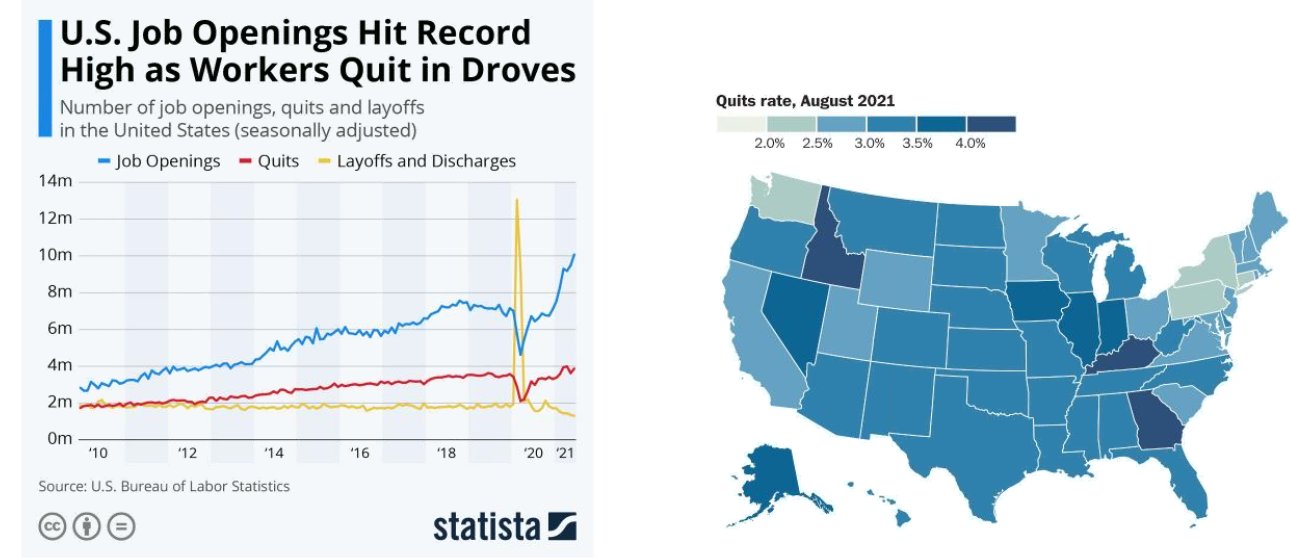

U.S. inflation is beginning to have a significant impact on the behavior of the labor market. More and more Americans are leaving their jobs, and the supply of jobs is also increasing. Labor is becoming scarce and expensive, and this is becoming more pronounced as inflationary expectations are now firmly entrenched. Inflationary sentiment has changed on the ground, and under these conditions, upward pressure on wages is taking hold in all sectors of the U.S. economy.

Inflation is also picking up in agricultural commodities.

Corn is above its ten-year highs, with prices tripling since the summer of 2020:

The CRB Commodity Index has started its phase of outperformance against the market. The CRB/SPX500 chart shows this. The change has occurred with heavy volume and the MA50 / MA200 weekly crossover is about to take place. In the short term, we are in an overbuying situation. It is likely that this ratio will decline slightly, but the trend has now reversed. After ten years during which markets have largely outperformed commodities, we are entering a cycle where the opposite will happen: commodities will outperform equity markets.

The volatility of commodities is a reflection of this change in the cycle.

