Silver metal reserves on China's Shanghai market fell by 39.7 tons in two days to 659 tons, or 21.2 million ounces. This is the lowest level since 2015. The Silver Short Squeeze 2 continues to unfold amidst general indifference:

The Chinese continue to flock to precious metals, bringing silver to the brink of an historic shortage.

We may be just a few weeks away from a silver short squeeze... in the midst of general indifference!

Meanwhile, the US markets continue their dizzying ascent, reaching new highs every day.

US market performances are often significant during election years, but so far, 2024 stands out as an exceptional year compared to all other election years since 1964:

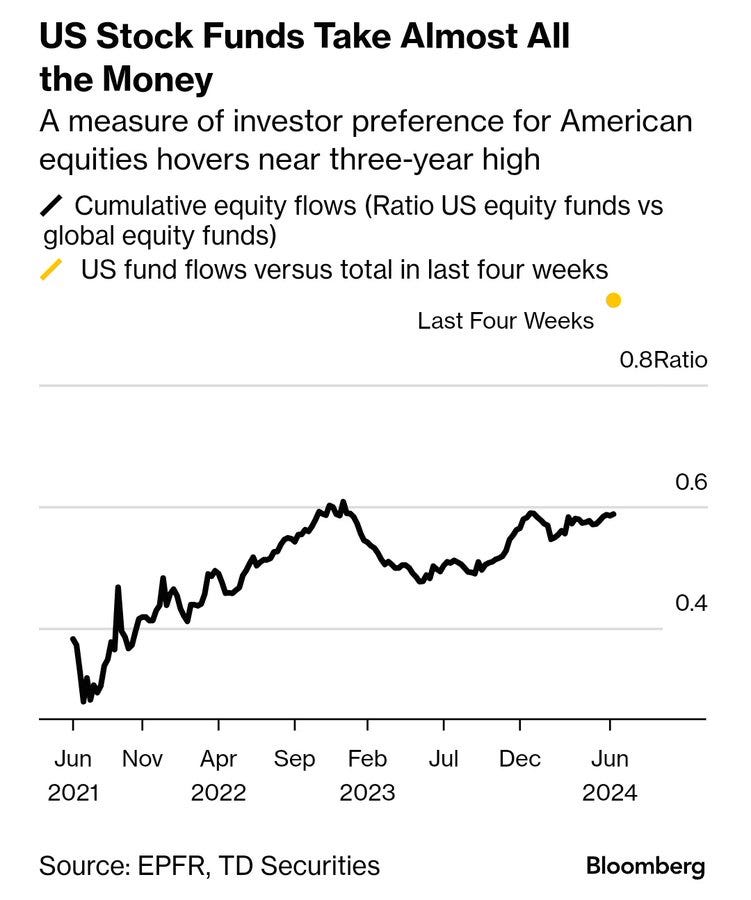

Markets have soared spectacularly in recent months. U.S. markets absorb a considerable share of global investment flows.

Investors from all over the world are flocking to US markets: over the past month, some $30 billion of new capital has been injected into equity funds, with 94% of these allocations going to US assets, particularly technology stocks, according to global EPFR data collected by TD Securities:

