Two important charts this week.

First, the DXY index, which measures the dollar's performance against other currencies:

The dollar appears to be weakening as August draws to a close, after soaring spectacularly over the past two years. The uptrend has clearly been broken, erasing in just a few sessions all the gains made in 2024.

Another crucial chart this week measures the performance of mining companies in relation to the rest of the market. This week, the GDX/SPX ratio broke its downward trend that began in the summer of 2020:

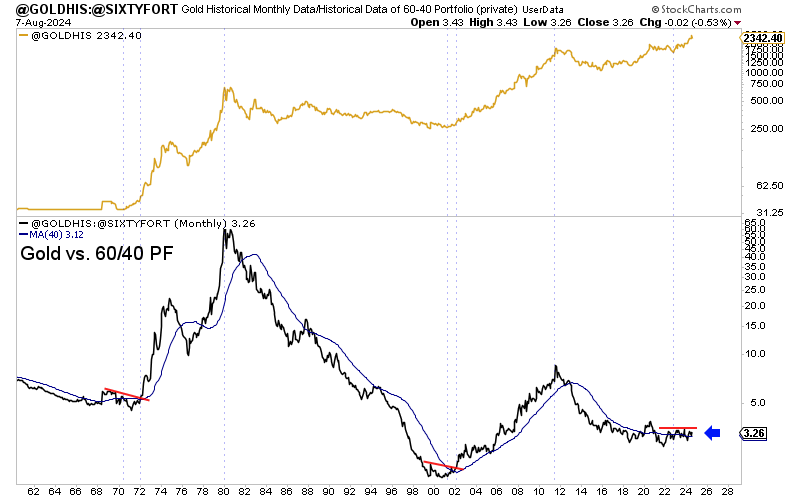

This mining outperformance comes at a time when gold is in the process of breaking a significant barrier to the “classic” 60/40 portfolio:

Explanations: since 1980, gold has never really managed to outperform a conventional portfolio composed of 60% bonds and 40% equities. The years 2000-2011 are an exception. Since Volcker's intervention in interest rates in 1980, gold has systematically underperformed this 60/40 investment strategy, which has enriched two generations of asset managers. Why invest in gold when such a simple, world-renowned strategy works so well?

Only when this chart breaks to the upside will gold become a must-have for Western investors. Gold will be favored provided it manages to outperform the classic strategy that has prevailed since 1980.

For this to happen, we need a real surge in demand for gold in the West.

