In the monthly bulletin reserved for GoldBroker clients, I analyze the historic rise in COMEX stocks recorded in January.

For the past two months, COMEX stocks have been rising significantly:

Over the past two months, no less than 500 tons of gold, or around 40,000 Good Delivery bars, have been discreetly stored in nine COMEX vaults, including those of JPMorgan, Brinks and HSBC.

What does “Good Delivery” mean?

Good Delivery is a standard defined by the London Bullion Market Association (LBMA) to ensure the quality of gold and silver bars traded on the world market. This certification specifies the technical criteria that precious metal bars must meet, notably in terms of purity, dimensions and marking.

Good Delivery-certified gold bars must have a minimum purity of 995/1000 and weigh between 350 and 430 troy ounces (i.e. between 11 and 13 kg). They are recognized on major international markets such as London, New York, Hong Kong, Tokyo and Zurich, as well as by central banks and the IMF.

Only accredited refiners can produce these bars, after meeting strict requirements in terms of production capacity, financial soundness and compliance with traceability standards set by the LBMA.

In just a few weeks, the gold reserves stored under Manhattan and in Delaware reached a total of 1,040 tons.

This remarkable quantity of physical gold accumulated in such a short space of time is roughly equivalent to central bank gold purchases in 2024.

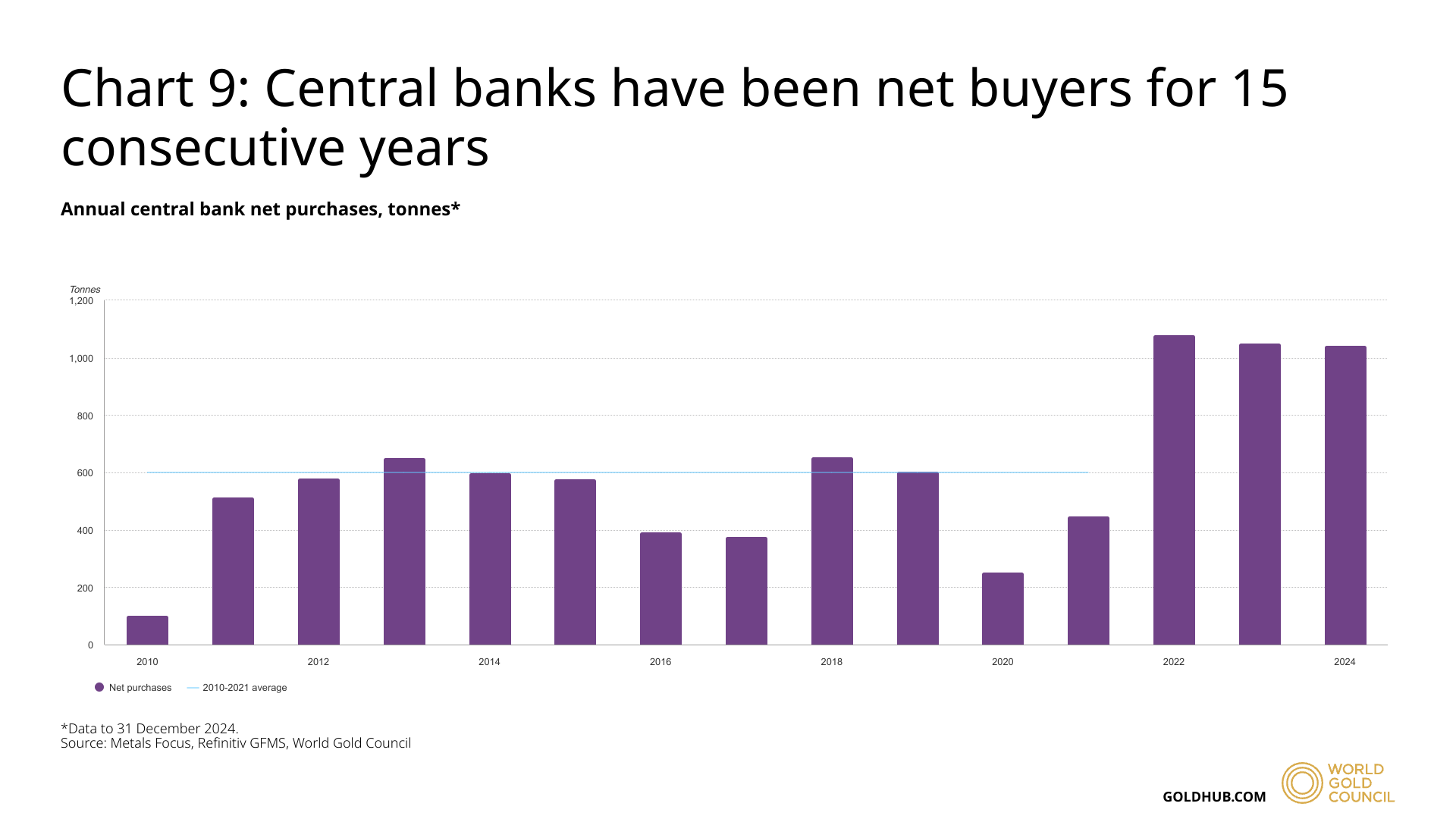

The World Gold Council recently published the key data for 2024:

In 2024, central banks bolstered their global reserves by adding 1,045 tons of gold, the third consecutive year in which purchases exceeded 1,000 tons. This volume is well above the annual average of 473 tons observed between 2010 and 2021.

