In this movie, the hero thinks he is living a normal life, but in reality he lives in a setting and all the other people are the actors of a permanent reality show around Truman's life.

Like him, we are trapped in a media frame, the threads of which are difficult to disentangle. True and false are very closely intertwined.

This story is written in several planes in space-time. Without describing them all, here are a few, that should allow you to understand some of what is happening before our eyes.

"In politics, nothing ever happens by chance" - Franklin D Roosevelt

This history begins in 1968, when the "Club of Rome" brought together scientists, economists and industrialists to question the future of Earth, after the years of strong post-war growth. In 1972, after 4 years of study, a thick document was published under the title "Stop growth?", which had been sold in 30 millions copies.

This report noted that our civilization was consuming at high speed the reserves of the planet, which were in finite quantities and not renewable. The conclusions announced a collapse of our society by 2030.

In 2012, a second report produced by the M.I.T, using the same methodology as the first one, with updated data, was made public. This report comes to the same result as that of 1972, with the collapse of current society by 2030. The rapporteurs sought to be optimistic, writing that if radical measures were taken to reform the system, the decline of our civilisation could be postponed for a few years.

Montreal (1987), Rio (1992), Kyoto (1997), Johannesburg (2002)... Large political summits have taken place in an attempt to change the industrial policy of the G20 states, but some large countries, including the United States, have been filibustering.

In 2019, environmental movements launched major international maneuvers to block, in particular, coal mines and mineral ports all over the world. At the same time, a movement was brought to the forefront of the political and media scene, "the Green New Deal" and children were used to sensitize world opinion to the future of our planet. Crude oil consumption suddenly became politically incorrect.

In early 2020, the coronavirus pandemic spreads in the city of Wuhan, which will cause China to shut down its economy. Production is suspended and exports are halted.

The declassified part of a study commissioned by the White House showed in 2019 that the American military industry was 100% dependent on China in all areas. In reality, the entire American economy is dependent on Chinese production. Therefore, logically, once the buffer stocks of American industrialists or distributors had run out, the entire American economy would find itself immobilized due to the break in the Chinese supply chain.

Four weeks later, the same epidemic affects Europe and the European Union will decree quarantine and put the main part of its economy at a standstill, further blocking the US economy.

Some experts are going to cry wolf in the United States, announcing that millions of people will be infected and that there will be several hundreds of thousands of deaths due to the Covid-19. To avoid this carnage, it was imperative to declare quarantine and therefore close shops and factories for a few weeks.

These factories and these businesses, which would have been in technical unemployment, in any case, because of the stop of the expeditions of China.

On another level

At the end of the 90s, the Asian crisis caused an alter-globalist revolt to arise. In general, the movement opposes economic liberalism and the globalization of financial practices to promote a more social and better distributed economy. These demands translate into a search for alternatives, global and systemic, to the international order of finance and commerce.

The Federal Reserve having refused to intervene in this monetary crisis, the emerging countries have come together to form a common front with a view to monetary reform.

During the systemic crisis of 2007-2008, it was all the members of the G20 who allied to ask for a request to end the current monetary system by raising the possibility of testing the system proposed by Keynes at Bretton Woods in 1944: the Bancor. The United States 'Congress, since then, has been doing everything it could to block the reforms negotiated during the successive G20s.

Remember that in April 2014, Christine Lagarde, as a representative of the member nations of the IMF, had presented an "ultimatum" to the United States' Congress for it to endorse the Reforms.

If we look at the facts, we can see that for the past ten years, American companies seem to have been encouraged to borrow to buy back their own shares. The managers had an obvious interest in it, since they were partially remunerated with options on these shares. The more the securities went up, the more their options were valued with a strong leverage effect. So much so, that American stocks soared exactly like from 1920 to 1929, while the other world stock markets stagnated.