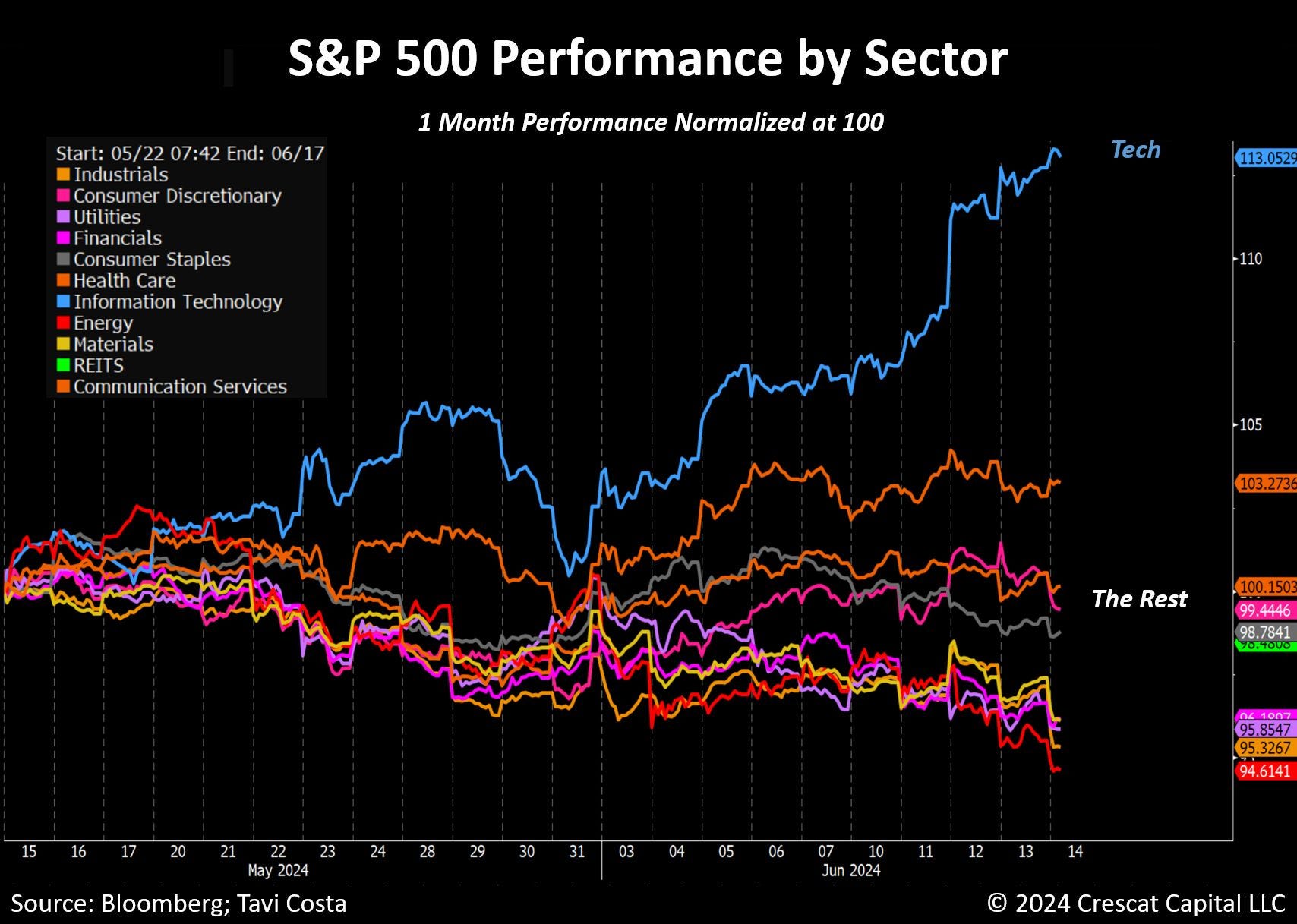

A closer look reveals that this investment has been concentrated mainly in the technology sector:

