Chinese investors continue to shun the stock market and the real estate sector.

This week, the real estate crisis took on a new dimension with the liquidation of Evergrande.

China's largest property developer was forced into bankruptcy due to the lack of a convincing restructuring plan, resulting in the suspension of its shares from listing on the Hong Kong Stock Exchange.

The decision by a Hong Kong court came as Evergrande faced a colossal debt of over $300 billion. The announcement of the Chinese real estate giant's bankruptcy triggered a fall of over 20% in the share price, leading to the suspension of trading.

The real estate sector accounts for a quarter of China's GDP, but high levels of leverage suggest that the sector's deleveraging process could send many banks into a deflationary spiral.

According to analyst Kyle Bass, who is quite critical of China, there is even a wider systemic risk within the Chinese financial system and economy, associated with the colossal debt of the country's real estate sector.

Does the Chinese stock market's underperformance stem from the risk of contagion in the financial sector?

In recent weeks, the Chinese stock market has maintained its downward trend, particularly affected by the fall in small caps. The CSI 300 index hit a five-year low last week.

Since 2021, the HSCEI (Hang Seng China Enterprises Index) has fallen significantly:

The Chinese authorities have been forced to intervene to halt the hemorrhaging of the markets.

The financial markets regulator announced measures to limit short selling, including a ban on brokers lending securities to their clients and restrictions on securities refinancing mechanisms.

The Chinese Securities Regulatory Commission (CSRC) warned that it would have "no tolerance" for short sellers, threatening severe sanctions.

Following the announcement of the ban on short-selling on the Chinese stock exchange, the markets closed higher after six consecutive sessions of decline. The Shanghai SSE Composite was up 3.23%, while securities lending was down 24%, and the CSI 300 was up 3.48% in a single session.

Will these measures be effective in attracting Chinese investors back to the stock market?

Lack of interest in real estate and stock markets benefits gold.

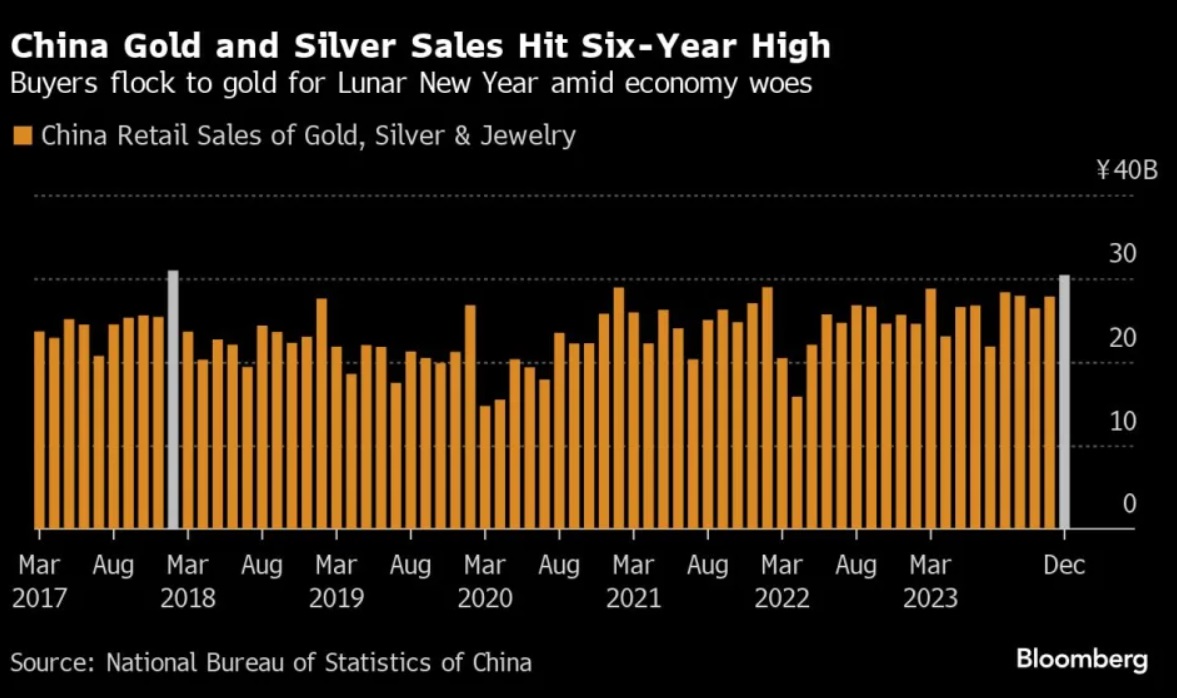

In my article from last December, I highlighted the Chinese enthusiasm for investing in physical gold, which was confirmed in January.

