In my bulletin from last week, I wrote that “the downturn in the property market and the stock market has cooled consumers down, prompting them to prioritize savings over consumption. The slowdown in consumption in China is mainly due to the impoverishment effect caused by the fall in property prices, as well as the collapse of the Chinese stock market."

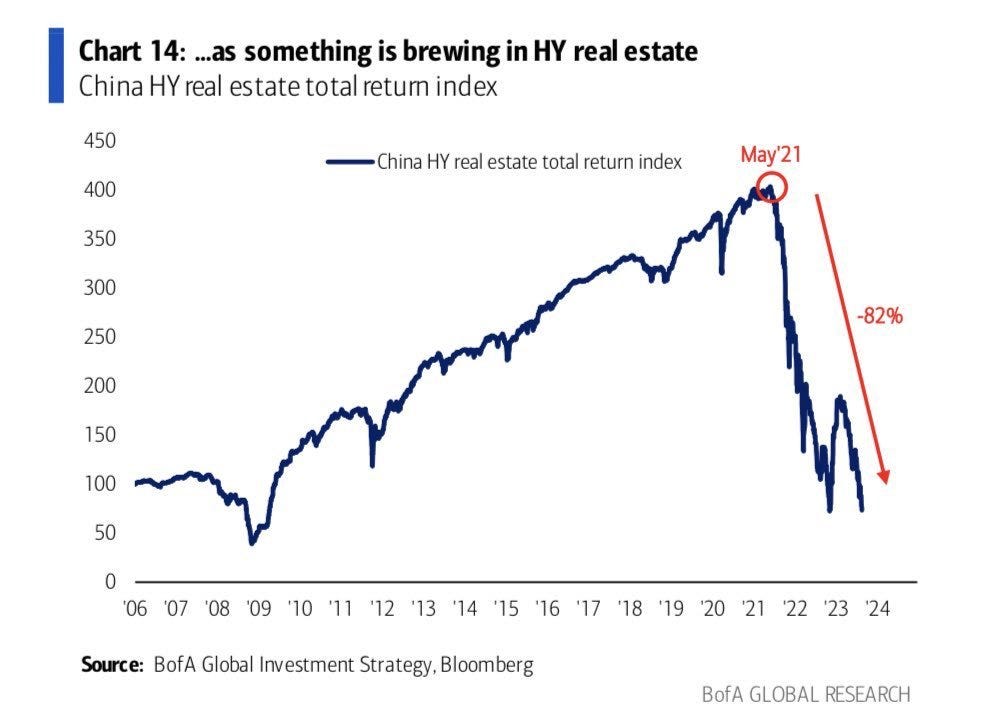

The fall in China's real estate sector since 2022 is impressive, with an 82% drop from the peak reached in May 2021:

In just a few months, property prices in China have returned to their 2008 levels.

Could we see a similar correction in the United States or Europe?

The monetary system allows new fiat money to be freely created via the credit creation process, and the real estate market relies on one of the main drivers of this credit creation: mortgages.

Over the past 50 years, the majority of developed economies have adopted the same model: steadily falling interest rates and growing public and private debt. This has enabled the economy and asset markets to thrive despite an aging population.

Low interest rates encourage people to take out larger mortgages, driving up property prices. More credit, at lower rates, pushes up house prices.

However, this expansion in the volume of credit also leads to a significant increase in the amount of paper money in circulation.

So, when real estate prices are measured against a competing money such as gold, which is in limited supply, prices remain stable.

A fully elastic fiduciary system is beneficial if used wisely, as it enables policymakers to support the economy in times of crisis. However, if mismanaged, it can lead to explosive asset price rises and inflationary pressures.

This is exactly what is happening.

According to Reventure's analysis based on 134 years of data, inflation-adjusted property prices are now almost 100% higher than the average for the last 130 years. Currently, prices even exceed those observed during the real estate bubble of 2006.

