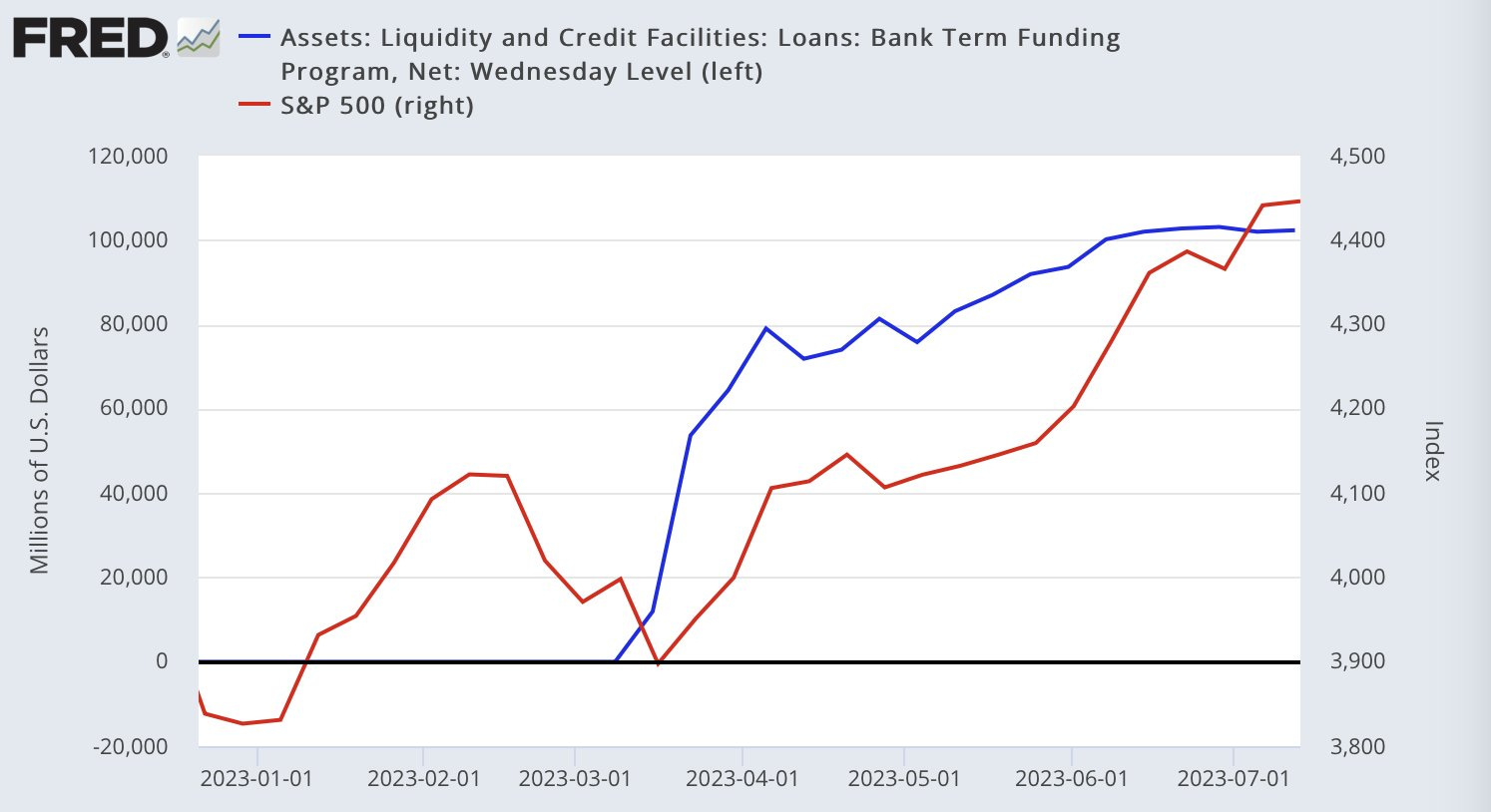

Since the introduction of measures enabling banks not to bear bond losses on their balance sheets, the markets have not recorded the slightest correction. We have just witnessed six months of spectacular gains. It's as if the Fed had assured the markets that it would not hesitate to intervene at the slightest threat of a liquidity crisis. The famous "Fed Put" is still in place, despite Jerome Powell's rate hikes. The provision of this new liquidity has completely overshadowed the effects of the rate hikes. The Fed even helped create a new asset bubble in record time!

The banking crisis was averted, but at the same time it inflated an even bigger bubble in listed stocks.

