This week's chart shows a spectacular drop in container bookings from China to the USA between February and April 2025, with a year-on-year collapse of over 40% as of April 7. This sharp drop illustrates a massive slowdown in trade between the two countries, a likely consequence of the growing impact of US protectionist measures, notably tariff hikes.

According to Freight Waves, global container booking volumes fell by 49% between the last week of March and the first of April 2025. Imports from China to the USA plunged by 64%, while those of clothing and textiles fell by 59% and 57% respectively, exceeding the crisis levels seen during the Covid-19 pandemic.

This spectacular fall reflects a general blockage in the global trade chain: neither US importers nor Chinese exporters are willing to absorb the costs of the new tariffs. The result is a wave of order cancellations, the accumulation of unsold containers in Chinese ports, and global overcapacity far exceeding expectations.

Contrary to popular belief that the American consumer would foot most of the bill, the data indicate a much more elastic demand than expected: buyers are simply refusing to pay more. This dynamic is jeopardizing hundreds of exporters — particularly in China — who find themselves at risk of bankruptcy due to a lack of sufficient working capital.

Faced with this brutal imbalance, two scenarios are emerging: either an acceleration of trade negotiations, or the risk of a global recession, or even a depression for economies heavily dependent on exports. In Europe, concerns are also growing about a possible influx of low-priced Chinese products diverted from the US market, which could weaken local producers.

