declining, with less than a billion ounces available, while the market processes tens of billions of ounces in paper transactions every year. Liquidity is shrinking, and the appearance of premiums on physical silver indicates that the spot market is beginning to feel the pinch.

The LBMA's free float (i.e. the amount of silver available to the market and not allocated to specific contracts) has just fallen below a critical threshold. It is now below the average daily volume traded on the spot market, meaning that there is not even a day's worth of real liquidity left in physical silver. If an institutional player or a bank were to request a large delivery, the market would run the risk of becoming completely illiquid.

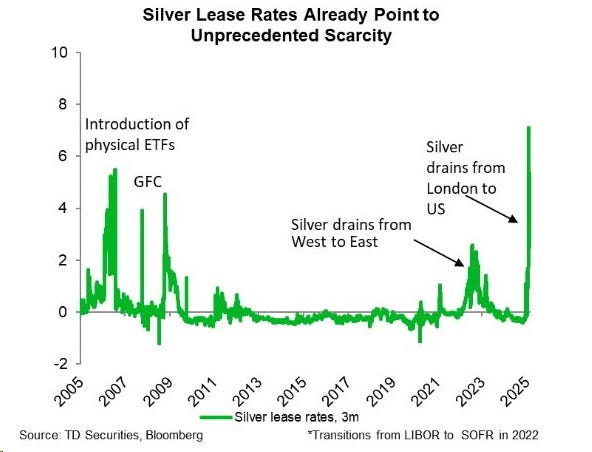

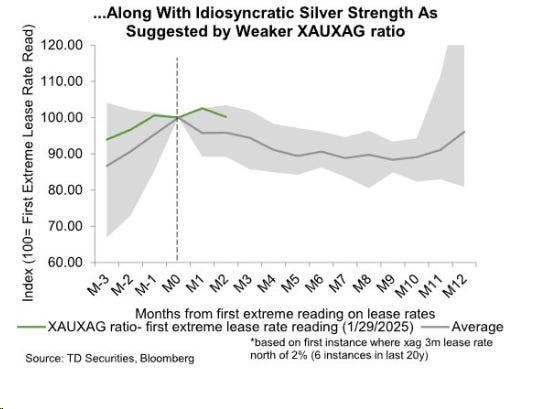

A recent study from TD Securities reported by analyst Daniel Ghali, highlights that Silver Lease Rates have reached extreme levels, suggesting an unprecedented shortage in the physical market:

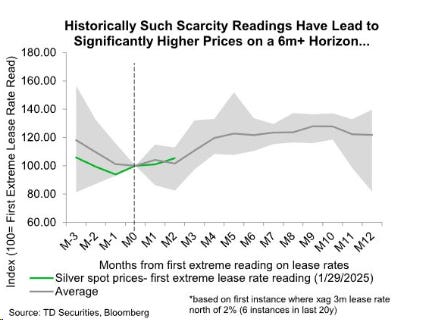

According to TD Securities, each time these rates exceeded 2% over three months - a critical threshold reached only six times in twenty years - the price of silver rose in the following 6 to 12 months:

The study reveals that these periods of tension have historically been followed by a rise in silver prices of 20% to 50%, and sometimes more.

In addition, TD Securities analyzes the relationship between this scarcity and the XAU/XAG (gold/silver) ratio. Their study shows that when silver becomes scarce, the ratio tends to fall, meaning that silver outperforms gold on the market.

During previous silver price tensions, the gold/silver ratio fell steadily, confirming that investors prefer silver during periods of supply contraction.

However, certain variables could temper the scenario of an immediate price explosion. Silver, unlike gold, is far more complex to store and transport. The logistics of physical silver delivery are costly and complicated, making the market less likely to experience a massive rush for the physical metal, unlike gold.

Moreover, silver stocks in China have recently been rising, and historically, a build-up of Chinese stocks tends to slow rallies on the international market.

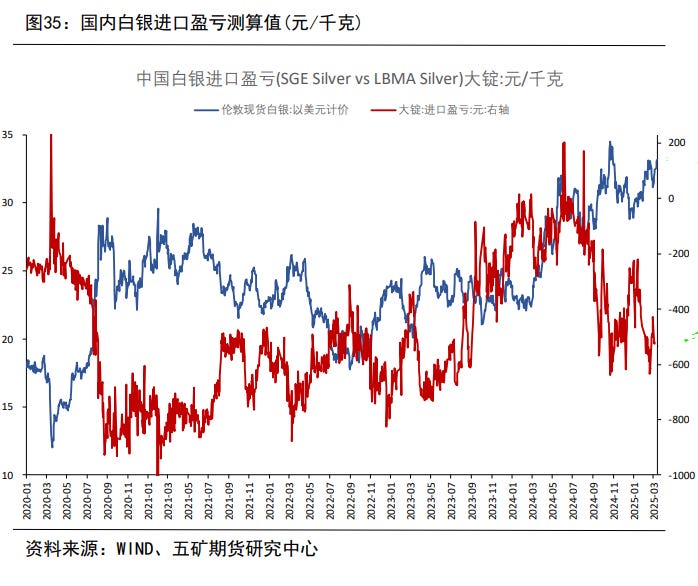

Since the end of 2023, China's silver import margin (red curve on the chart below) has fallen from around +200 yuan/kg to -500 yuan/kg, making imports significantly less profitable:

Historically, a negative margin has coincided with a slowdown in silver flows to China, reducing demand on the international market.

