The price of gold broke another all-time record in all currencies last week.

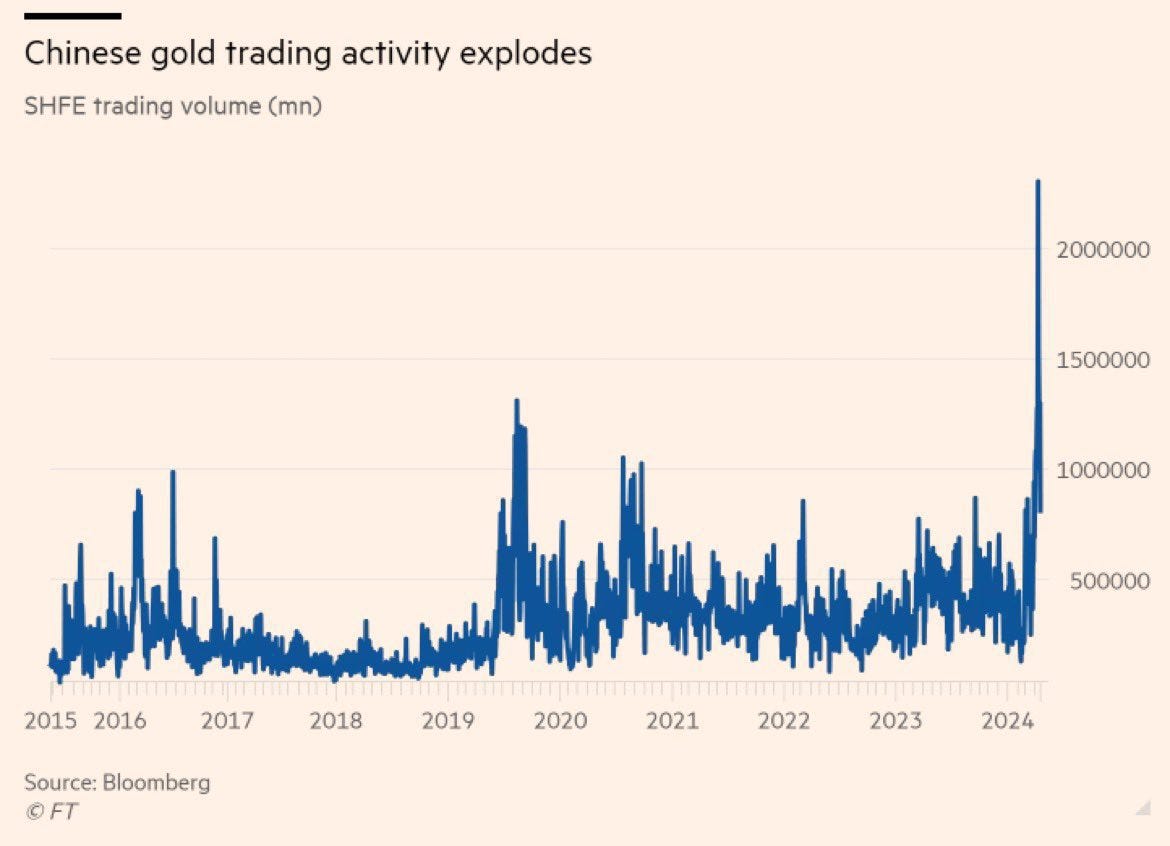

China remains the main driver of this gold frenzy. Trading volumes on the Shanghai market have exploded in recent days:

This feverish outburst is now largely accompanied by a record number of open long positions in the futures market:

What are the reasons behind this surge in interest in gold in China?

Gold has been the asset of choice for the Chinese since the stock market underperformed and the property market fell.