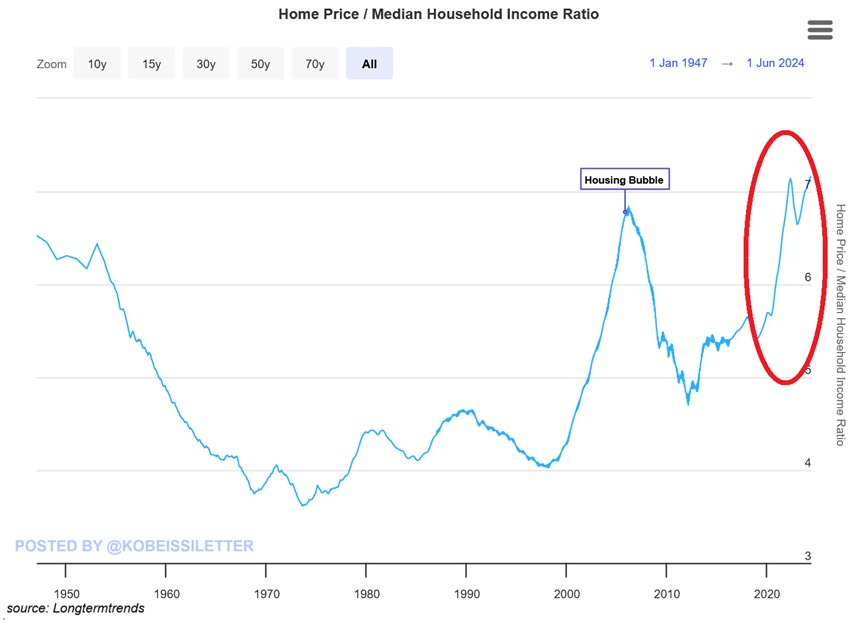

The ratio of house prices to median household income in the USA has reached a record 7.2x, surpassing the 7.1x of 2022 and the 6.8x of the 2008 housing bubble. Before the 2020 pandemic, this ratio was 5.5x. In the space of 5 years, house prices have jumped by 50%, while household incomes have risen by just 17%. Access to housing therefore continues to deteriorate:

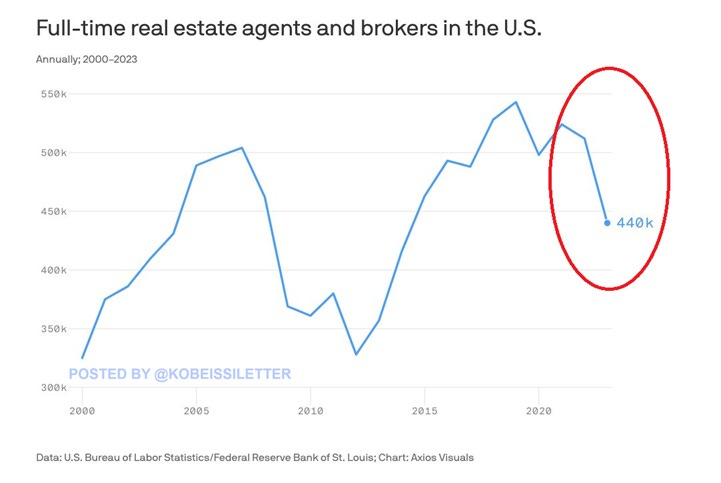

In the United States, the number of full-time real estate agents and brokers fell to 440,000 in 2023, its lowest level since 2014. This figure fell by 72,000 in one year, a 14% drop, the largest since 2008:

Membership in the National Association of Realtors has fallen by 100,000 since 2022, to around 1.5 million. In July, pending home sales hit their lowest level on record, falling even below levels seen during the 2020 pandemic. At the same time, mortgage demand is at its lowest level in 30 years.

