The year 2025 is beginning with stagflation.

In Europe, economic activity continues its slowdown. The latest manufacturing PMI indices all show a marked decline, while the job market in turn is likely to be impacted by this slowdown in the months ahead.

The German economy is going through a deep crisis that threatens to spread to Europe and the rest of the world. In December, the PMI services index rose modestly to 51.2, suggesting a timid recovery. However, the manufacturing sector remains in the midst of a depression, marked by virtually empty order books and a fall in employment for the sixth consecutive month. The service sector, which is closely linked to industry, with 70% of its activity dependent on it, is also feeling the effects of the crisis, recording a fall in new orders for the fourth consecutive month.

Job cuts in Germany are on the rise, as companies seek to improve productivity to compensate. But higher productivity means a smaller workforce, further weakening domestic demand. Although job cuts remain modest for the time being, the current economic fragility points to a possible deterioration.

In Europe, the eurozone economy recorded a downturn in December, marked by a fall in manufacturing employment and a decline in order books since April 2023.

In the United States, similar trends are emerging: factory orders fell by -0.4% in November, following a year-on-year decline of -1.9%, representing the sharpest contraction since June. New orders for durable goods fell by -6.4% year-on-year, while unemployment claims are rising steadily, reflecting the growing fragility of the labor market. At the same time, consumption is slowing down as a result of high prices, and retail sales are showing signs of weakness.

With inflation persisting, unemployment rising and industrial order books emptying, a global recession looks increasingly likely.