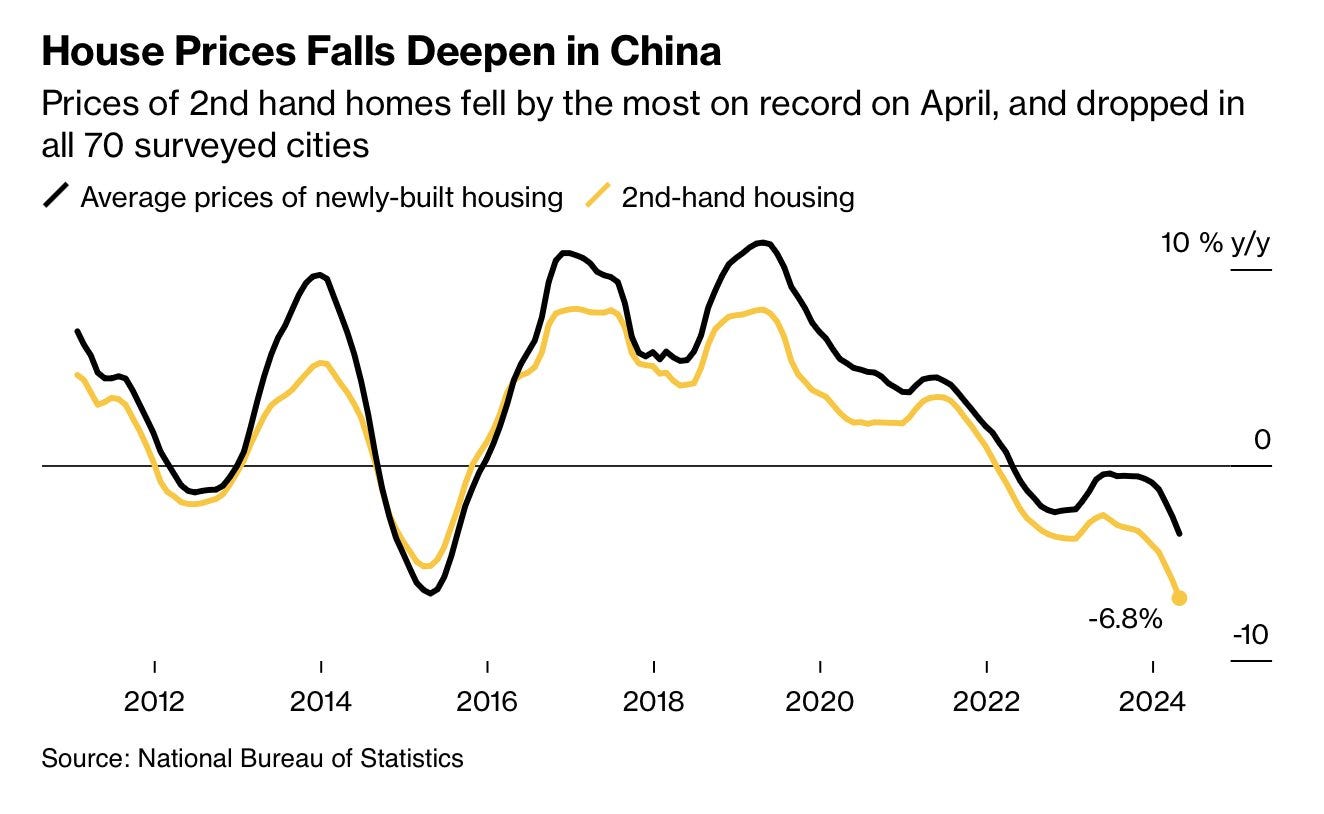

In fact, in recent weeks, the fall in Chinese real estate has accelerated:

The first fall in property prices coincided with the start of the gold rush in China.

The intensification of this gold craze also coincides with an acceleration in the property downturn. Property prices have now fallen by -6.8% year-on-year, a figure unprecedented in contemporary Chinese economic history.

The importance of real estate and the scale of indebtedness in this sector have raised fears of massive intervention by the Chinese monetary authorities. Such action would have a marked effect on the value of the yuan.

Is the gold craze a signal of imminent currency devaluation?

In any case, the gold rush is now accompanied by a craze for other metals.

Copper has also soared to new highs.

This comes at a time when the slowdown in China's real estate market is expected to exert downward pressure on the red metal, which is widely used in this industrial sector.

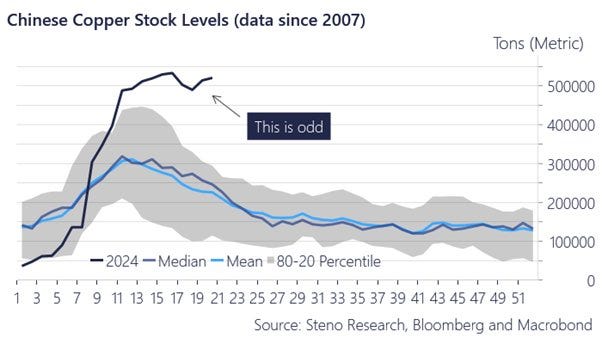

In fact, Chinese copper stocks are much higher than they should be at this time of year:

Analysts scrutinizing these inventories are logically adopting a bearish short-term outlook.