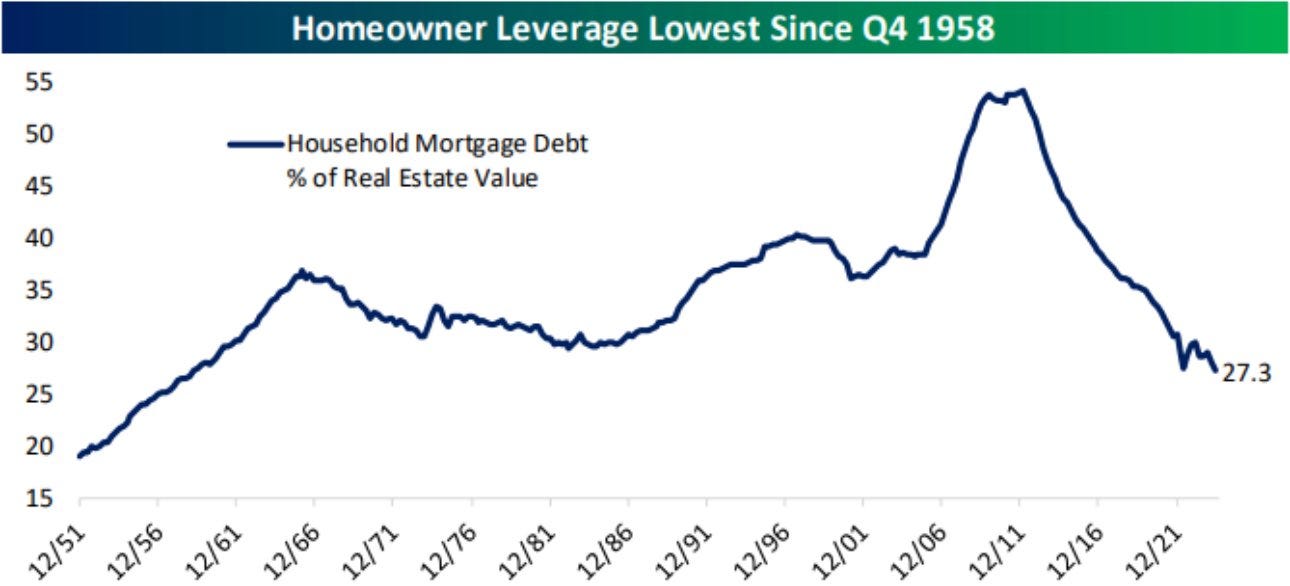

Homeowner leverage (i.e. household mortgage debt as a percentage of property value) is currently at its lowest level since the fourth quarter of 1958, at around 27.3%. After peaking in 2008, just before the global financial crisis, this percentage has fallen steadily as interest rates have fallen:

Borrowing capacity could deteriorate again as long-term interest rates rise. Against all expectations, the Fed's rate cuts have not had the desired effect in recent weeks, with long rates actually rising sharply.

The yield on US 10-year bonds is now over 4.10%, having reached a low of 3.6% just a few weeks ago:

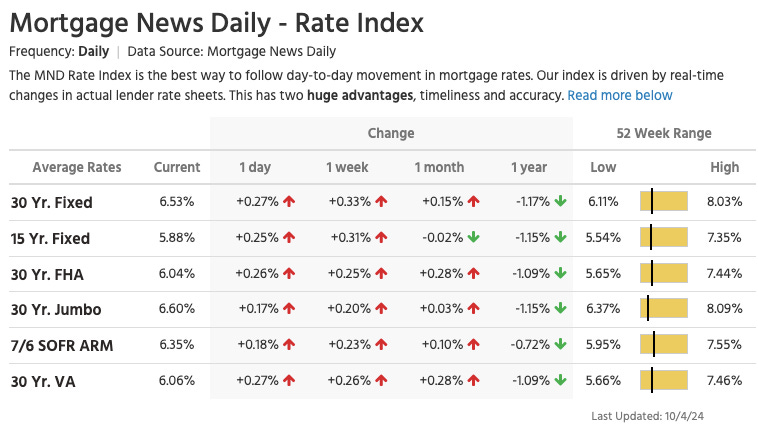

Rising long-term rates are having a direct impact on mortgage prices, which are once again soaring in the United States. The “base” borrowing rate, now calculated over 30 years (rather than 20 years), climbed to 6.53% in just one session last Friday:

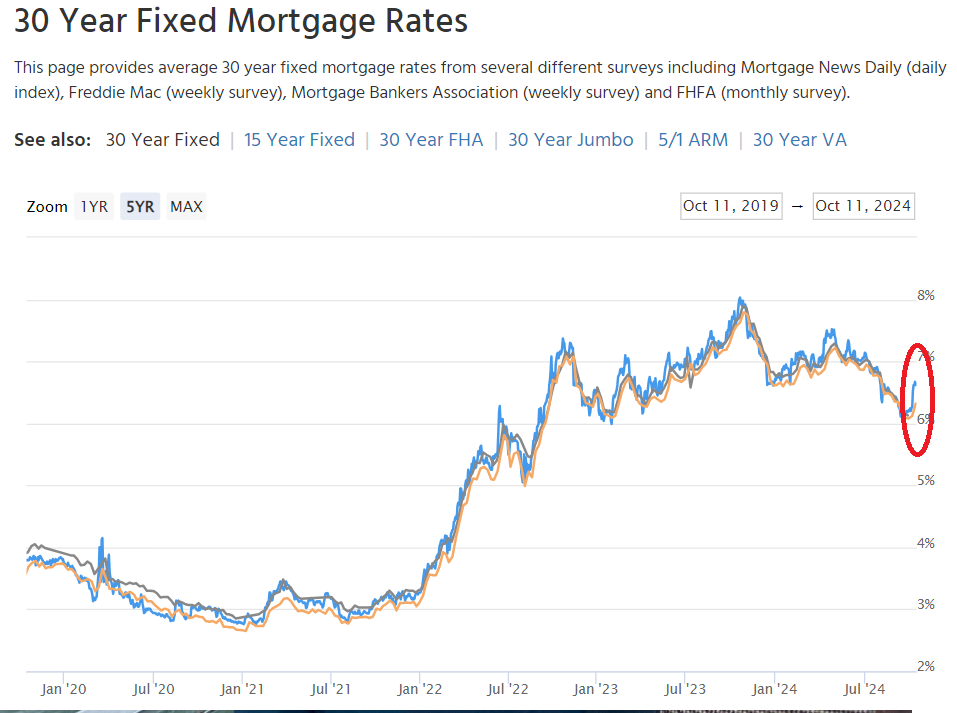

The rapid resumption of the rise in real estate rates has come against all expectations:

This movement should not encourage sellers!

Nobody wants to sell, because nobody wants to give up a mortgage rate of 3% or less. Many homeowners are reluctant to put their house up for sale because of the level of these interest rates. Unless you have enough capital to buy in cash, swapping a 3-4% mortgage rate for a 6.5% rate makes no sense, unless you're moving to a cheaper area.

And nobody wants to buy either! Now that rates have gone up, who would want to pay more than 35% extra on the principal?

The market has ground to a halt!

The fall in interest rates reinforces this sense of expectation. What's the point of buying today if rates continue to fall?

Real estate agents are leaving the sector as they struggle to obtain new mandates due to the current situation. The low availability of properties on the market discourages new agents as well as their buyers, as several people are bidding on the same houses. Real estate is already a difficult sector, with long periods of no income. However, the current stalemate is unprecedented in the last 50 years, with the market completely frozen.

