July is a long way from the summer break we had hoped for. The Olympic truce should have brought a period of tranquillity, but this is not the case.

Elections in France have brought a new order of events, increasing uncertainty about the country's future with each passing day, as well as the growing challenges of refinancing an increasingly problematic debt.

The gap between France's debt-to-GDP ratio and that of Germany puts France in a new position within Europe. The country could face the next economic shock in greater isolation than in 2008:

In fact, the Cour des Comptes (French Court of Auditors) sounded the alarm in the middle of July:

France is “dangerously exposed” to a new economic shock, warned the Cour des Comptes report on Monday, expressing concern about the country's rising debt.

France's budget deficit reached €154 billion, or 5.5% of GDP, last year. This is 0.7 percentage points higher than in 2022 and 0.6 percentage points higher than promised by Finance Minister Bruno Le Maire.

“Public debt, amplified by repeated deficits and by its sheer scale, weighs on the country's investment capacity and leaves it dangerously exposed in the event of a new macroeconomic shock,” warned the Cour des Comptes.

The French Cour des Comptes has declared that France's public finances are in a “worrying situation” and that the country must take steps to honor its debt control commitments within the eurozone.

For the first time since the 2008 crisis, Portugal's 10-year yields fell below those of France:

In terms of debt, France is gradually becoming the dirty man of Europe.

The markets don't seem reassured by the concrete solutions France has put in place to manage the dual problem of debt and public deficit. The recent electoral campaign largely addressed the issue of spending, on both the right and the left, but the country's fiscal situation and the discipline this configuration requires were never put on the table. So it's only logical that the markets are now sending a clear signal on this urgent issue.

France cannot count on a global economic recovery to solve its current problems.