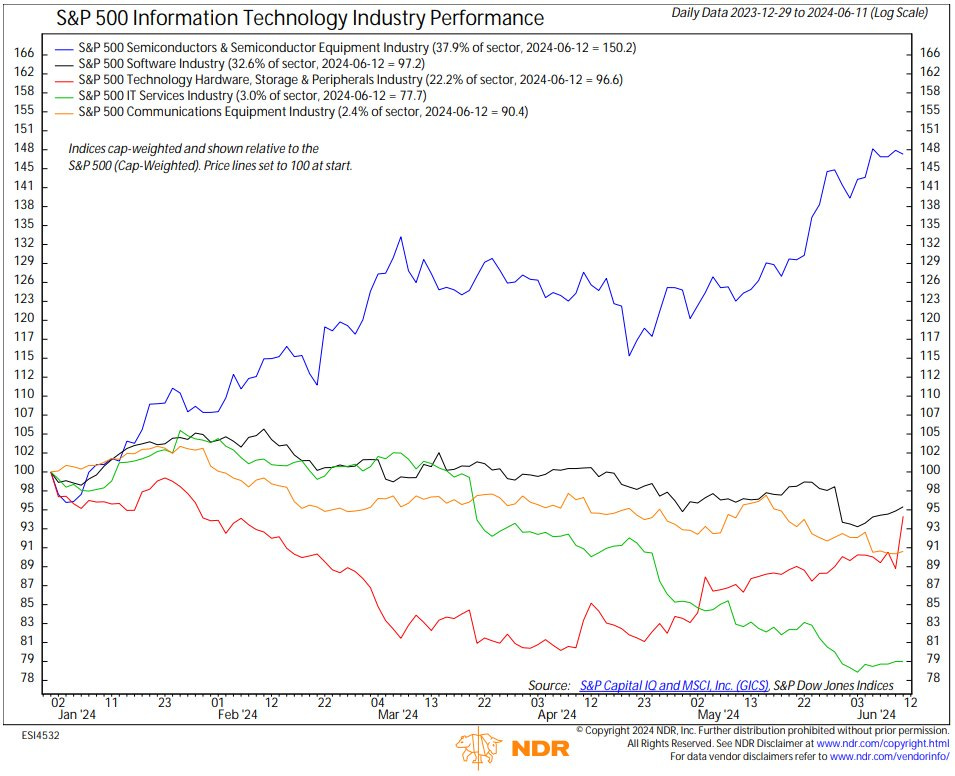

Within technology stocks, performance varied considerably. Only the semiconductor sector is driving the increase, while the software and, above all, services sectors are in decline:

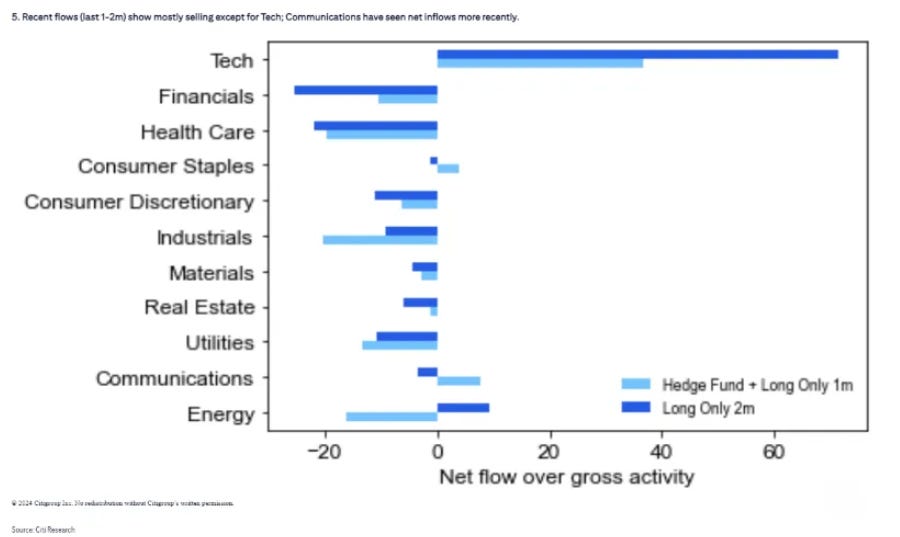

The infatuation with the technology sector is confirmed by a significant influx of capital from hedge funds, which have massively increased their exposure to this sector over the past month:

This surge in technology stocks is benefiting only a handful of companies.

