Breaking Up is Hard to Do

In markets, as in love, it’s obviously hard to let go of something familiar yet clearly not working; but as all sober romantics eventually discover: Toxic relationships hurt.

As for our toxic yet often enjoyable ride through the post-08 markets, it was easy to be seduced by the surface of things, as low rates, FAANG-driven tech seductions and a now unlimited money printer seem to make an otherwise ugly financial system appear attractive.

But a bad love is still a bad love, and a bad market is still a bad market, no matter how much lipstick the central banks put on a securities pig.

Nowhere is this truer than in the global and US credit markets.

The Courage to Walk Away?

Many investors, like star-crossed lovers, still feel the need to hold on to illusions, nostalgia and thus bad unions (and unfaithful bond markets) despite all the danger signs lurking beneath debt-soaked balance sheets.

In the end, however, it takes a kind of personal courage to shed illusions and embrace cold math.

But we are all, as Nietzsche warned, human, all too human. We love our illusions. We stay too long in toxic relationships.

As such, we are prone to prefer fantasy over reality.

Like hopeless romantics chasing shallow and vapid loves, many investors are chasing empty promises (and yields) from an equally empty bond market.

Goethe’s Warning?

In The Sorrows of Young Werther, von Goethe tells the 1787 tale of a young artist placing his love and blind faith in a woman who otherwise lacks the depth of his generous soul.

In the end, Werther wastes his life chasing the equivalent of an empty cup.

Speaking of empty cups, the U.S. bond market comes immediately to mind, and those who place their trust in it are doomed to become a large group of market “young Werthers.”

As Bob Prince, co-chief investment officer at Ray Dalio’s Bridgewater fund warned over the summer, investors have fallen foolishly in love with bonds and negative yielding returns despite obvious signs of deception and toxic love.

COVID conditions and market risk have sent more investors into the “safe arms” of bonds as a traditional place to “store wealth.”

But with the Fed buying bonds as well as repressing rates, the net result is that investors are literally paying to lose rather than store their wealth.

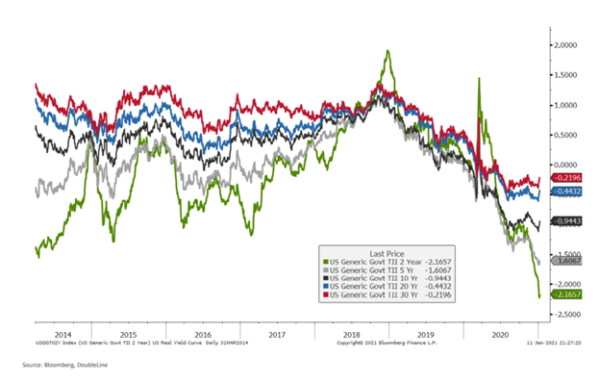

Adjusted for inflation, U.S. Treasuries produce negative returns.

Stated otherwise, many investors are falling for the wrong gal…

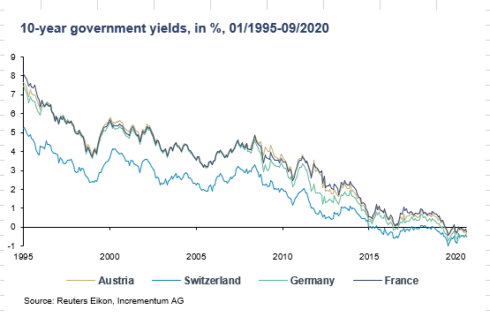

But toxic love is not just an American problem; it’s global, as the following chart of negative global yields confirm:

Folks, if there is no interest rate, that means there is no discount rate on cash flows.

This means the reward of holding bonds is blatantly asymmetric to the risk of losing money.

In short, investors are buying lots flowers but getting no kisses.

Alas, time to break up.

It will take years, not days, for the economy to return to “normal,” which as we’ve warned elsewhere, is itself an extreme irony, as “normal” before COVID was anything but normal…

In other words, even going back to pre-COVID markets is nothing to get excited about. The love story was bad then, and bad today. Why fall for it?