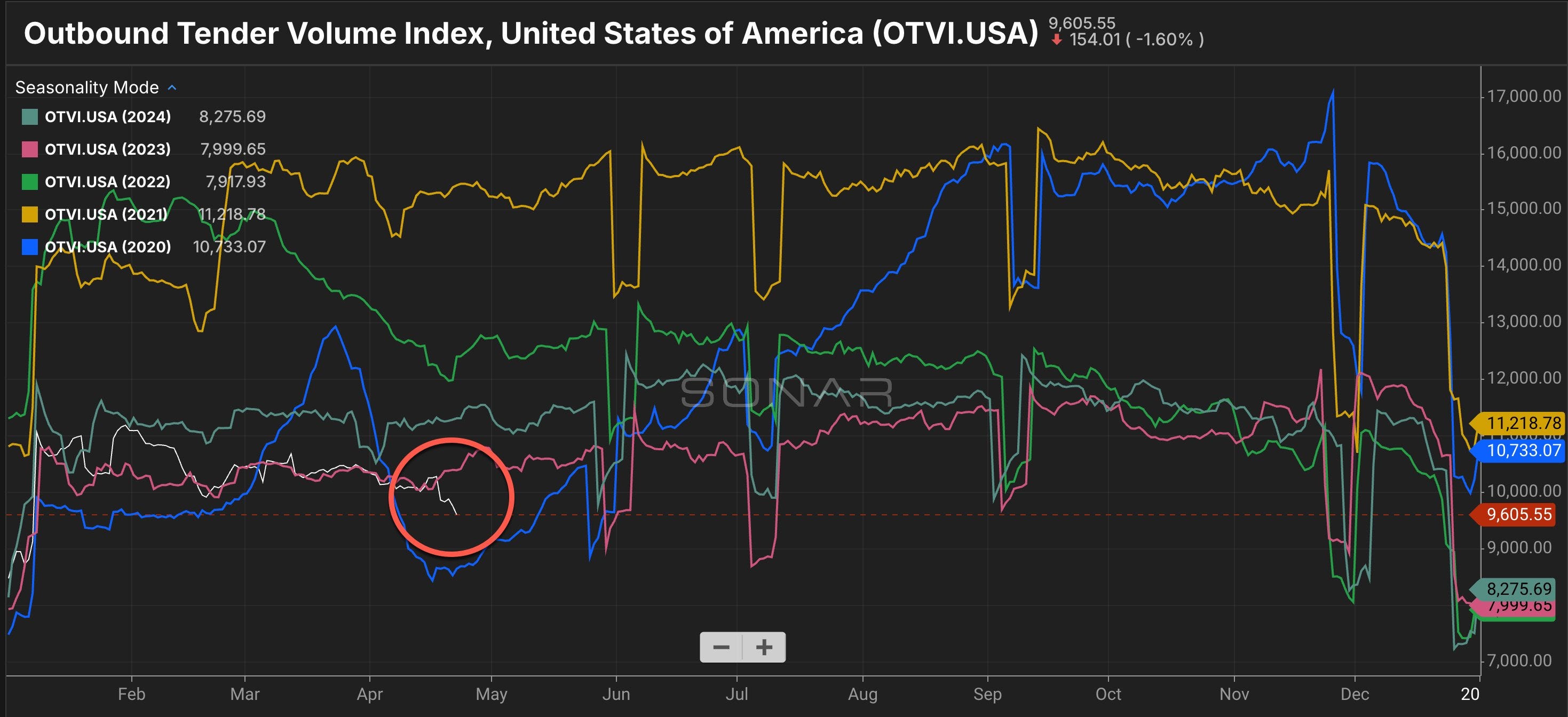

On the ground, trade tensions are beginning to have concrete repercussions on the real economy, notably in the freight transport sector in the USA, where the slowdown is becoming more pronounced: in one month, road freight volumes fell by 8.3%, reaching levels comparable to those at the bottom of the Covid crisis.

In some industrial states, such as Michigan, heavy-duty truck drivers have not had a load for over two weeks, particularly in the automotive sector (GM, Ford). This sudden contraction in logistics activity is fuelling a wave of stress in the banking sector linked to the non-repayment of leases on truck fleets, some of which have been outstanding for over a year.

However, several financial analysts believe that a rapid resolution to the ongoing trade war — which began around Valentine's Day with the announcement of new tariffs — would prevent a collapse comparable to that of 2020. On the other hand, if the tariff tug-of-war between the United States and China were to drag on, the consequences could spread to the entire North American industrial fabric, with the resultant structural economic slowdown, cancelled orders, bankruptcies in the transport sector and a contraction in manufacturing employment.

Beyond the raw data, this figure highlights the ideological divides currently sweeping the United States. For advocates of a nationalist economy, this drop represents a strategic success: it demonstrates the decline in imports from China, the emergence of industrial autonomy and, ultimately, increased consumption of local products by Americans.

Conversely, other observers see it as an alarming sign of increased risk of shortages, imported inflation and logistical disruptions, particularly in mass retail and within supply chains.

In short, the same curve is either alarming or reassuring, depending on one's political perspective: for some, it embodies an inflationary shock and economic derailment; for others, a sovereignist success and a salutary break with China. This polarization reveals the extent to which economic facts are now interpreted through antagonistic narratives, making any objective reading more difficult to convey.