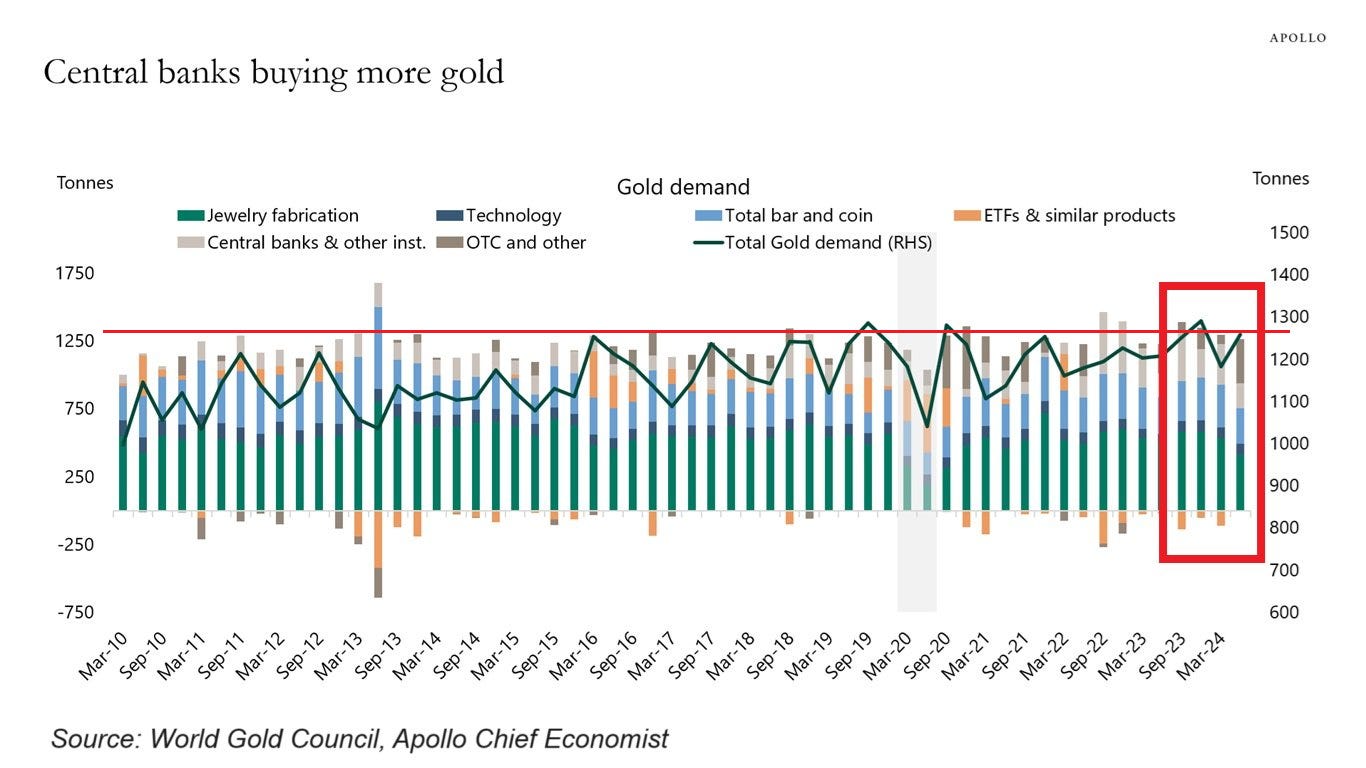

For the moment, this demand (at a record high) is mainly driven by central banks and Asian demand (China and India) for physical metal:

In July, demand for gold rose sharply, approaching its highest level in fourteen years.

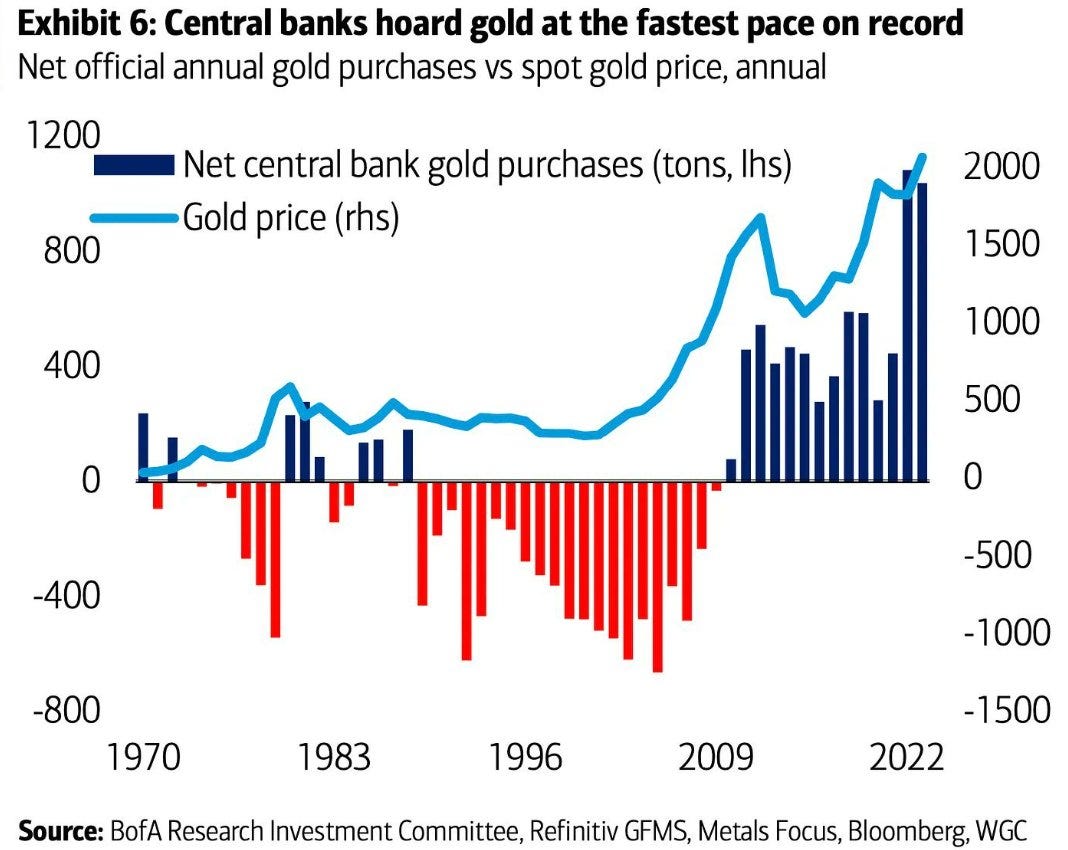

Over the past three years, total gold demand has fluctuated between 1,200 and 1,300 tons, mainly due to two types of buyer: Asian physical gold investors and central banks. The latter have never bought as much gold as in the last two years:

What has changed over the past month is the return of demand from Western investors, as evidenced by the recovery in ETF outstandings and over-the-counter investments.