Inflation’s “Mind-Blowing” Dark Side—How the Love Affair (and Party) Ends

Although the pundits and mad scientists behind MMT still believe inflation is an extinct remnant of the past, should the US see even a slight rise in otherwise bogusly reported CPI data, such inflation would be devasting to bonds, or as Prince described it: “mind-blowing.”

WHEN, not IF, inflation returns and investors finally end their bad love affair with bonds, then bond prices will fall, which means bond yields will rise—which means interest rates will rise too.

Furthermore, as the headlines push the virus vaccine, stocks could see a temporary glow as investors dump bonds to chase topping stocks, sending yields—and hence interest rates—higher.

But as informed investors know, rising yields and rates are to record-breaking debt bubbles what shark fins are to a surfer—really bad news.

Markets driven by debt eventually die (and I mean die hard) when the cost of servicing that debt (i.e. interest rates) becomes too high.

Every debt bubble comes to an abrupt end as inflation slowly rears its all-too-real head.

Still in Love with the Illusion of No Inflation?

But again, love-sick folks often ignore the pig beneath the lipstick.

And bond-enamored investors often ignore the inflation risk beneath these markets.

For me, the inflation vs. deflation dialogue is not a debate, it’s a cycle—one following the other.

Inflation, alas, is coming, as is the big, bad “bond divorce.”

The Deflation Camp

As for deflation, clearly the pandemic and its global policy response has devastated world economies, including the U.S., thereby adding to a low-growth deflationary trend.

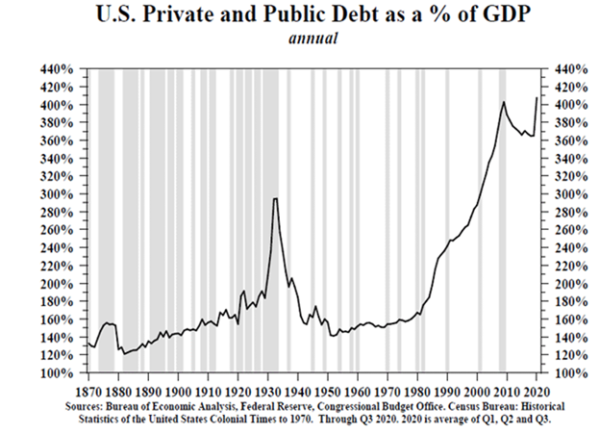

Low economic growth (for which stimulus is having an increasingly lower multiplier effect) reduces money velocity, and adds to the deflation argument in a nation whose growth is guaranteed to stagnate given current (and shameful) debt-to-GDP levels.

Those in the deflationary camp will also (and rightfully) argue that Fed critics have been calling for inflation for over 12 years, and it has yet to surface.

Furthermore, the pandemic has created savers not spenders—or even more likely, lots more people who are simply tapped out (i.e. broke) as wages remain stagnant or evaporated.

Either way, that means less spending, less velocity, and hence less inflation. Fair enough.

The Inflation Camp

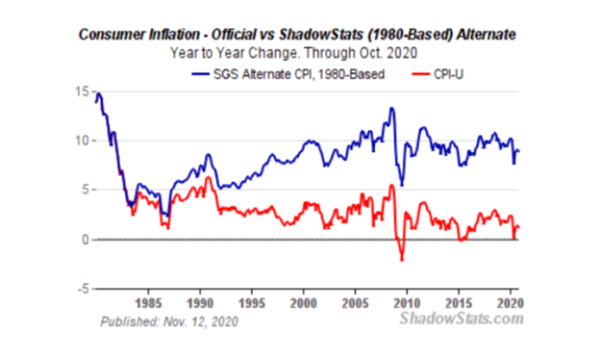

But as for the inflation case, the easiest place to start is with the CPI scale used to measure it—which is about as bogus as 42nd Street Rolex.

Using the CPI methodologies of the 1980’s rather than the watered-down version which the Bureau of Labor Statistics employs (manipulates) to report inflation, we are in fact far closer to 10% inflation today (blue line) than the sub 2% levels “reported” by the fiction writers in DC (red line).