It is all the more remarkable that this latest rush by Chinese investors into gold comes at a time when the markets have taken a very sharp plunge at the start of the year:

The perception of gold as a safe haven in times of crisis is attracting new buyers, especially young people. Sales of gold jewelry remain high despite the economic difficulties, fuelled by the desire to preserve wealth and a new trend towards more modern designs.

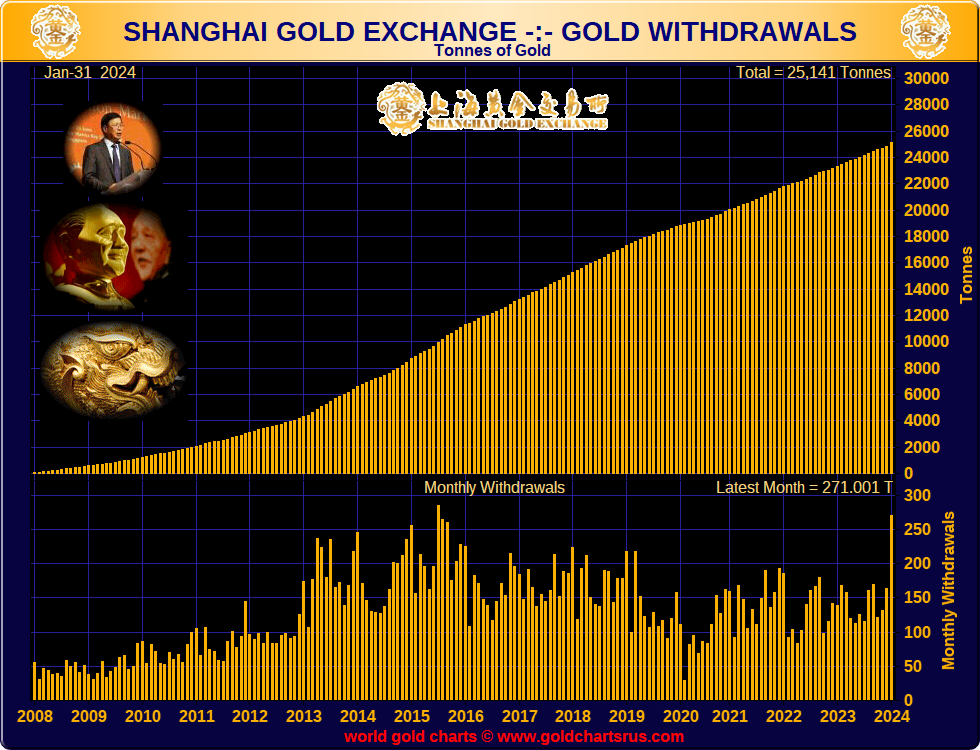

These gold purchases involve both individuals and investors, with the latter taking delivery of a record amount on the Shanghai market during the month of January.

Gold withdrawals from the Shanghai Gold Exchange (SGE) rose again in January 2024 (+271 tons), reaching their second highest level since 2008:

Chinese investors are not even seeking exposure to gold-linked stock market products such as ETFs, opting instead for direct delivery to the Shanghai market to physically hold gold in their hands. Lack of interest in real estate and the stock market, combined with a loss of confidence in the banking system, has led to this gold rush, at a time when gold prices are at their highest.

These investors didn't even wait for the Chinese New Year to make their purchases. This year, the SGE will be closed for the New Year period between February 9 and 15. If history repeats itself, we're likely to see a pullback in gold prices due to cheap selling of futures contracts on the COMEX, precisely during the Shanghai closure. It seems that investors did not wait for this more favourable arbitrage period: with the delivery of 271 tons in a single month, this is equivalent to more than a tenth of France's gold reserves!