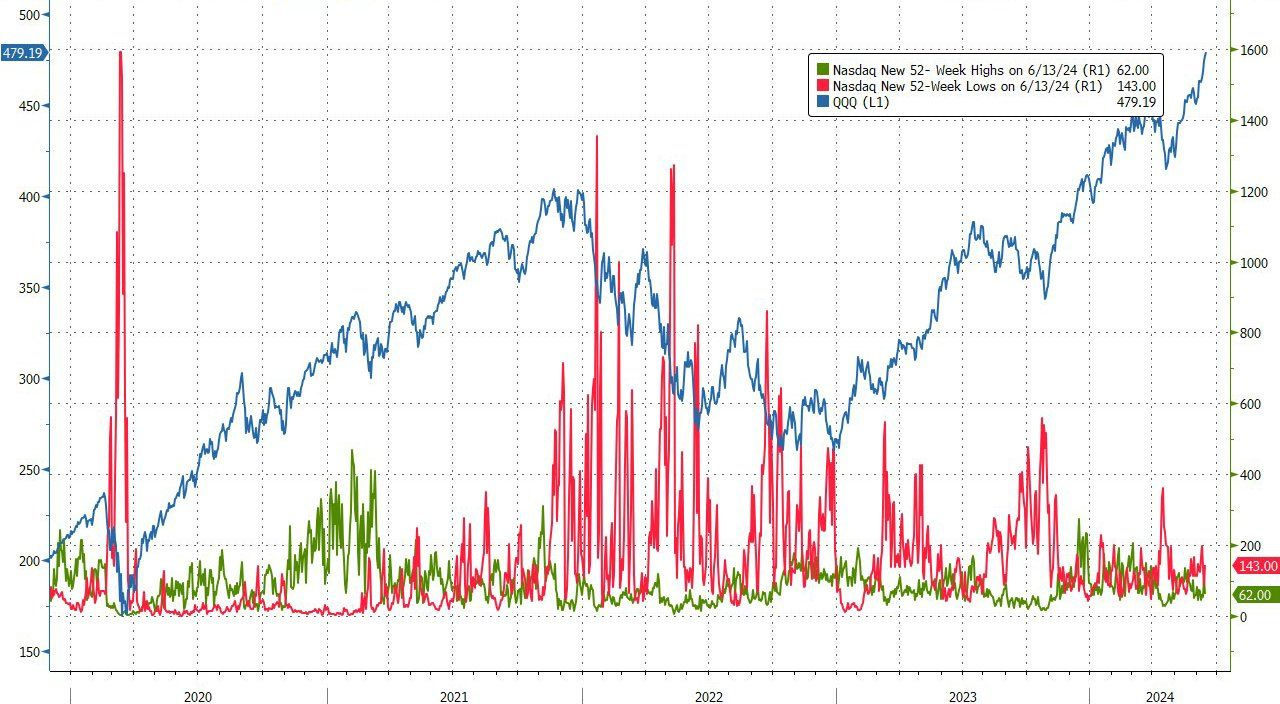

The rise is highly concentrated. While the Nasdaq set a string of records, very few stocks reached their highs, marking a major difference from the boom of 2020:

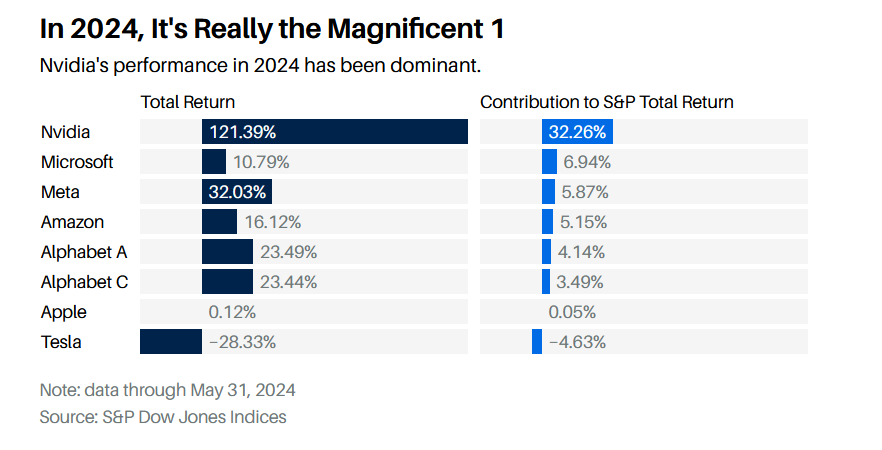

The rise remains concentrated on the "Magnificent 7", but what has changed in recent weeks is the extreme concentration on a single stock, NVIDIA, which now contributes 32% of the S&P 500's rise!

NVIDIA alone makes up for all the underperformance of other sectors!

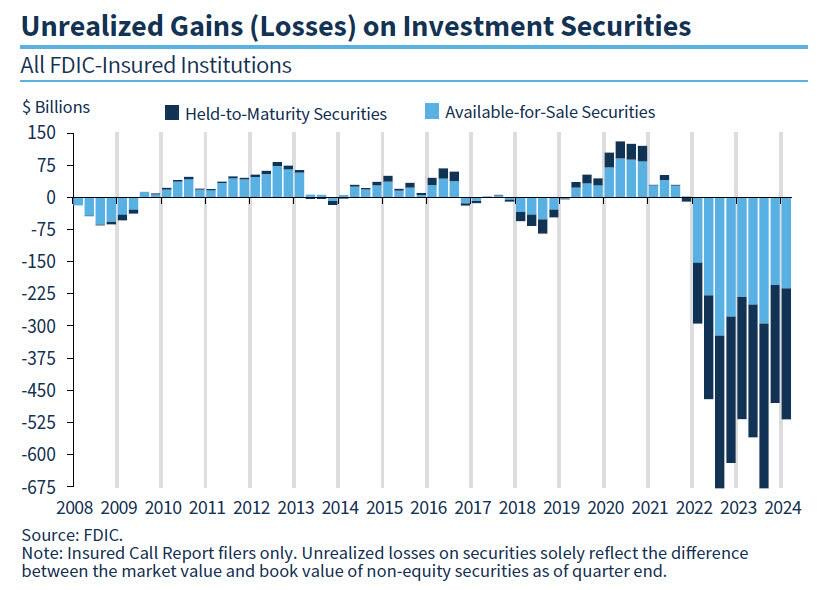

When a single stock soars, we often lose sight of the bigger picture. NVIDIA, for example, allows us to overlook the fact that banks are facing record losses due to the collapse of the bond market:

Sovereign bonds have fallen by 45% since their peak in 2020, which explains the accumulation of unrealized losses on bank balance sheets:

To stop the hemorrhaging, Japanese banking giant Norinchukin will liquidate $63 billion of European treasury bills and bonds to cover large unrealized losses. The Japanese institution prefers to cut its losses today without waiting for a hypothetical rate cut, becoming one of the first banks to do so.