A vaccine “re-start” is also predicted to be temporarily inflationary if and when “pent-up demand” resurfaces. But this is debatable, especially given the tissue damage already done to the global economy.

China is an inflationary factor too.

It’s “cheap labor” is less cheap, and supply-chain damage unleashed by the pre-COVID trade war and then the current COVID disaster has sent prices along that chain upward, adding to inflationary tailwinds.

But the obvious and real inflationary factor remains the central banks, whose money printers are effectively on an auto-pilot to insanity.

Price inflation pushes rates higher, forcing more “yield curve control” from the central banks, which just means rising money printing, a sinking dollar and yes, rising inflation and tanking real rates.

In short: the perfect environment for gold.

But others will say that even the insane levels of current and future central bank money creation do not lead to increased money velocity.

Instead, those printed dollars are absorbed by the ever-liquidity-thirsty repo and Euro-Dollar markets, or self-contained within the highly inflated risk asset markets.

But this ignores the fact that central banks are slowly turning from lenders to spenders, making direct ETF and security purchases rather than “loans.”

As discussed recently, such “spending” slowly increases velocity and hence inflationary winds.

Like Hemingway’s description of poverty, the inflationary forces which follow “begins slowly at first and then all at once.”

Thus, rather than academically debate inflation vs. deflation, one must consider common sense as well as distorted rather than accurate data.

Ultimately, and regardless of how inflation is reported or argued, the Dollar, Euro, Pound Sterling and/or Yen in your wallet is being debased by the second when measured against physical gold.

Again, this is a graph worth repeating over and over and over.

How the Love Affair with Bonds Turns into One Big Regret

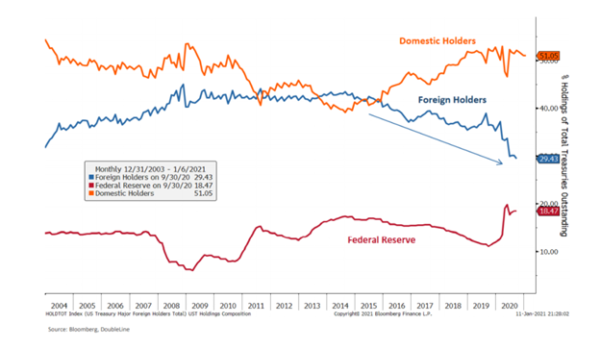

First, and as usual, the US Treasury Dept, having so little national income growth (i.e., GDP) to speak of, will do what it always does to “solve” a debt crisis: Issue more debt.

This means more long-term Treasury Bonds (IOU’s) are being issued minute by minute in DC.

After all, we have bloated budget deficits to “pay for” (i.e. deficit spend/borrow/print away).

But who will want to buy those Treasury bonds if their real return (i.e. inflation-adjusted return) is negative?

Well, the short answer is less and less informed investors outside of the US…Which means the Fed will be the buyer of last resort.

This also means Uncle Sam will have no choice but to sweeten the dinner date by promising higher yields/returns to his star-crossed investors.

Ah the sweet lies and petty games of a toxic love…

This, however, also puts Uncle Sam (and hence the bond market) into a viscous circle of almost comical proportions.

That is: a) DC needs to raise yields/rates to attract other bond buyers (suckers), yet b) if yields/rates rise, the government can’t afford the debt cost.

See the dilemma?

Falling Back in Love with Precious Metals

Of course, we already know what the US will do to pay for this increasingly painful debt burden—namely: Print more money…

Printing more money, in turn, simply means that the purchasing power of the dollars sitting in your current bank account are getting weaker by the second as the dilution effect of unlimited QE does its quiet yet dirty work on your trust and currency like a secretive and toxic partner in a toxic love gone bad.

The obvious remedy in this toxic relationship with bonds, central banks, inflation “debaters” and false hope is to do what Young Werther could not do—that is:

Wake up and then break up with your toxic partner and find a new one.