The Nasdaq is approaching its all-time highs:

Sentiment has entered a phase of extreme greed that corresponds to a historically euphoric phase. The prevailing sentiment is that the Fed will intervene whatever happens, to save the markets, even if a new crisis should affect liquidity conditions:

There is an increasingly visible disconnect between this market euphoria and the worsening economic situation in the United States. That's why many observers are talking about the inflation of a new bubble: the valuations of certain stocks include earnings that the deteriorating economic conditions will not allow to be honored. The market is becoming irrational - it's a bubble.

The worsening economic situation is even accelerating at the start of summer.

According to Epiq Bankruptcy, nearly 3,000 companies filed for bankruptcy in the last six months of the year. A record since 2010.

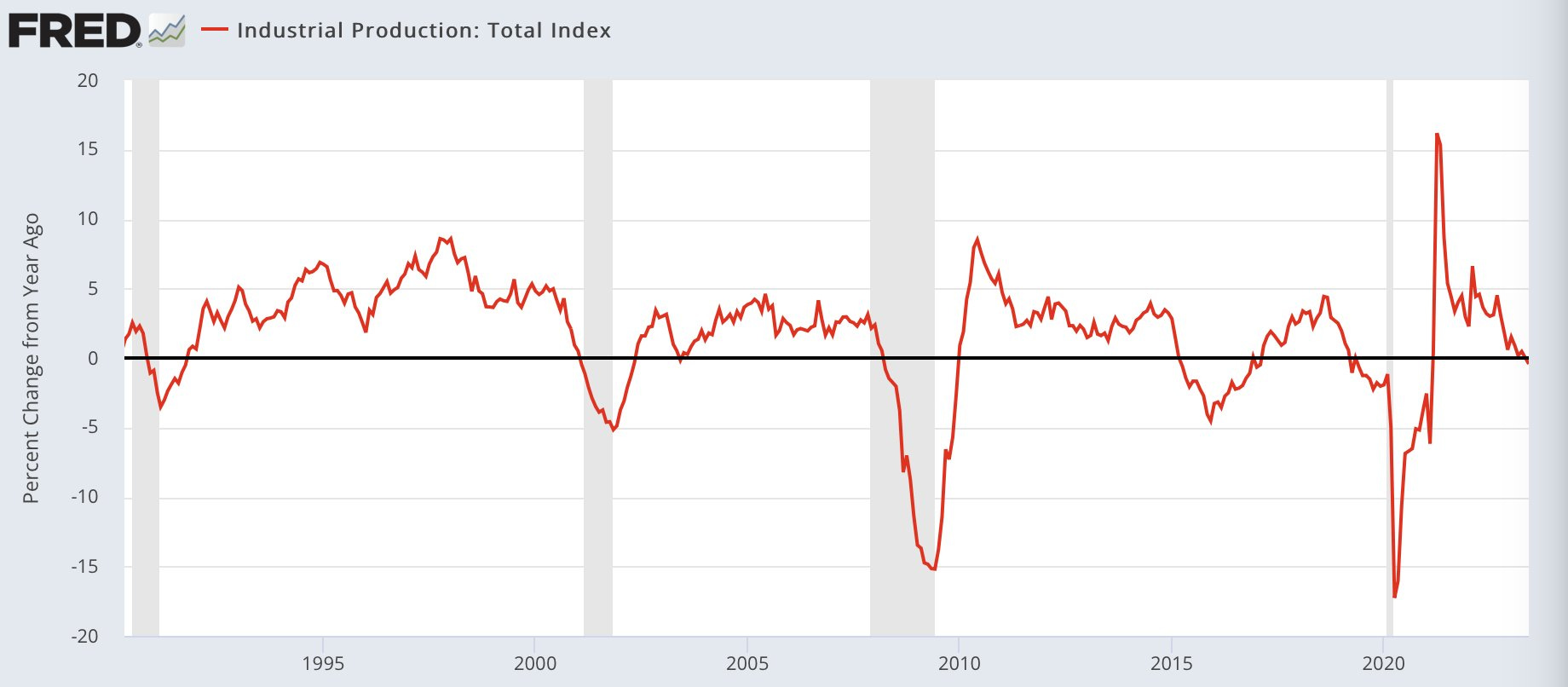

Annual industrial growth is negative for the first time since 2020:

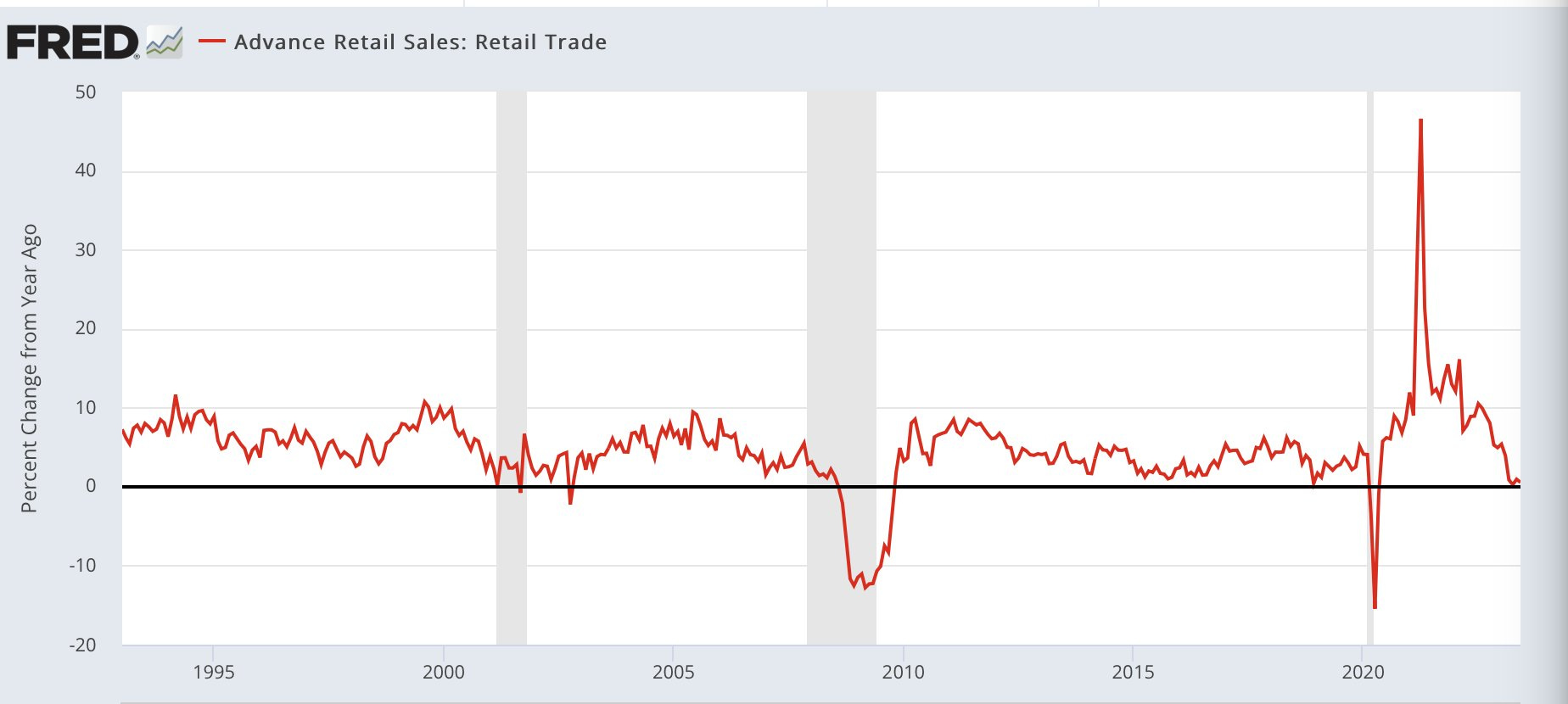

Retail sales growth also moved into negative territory in June:

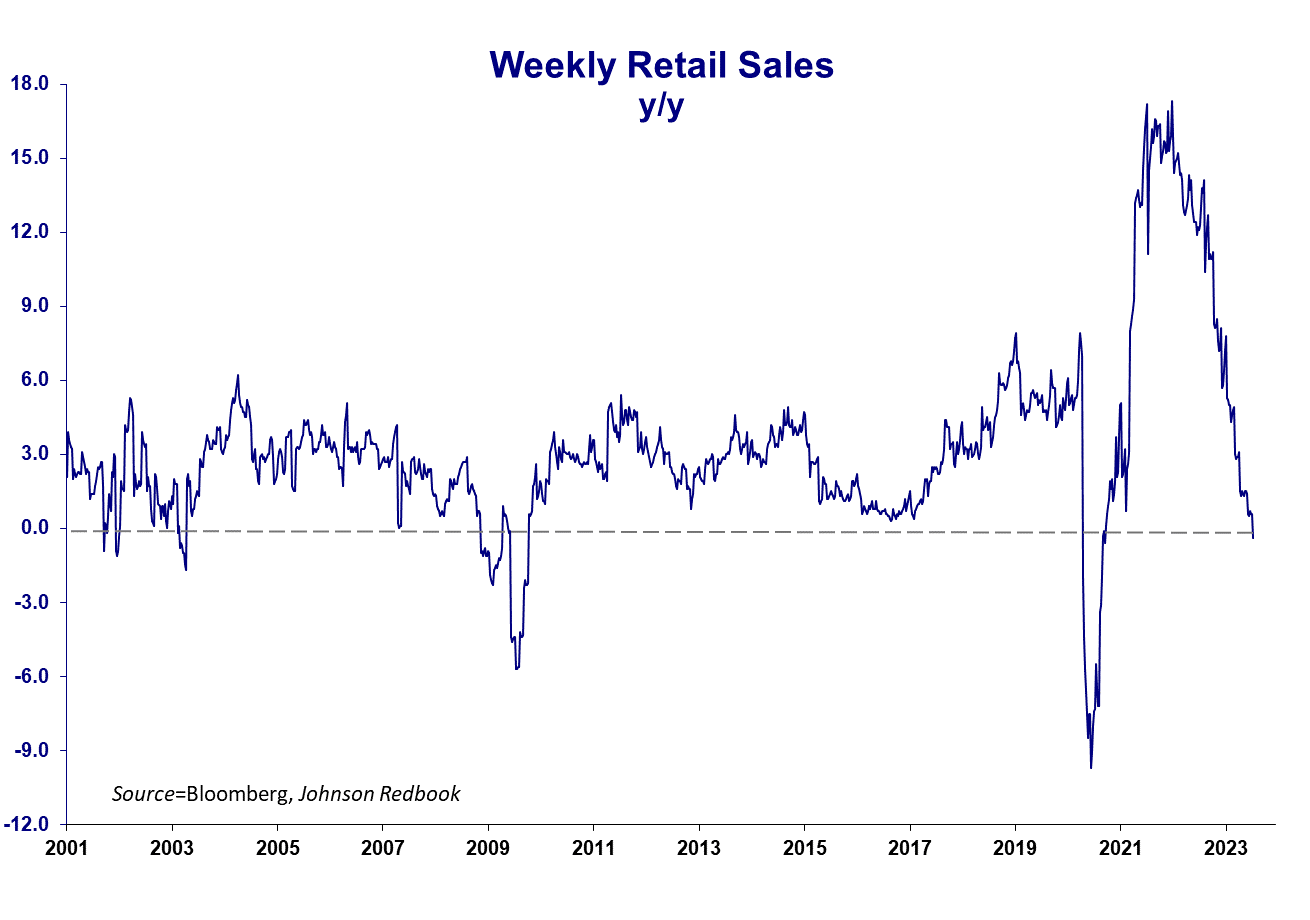

In fact, these indicators have been falling sharply since March. The weekly change in retail sales is even in free fall:

As we saw last week, the American consumer is cracking.

But what counts for the markets are the new liquidity windows opened by the Fed, which have relaunched the "Fed Put", which is very favorable for the indices:

These new Fed interventions have once again distorted the value of risk. But this time, this misjudgment of risk is taking place against a backdrop of deteriorating economic indicators linked to rising interest rates!

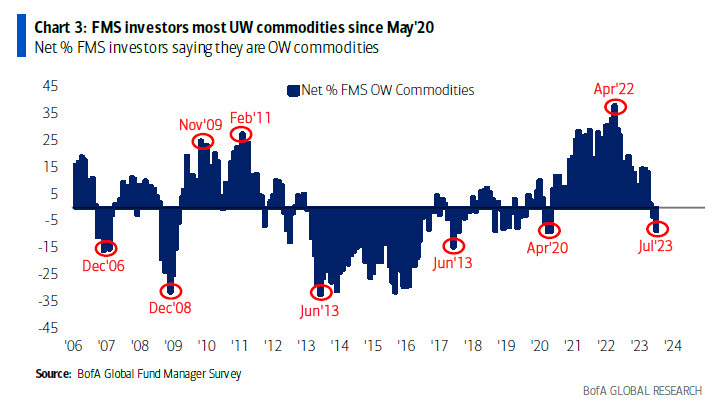

This deterioration can be seen in investor sentiment on commodities. Economic activity at half-mast does not bode well for the sector, but it is above all the rise in equities that has helped push investors towards the star stocks of these markets, to the detriment of tangible assets.

The economic downturn is also reflected in China's declining export figures, which are now at a three-year low. The slowdown in exports is a further factor weighing on commodities.

Some analysts believe that this negative sentiment offers a real opportunity. Such is the case of Evy Ambro of Blackrock, Matty Zao of Bank of America, Wayne Gordon of UBS, and Jeffrey Curie of Goldman Sachs: all these analysts have published very bullish notes on commodities in recent weeks, particularly for certain metals such as copper.

This month has also seen a resumption of the rise in silver relative to gold, which traditionally indicates renewed investor interest in tangible assets.

This return to tangible assets is not yet perceptible in the current market euphoria. Against this backdrop, precious metals are continuing their accumulation phase.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.