Saudi Arabia recently orchestrated the issuance of $2 billion of Chinese sovereign bonds, denominated in US dollars, marking a notable evolution in the global financial landscape. Contrary to usual practice, these bonds were issued in Riyadh rather than in traditional financial centers such as New York or London. The yield offered was competitive, in line with that of US sovereign bonds (UST), even though the highest-rated countries usually offer a premium of 10 to 20 basis points. The deal was also a resounding success, with demand twenty times greater than the initial offer, in stark contrast to USTs, which are usually only oversubscribed by around two times.

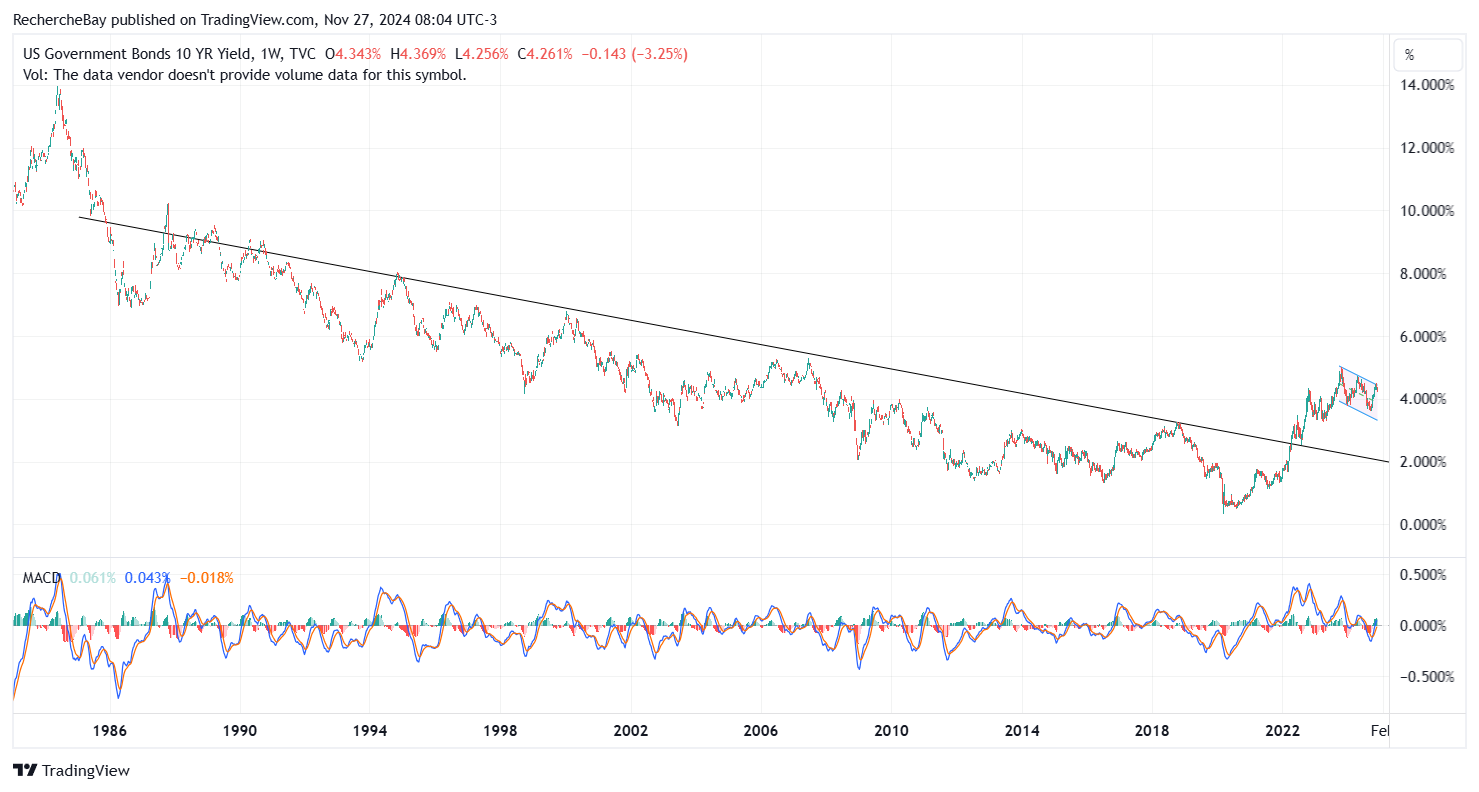

This operation highlights the growing vulnerability of US Treasuries, a key pillar of global finance. Since 2022, 10-year bond yields have deviated from their long-term downward trajectory, marking a significant break in yield dynamics. This reversal reflects a structural imbalance in the US bond market, which is struggling to absorb the growing refinancing needs of the federal government:

Several factors explain this fragility. On the one hand, the rapid increase in government debt, fuelled by colossal budget deficits, is prompting investors to demand higher yields to compensate for the increased risk. On the other hand, persistent inflation has heightened expectations of rate hikes by the Federal Reserve, reducing the attractiveness of Treasuries in favor of other asset classes. Finally, international demand for these securities, traditionally robust, is showing signs of weakening, partly due to the diversification of foreign exchange reserves by countries such as China and Saudi Arabia.

Since 2022, this imbalance has widened, causing increased volatility in the bond market. The rise in yields reflects not only a technical adjustment, but also a deeper erosion of confidence in the ability of the United States to guarantee sustainable financing of its public debt.

This loss of confidence has been accompanied by a spectacular fall in the TLT index, a barometer of the performance of 20-year US government bonds:

TLT is about to break a bear flag once again...

This situation represents a major challenge to global economic and financial stability, as a prolonged dysfunction in the T-bill market could have repercussions on overall interest rates and the cost of financing for businesses and households.

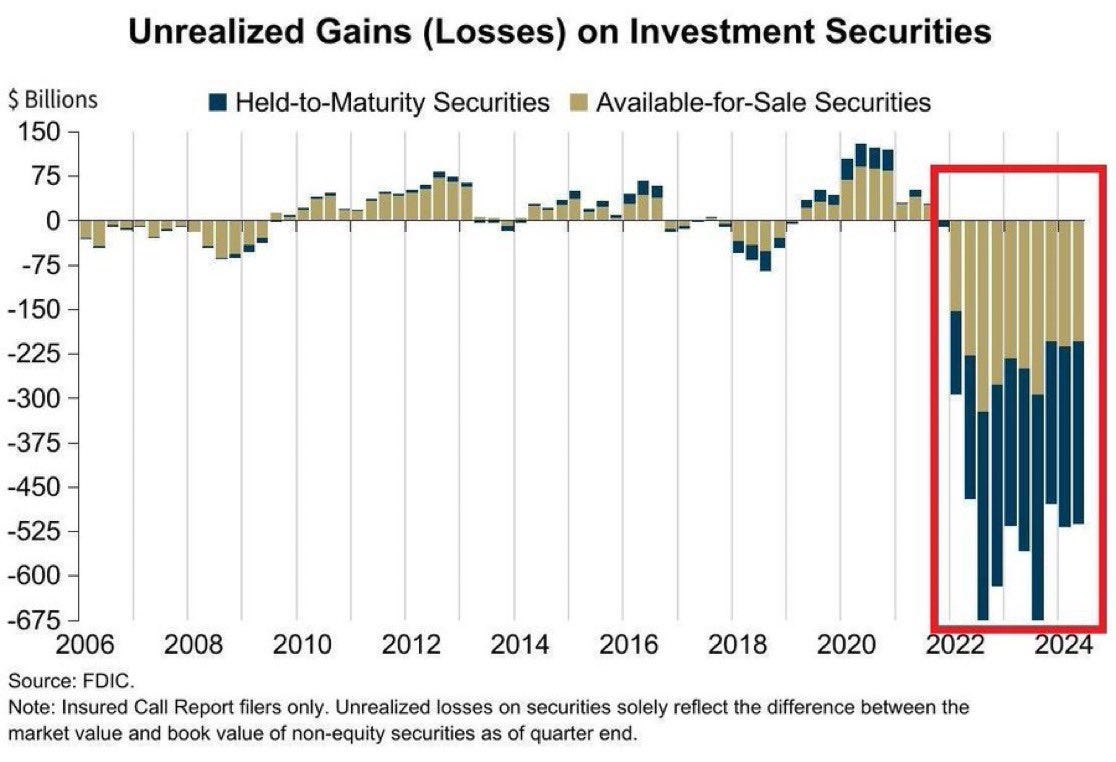

The losses generated by the bond crash of 2022 are already seven times greater than those of the last financial crisis. Even more alarming, 50% of these losses are classified as “hold to maturity”, which means that they are not immediately reflected in the balance sheets, but represent a real time bomb for banks if they have to liquidate these assets before maturity:

Since 2022, central banks, particularly the US Federal Reserve, have adopted a policy of aggressively raising key interest rates to counter inflation.