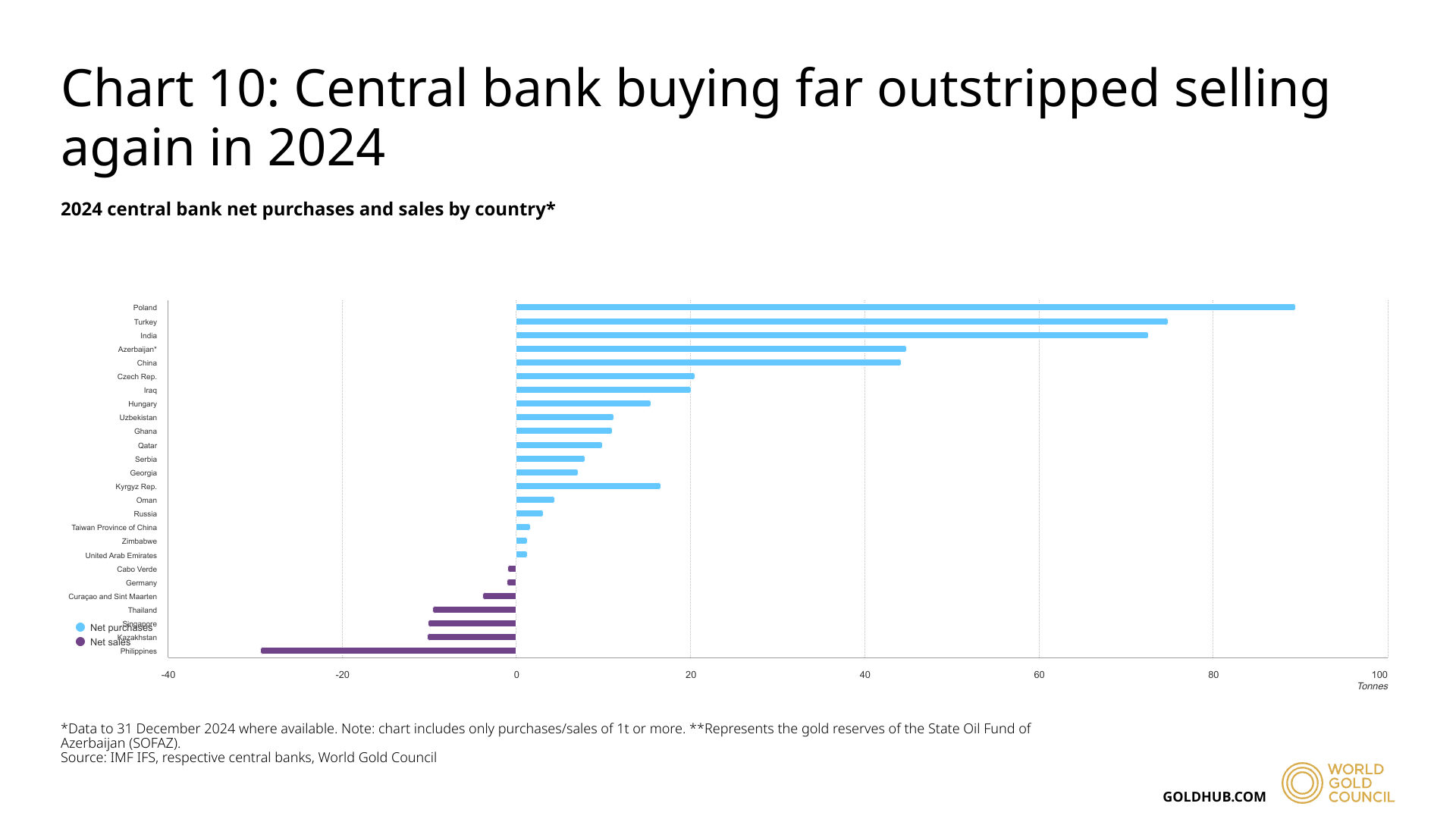

Major buyers include the National Bank of Poland, which acquired 90 tons, as well as several emerging market banks, such as India (73 t), Turkey (75 t), Hungary (16 t) and China (44 t):

The main reasons for these purchases are to diversify foreign exchange reserves, reduce dependence on the dollar, and protect against geopolitical and economic uncertainties.

The gold rush at the COMEX is even more impressive than these central bank purchases, which were already very significant.

Until recently, physical gold used to flow mainly from refineries to the BRICS countries. Now, over the past two months, it's the US market that's acting as a veritable vacuum cleaner, absorbing an ever-increasing share of the physical gold market.

This gold rush in the USA coincides with another striking fact: the number of requests for deliveries of physical gold on the COMEX market has never been so high.

In just three days at the beginning of February, 40,649 gold contracts were delivered, representing some 126.43 tons of gold, with an estimated total value of $11.38 billion, based on the current price of $2,800 per ounce.

COMEX deliveries are not really physical withdrawals from the institution's vaults. Rather, they are stock assignments, i.e. the allocation of reserves to investors wishing to secure a portion of the gold stocks available on the COMEX.

Contrary to the idea of a physical raid to empty reserves, we are in fact witnessing a gradual deleveraging of the market. In other words, the COMEX structure is evolving towards a model where gold holdings more closely reflect actual physical reserves, thereby reducing financial leverage on the futures market.

This change brings COMEX closer to the Shanghai Gold Exchange (SGE) model, where transactions are mainly based on physical exchanges with clearly identified reserves. This evolution represents a major turning point: the COMEX, which was historically dominated by derivatives and paper positions, is being transformed into a more transparent market, better aligned with actual physical gold flows.

The urgent rebuilding of COMEX stocks is catalyzed by the trade war between China and the United States.

Tensions between China and the United States continue to escalate, with reciprocal measures affecting various economic and technological sectors. Recently, the U.S. imposed an additional 10% tax on a range of products imported from China, while removing the “de minimis” exemption, which previously allowed packages valued at less than $800 to be exempt from customs duties. In response, the US Postal Service (USPS) temporarily suspended acceptance of packages from China and Hong Kong, directly impacting popular online shopping platforms such as Shein and Temu.

