There is a certain kind of wealth that endures throughout several generations due to the efforts of the people who built it, but also due to the help they’ve gotten from professionals to keep it protected. Each wealth management advisor has thus in mind to have his/her clients profit from a full range of wealth management solutions with the finest products available.

I would like to take this opportunity to speak to you about an asset class that I’ve written a book on and that I’ve noticed – after having been around many wealth management people – that it remains relatively unknown within the profession: gold, that is. Along these posts, I will try to debunk some of the quite enduring myths about the yellow metal. My goal is that after you have perused those few notes, you will know precisely:

- In which currency should one track the price of gold;

- What are the main financial properties of gold;

- If taking a position on a gold miner equates buying physical gold;

- If the purchase of "paper gold" is equivalent to the purchase of physical gold [Part 1] - [Part 2];

- What kind of performance can your clients expect over the long term with physical gold?;

- If bancassurers are the best partners for wealth management advisors to buy physical gold;

- If the commercialisation of physical gold is likely to make you money as a wealth management advisor;

- Finally, I will probably be brought into talking about other subjects, in answering some of your questions. Feel free to contact us at wealthmanagement@goldbroker.com.

Price of gold: why think in dollars when you live with euro?

Unless your office is specialised in an expatriated clientele, the euro is the currency of the monetary zone in which most of your clients get their revenue and hold their wealth.

You’ve probably noticed that most European medias communicate the price of gold in US dollars. I find this quite curious, be it with the timing of the rallies and corrections or their magnitude, depending of the currency.

The offer curve for the price of gold differs considerably depending on the currency pairing

Here is a chart you’re probably familiar with: the gold-dollar pair:

If we look at the price of gold in US dollars, we see gold hit a peak at $1,896 on September 5, 2011, before falling hard for four long years, reaching a low of $1,049 on December 17, 2015, a correction of 44%. It can be said that American investors in gold have had a lot of time to lament before its price started to move upward again in January, 2016.

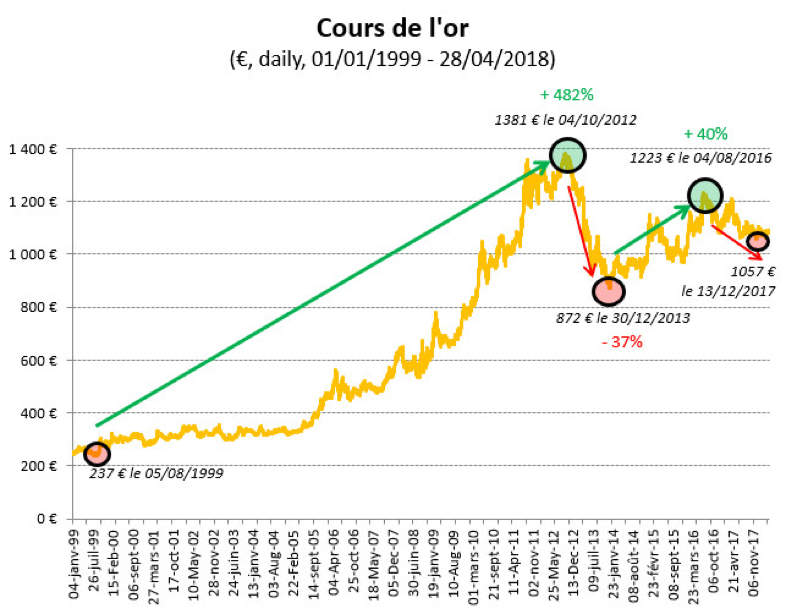

What of the gold-euro pair? After the spectacular surge that took gold from €237 in August, 1999 to €1,381 in October, 2012 (+ 482% in 13 years), the ounce has corrected by 37%, which took it to a low in December, 2013 of €872. So the Euro zone investor only had to wait for a full year before the price started to move up again. Since then, gold has moved back up to €1,224 in August, 2016, and is now presently around €1,100, as I’m writing this.

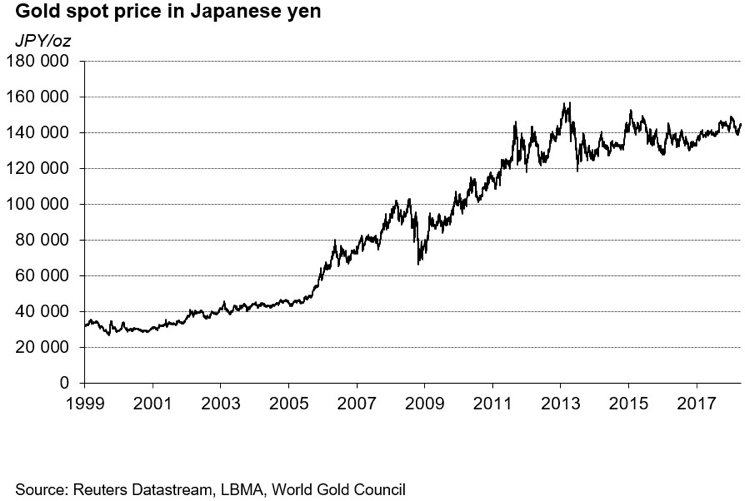

Now look at how the curve, below, is different than the two preceding ones:

This is the curve of the price of an ounce of gold in yens. And knowing that Japan is quite the laboratory for non-conventional monetary policy experiments, it seems to me that the trend of that price curve is interesting to watch. In fact, the minor correction in 2013 hasn’t put into question the long-term bullish trend for the price of gold.

The American saver is not the European saver, and even less the Japanese saver

To sum it all, whereas many American gold investors have had reason to panic with a brutal correction that stretched over four years, those in the Euro zone quickly stopped sweating after an almost as severe correction, but one that lasted for only one year. Meanwhile, the Japanese investors did not see their gold savings’ purchasing power move by even an inch.

For a European investor, deciding to buy gold on the basis of its spot price in dollars makes as much sense as buying on the basis of its spot price in yens or in bolivares soberanos.

So, logically, I will refer to the price of gold in euro. I’m taking this opportunity to point out that the worldwide benchmark spot price is fixed twice a day (at 10.30 AM and 3.00 PM) in London by the London Bullion Market Association (LBMA). It is set in ounces denominated in US dollars (and then converted into euro).

Gold in euro: what are its financial properties?

I’m certainly not going to pretend that the ownership of physical gold is indispensible at all times and in all places. Whether you’re an intractable gold bug or you consider gold, on the contrary, as an unproductive and useless asset, or you don’t have any religion regarding the yellow metal, I would simply like to indicate to you what its financial properties are, for your European clients.

The yellow metal is appreciated practically because it can fill two roles: it is a hedging tool against certain macro-economic scenarios; and it can be used for portfolio diversification.

We’ll see in a future post that when it comes to gold’s financial properties, it is very important to be quite meticulous, and to take the media’s spin ideas with a grain of salt.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.