JPMorgan Chase & Co.'s results are first and foremost a factual reminder: 2025 was not the year of macroeconomic disruption that had been predicted. A major bank does not have an exceptional year in a recessionary economy—and JPM clearly benefited from a still-favorable environment.

The main drivers remain strong. Interest margins—the income the bank derives from the difference between what it earns on its loans and what it pays on its deposits—remain high. Trading activities are holding up well, a sign that markets are liquid and dynamic. Asset and wealth management are making a steady contribution. Capital is comfortable and credit is generally healthy.

Only investment banking is slowing down, primarily due to a less favorable cycle for IPOs and large M&A deals—not a deterioration in the real economy.

In the fourth quarter of 2025, JPMorgan posted a ROTCE of 18%. In other words, for every $100 of capital actually deployed, the bank generated $18 in annualized profit—an exceptional level for an institution of this size. The issue is therefore not the quality of the results, but the market's interpretation of them.

At current valuations, the stock prices in the idea that JPM could generate a sustainable return of 30% or more on this capital, assuming a cost of capital of around 10%. This is an ambitious extrapolation, which translates into a multiple of around 3.2 times tangible book value, a historically very high level for a universal bank.

On the consumer front, JPM has strengthened certain provisions, particularly on Apple Card. A provision is simply money set aside to cover potential future losses. This is not a sign of crisis, but a prudent adjustment. Consumption remains resilient, but behavior is changing: households are starting to carry more credit card balances instead of paying them off immediately. Payment delays are rising slightly, but remain at low levels. This is not a cause for concern, but rather the gradual end of an exceptionally favorable phase.

In the background, the risk structure deserves attention. JPM's exposure to NDFIs—non-bank financial institutions such as private credit funds—now accounts for about 13% of total loans, or nearly $300 billion. The central idea is simple: this credit, presented as “outside the banking system,” is in fact financed... by the banks themselves. The risk has not disappeared, it has been repackaged. As long as liquidity is abundant and defaults remain limited, this risk remains silent. If it were to materialize, it would return to the banks' balance sheets.

Regulatory liquidity has deteriorated slightly. The LCR—the buffer that is supposed to ensure that a bank can withstand a month of stress—fell from 124% to 115% in one year. The level remains comfortable, but it indicates that the bank is using more of its liquid assets to keep the market machine running and finance the economy. In other words, the system is working, but with less margin for error.

It is precisely this reduction in the safety net that makes JPM more vulnerable today, despite seemingly excellent results. If a recession were to occur, the capacity for absorption would be much weaker, particularly in shadow banking, where a growing share of risk has been shifted. It is most likely this fragility that the market began to factor in immediately: the stock lost more than 4% when the results were announced, not because they were bad, but because they were interpreted as a look in the rearview mirror.

This move is a prelude to other publications to come: the market is starting to look to the future rather than rewarding the past.

These results also bring to a close one of the major debates of 2025. Contrary to the fears widely reported at the beginning of the year, customs tariffs did not cause a recession or trigger a new wave of inflation. 2025 was an excellent year for banks, which would have been impossible in a recessionary environment. On the price front, the latest US inflation figures (CPI) came in better than expected, confirming a continuation of disinflation rather than a surge. The “tariff recession” was, in practice, a non-event.

During the conference call, Jamie Dimon was significantly more optimistic than in previous quarters, with a clearly constructive outlook for the next year. He mentioned liquidity and a possible return to QE—the creation of liquidity by the central bank—as a potential tailwind. This tone is consistent with high market sentiment and valuations that already factor in a lot of good news.

It is important to highlight the psychological shift that took place between 2025 and 2026. In 2025, the consensus was overwhelmingly pessimistic: everyone expected an imminent recession, investors were cautious, often underinvested, and volatility was bought as protection. That recession never came. In 2026, the pendulum has swung to the opposite extreme. Asset managers are now seeking to invest at all costs and make up for lost performance. To achieve this, they are massively shorting volatility: in practice, they are selling protection options, which compresses the VIX and mechanically pushes markets higher as long as nothing breaks. This is classic procyclical behavior: when the market does not fall, insurance is removed, which further fuels the rise.