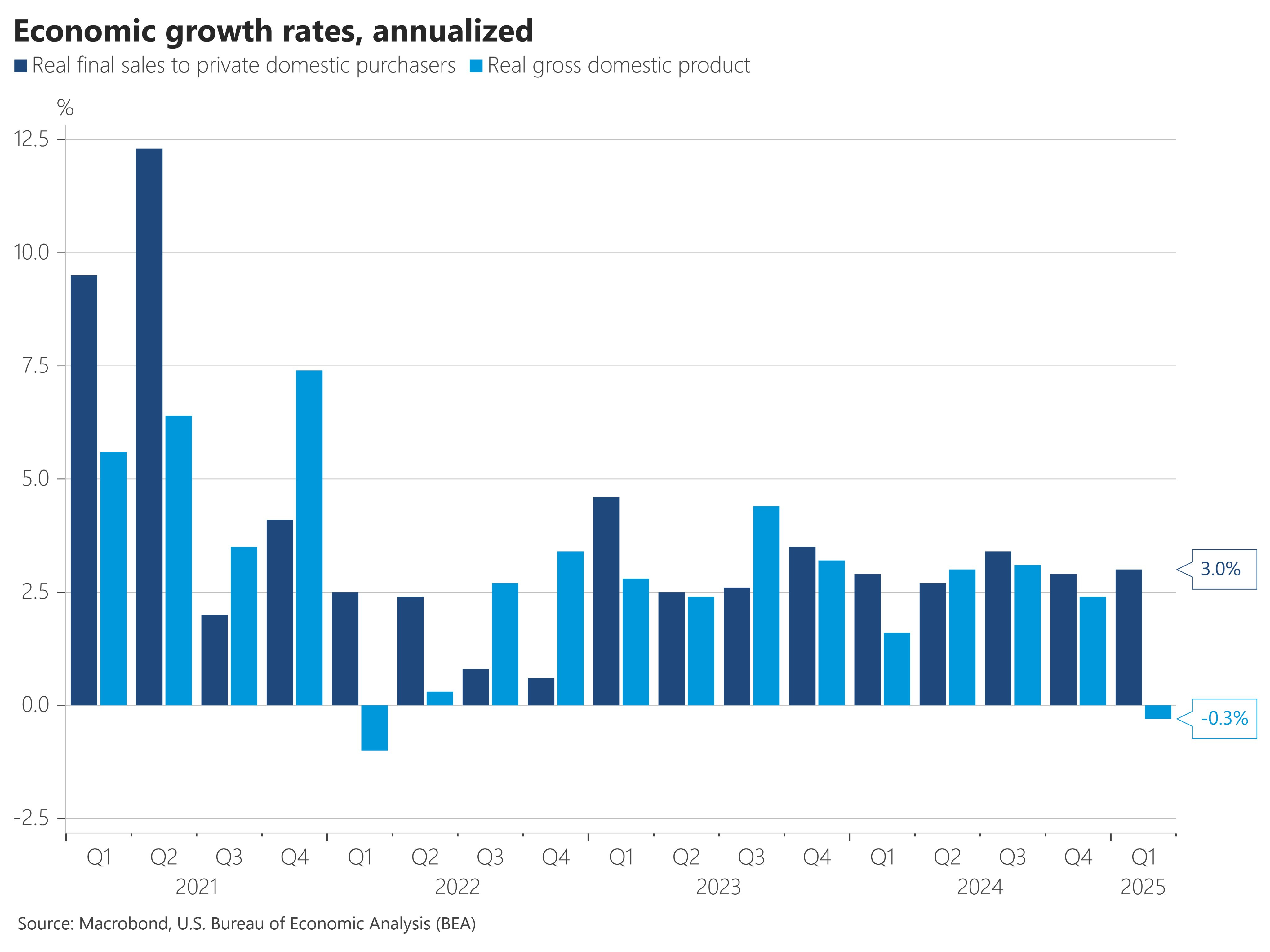

This divergence of interpretation is also evident in the reading of the recent contraction in US GDP. For Donald Trump's opponents, this decline marks the country's entry into recession, directly caused by the tariff escalation. His supporters, on the other hand, see it primarily as the effects of the so-called “DOGE” fiscal policy, focused on reducing public spending — which, mechanically, weighs on GDP. In other words, according to them, the level of growth under Biden was artificially inflated by excessive public demand.

The current president's supporters point to encouraging indicators, starting with the strength of retail sales:

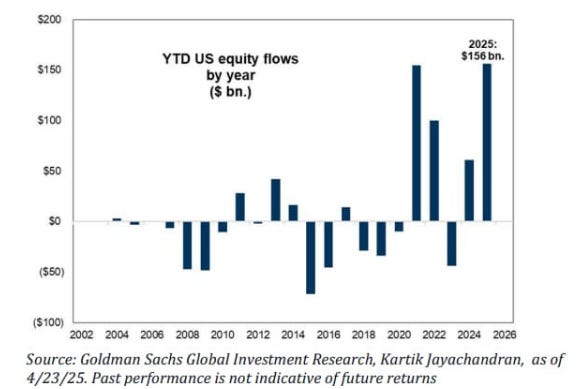

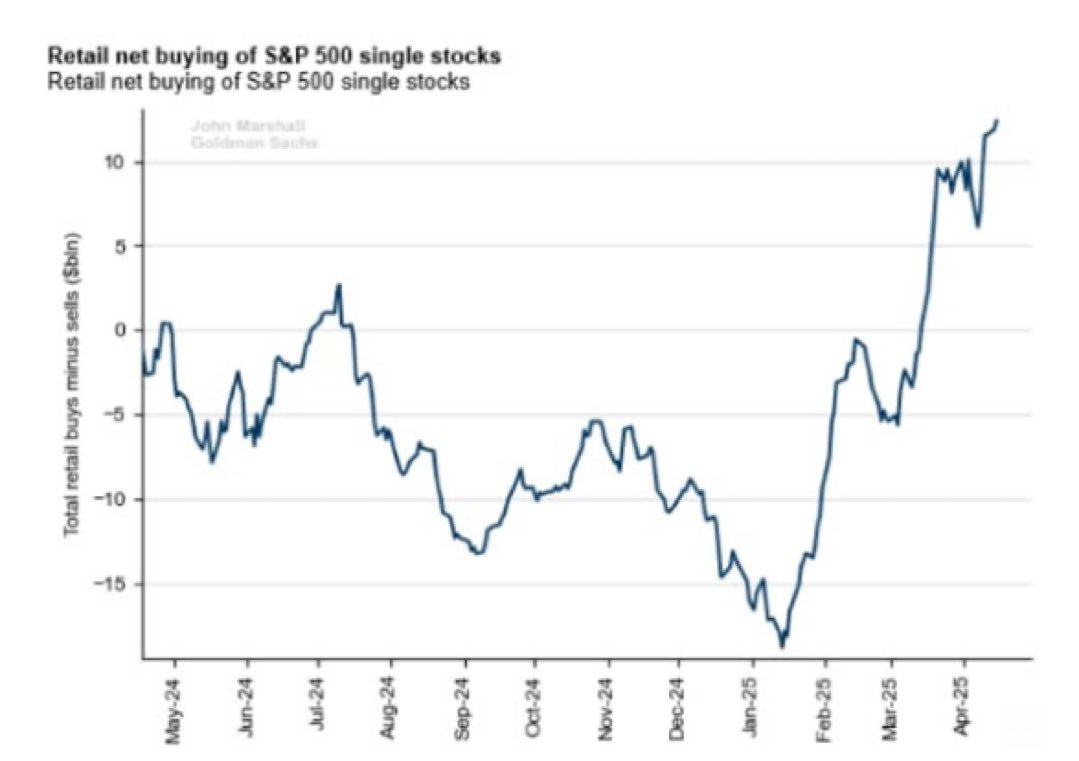

Inflation is showing signs of easing, and financial markets have rebounded sharply, buoyed by a record influx of new investors:

Skeptics, however, qualify this reading: they believe the strength of retail sales is primarily due to an anticipated stockpiling phenomenon in anticipation of the implementation of new tariffs. Similarly, the massive return of retail investors is typical of phases of deceptive rebound in a bear market.

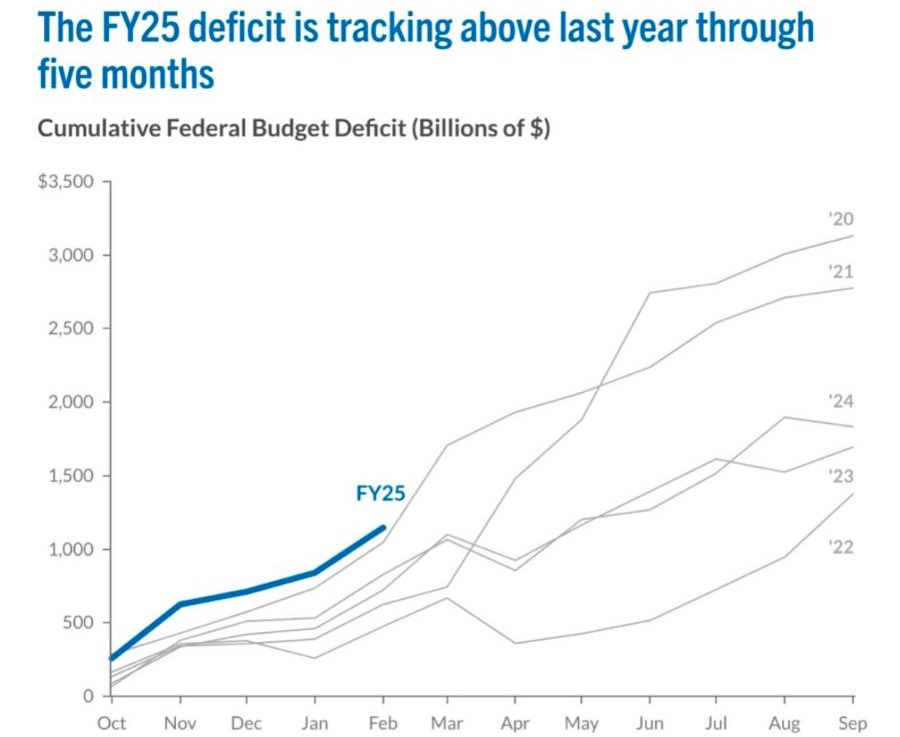

As debates rage in the US over the future trajectory of the economy and markets, one fact remains unchanged since the change of administration: the continuing rise in the budget deficit remains a major source of concern. On this front, no improvement is in sight; on the contrary, the situation is deteriorating. This is a logical consequence: the burden of public debt is exploding in an environment where interest rates remain at unsustainable levels for such a level of deficit.

It is precisely this worrying trajectory of public debt that gold seems to continue to follow closely, helping to explain its current surge.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.