When interest rates rise, the value of fixed-rate securities such as bonds falls, as newly issued securities offer more attractive yields.

Banks holding these securities suffer huge unrealized losses, as their old securities are now worth less on the market.

"Held-to-Maturity” securities do not have an immediate impact on balance sheets, but if a bank is forced to sell these assets before maturity, it will have to realize these losses, which could lead to bankruptcies, as was the case for Silicon Valley Bank in 2023.

We can clearly see how the risk weighing on the US bond market is being transformed into a banking risk of even greater magnitude.

The Chinese debt issue goes far beyond the purely financial sphere. It reflects Saudi Arabia's desire to distance itself from American influence, while consolidating its relations with China. It also marks an important step in challenging the Petrodollar system established in the 1970s, and paves the way for trade in yuan. By positioning itself as a new platform for recycling global liquidity, Riyadh is offering international investors an alternative to Western financial channels. This move is part of a broader drive by Gulf countries to diversify their economic and security alliances, with the aim of reducing their dependence on the West.

This rapprochement is also part of the Chinese strategy launched at the 2022 China-Arab States summit, with Riyadh now playing a key role in the Belt and Road Initiative (BRI). Countries participating in the BRI, often indebted to Western institutions in dollars, can now turn to Chinese financing to repay their debts. In return, China is repaid in yuan or strategic resources, while enabling these countries to free themselves from the dollar debt trap and US financial sanctions.

If the United States, under a Trump administration for example, were to respond by imposing sanctions against buyers of Chinese debt, this would reinforce the idea that dollar-denominated assets are no longer as safe as they once were. Such a situation would further encourage investors and countries to diversify their reserves and portfolios, further weakening the dollar's dominance in international trade.

But if Trump fails to act, the risk of a system competing with the Treasury for debt issuance poses a real challenge to US debt financing. Who will take on this refinancing if another, more accessible source of dollar-denominated debt becomes available?

Although last week's Chinese bond issue was relatively modest in volume, it was a clear political signal to Donald Trump and, more broadly, to the US administration. This is not just a financial maneuver; it illustrates a geopolitical game in which every action, however symbolic, is of great importance. The Chinese are demonstrating their ability to use the financial tools at their disposal to assert their presence on the international stage and subtly undermine American domination of the global financial system.

Against this backdrop, it becomes clear that keeping the US fiscal accounts under control is more crucial than ever. The U.S. economy relies on constant refinancing of its debt, mainly by foreign investors buying U.S. Treasury bonds (USTs). If this demand were to diminish, particularly through initiatives such as China's, this could seriously undermine this dependence. With a reduced need for refinancing, the United States would be much better equipped to respond to this type of challenge. A more resilient economy would enable it to limit the impact of such Chinese emissions and prevent the dollar from losing its status as a key safe-haven asset.

However, the reality is far more complex. Current U.S. fiscal imbalances make this hypothesis difficult to achieve. The federal deficit continues to grow, reinforcing the United States' dependence on foreign investors to finance its debt. Against this backdrop, even a marginal decline in global demand for USTs could have serious consequences, notably by prompting the US to raise interest rates to attract new investors. Such a move could further exacerbate the fiscal situation and weaken the US position in the face of similar Chinese initiatives.

In short, this modest Chinese issue, far from being insignificant, highlights the structural flaws in a system based on international appetite for the dollar. If the United States is to maintain its dominant position in the face of such a threat, it is crucial that fiscal imbalances be corrected, otherwise such initiatives will multiply and gain in influence. This situation is just a foretaste of the much larger financial and geopolitical confrontation that is shaping up over the coming years.

The United States must reduce its structural deficit, but there is no sign that the next administration will have the means to do so.