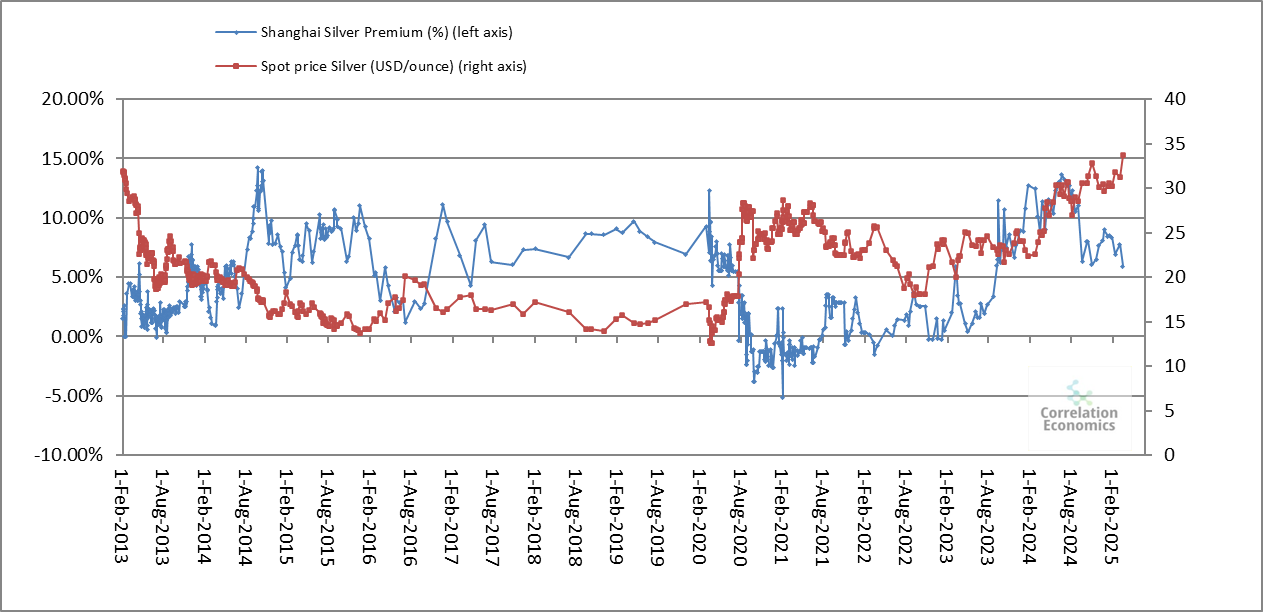

At the same time, the silver premium in Shanghai, which had reached 10% at the beginning of 2023, has now dropped to around 6%. Although still significant, a further decrease would indicate a waning Chinese interest in physical silver:

This drop in the premium means that Chinese buyers are less inclined to turn to imported silver, leading to a slowdown in purchases on international markets. In 2020, when the premium plunged below 0%, the silver price went through a consolidation phase after a sharp rise.

The key factor in a potential rise now lies in a possible loss of confidence by Western investors in the paper market. Currently, the majority of silver futures contract holders do not request physical delivery, preferring to settle in cash or via ETFs such as SLV. This is what enables the system to function despite the shortage of physical metal. However, it would only take a small percentage of these investors to request physical delivery of their silver to trigger a major upheaval.

Such a shock could also reveal another risk: the fragility of ETFs like the SLV, which are supposed to be backed by physical metal. At present, the SLV officially holds over 450 million ounces of silver, but doubts persist as to the funds' real capacity to guarantee this inventory in the event of a massive demand for deliveries.

The illusion of liquidity provided by these ETFs is based on the fact that the majority of investors never request physical delivery, preferring to trade fund units rather than claim metal. As long as this dynamic continues, prices can be kept under control, despite tensions on the physical market. That said, should a growing number of investors decide to demand real metal rather than simple cash settlement, this could quickly reveal a structural deficit in the stocks actually available.

If just 5% to 10% of COMEX contract holders insisted on physical metal instead of cash settlement, this would be enough to exhaust available stocks in a matter of weeks, exposing the fragility of the paper market and forcing banks to buy back physical metal on the market at much higher prices.

But even without delivery requests, this tension over the availability of physical silver on the LBMA poses a major problem for the COMEX.

The risk of a short squeeze on the COMEX does not depend solely on delivery requests exceeding available stocks. Even with a low volume of deliveries, a short squeeze can occur if stocks remain blocked and short sellers are left with no way of honoring their positions.

It doesn't matter whether the large buyers of gold and silver on the COMEX withdraw their metal immediately or not. As long as they retain their warrants, they are blocking these stocks from recirculating on the market. A warrant is a title deed which certifies that an investor holds physical metal in a COMEX warehouse. As long as the warrant is held, the corresponding gold or silver is unavailable for delivery, reducing liquidity and increasing pressure on the market.

This situation forces the LBMA to continue supplying metal via EFPs to the COMEX. However, if the LBMA reaches a point where it can no longer deliver enough physical metal, COMEX short sellers will be forced to urgently buy back long positions to cover their losses. This could trigger a veritable short squeeze, with the scarcity of physical metal causing prices to soar.

As with the gold market, we're at a critical juncture in the silver market. Physical scarcity is real, lease rates are skyrocketing, and the only reason the paper market is still holding is that the vast majority of investors are not requesting delivery. However, if confidence in the paper market begins to crumble, as has been the case with gold, even marginally, the impact on prices could be brutal and immediate.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.