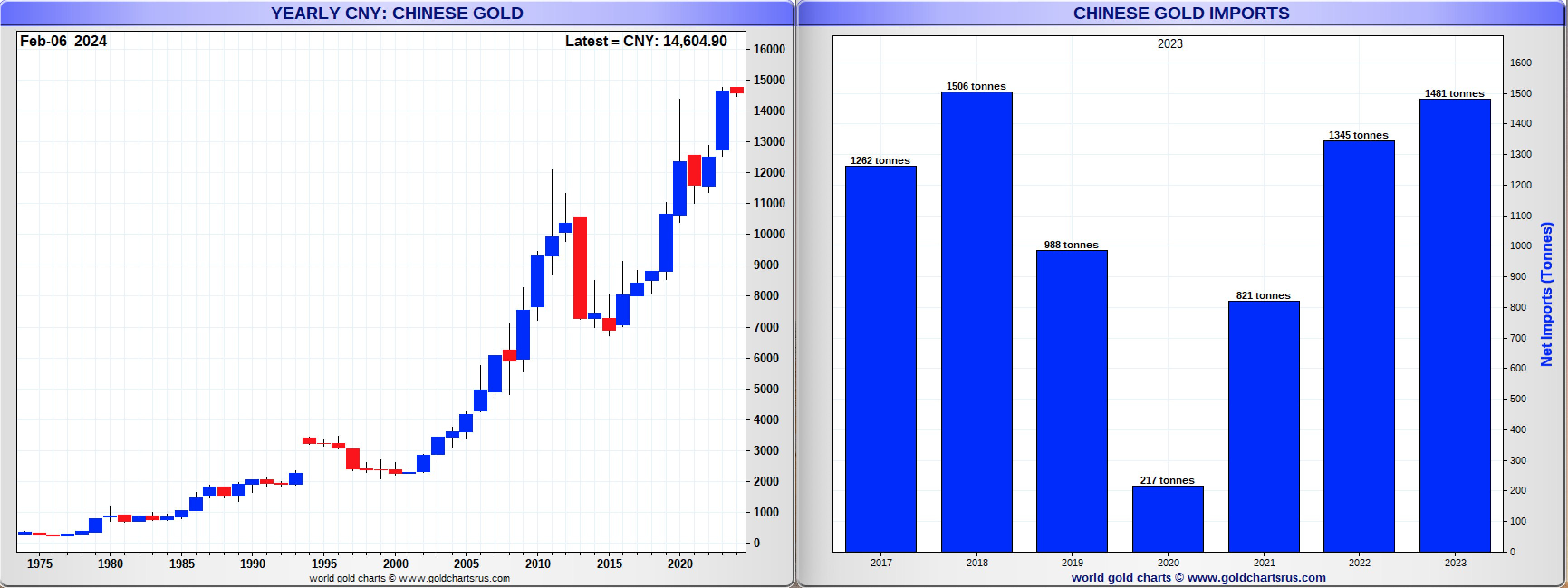

These physical purchases also involve the Chinese Central Bank. At the end of January 2024, the Chinese Central Bank's gold reserves stood at 72.19 million ounces, an increase of 320,000 ounces (9.953 tons) from the previous month.

This marks the fifteenth consecutive month of increases in the Chinese Central Bank's gold reserves, and these additions were made at high yuan gold prices:

The central bank is no longer waiting for prices to fall before buying gold. It is now pursuing a regular program of gold purchases in tandem with the ongoing sale of US Treasuries:

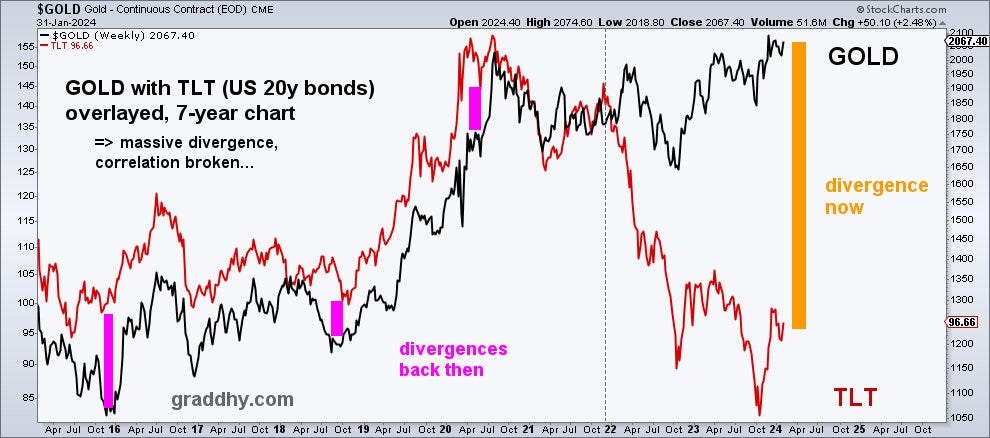

Since 2023, gold has been decorrelated from the iShares 20+ Year Treasury Bond ETF (TLT). Gold has become a separate investment from Treasuries following China's change of reserve strategy:

Interestingly, gold is the only asset to benefit from China's ongoing deleveraging process. As bubbles deflate, gold once again becomes the safe-haven asset par excellence.