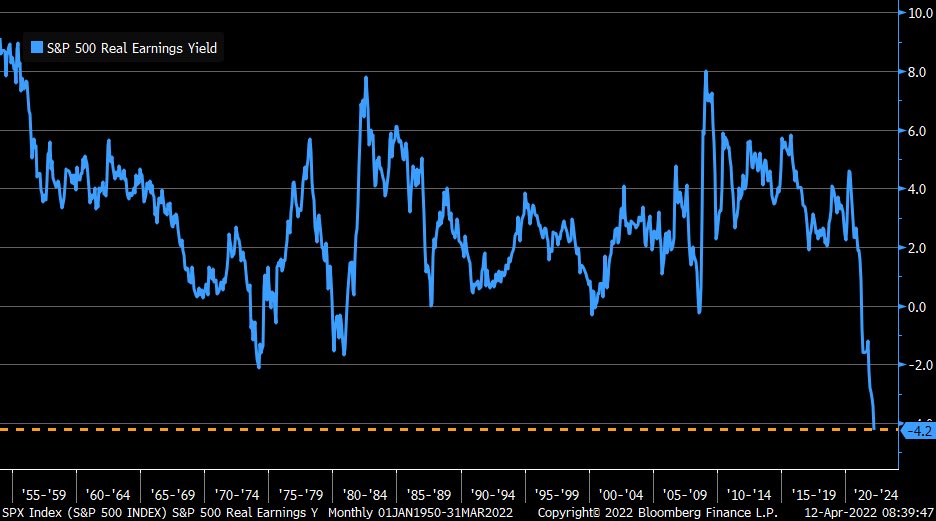

Real equity returns are at their lowest level since the post-war period. Inflation no longer allows for sufficient remuneration of shareholders.

Share buybacks started up again in March. They are back at a high, but unfortunately this is no longer enough to support the markets.

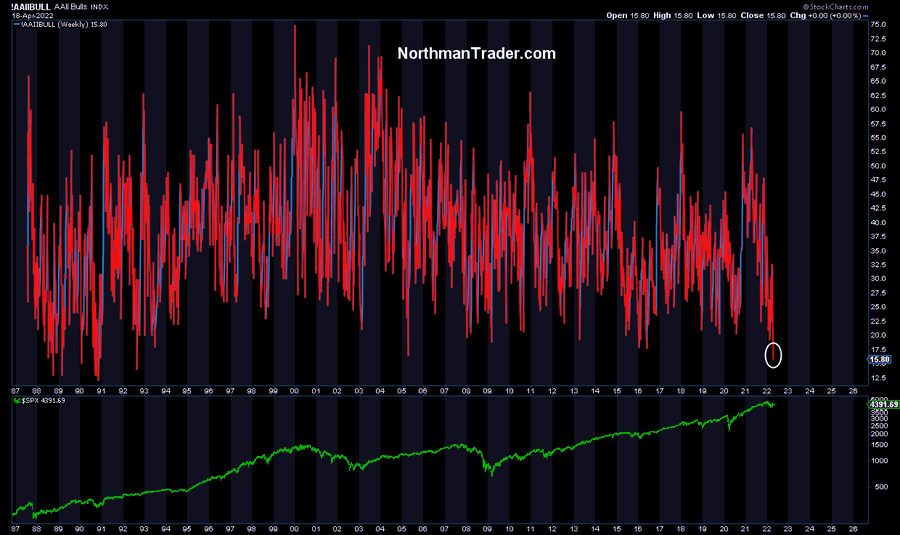

The ratio of bulls to bears is now at its lowest since 1991.

It is “Berezina”: the bond market is on a downward trend, and the decline in the equity markets has not really benefited bonds. The rebound of the TLT is very timid. In the past, with such corrections in the markets, the US 20-year bond acted more as a safe haven.

This is no longer the case today. Since February, a classic 60/40 portfolio, composed of 60% stocks and 40% bonds, has lost -10% / -20% on average.

Gold has not escaped this correction, but in a much more moderate way. This week, the price of gold is down -4%.

The metal nevertheless managed to hold on to the $1900 mark, still finding buyers under $1890. The sharp correction in mining should have heralded a much more significant decline in gold. This was not the case.

So here are the two surprises of the week: the market correction did not benefit US bonds and despite the fall in commodities and especially mining stocks, gold did not deviate and even held its support at $1900.

The massive selling of the algos succeeded in breaking the sentiment on mining stocks (let's not fool ourselves: it was already not very high). However, this change in sentiment does not affect gold (for the moment), which manages to maintain its uptrend in euros. The five-day decline in mining stocks coincided with a minimal correction in the spot in euros. Gold in euros has even rebounded on its MA50 in daily.

The market correction and the margin calls it provides do not significantly affect the price of gold, which is a big change from the recent severe equity market corrections.

But make no mistake. With the futures market now facing the closure of the open contract, price volatility is not about to end. Historically, sharp declines in mining anticipate sharp corrections in the price of paper gold. We will see in the coming days if sharp declines below $1890 continue to be bought back.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.