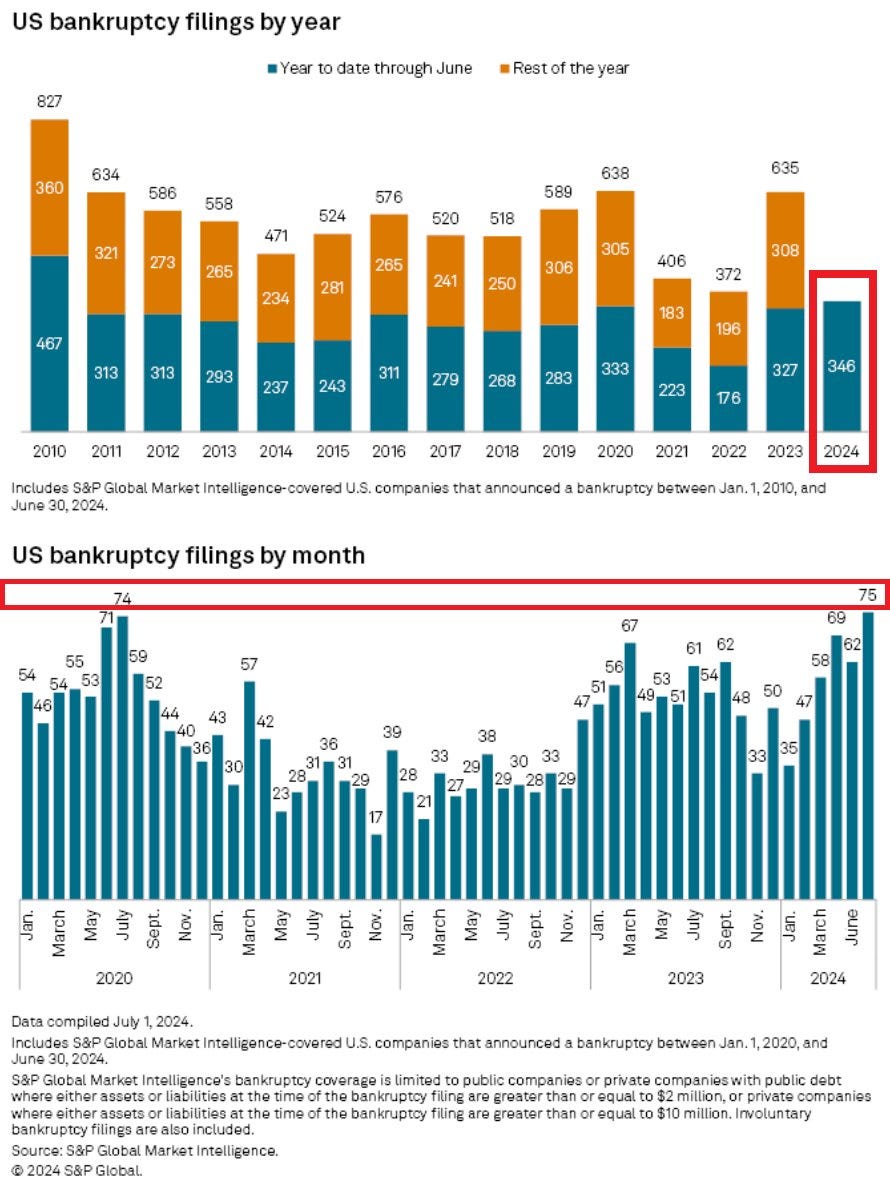

The American engine is seizing up, with the slowdown having a devastating effect on the number of business bankruptcies, which is now at its highest level since the Covid crisis. Should we expect a sharper-than-expected slowdown in the United States?

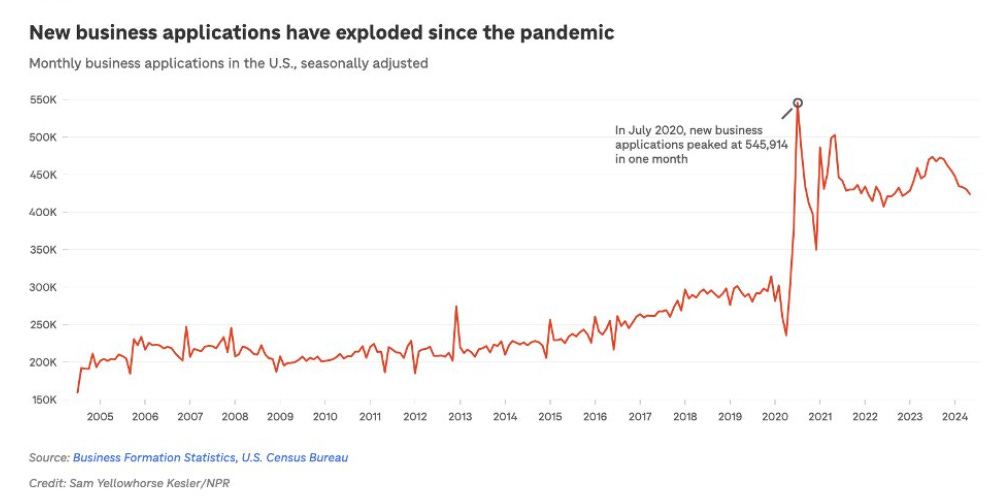

Business start-ups in the US have exploded since the Covid-19 crisis:

The sharp rise in business start-ups is due to the transformation of economic activity brought about by inflation and the new post-crisis working conditions of Covid-19. Attributing it solely to an economic upturn, as many analysts have done, has led to several misinterpretations of this data. A decline in business start-ups could lead to another error as to the true nature of the US economic slowdown. After years of excessive optimism, there is a risk of tilting towards a pessimistic view: the more bankruptcies of businesses created after Covid-19 increase, the more there is a tendency to paint a negative, recessionary picture of the US economy.

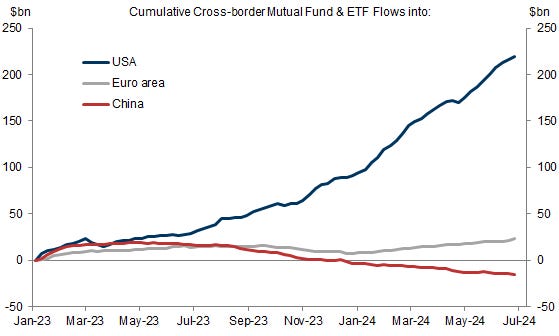

The economic situation in the United States is closely watched by all markets for one simple reason: in recent months, the US market has captured the majority of global savings flows. Concentration on the US market has intensified over the past two years:

The attempted assassination of Donald Trump and the emotion it provoked led the markets to anticipate a Republican victory in the November elections. This latest twist in a decidedly far from tranquil summer comes at a time when the Democrats are facing an unprecedented crisis. President Biden's party seems to be disintegrating before the public eye, with the president's speeches deemed less and less convincing, and openly criticized even within his own party.