This gold rush has yet to be seen in the West, as the great deleveraging has far from begun. In fact, bubbles are still inflating, as liquidity continues to flow into the system, unlike in China.

Although signs of a slowdown are beginning to emerge, especially in Europe, what really matters is liquidity. In the United States, the credit tap is far from closed, and the financial system continues to benefit from the necessary liquidity, preventing the same deleveraging seen in China.

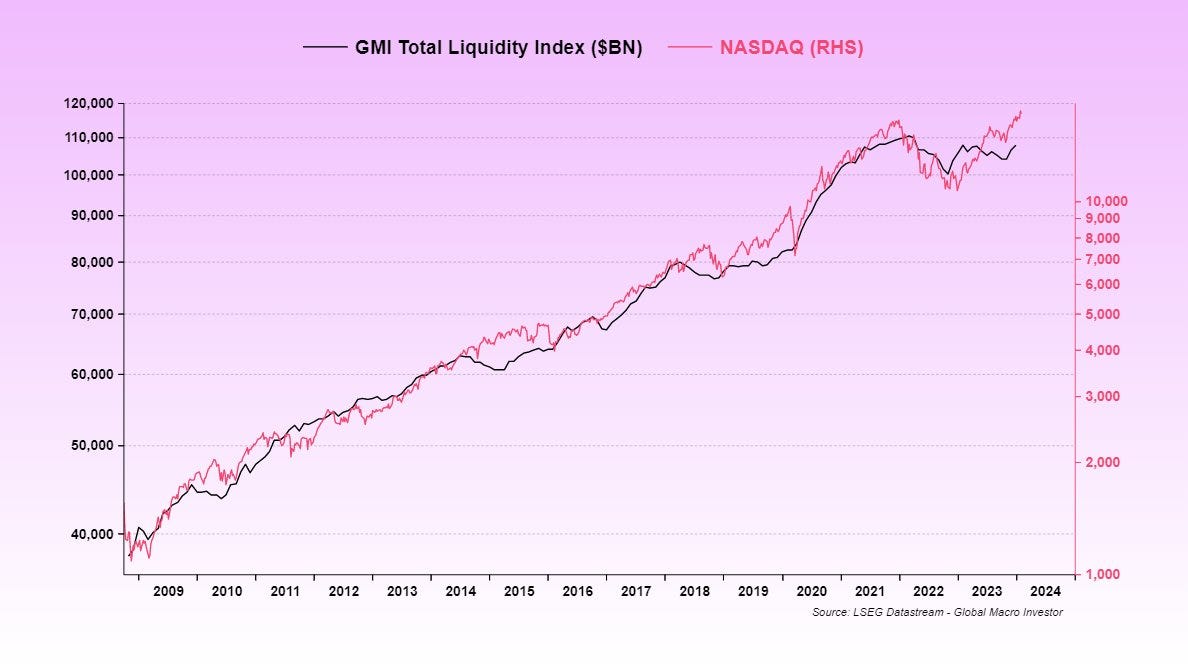

Since 2008, this global liquidity has acted as a fuel for US markets.

This is the argument put forward by Global Macro Investor analyst Raoul Pal, who convincingly explains this phenomenon by comparing the Nasdaq and GMI curves, which measure the total liquidity injected by central banks:

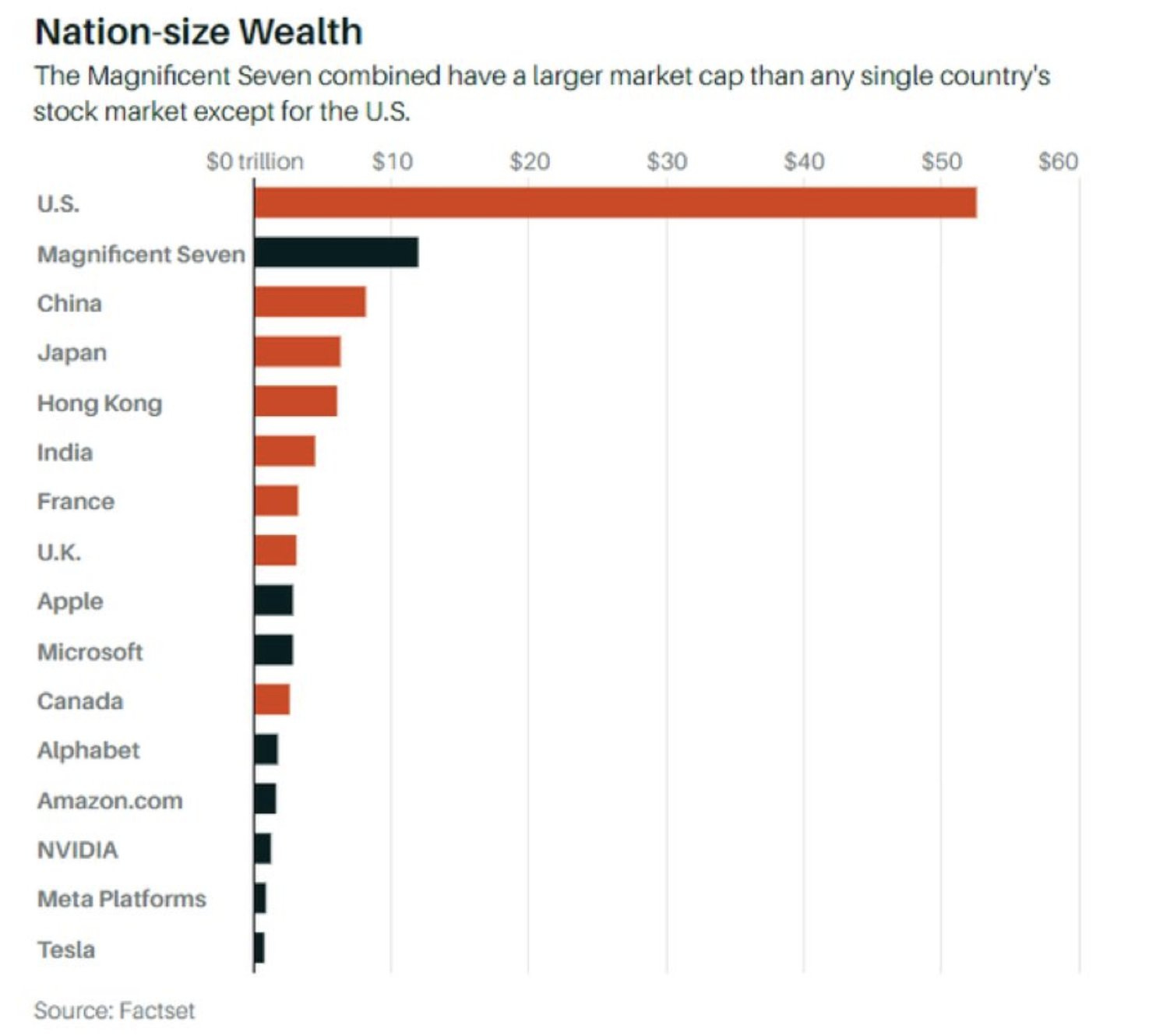

This liquidity bubble is now concentrated in an increasingly small number of stocks. Since the index last bottomed in October 2022, the "Magnificent Seven" (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) have collectively risen by over 110%, vastly outperforming the other 493 companies in the S&P 500!

These companies alone surpass in market capitalization any other exchange in the world, with the exception of the US stock market.

It's as if all the liquidity injected by central banks since 2008 were now concentrated in these seven stocks!

Regardless of these companies' economic prospects, such a concentrated liquidity bubble can only lead to even more rapid deleveraging, precisely because of this concentration.

The vast process of deleveraging our extremely financialized system (currently even more bloated than in 2008) has not yet begun.

Once this movement is underway, physical gold will, like China, regain its role as a safe-haven asset.

Chinese are Embracing Gold as a Safe-Haven Investment: Will Europeans Soon Follow? (@LaurentMaurel_)

— GoldBroker (@Goldbroker_com) December 22, 2023

➡ https://t.co/67kyI9uxj3#China #gold #savings #investing pic.twitter.com/fDwclUHjRK

What keeps the system in place is the confidence that investors still have in the Fed's ability to continue injecting liquidity to keep the markets rising, a rise that is based on a very limited number of stocks.

If this confidence were to collapse, as has happened in China, we could see a wave of physical gold buying that has yet to begin in the West. Gold purchases, as an alternative investment during a wave of massive deleveraging, could then rise sharply... provided the Chinese leave us some!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.