Western investor sentiment towards gold is at an all-time low, while we have literally been witnessing a gold rush in Asian countries for the past two years.

ETF outflows persist, particularly in Europe, while India and China step up gold purchases.

Why are the Chinese and Indians buying physical gold, while financial institutions in Western countries are reducing their exposure to the precious metal? What are the reasons behind this diametrically opposed behavior?

The cryptocurrency rush in the West appears to be one of the main reasons for the disinterest in gold. Defensive investments, which traditionally gravitated towards the golden metal, are now turning to bitcoin and other crypto-currencies.

This phenomenon mainly concerns younger investors, notably Generation Z, for whom traditional investing, such as active management and hedge funds, is a thing of the past. Today, they favor high-potential strategies with asymmetrical risk (limited loss, exponential gains).

These young investors reject old standards such as oil, commodities and the contemporary art of the 1990s and 2000s. They value memes and digital culture.

In just a few days, the capitalization of Fartcoin, nicknamed “the fart currency”, reached $800 million. This cryptocurrency is based on the slogan “hot air rises”, suggesting that its price is destined to soar.

The fact that one memecoin, born of a simple joke between “degenerates”, exceeds the valuation of over 40% of listed companies in the USA shows the scale of the phenomenon. Generation Z in developed countries is taking advantage of the prevailing fiscal and monetary indiscipline, as well as the abundance of liquidity, to speculate on unregulated markets. Meanwhile, the Chinese and Indians are taking massive refuge in physical gold to protect themselves against the devaluation of fiat currencies.

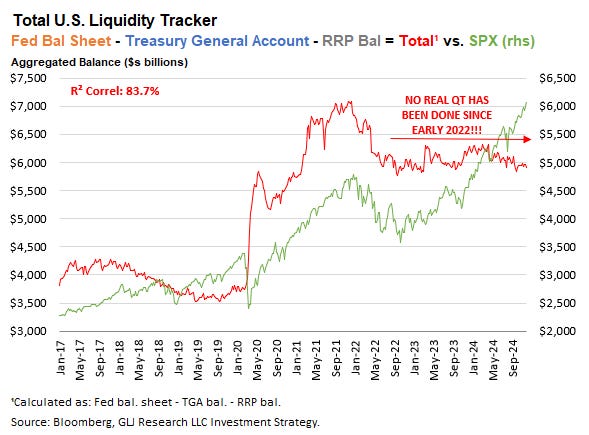

Between 2020 and 2022, liquidity in the United States increased recklessly. The Fed refused to remove this excess from the system. As a result, this influx is flowing into equities and cryptocurrencies, driving them up regardless of fundamentals. We are now in a phase of euphoria characteristic of soaring markets, and this abundant liquidity is also behind the emergence of this type of memecoin.

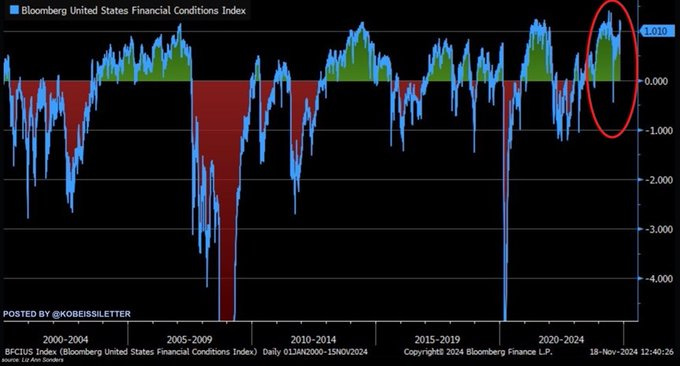

The Fed is continuing its accommodating policy, although financial conditions in the US are currently relaxed and favorable, which should instead necessitate a restrictive policy.

How can we fail to see this picture as a major failure of the monetary policies pursued since 2008?

From the point of view of Generation Z, the Fed has succeeded in only one thing: artificially enriching boomers by inflating asset prices via a zero interest rate policy. This illusory enrichment has been at the expense of young people. Never before have 15-35 year-olds been at such a disadvantage compared to older generations, a trend that can be observed in all Western countries. This phenomenon is particularly marked in nations where the demographic imbalance is pronounced: young people, poorer and fewer in number, have to put up with a standard of living artificially maintained by inflation fuelled by spending that the baby-boomers were unable to manage. Today, the new generation is footing the bill for this monetary policy.

How can we fail to see in Generation Z's rush to Fartcoin a real middle finger to this monetary policy, a cynical and provocative response to a system that has sacrificed their purchasing power in favor of inflated assets for the boomers?

This type of behavior is increasingly reminiscent of a pre-Weimar situation, where only the cleverest manage to get away with financial coups, while fiat money gradually devalues.