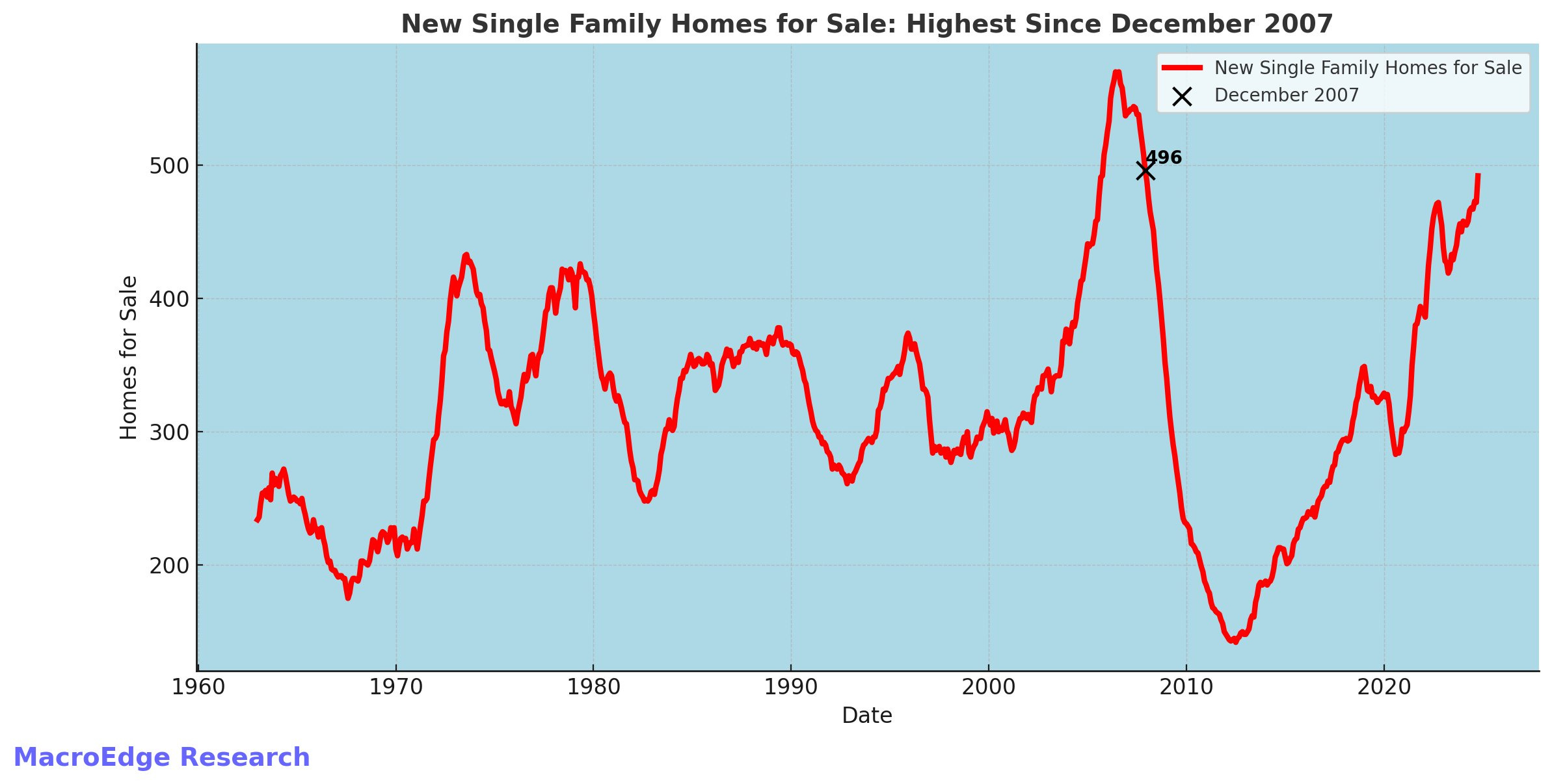

The country is facing an unprecedented situation in the real estate market. The total stock of unsold new homes has reached its highest level since December 2007:

As we mentioned in our bulletin from last month, the US real estate market is completely paralyzed. There's no doubt that Trump's entourage is directly affected by this situation, and it's highly likely that the new president will see this blockage as a priority to be resolved during his term in office. It's also very likely that Trump's weapon will be fiscal. In the first few months of his presidency, we could see reforms aimed at reducing taxes on real estate. However, these measures are unlikely to solve the problem of the structural deficit. On the contrary, they are likely to worsen it, and the United States could find itself with a structural deficit in excess of $5 trillion in the years to come.

Physical gold naturally appears to be the preferred safe-haven investment in the face of the deficit-financing impasse. It is benefiting from both growing concerns about the worsening of this deficit and the potential repercussions for US Treasuries. The latter could be amplified by rising tensions between China and the United States, creating a climate of uncertainty that reinforces gold's appeal as a safe-haven asset.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.