While macroeconomic noise remains intense - between geopolitical uncertainties, interest-rate tensions and resurgent inflation - households and small businesses in the US are in generally solid financial health. The picture that emerges is one of a soft landing, with fundamentals holding up well despite deteriorating sentiment.

First and foremost, the labor market is showing clear signs of moderation. After several years of robust growth, the pace of hiring is slowing and companies are scaling back their recruitment plans. Nevertheless, indicators of tension remain moderate: layoffs remain rare and recruitment is still a challenge for many SMEs, a sign that demand for labor persists. Furthermore, reported pay interruptions are stable compared to last year, underlining the resilience of employment in a context of gradual disinflation.

On the consumption side, households are maintaining a sustained level of spending. Aggregate data on credit card payments show a +1.6% year-on-year increase since the start of the year, compared with just +0.3% for the same period in 2024. This increase is relatively even across income brackets, although there is a slight weakness in spending on air travel - a segment often sensitive to price volatility and economic uncertainty.

The stability of this consumption is partly explained by a relatively healthy household financial situation. Cash buffers, i.e. the reserves available on current accounts, have returned to their pre-COVID levels and remain stable overall. On average, households now have two more days' reserves than in the past - a modest difference, but indicative of a controlled situation. The debt/income ratio for low-income consumers also remains within the norm, with no worrying deviations.

Smaller companies are not to be outdone. Their financial indicators show a normalization of cash reserves, which are also in line with pre-crisis averages. Cash flows remain relatively constant from one year to the next, and available buffers are on average four days higher than the historical norm. This reflects a still favorable environment, despite more demanding access to credit.

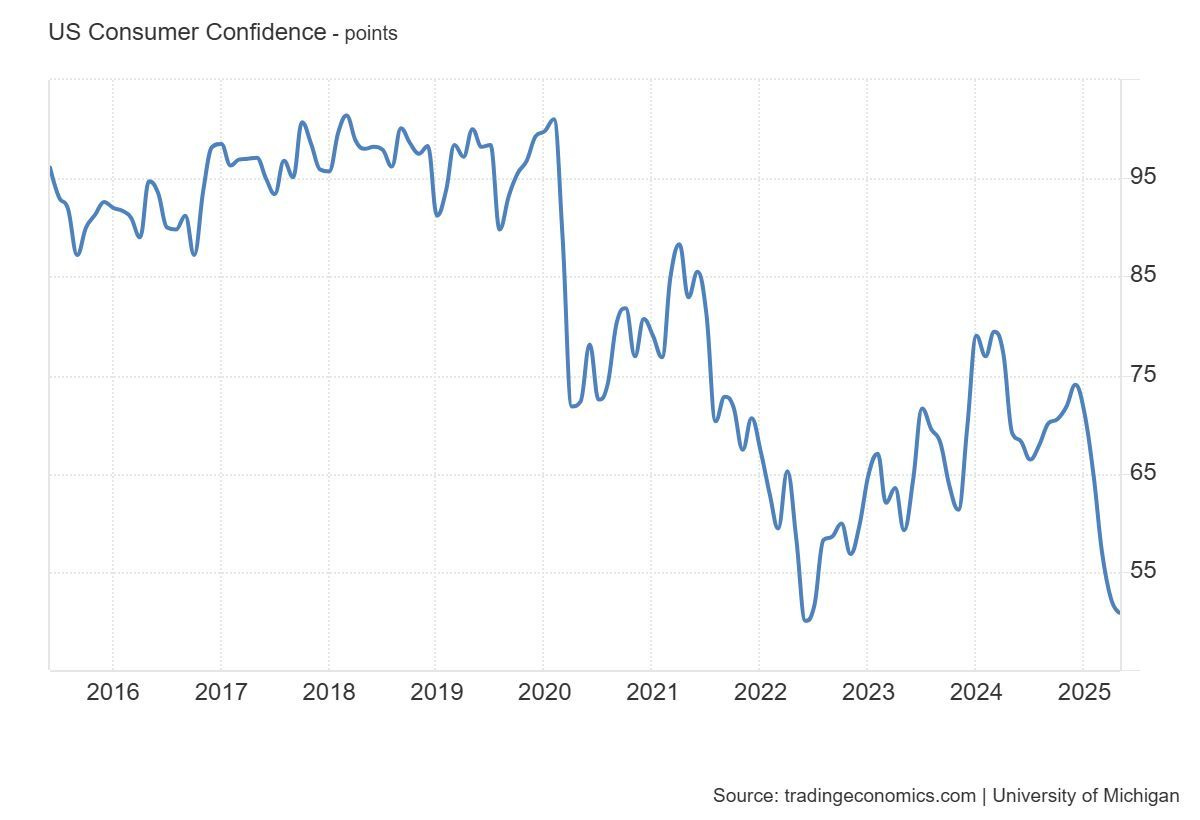

But behind this façade of robustness, the climate of confidence is deteriorating rapidly. The latest sentiment surveys show a decline of 22 points for consumers and ten points for small businesses since the start of the year.