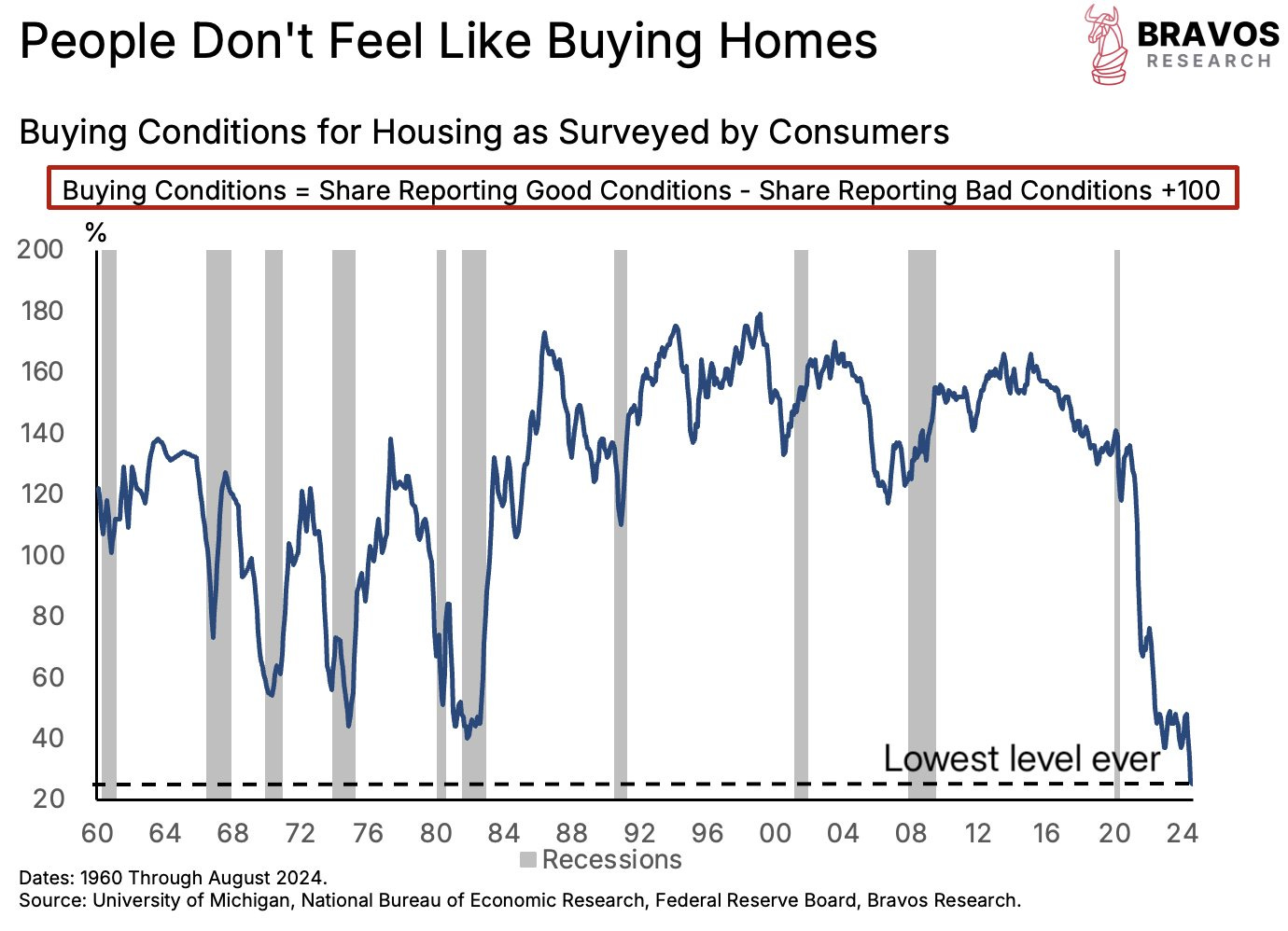

Worse still, this stalemate is radically transforming sentiment around this market: the desire to buy real estate in the United States has never been so low:

Buying a house or apartment is now seen as an absurd idea in the United States, and never in history has such negative sentiment towards the real estate sector been observed.

This extreme situation, characterized by the absence of buyers, sellers and liquidity, while prices are reaching record highs and no one is interested in buying a property anymore, is unprecedented in the history of real estate in the United States.

In France, the desire to buy a property could also be affected, due to rising interest rates, but also for reasons intrinsic to the market.

The government is planning to toughen the taxation of non-professional furnished rentals (LMNP-Non-Professional Furnished Rental) in the 2025 Finance Bill. Currently, owners benefit from depreciation, which is not taken into account when calculating capital gains on sale. The reform proposes to reintegrate this amortization, thereby increasing the taxable capital gain.

If an amortized property is sold, the capital gain to be taxed will be considerably higher.

In other words, owners' rental income will be heavily taxed... when the property is resold!

Professionals are concerned about the impact on the rental market, fearing a reduction in the attractiveness of furnished property investments.

But it is above all the sentiment surrounding real estate investment that is likely to be impacted.

In France, as in the United States, the desire to buy real estate could be further eroded.

The Chinese have already gone through this period of negative sentiment towards real estate, which partly explains the craze for physical gold. Gold is shining in China, largely because bricks and mortar have fallen out of favor. Are we seeing a similar phenomenon here? Will those who shun real estate turn to physical gold to preserve their savings?

Sentiment towards gold is beginning to change in the West.

Every week, the price of gold sets new records in both dollars and euros, at a time when investors are gradually moving away from real estate.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.