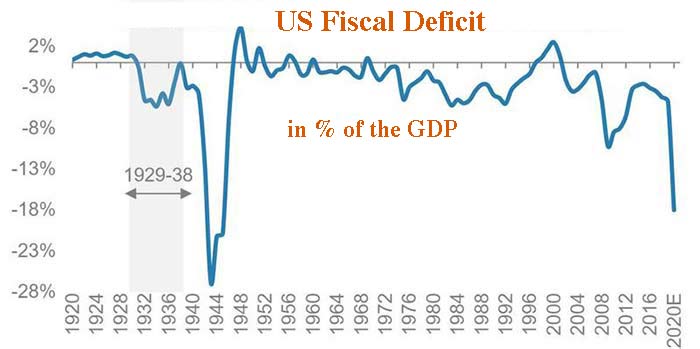

On Monday, February 24 2020, the New York Stock Exchange began a fall, which turned into a historic crash more devastating than that of 1929 and which could only be in its infancy. Indeed, the early effects of the break in the Chinese supply chain, are only at the beginning, those of the quarantine decreed by the executive, are not yet in the graphs. In the last week of March, the number of job seekers rose sharply by more than 3 million unemployed people. These figures could be close to 24 million in May. Goldman Sachs estimates that in the first quarter, the US GDP fell by 9% and that it should drop by -34% in the second quarter. The fall should be most noticeable in April with a 14% drop in economic activity. We should therefore expect a much more violent crash at the end of the month and in the first half of May.

Trump had often promised to dismantle some giant groups, the power of which made them think they were above the states. By pushing them into debt to buy back their shares, these groups put themselves in danger. When their stocks and bonds will have collapsed on the stock market, many of these groups could be like Boeing, bankrupt for its civil part and nationalized for its military sector.

After the "Currency War" and the "Trade War", we are witnessing a "Financial War", the coronavirus pandemic is perhaps the tree that hides this forest.

On a parallel plane

Remember those successive tanker attacks in the Persian Gulf or the Oman Sea in may 2019, that failed to start a war, and that missiles attack on Aramco refineries. The only apparent corollary was a panic in the REPO market the following Monday. The Fed was forced to suddenly flush this market with 183 Billion Dollars, whereas normally, it is the big American banks, which place their short-term cash there. But the big banks had seen their cash flow drained by the purchase of Treasury bills. Saudi Arabia, which precisely held $ 183 billion in US treasury bills, could have placed them as collateral for a loan from these big banks, which have no right to refuse.

And why was the Fed forced to put $ 500 billion in cash on the REPO market at Christmas, then $ 1,500 billion in March? Did China, in turn, deposited its $ 1,078 billion in treasury bills as collateral for a loan to the largest American banks, which cannot refuse? Which nations are liquidating their US Treasury bonds?

Is there currently an underground war against what was until now the safest monetary instrument in the world for central banks?

On a very close level

Since the 1970s, after the sharp rise in the price of a barrel following the Kippour’s war, the oil-producing countries have parked their surplus cash in US Treasury bills. The petro-dollar deal assured the United States of buyers of their debts, whatever their policy. It is true that in return Washington undertook to buy oil from Arab tankers by reducing their own production. To explain the drop in American production after these agreements, the pic oil myth became the official truth. For the past decade, US production of shale gas and oil has been promoted as the new El Dorado enabling the United States to be energetically independent. The reality is that shale oil and gas are financial chasms. When prices fall below $ 50, American companies in this sector cannot honor their debts. The prices have been maintained at this level for the last 4 years ...

But in February 2020, because of the epidemic, since China was in quarantine, that the cargo ships did not leave any more its ports, that the planes were nailed to the ground, that the Chinese no longer took their car and that the factories were closed, the consumption of oil was experiencing a severe drop and the price of a barrel plummeted. The situation worsened when Europe also quarantined itself. With the price of WTI at $ 20, a barrel of Dakota shale oil fell to $ 10. It’s a debacle and all energy related obligations are worthless. The companies themselves go bankrupt one after the other.

The media is talking about an oil war between Russia and Saudi Arabia, but in reality there is an agreement to annihilate the American oil companies and, more likely, to put an end to the petrodollar agreements. If this is the case, the United States no longer has creditors to buy its debts, just as Washington is spending thousands of billions of dollars ($ 7T) to try to avoid falling into recession.

If the American industry is in technical halt of production because of the rupture of the Chinese supply chain and in forced unemployment, because of the quarantine of an increasing number of states, the American economy no longer generates profits, therefore no more corporate taxes, no more VAT due to the brutal slowdown in consumption. The US Treasury is left with a more disastrous balance sheet day after day.