On the evening of July 14, Jamie Dimon sent a letter to all his employees and issued the following statement: “We must all stand firmly together against any acts of hate, intimidation or violence that seek to undermine our democracy or inflict harm.”

Trump plans to appoint JP Morgan Chase CEO Jamie Dimon as Treasury Secretary, while keeping Powell as Fed Chairman.

The Republican candidate has also just promised a 15% corporate tax cut.

The market sees the Fed's binding stance as far from certain in this new political context.

If the economic slowdown worsens, this tax cut is likely to reduce government revenues even further, meaning that the US deficit will not diminish any time soon.

Even with a much more robust economy than in Europe, the United States is not immune to the same kinds of warnings that are now being addressed to France.

Gold is currently benefiting from concerns over the dual problem of debt and deficit in the United States. The more tangible the signs of economic slowdown, the more gold will succeed in reaching highs in a context of fiscal indiscipline in the US.

The price of gold in dollars confirms its April breakout, with support at $2,200 recently validated by the 200-day moving average (MA200). Gold has even broken new all-time records in dollar terms in recent days:

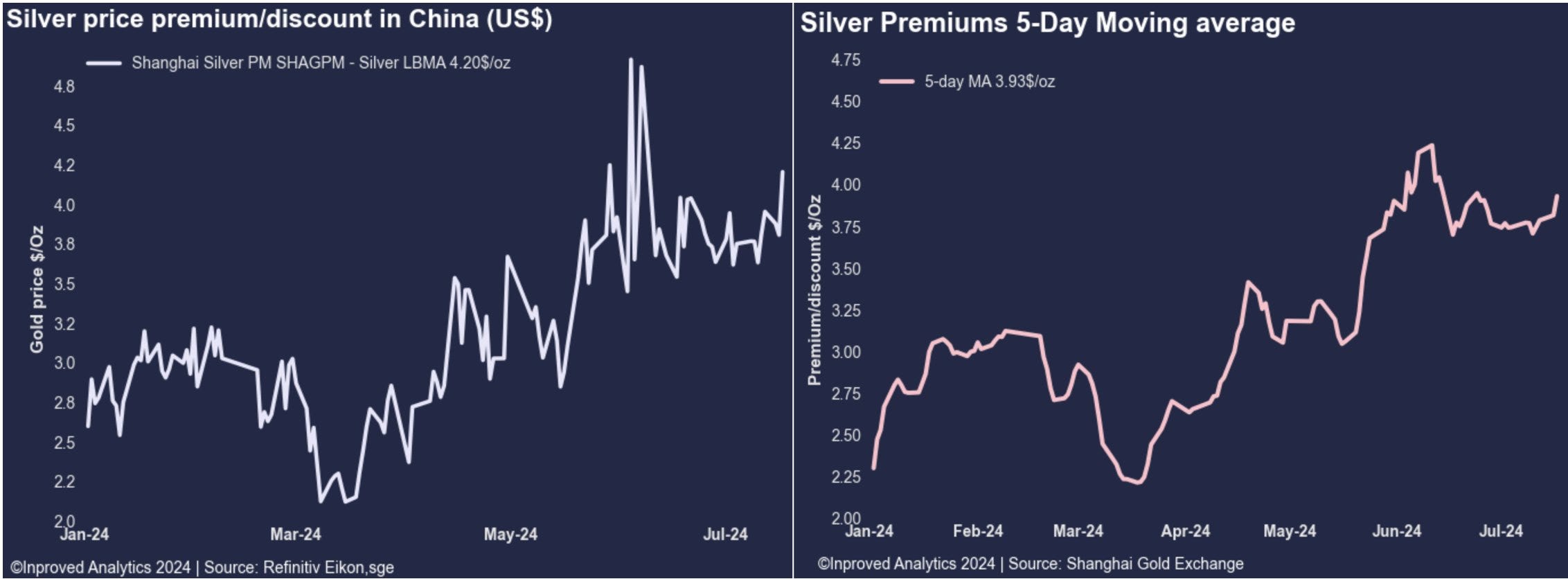

The price of silver is currently more bullish than gold in the short term: silver premiums remain very high in China:

Silver's chart pattern is increasingly resembling the explosive phase seen in 2011:

These ups and downs in precious metals are occurring at a time when physical gold and silver are only just beginning to attract the interest of Western investors.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.