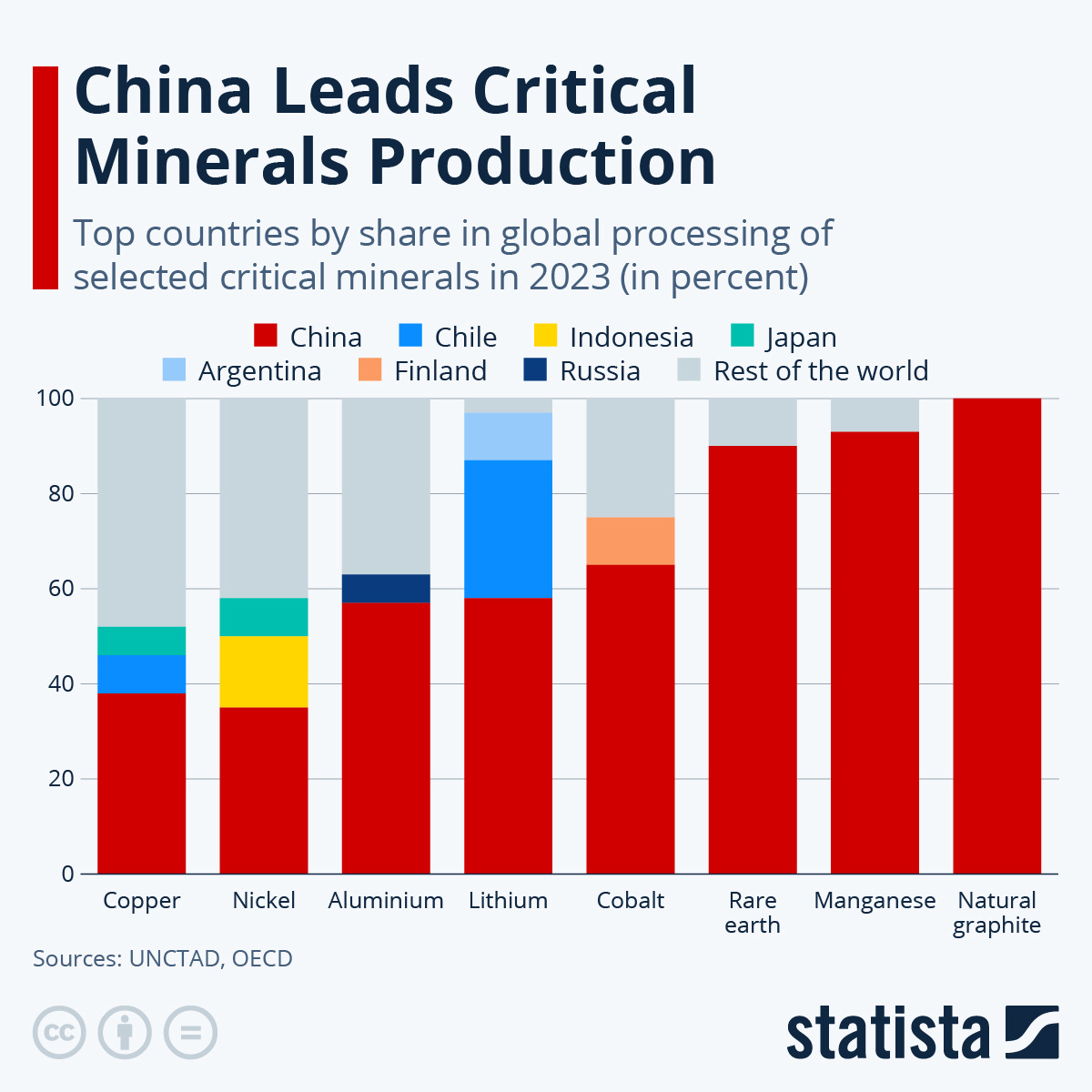

In response, China announced, effective February 10, the imposition of 15% tariffs on US imports of coal and liquefied natural gas (LNG), as well as 10% on oil, agricultural machinery and vehicles. This could have a direct impact on Elon Musk's Tesla, for whom China is a key market. At the same time, Beijing has tightened export controls on strategic metals such as tungsten, tellurium, bismuth, molybdenum and indium, which are essential for the production of weapons and semiconductors.

Stopping tungsten exports would have catastrophic repercussions for the Western oil industry. Tungsten is the only metal capable of withstanding the extreme conditions of deep drilling, a key sector for the new US administration. Without tungsten, no new drilling will be possible.

In addition to its role in the energy sector, tungsten is also crucial to the military industry, where it is used in the manufacture of essential components.

China had already introduced export restrictions on other strategic metals, such as gallium and germanium, which are essential for semiconductors and communications technologies.

This new export ban is far more severe than the previous ones, and represents a major escalation in the trade war between China and the United States.

After tungsten, it is highly likely that other strategic metals will also be subject to restrictions, which could further intensify the pressure on US industry.

An important reminder: China controls not only the production, but also the processing of the majority of metals essential to American industries. This dependence represents a major strategic lever in the current trade tug-of-war:

On the technology front, the Trump administration has hardened its stance by banning the import of small items from China, leading the USPS to suspend all shipments from that country. This measure aims to restrict the circulation of products deemed to threaten national security or linked to intellectual property violations.

What's more, the USA is considering strengthening its legislative arsenal by imposing penalties of up to 20 years' imprisonment for any infringement of intellectual property rights. This new measure would particularly target people downloading Chinese applications, which could have a considerable impact on millions of users.

In response to these restrictions, Beijing has introduced a targeted tax on Apple products, putting further pressure on one of the leaders in American tech. This measure could severely affect the brand's sales in China, one of its most strategic markets.

These decisions represent a turning point in the Sino-American rivalry, which is no longer limited to a simple commercial issue, but now extends to the control of tomorrow's technological and digital resources.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.