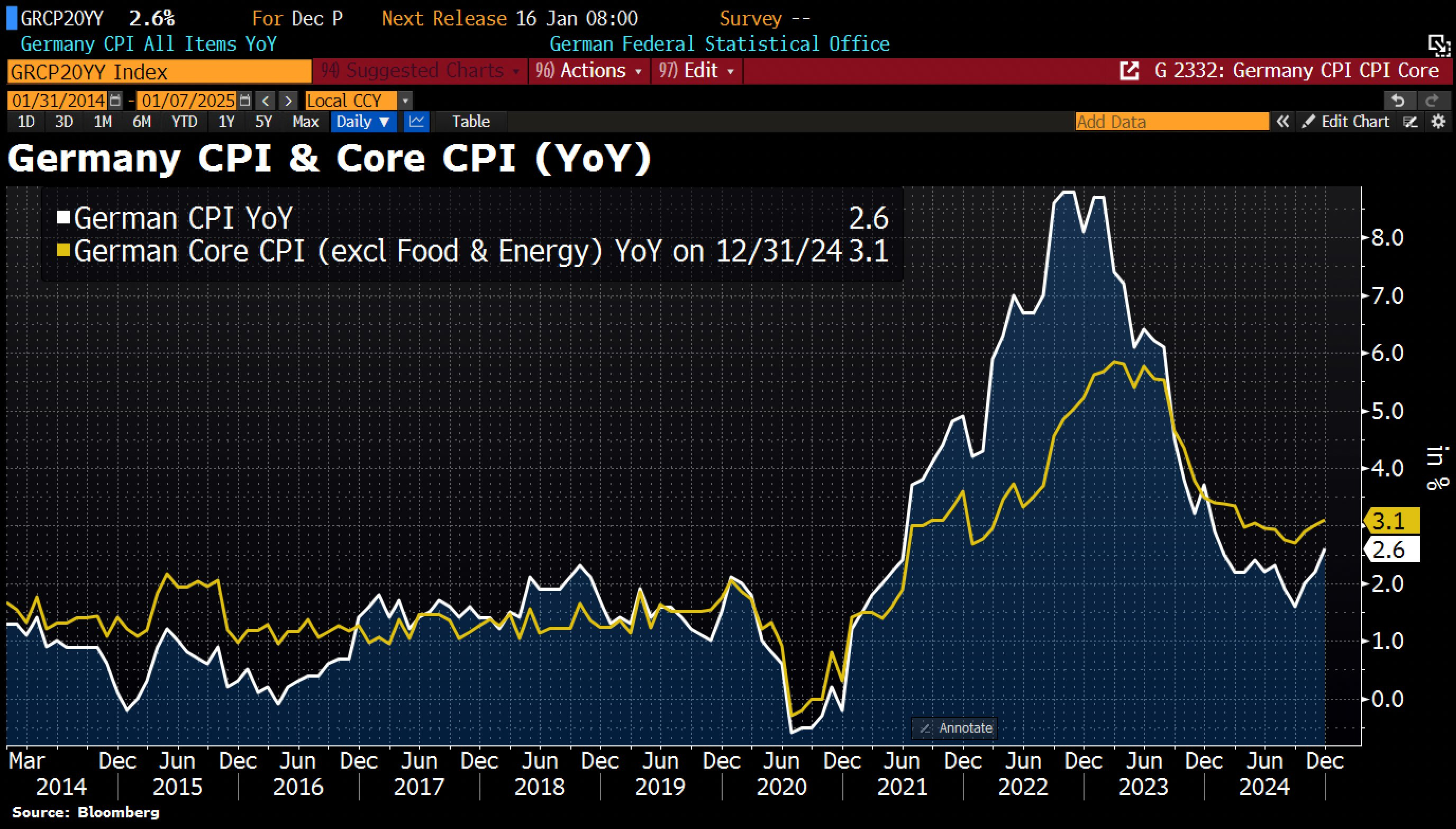

In parallel with this global slowdown, inflation is on the rise again. The harmonized EU inflation rate in Germany rose to 2.9% year-on-year in December 2022, its highest level since January and above market expectations of 2.4%, according to preliminary estimates.

Month-on-month, harmonized consumer prices rose by 0.7%, exceeding forecasts of a 0.5% increase:

The “Core CPI” index, which excludes the Energy and Food categories, once again exceeded 3%:

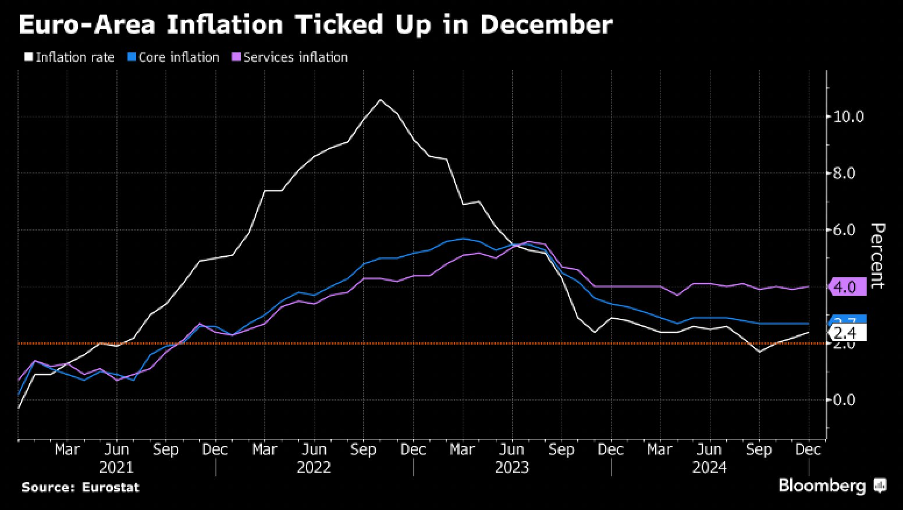

Inflation picked up across the European continent in December:

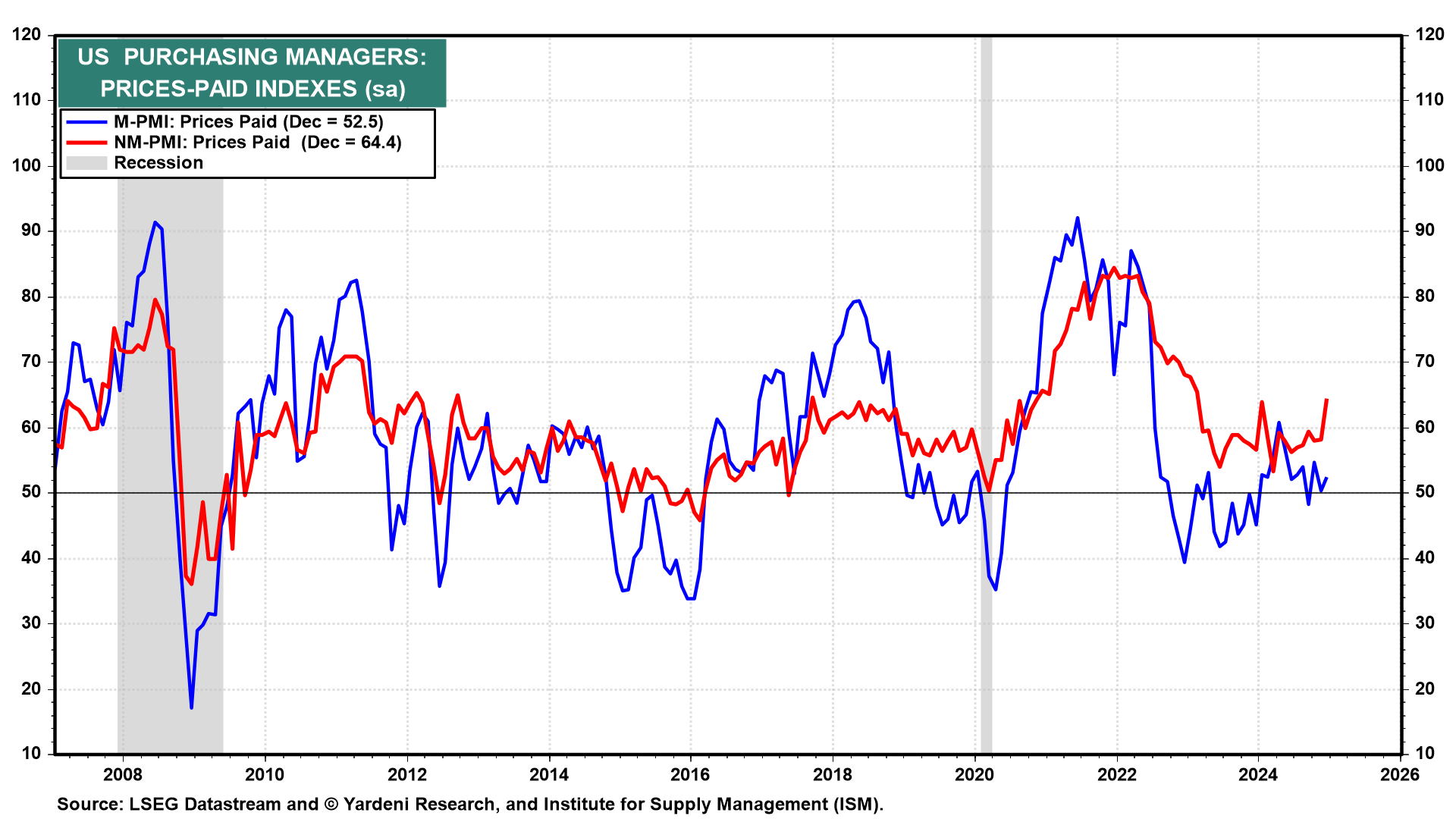

In the United States, inflation figures are also rising: the paid price index has reached 64.4, compared with a forecast of 57.5 and a previous reading of 58.2:

Is this renewed inflation behind the rise in rates?

The year 2025 is off to a very bad start for the sovereign debt market.

The British 10-year GILT has returned to its lowest levels:

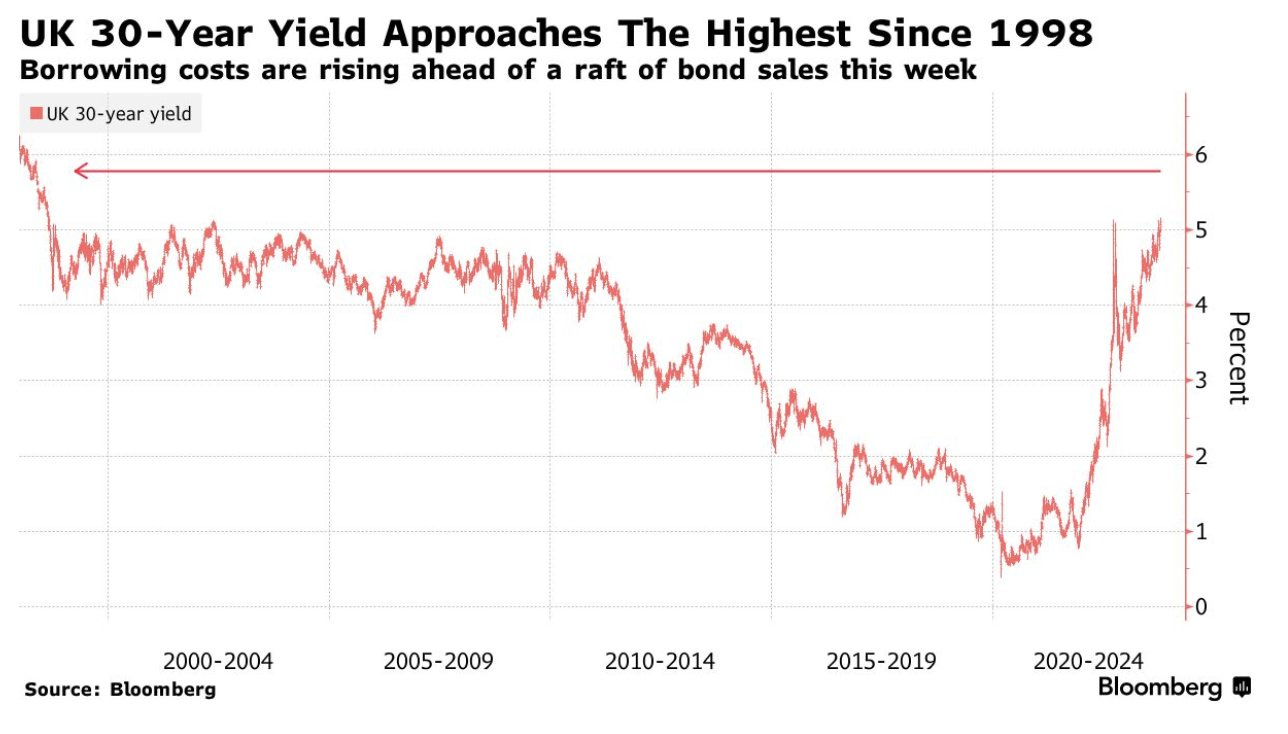

UK 30-year yields are back to their highest levels since 1998:

The same level of rates had previously led to intervention by the Bank of England.

In 2023, the Bank of England had to intervene urgently when interest rates reached a critical level, creating tensions on financial markets. The main aim of this intervention was to stabilize bond yields and prevent a systemic crisis, by supporting weakened players such as pension funds, already affected by the rapid rise in interest rates. The situation was reminiscent of the 2022 crisis linked to LDI strategies, when excessive volatility jeopardized market liquidity and the economy.

Are we once again on the verge of intervention by the Bank of England?

US rates are also climbing to record levels at the start of the year:

The fall in the bond market is accelerating, with the TLT index breaking a new bear flag in the first few sessions of the year:

The French bond market has also been under pressure since the start of the year. 10-year yields are approaching 4%, apparently signalling the end of the low-rate era that has dominated France since the 2000s:

The decline in the bond market is pushing equity markets to new heights. It seems that the “Magnificent 7” are now seen as a safe haven from bond market risks. Not so long ago, the bond market was seen as a refuge from market uncertainties, but today, the situation has been reversed!

The Nasdaq is maintaining its gains after two years of spectacular increases:

Individuals are particularly keen to buy equities at the start of the year, with expectations of high growth in the retail market:

The onset of a global recession, the continuing collapse of the bond market in early 2025, and the risks it poses to the banking sector and the economy as a whole, are the main reasons currently underpinning the rise in gold prices.

Neither rising interest rates nor a strong dollar have succeeded in driving gold down for long. On the contrary, the precious metal is becoming even more attractive to Western investors.