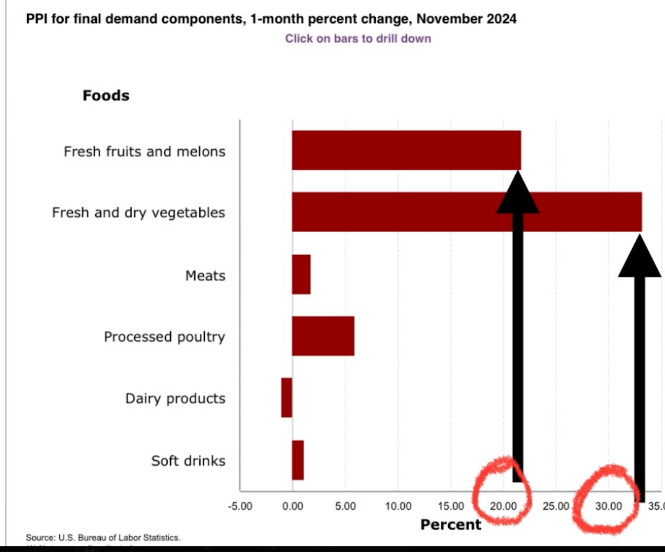

The value of money continues to plummet: the latest PPI inflation figures (prices paid by producers) confirm the resumption of inflation in the United States.

The US Bureau of Labor Statistics has revised PPI inflation for October from 2.4% to 2.6%.

Underlying PPI inflation for October was also revised upwards, from 3.1% to 3.4%.

This represents the sixth upward revision in the last seven PPI reports.

With PPI inflation at 3% announced on Thursday, we have now reached the highest level since February 2023.

Among the PPI components, some increases are particularly spectacular, notably fresh fruit and vegetables, where prices have jumped by over 20%:

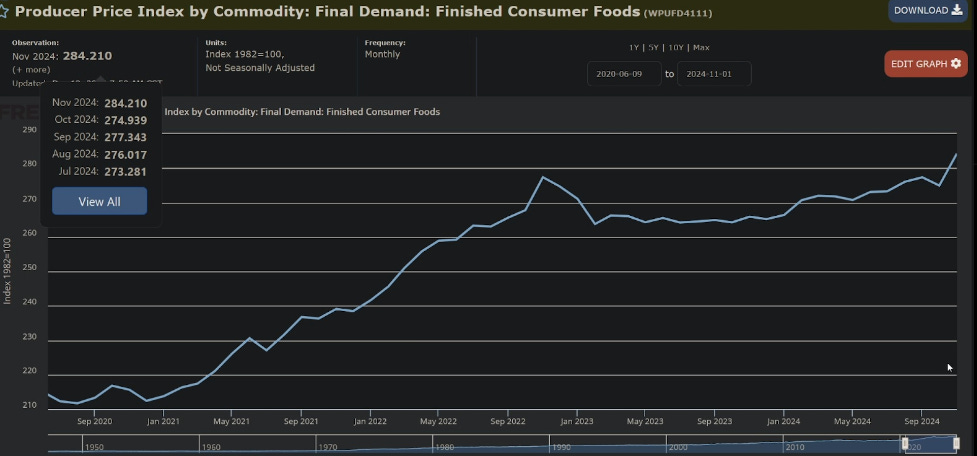

The upturn in the PPI index is now accelerating at a pace similar to that of the first inflationary shock. The pause observed at the end of 2022 now seems to be over:

In a tweet from October 2023, Paul Krugman's claim that inflation had been beaten perfectly illustrates the gap between the vision of many economists and reality:

The war on inflation is over. We won, at very little cost pic.twitter.com/opumf3nEvL

— Paul Krugman (@paulkrugman) October 12, 2023

As a reminder, the PPI index is a key indicator of inflation, as it measures the prices paid by producers. These prices then define the prices paid by consumers. Consequently, any rise in the PPI logically leads to a rise in the CPI in subsequent months.

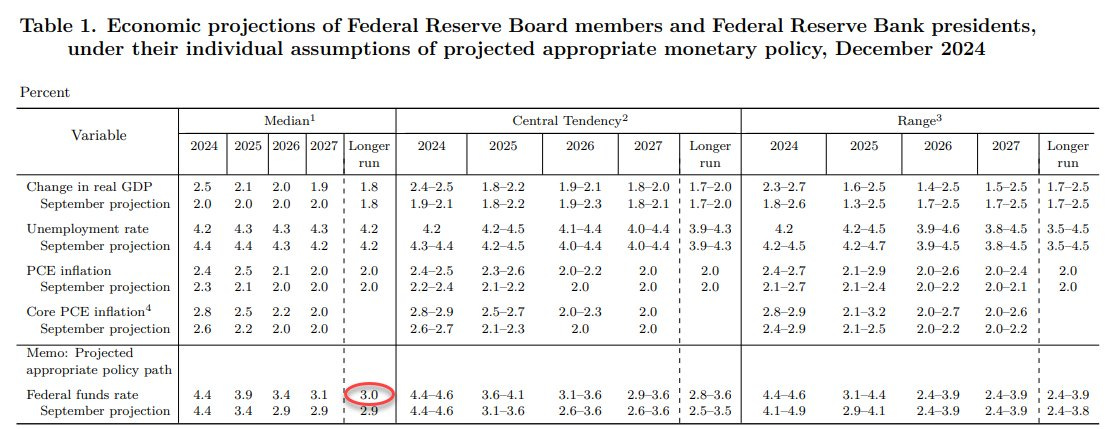

The Fed recently revised its inflation forecasts for the coming years, as indicated in its latest statement published on Wednesday:

In other words, the Fed has just admitted that 2% inflation is no longer in its mandate.

The 0.25% cut in the Fed's key rates was expected, but the abandonment of the historic inflation target is a real admission of failure.

The monetization of debt through inflation will continue.

And we wonder why the Chinese and Indians are flocking to physical gold...

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.