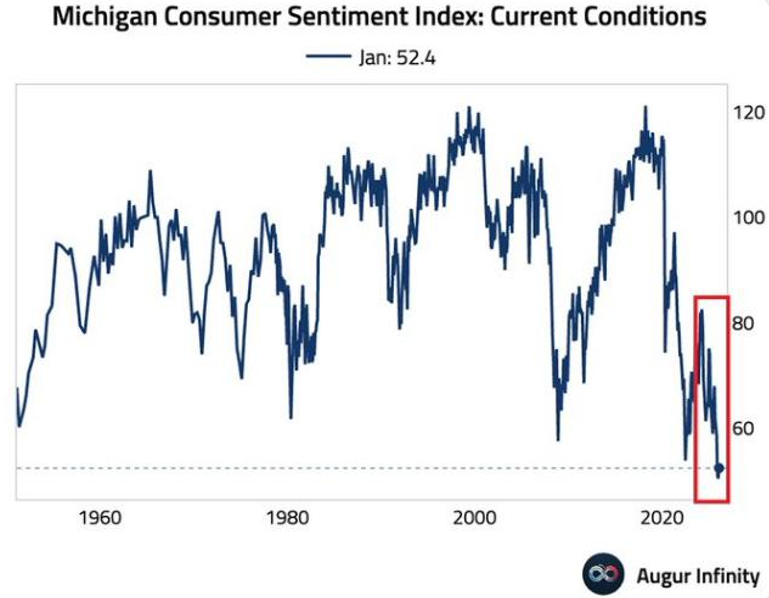

The paradox is that this rise in financial optimism comes at a time when the real economy is beginning to turn around. The contrast with household morale is striking: the Michigan Consumer Sentiment Index remains historically depressed, at levels close to those seen in periods of major stress. Consumers are holding back—even if the markets are choosing to ignore this for now.

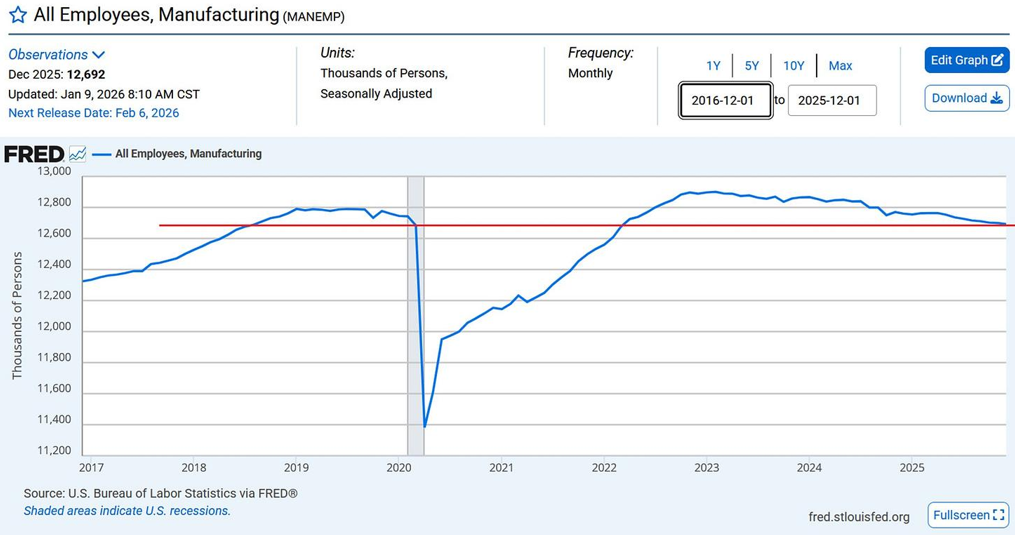

Further upstream, industrial employment sends an unambiguous early warning signal: manufacturing payrolls have been declining for eight consecutive months, falling to 12.7 million jobs—below their pre-pandemic level—with a marked deterioration since 2023. Historically, this type of dynamic precedes recessions... not expansion phases.

In 2025, everyone was expecting a recession—it never happened. In 2026, no one is anticipating it anymore, buoyed by investors catching up, volatility crushing, and management euphoria. However, if history repeats itself, the probability of recession is paradoxically higher today than it was a year ago, precisely because the real cycle is deteriorating while the financial cycle is tightening.

The Supreme Court's failure to rule on the legality of customs duties is maintaining legal uncertainty, which has become problematic in the current market context. In 2026, investors are overwhelmingly positioned for continuity, volatility is being sold off, and the system is based on the assumption that nothing will disrupt the existing framework. This uncertainty creates an asymmetric risk: as long as the economy does not deteriorate, the markets will continue to grow, but at the slightest shock, there will be no real buffer. The contrast with 2025 is striking: last year, pessimism prevailed while the economy held up; today, financial optimism prevails even as leading indicators of activity deteriorate. By leaving the question unresolved, the Court increases the likelihood that the adjustment will be made by the markets rather than by the law. In this context, the rise in gold in 2025 does not contradict the apparent strength of the economy. Gold has not risen against growth, but against the weakening of the framework. Growth is holding up, inflation is slowing, but the system is more indebted, more politicized, and more fragmented. Non-Western central banks have continued to buy gold not out of fear of an immediate recession, but as a strategic choice. Gold does not reflect a past crisis; it insures against a loss of future visibility.

The overall picture is clear. 2025 was a very good year economically, and JPM is a case in point. But the market is already valuing this success as if it were set to continue without friction, with exceptionally high returns over the long term. Gold, however, does not validate this extrapolation. It simply reminds us that even when everything seems to be going well, imbalances continue to accumulate beneath the surface. And this warning is all the more serious because it does not come from secondary indicators, but from monetary metals themselves. At the start of this year, the gold price is breaking new historical records, and silver is following suit, emerging in turn from long periods of compression.

Historically, these two markets do not deliver this type of signal amid the noise: when gold and silver soar together and reach new highs, it is not simply a speculative bet, but a fundamental message. These assets do not react to the latest statistics, they anticipate them. And what they are signaling today is that, beyond the superficial optimism of the equity markets, the risk regime is shifting.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.