The US consumer confidence index, published by the University of Michigan, collapsed in May to 50.8, from 52.2 in April, well below market expectations for a rebound to 53.4. This was the fifth consecutive decline in this key indicator, which thus fell to its lowest level in almost three years and recorded its second-lowest score in history.

This sharp decline reflects the growing unease of American households about the economic situation. After several years of consumer euphoria, marked by widespread overvaluation of goods and services - from real estate to cars to consumer goods - the return to reality is proving difficult. The prevailing perception is one of having paid too much, for too long, for almost everything.

This loss of confidence is not confined to opinion polls: it is also evident in financial behaviour. Credit card balances are once again approaching their ceilings, while late payments of 60 to 90 days are increasing every week, revealing growing pressure on household finances. At the same time, the rejection rate for property refinancing is now approaching 50%, reflecting both rising rates and the excessive debt accumulated during the zero-interest-rate period.

Finally, the rapid wealth creation models that flourished in the post-COVID period - such as Airbnb and other speculative or rental investment activities - are showing signs of running out of steam, if not reversing course. Disillusionment is growing around these “success stories” that have become inaccessible or unprofitable, and the speculative enthusiasm that dominated the early part of the decade is giving way to a growing distrust of promises of easy returns.

Fears of persistent inflation, rising supply costs and a complex economic environment are fuelling growing mistrust. The mismatch between balance sheet strength and risk perception is a key variable to watch over the coming months.

In short, while economic resilience is real, it now coexists with a diffuse anxiety, fuelled by global instability. The risk is not so much a sudden deterioration in fundamentals as a self-perpetuation of pessimism, likely to hamper investment or consumption decisions. At this stage, the system is holding up - but the balance remains fragile.

In this climate of psychological market fragility, the slightest piece of bad news acts as an immediate catalyst, provoking overreactions. And as we had anticipated in our previous bulletins, the real sources of concern in the short term lie not so much in economic data or consumer price trends, but in the gradual deterioration of the bond market.

The wake-up call came this week with the abject failure of the 20-year US Treasury bond auction. Demand for the issue was anemic and well below expectations, triggering widespread nervousness in the fixed-income markets. The bond market, already under stress as we reported last week, saw long rates soar. The yield on the 30-year Treasury note rose well above the symbolic 5% threshold, triggering a sharp revaluation of the entire long yield curve.

This weakness in demand is not an isolated accident, but part of a broader trend. Many sovereign states are facing growing financing needs, without a sufficiently solid buying base to meet them. Among them, the case of Japan is particularly emblematic. Long accustomed to yields close to zero, Japan's 40-year yields are now rising spectacularly, a sign of the gradual disengagement of traditional investors.

The Japanese long debt market is in the midst of a major upheaval. The extreme movements observed in the 30- and 40-year maturities are no longer the result of a simple technical adjustment or investor repositioning: they signal a structural break in Japan's financing equilibrium. In a country that for decades embodied the paradigm of bond stability and eternal zero interest rates, the sudden rise in long-term yields constitutes a systemic shock.

For the moment, global markets are only partially aware of its implications. In many respects, however, this is the greatest macroeconomic cataclysm of 2025 so far: not because of its immediate scale, but because it calls into question decades of consensus on Japan's role as a passive financier of the developed world. This brutal rebalancing of the yield curve is not without consequences: it affects global demand for US bonds, recomposes international capital flows, and reawakens long-suppressed fears about global leverage and the structural financing of Western deficits.

This Japanese move is not without consequences for the United States. The decline in Japanese demand for US long bonds - historically a pillar of Treasury financing - contributes directly to the weakness observed at this latest auction. The domino effect is in place: stress on Japanese long rates is feeding stress on US long rates, at a time when the sustainability of public debt is becoming an increasingly pressing issue on both sides of the Pacific.

Against this backdrop, the sustainability of the system is being put to the test. A world in which long rates persistently exceed 5% without excess growth or falling inflation is a world in which asset allocation models need to be reassessed. The gradual disappearance of structural buyers of sovereign debt - central banks, Japan, pension funds - ushers in a new era in which debt is no longer “free by design”, but must once again become desirable in a competitive universe.

In this new context, physical gold is regaining its role as a safe-haven asset.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.