In the current fiat system, the value of the currency is guaranteed by the tax that the state can levy on businesses and the population. If a country's economy stops, the value of its currency should collapse.

If all the different nations stop their economy at the same time, we should look at the relative value of one currency compared to another, but the price of gold, which reflects the reality of the purchasing power of each currency.

As Europe and US are in quarantine in april, precious metal prices are expected to soar in May and June.

Did you know that South Africa’s gold mines are closed due to the epidemic?

If you do research on the subject, you will find that the largest mining companies have taken steps to fight the epidemic, whether in Africa, South or North America, Russia, Australia, etc. This is also true of the copper mines of Peru and Chile and the silver mines of Mexico, which alone produces a quarter of the silver produced in the world.

#Mexico Mining Suspension to Hit #Silver Supply https://t.co/WExw3I2ReE pic.twitter.com/E36WBGuPx1

— GoldBroker.com (@Goldbroker_com) April 4, 2020

For the same reasons, the Swiss refineries, which process a third of the world precious metals, were closed from the second half of March. The US Mint and the Canadian Mint are closed too.

It's official : Three Swiss gold refineries suspend production due to... https://t.co/MHkGhTriWs #gold #silver #valcambi #pamp #argor #refineries #switzerland

— Fabrice Drouin Ristori (@FabriceDrouin) March 23, 2020

The usual flows of precious metals have dried up and reserves have quickly run out because of a strong demand. Most online shopping sites advertise several weeks of delays.

On March 23 and 24, on COMEX, there was a bullish panic. Several banks were defaulted, unable to deliver the gold they had sold. It is difficult not to reconcile with the immediate decision of the Dutch bank ABN AMRO to close all the metal accounts of its customers. The bank gave just a week to its clients to find a new bank. After that delay, their precious metals will be sold on the market. You could hear similar stories soon.

COMEX opened its April session when its warehouses are empty of 100-ounce bars. In order for deliveries to take place at the end of the month, the London market, the LBMA, must melt gold bars to bring them up to COMEX standards and successfully deliver them to New York under quarantine.

Given all of the above, which could be mistaken for a vast military-financial strategy perfectly implemented, I would not be surprised that these ingots do not arrive at COMEX and that this market finds itself in flagrant default by the deadline for deliveries.

What is true for gold is obviously true for silver.

With the ongoing financial meltdown, demand for precious metals has exploded while at the same time, supply has abruptly dried up. Prices will not stay long at current levels. Expect some great surprises in May-June.

- Most of the mines are closed

- The refineries are closed

- Mints no longer produce coins or ingots due to containment

- Physical numismatists shops lowered the curtain

- Online stores have between 3 and 5 weeks of delivery times due to lack of stocks

For me, there is a 99% chance that we will reach soon a situation where on the market, nobody will be a seller.

"No ask"

Such a possibility has been foreseen. It is from this perspective that rule No. 589 was set up on Monday December 22, 2014.

As you already know, if no one is a seller at the opening of the daily session, gold prices will jump by $ 100. There will be a 2-minute break to see if someone wants to sell, then gold will rise again by $ 100, before a new break… When gold has thus risen by $ 400 during the day without anyone wanting to sell, the market will be closed overnight, with no fixing. As a result, nobody can buy or sell physics.

The next day, the market will open the auction at the close of the day before and if there is no seller, in a few minutes, the price of gold will have further increased by $ 400.

In a single week, in only five days, gold could be at the mythic level of 100 times the value of an ounce during the "Gold Exchange Standard" period.

1,500$ + 400$ = 1,900 $

1,900$ + 400$ = 2,300 $

2,300$ + 400$ = 2,700 $

2,700$ + 400$ = 3,100 $

3,100$ + 400$ = 3,500 $

For silver, rule 589 allows prices to go up $ 12 a day if there is no seller.

When the US Mint on its front page shows a price of $ 54 for a Silver Eagle, this "proof" seems a subliminal message to those who have eyes to see.

I wasn't expecting this level for silver until early 2021.

The events we are living never happened in the past. Something BIG is brewing.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.