The rise in demand for gold seems to be on the right track.

But the second condition for gold to become an attractive asset again, is to see this classic 60/40 portfolio fall in value.

In these bulletins, we have explained at length the losses incurred by bond portfolios as a result of rising interest rates. These losses are confined to hold-to-maturity products, and present no risk until they are realized.

For example, Bank of America is facing unrealized losses in its bond portfolio that now exceed $100 billion. These losses represent around half of the bank's tangible equity before tax. This means that the present value of their bonds has fallen considerably compared with their original purchase value, which could have significant implications for the bank's financial health if these losses were realized.

The majority of Bank of America's bond portfolio, valued at $466 billion, is classified as HTM (held-to-maturity). This means that these securities should return to their nominal value over time, barring a systemic event forcing the bank to liquidate these assets. However, the bank has several resources at its disposal to avoid a forced liquidation of this portfolio.

Firstly, the $301 billion AFS (available-for-sale securities) portion serves as a significant hedge in the event of rising rates during a recession.

In addition, the bank has around $1 trillion in liquid assets and a very satisfactory loan-to-deposit ratio of 55%.

The LCR of 113% at holding level is also more than sufficient to cope with a systemic event without affecting the HTM portfolio.

The LCR (Liquidity Coverage Ratio) is a financial indicator used by banks to assess their ability to cope with liquidity outflows over a 30-day period in the event of a crisis. It measures the ratio between high quality liquid assets (HQLA) held by the bank and expected net cash outflows over this period. An LCR of 100% or more indicates that the bank has sufficient liquidity to cover its needs in the event of financial stress, which is the case for Bank of America.

Unrealized losses are not perceived as a major risk for the banking sector by the markets.

This is probably why there has been no flight of investors from the bond market. In fact, high interest rates have attracted many new subscribers to debt-linked products.

The 40% share of these conventional portfolios traditionally allocated to equities has not been called into question for the time being. Analysts prefer the hypothesis of a soft landing for the economy, and do not foresee any major market correction. The expected rate cut in a US election year, when pressure will be high on the Fed and Treasury to intervene in the event of a severe index correction, contributes to this outlook.

However, there are already clear signs of a slowdown in the US economy in those sectors most sensitive to economic downturns.