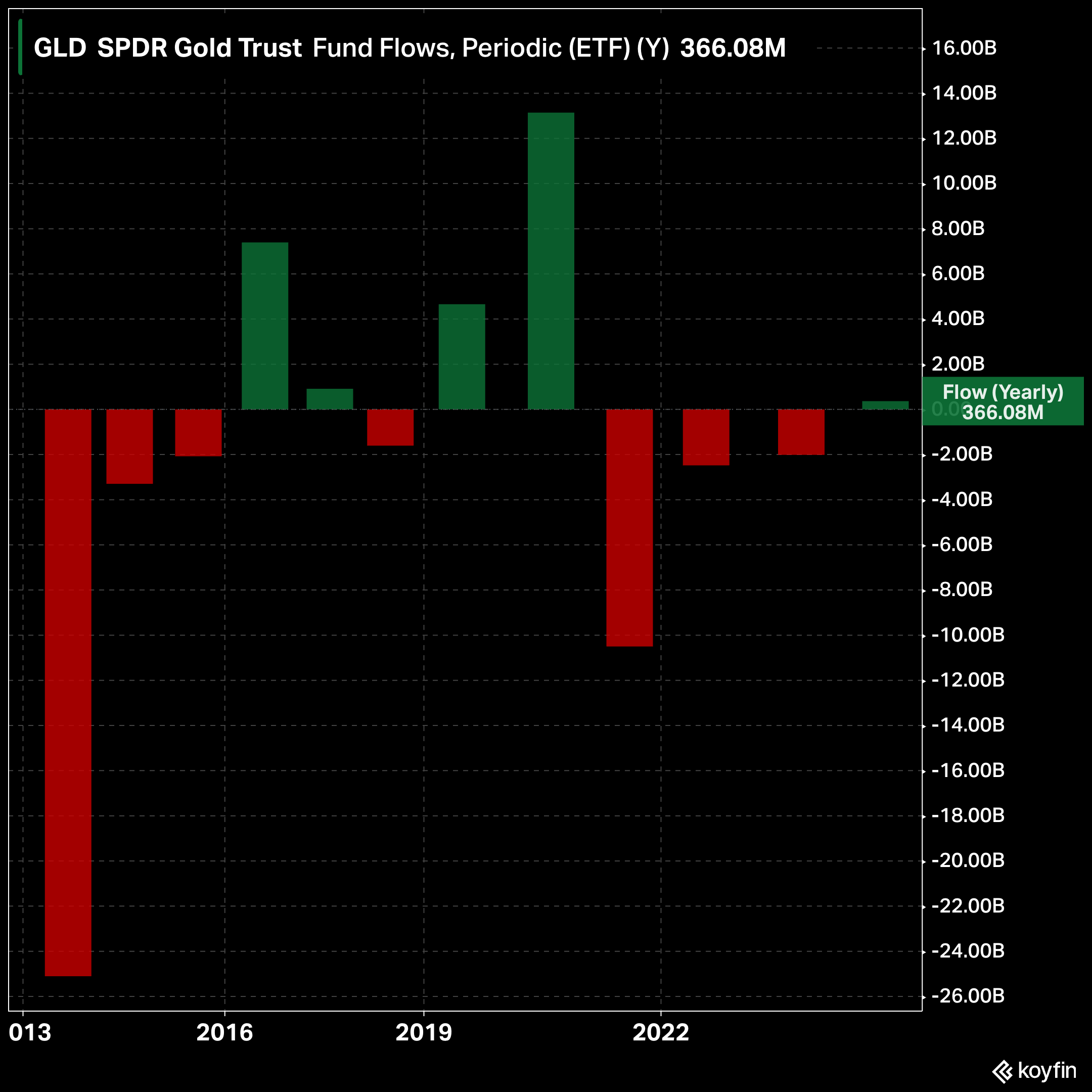

The increase in the GLD fund's assets under management in recent weeks marked the end of a period of outflows that had lasted since 2022. For the first time in four years, GLD has recorded positive net inflows, testifying to the return of Western investors to gold in recent weeks:

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.