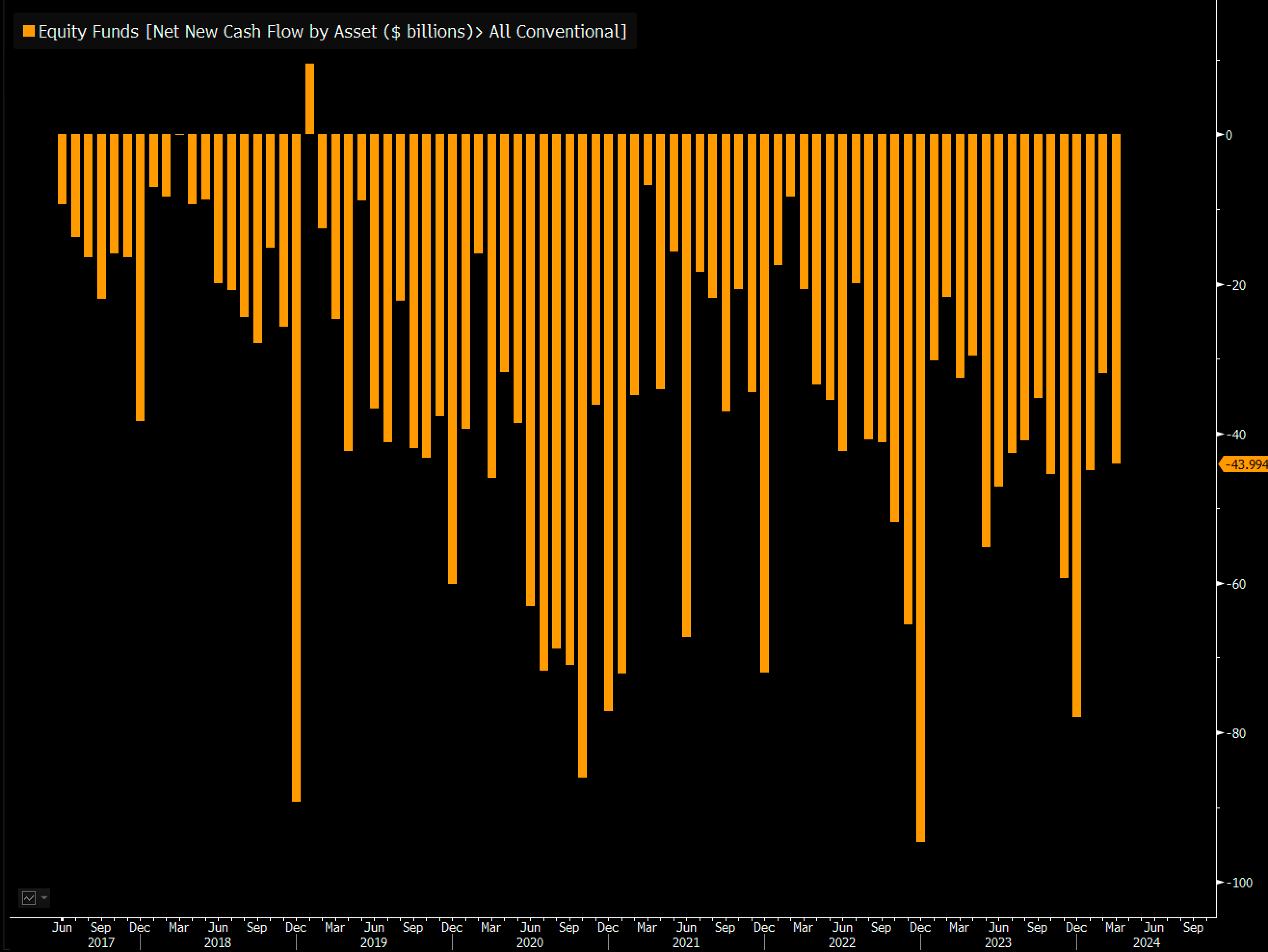

The fall in bond yields is also putting pressure on mutual funds, which have been faced with a veritable flood of withdrawals since the rise in rates.

While NVIDIA is breaking records, mutual funds are recording their 82nd consecutive month of outflows!

F

Banks and pension funds are suffering, but the stock market seems to be doing just fine!