At this price level, and given inventory levels, it would therefore be logical to expect China to proceed with massive copper exports.

However, this once-dominant angle of analysis now seems to be coming up against a new reality: China is building up reserves of raw materials.

What's the point of China stockpiling so much copper?

By accumulating metal, China removes physical stocks from the market.

Finding sources of copper supply is becoming particularly complex, especially in Western countries.

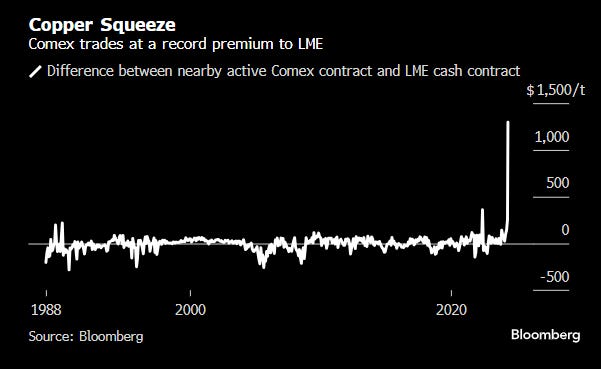

The significant divergence between prices traded in New York (COMEX) and those on the London Metal Exchange has shaken the global copper market, leading to a frenzy for supplies to the USA. This disconnection between paper and physical prices highlights the difficulties in sourcing physical metal.

This difficulty of supply is the sign of a short squeeze, responsible for the surge in copper prices:

The disconnect between the paper market and the reality of the physical market could force manufacturers to conclude over-the-counter agreements directly with producers. For copper, we seem to have entered a new supply environment.

This pressure on copper is also reflected in the fact that concentrate refining costs are now negative, a historic first. In other words, refiners are willing to pay their suppliers to continue getting their concentrate. There is less and less copper concentrate available in an increasingly competitive refining market. Is copper becoming.... a precious metal?

Another metal has taken a giant leap forward in the space of a few weeks: silver.

In my bulletin published two weeks ago, I mentioned the risk of a second Silver Short Squeeze.

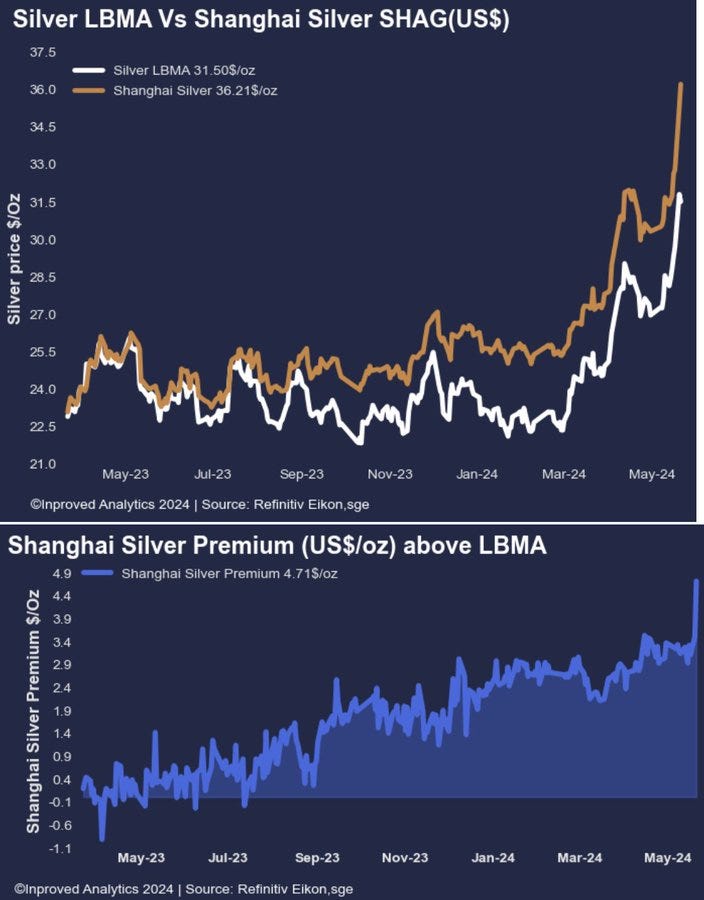

Silver prices quoted in Shanghai continue to break records, while premiums between the Chinese and London markets are also at historically high levels:

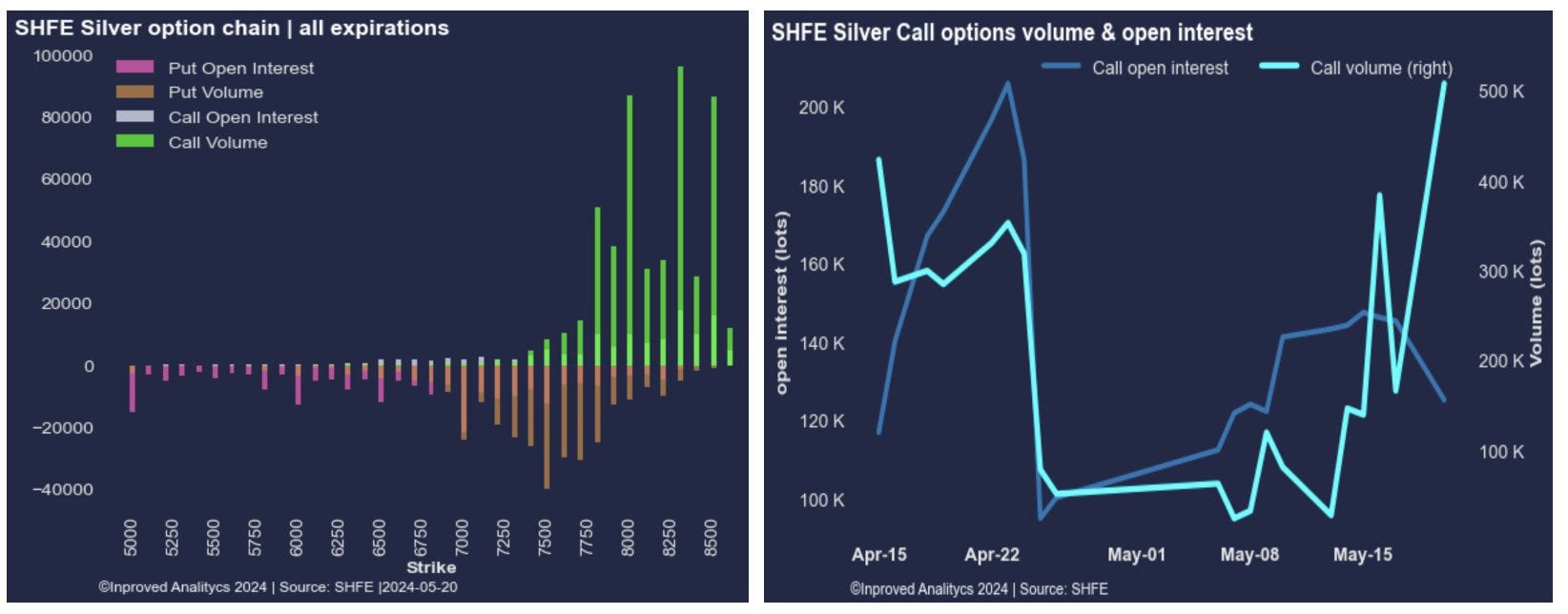

Trading volume in silver contracts also reached a peak on the Chinese futures market SHFE (Shanghai Futures Exchange). The influx of long contracts even forced the Chinese authorities to raise margin levels to calm speculation:

China's gold rush is turning into a silver rush!

A phenomenon still largely neglected in Western countries.

In nominal terms, the price of silver has returned to levels seen eleven years ago, but in real terms, it is still a long way from the peak reached in 2020, equivalent to $34.45 today.

Looking back to the 1980 peak, we can see that, in real terms, silver is still a long way from its value at the time. In fact, adjusted for inflation, the price of silver has fallen considerably over the last 45 years. The silver/inflation ratio is currently trying to break through a negative trend:

This generational resilience, which is currently being tested, can be found at certain mines such as Hecla Mining:

Silver's continued rise would be a generational event, as it would finally mean that the metal is emerging from its downtrend in real terms.

This is the signal many investors have been waiting for to get back into mining companies.

In China, the gold rush is now accompanied by a copper and silver rush.

This rush into tangible metals comes at a time when China is stepping up its sales of US Treasuries.

China has reduced its holdings of US Treasuries for three consecutive months, liquidating a total of $76 billion. Chinese reserves now stand at $767.4 billion, returning to levels similar to 2009.

China is selling its US Treasuries and stockpiling metals.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.