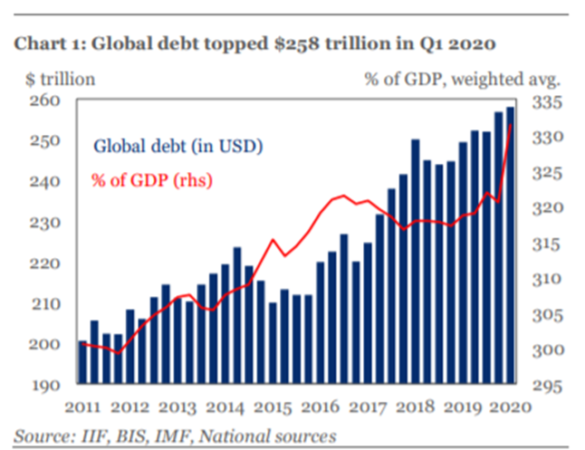

And what better partner than gold and silver, as precious metals are absolutely precious to broken-hearted currencies diluted by years of dishonest, artificial, low-rate supported bond markets and a national and global debt bubble (ripping north from $258T to +$280T in less than a year).

That just screams of toxic.

We’ve been talking about gold for years, not weeks. But Goldman Sachs and others will not.

Why?

Simple: There’s no big fee-churning trade gains for the big banks to recommend physical gold.

So much for “fiduciary care.”

Furthermore, the Fed, BIS and all the major central banks know that rising gold prices are embarrassing proof of their failed monetary experiments and dying currencies.

To mask such shame, the bullion banks openly manipulate the paper pricing of precious metals through deliberate cheating in the futures market.

Bullion banks are shorting over 100 million oz of silver on the COMEX to artificially influence its price, hoping to see gold follow this manipulated trend, despite no liquidity in the actual metal itself in London.

Fake paper is the COMEX tail wagging the physical metals dog—but it’s only a matter of time (and illiquidity) before that dog bites back…

But I know…no one likes to feel cheated or to erase those fond “good-time” memories.

The “young Werthers” cling to their conditioned faith in, and love affair with, toxic stocks, bonds, tech names and, of course, our rich central banks and their magical, Santa Clause-like powers to solve every problem with a new bag of debt and fiat currencies.

Investors in physical gold and silver, however, are not fooled by the current surface of things or the sweet lies of a toxic market.

For those who see bonds as a “safer haven” or equities as “miracle solution,” it’s time to face facts and break up with such dishonest affairs of the wallet.

A Chart is Worth a 1000 Words

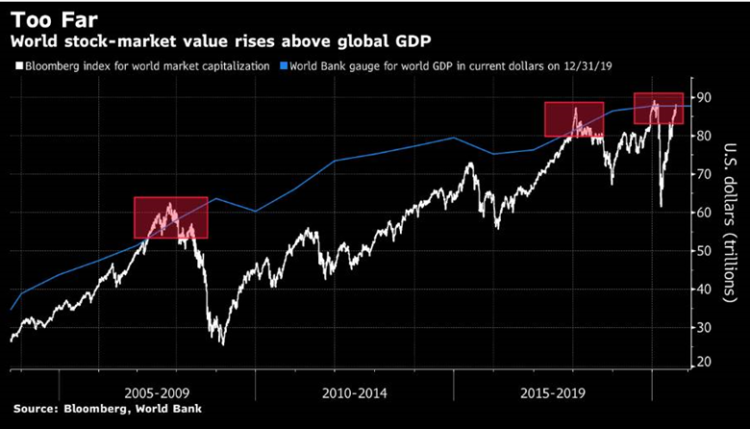

In case you still need more signs of this toxic relationship between investors and deceptive markets, just consider the following simple warning sign…

The above data confirms that the market value of the world’s equities has once again risen above the dollar value of the entire world economy.

Read that again and let it sink in.

If there was ever one warning sign of an over-heated (i.e. cheating and toxic) market, this is it.

And with greater than $18T worth of sovereign bonds offering negative yields, the bubble you’ve fallen for is even more of a femme fatale than the chart above warns.

In short, be warned—this market is toxic.

Meanwhile physical gold, that “barbarous relic” stands patient and smiling in the clever corner of honest history and far-sighted investing.

Original source: Goldswitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.