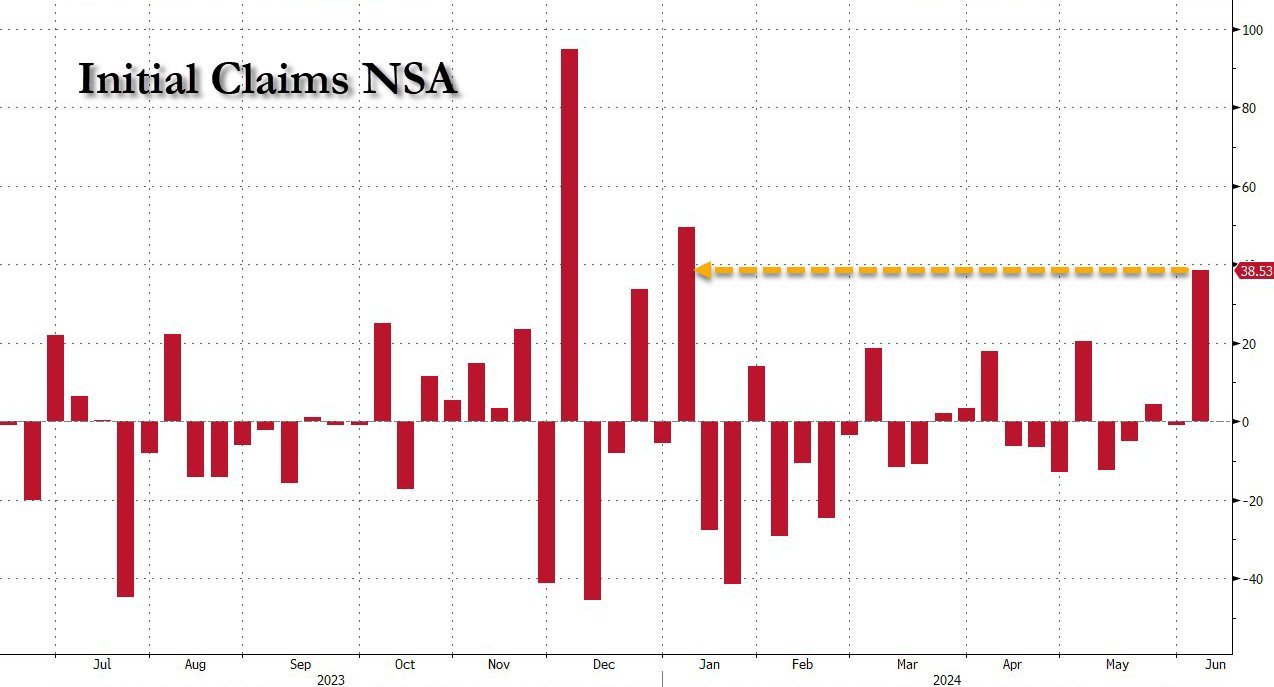

The exceptional performance of a single stock on the markets also avoids tackling the problem of the US economic slowdown. The job market is deteriorating faster than expected, with rising claims for unemployment benefits:

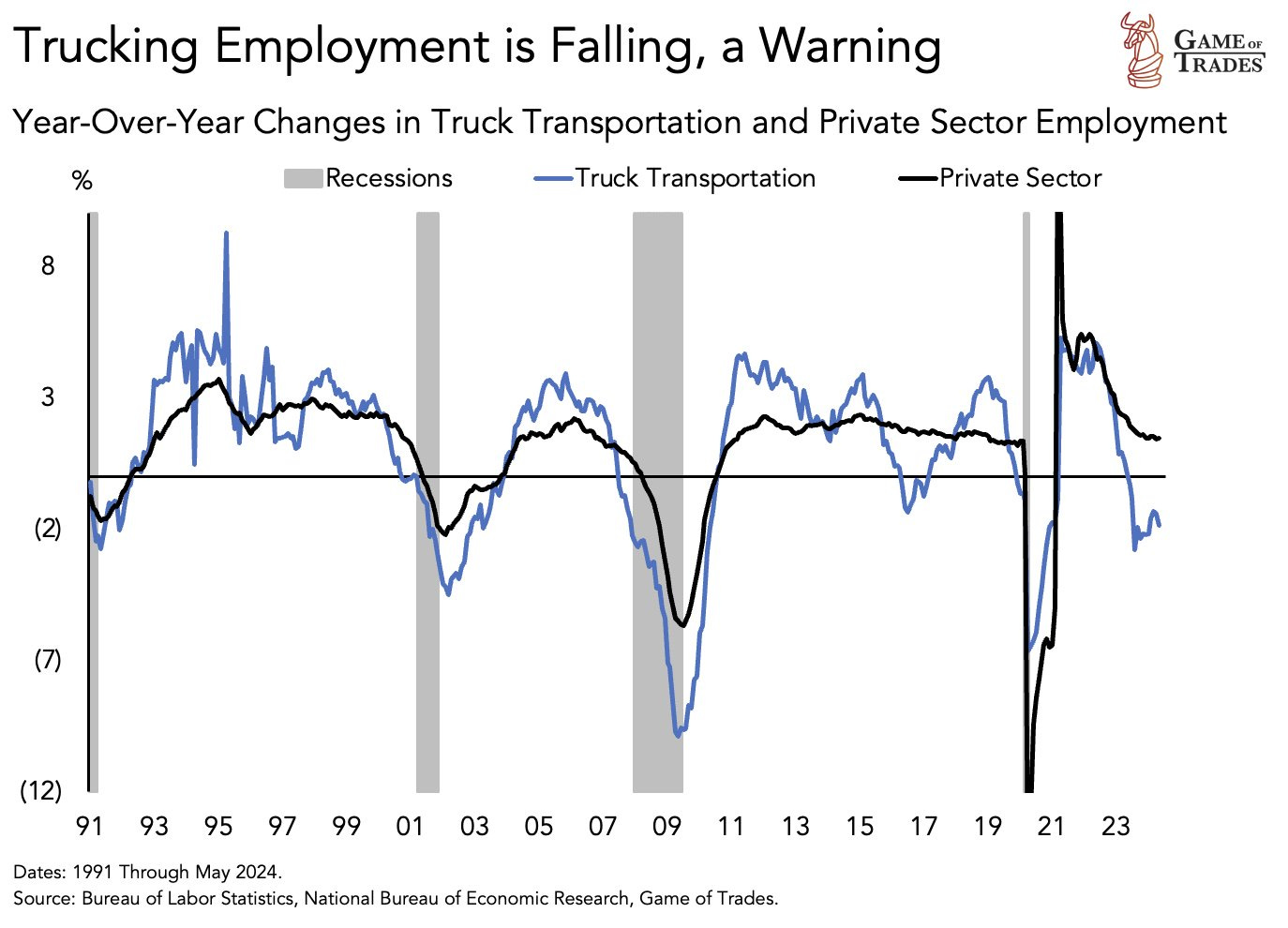

Employment in the transport sector continues to deteriorate, a major indicator of an impending recession:

The inversion of the yield curve persists for the 20th consecutive month - a record!

Historically, every inversion of the yield curve has preceded a recession...

"This time, it's not like before."

At present, it is believed that AI will enable us to enter a new growth cycle, capable of gradually cushioning the banks' unrealized losses and facilitating a soft landing for the US economy. The economic boom associated with AI could also help absorb the impact of rising rates.

NVIDIA will save us!

That's certainly not the opinion of analyst Adam Taggart.

In a remarkable exposé, Adam warns that the AI-related semiconductor market could face an inventory glut, similar to what happened during the tech bubble of 2000, leading to a fall in the shares of the companies concerned.

AI, while promising in the long term, would not, according to the analyst, justify today's massive investments in large language models (LLMs). These technologies, while bringing improvements such as faster translation and code-writing assistance, are not revolutionizing industries as expected. Disproportionate investment could even lead to an economic crisis similar to the dot-com bubble of the 2000s.

This exposé raises questions about the sustainability of the current valuation of technology companies, and warns of a possible economic backlash.

If the analyst is right, the smokescreen surrounding NVIDIA could quickly dissipate: even a minor correction in NVIDIA's share price could suddenly reveal all the realities that the infatuation with this stock has so far managed to conceal.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.