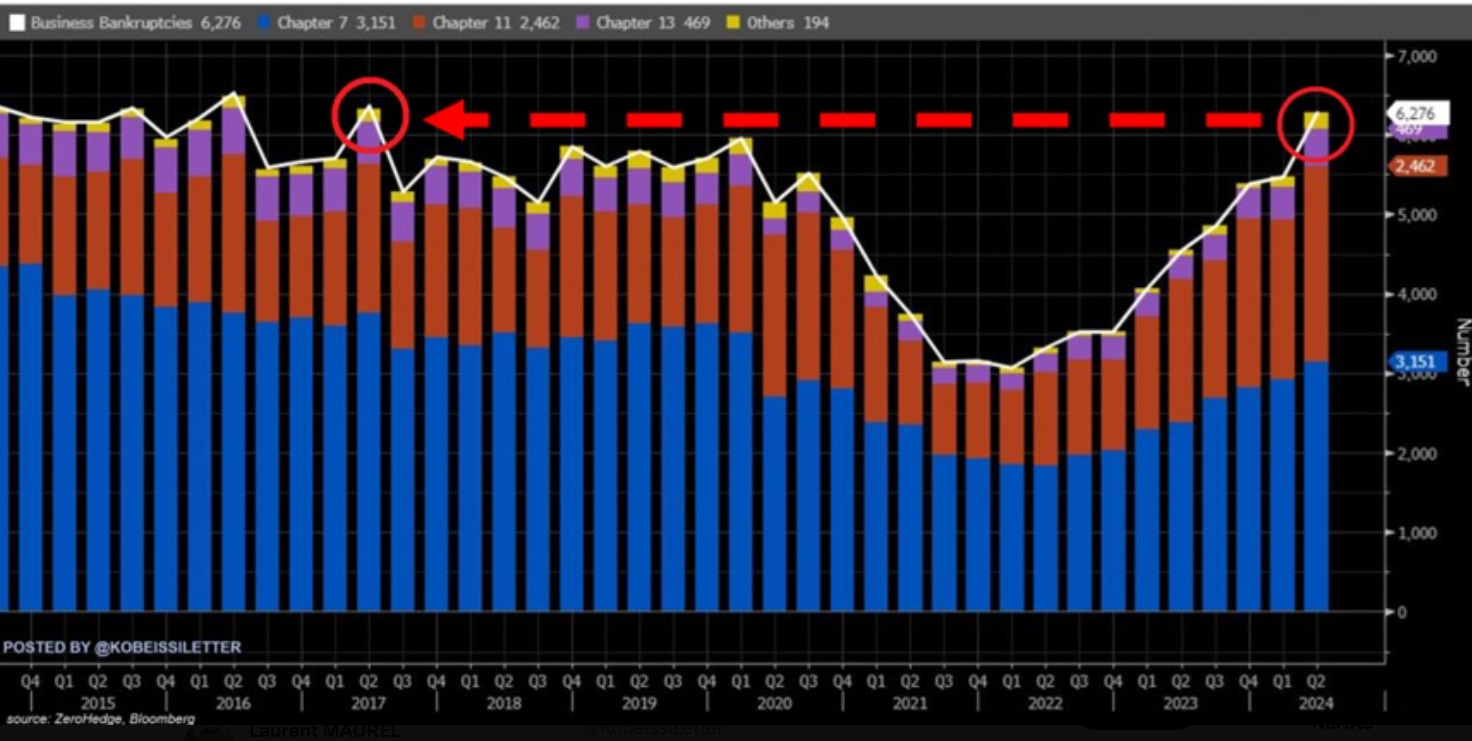

In the second quarter of 2024, new bankruptcies in the United States reached 6,276, the highest level since 2017. The number of business bankruptcies has doubled in two years. Chapter 7 (liquidation) filings climbed to 3,151, the highest since the 2020 pandemic. Chapter 11 bankruptcies, which allow companies to continue operating while developing a reorganization plan to repay some or all of their debt over a specified period, reached 2,462, surpassing all other quarters in the last ten years. Chapter 13 and other bankruptcies also increased. Chapter 13 allows debtors to establish a repayment plan over three to five years, with regular payments to creditors based on available income. This rise in bankruptcies, due in particular to loan defaults, indicates an alarming trend reminiscent of the great economic recessions:

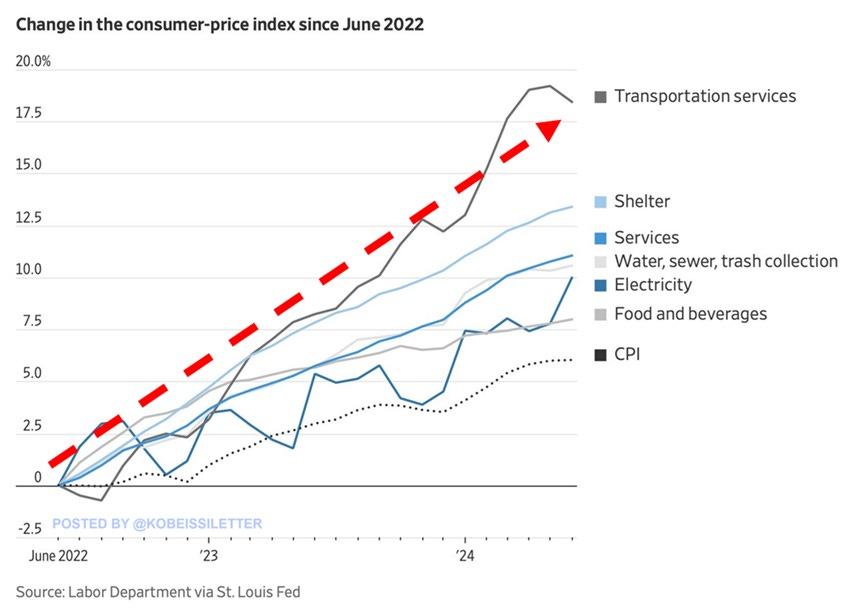

Small businesses seem particularly vulnerable to recent increases in prices. Since June 2022, overall Consumer Price Index (CPI) inflation in the US has risen by around 6%, but inflation for many essential goods has been much higher. Prices for transportation services climbed by 18.5%, while housing and utility costs rose by 13.5% and 11% respectively. Prices for water, sanitation, waste collection and electricity rose by around 10%, and those for food and beverages by 8%. When these costs cannot be passed on in sales prices, margins are squeezed, making it difficult to repay debts and threatening the very survival of businesses. Defaults on debt repayments immediately lead to defaults, which in turn lead to more bankruptcies:

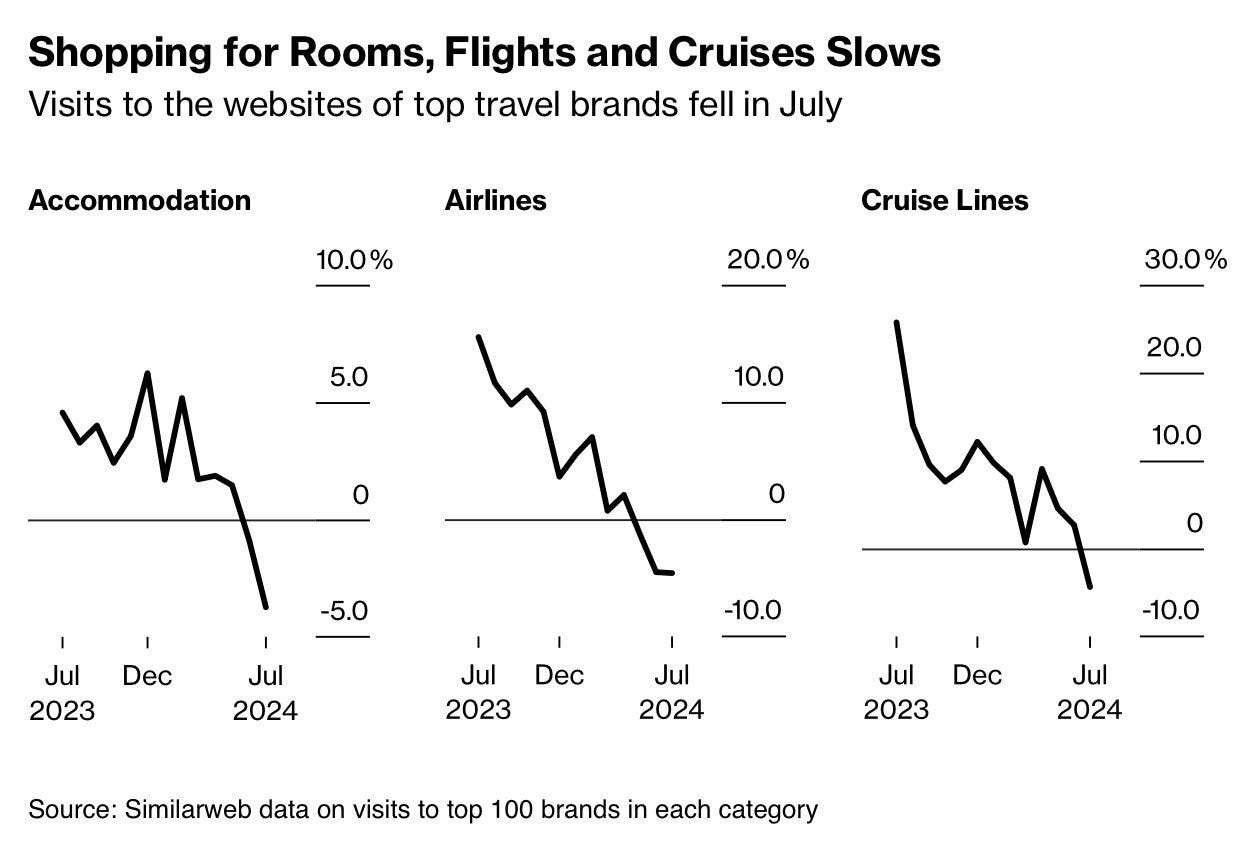

As the summer of 2024 draws to a close, the United States is facing a rise in bankruptcies and a noticeable decline in leisure activities. The end of the summer season is bad on the demand side, as evidenced by search indicators on travel agent websites:

The growing number of defaults logically drives up the price of gold.

Confirmation of a recession, triggered by an increase in defaults in the country, heralds gold's future outperformance of the classic 60/40 portfolio. This is probably when gold will begin to attract Western investors in a significant way. Many analysts, who have been reluctant to invest in gold over the past twenty years, are beginning to watch this rise in defaults. According to their logic, the more defaults rise, the greater the chances of gold appreciating, even from its highs. For these observers, it is the growing number of defaults in the US economy that will drive gold's next rise.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.