France will not publish a list of countries holding its public debt, contrary to the United States, for example. We found out recently that Russia and, to a lesser extent, China and Japan, have been dumping their American Treasury bonds. This information is quite important and significant, because it illustrates a “de-dollarization” that is seen through other signals. But for the French debt, we know nothing. The sole element that is communicated officially is the part owned by foreign holders (the “non-residents”), currently at 55%, without any more precise indicators.

But we have nevertheless found, in exclusivity, some data. Although there exists much lighter summer reading, Agence France Trésor (the agency in charge of the public debt’s) 2017 annual report publishes a rundown by country in regard with two specific debt issuances:

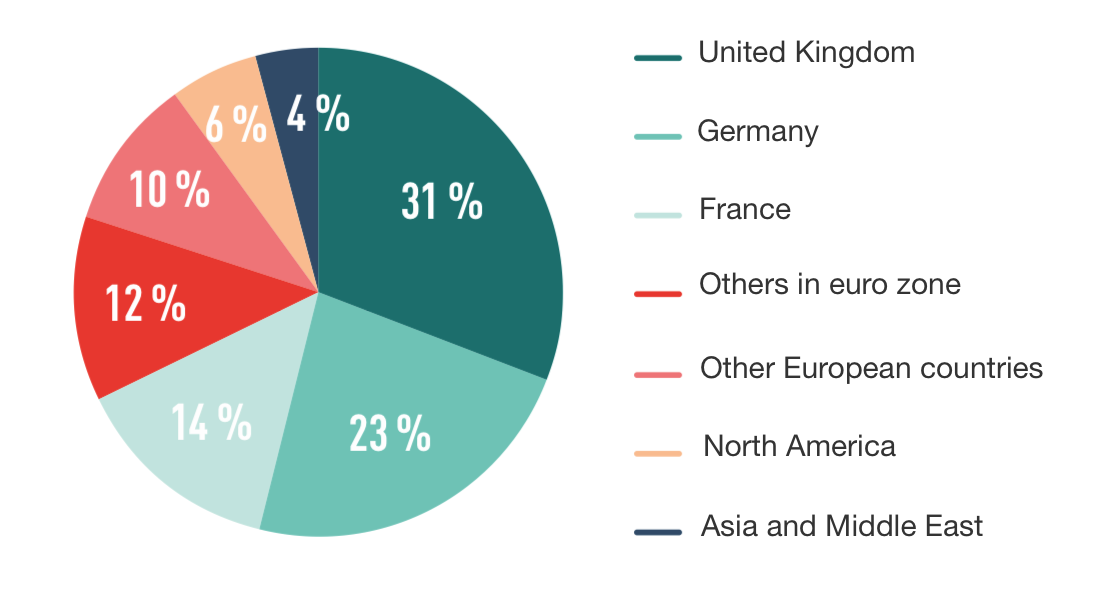

- The first one is a fungible Treasury bond (OAT) with a 30-year duration issued on May 16, 2017, for an amount of 7 billion euro (page 37):

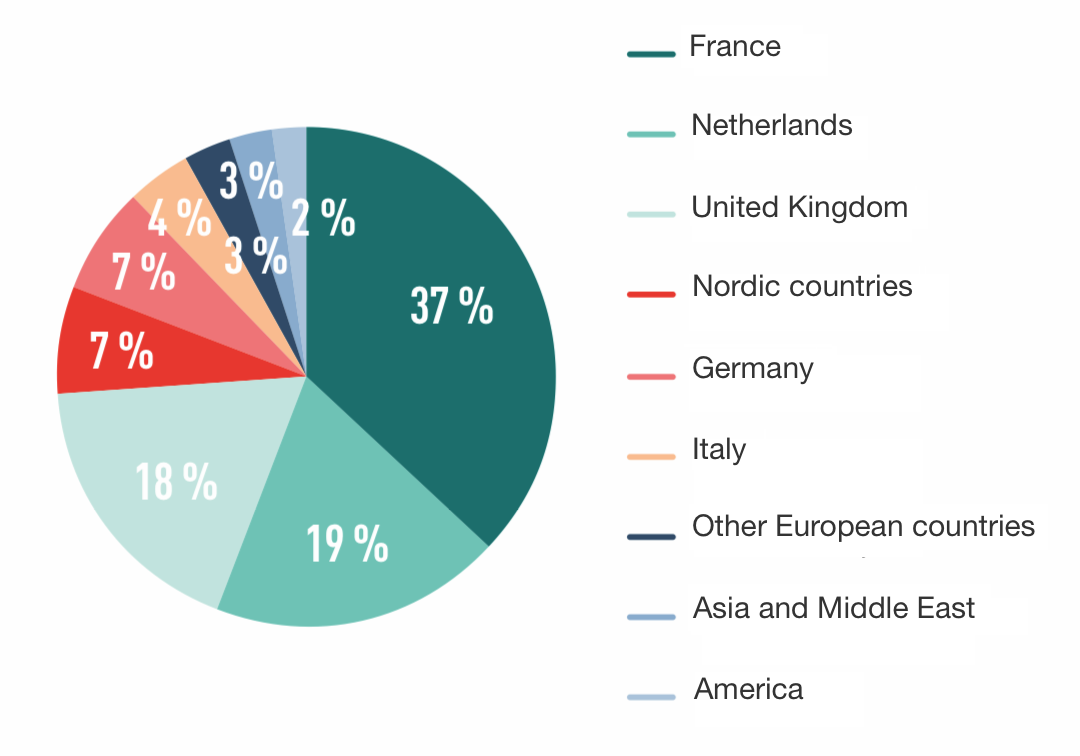

- The second one is a “green” OAT (slated to finance energy transitioning) on 22 years issued January 24, 2017, for an amount of 7 billion euro (page 40):

The British appreciate long term bonds, because their pension system is based on capitalization, which means investing money on the long term. That explains their first place on the 30-year OAT list. The green OAT is more recent and more “political”... the government has probably pressured the French banks and insurers to go with it. But what is most significant is the low participation rate of the United States, Asia and the Middle East, which is between 5 and 10%.

If we are to judge by these two issuances, French public debt is held almost exclusively in Europe and, marginally, in the other large economic zones. These poor results show to what extent the narrative of finance ministers boasting about the international success of French Treasury bonds is flawed...

French debt is going well in Europe, because there’s not much to choose from: Germany is restricting its debt issuance because it no longer has a budget deficit, Italy and its banks are ailing... which leaves only mid-size countries. France offers both volume (195 billion euro in 2018) and relative safety (for now – if interest rates rise, it will be another matter). European investors, finally, don’t have much of a choice. But on the other hand, outside of Europe, we see only marginality, a failure. North America, along with Asia and the Middle East, show very little interest. The euro as the world’s reserve currency? We’re far from it, and certainly not with the help of French Treasury bonds.

All of that indicates that the euro zone is functioning in a vacuum, with growing internal imbalances (Target 2 balance, ailing banking sector in Italy, Greece and Cyprus, risks with Deutsche Bank, too many Too-Big-to-Fail banks). In short, there’s nothing there to reassure the French and European savers.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.