The news on precious metals is still very lively this week.

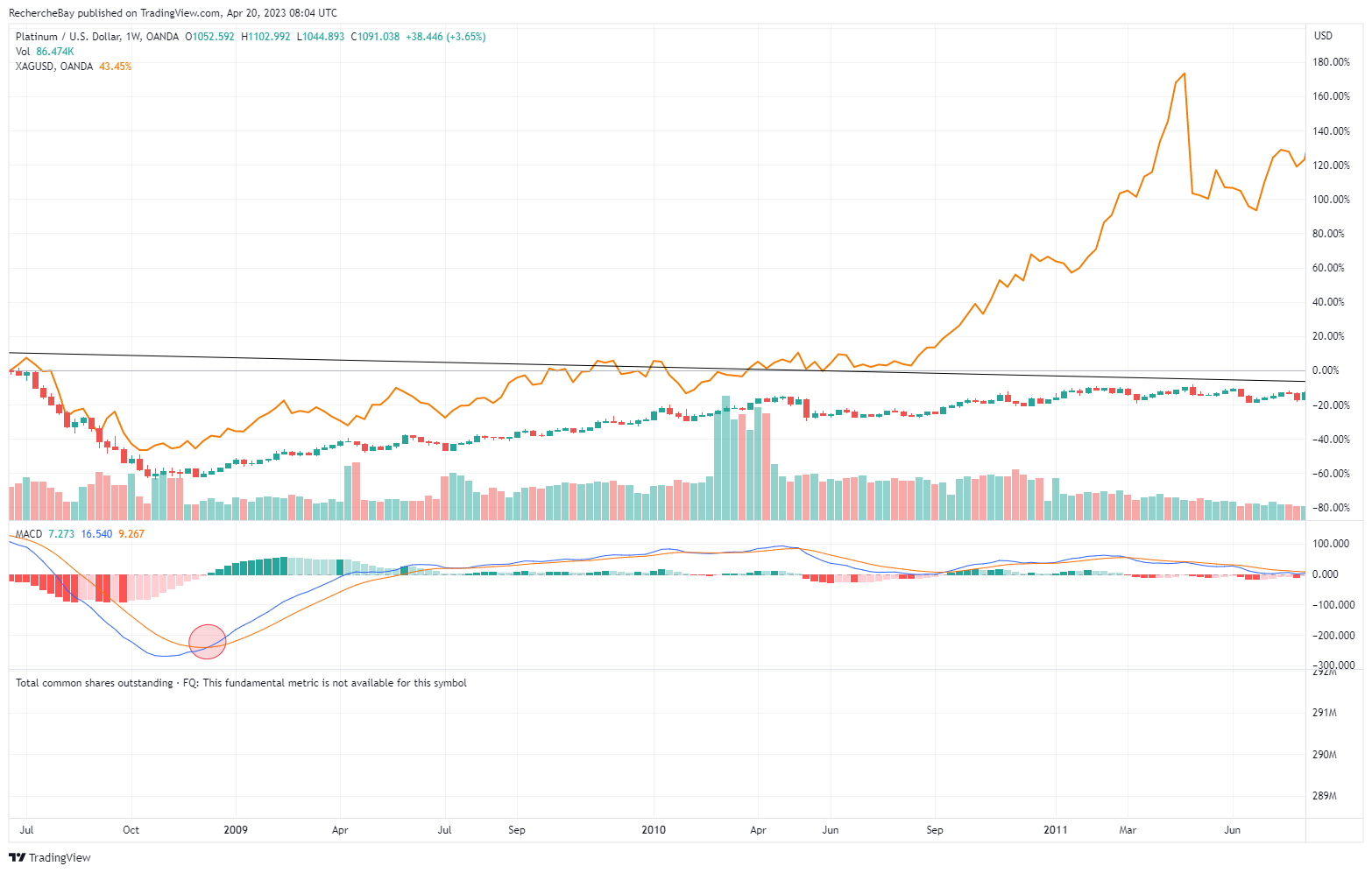

The Silver Institute has just released its 2023 report and the numbers reported are simply mind-blowing:

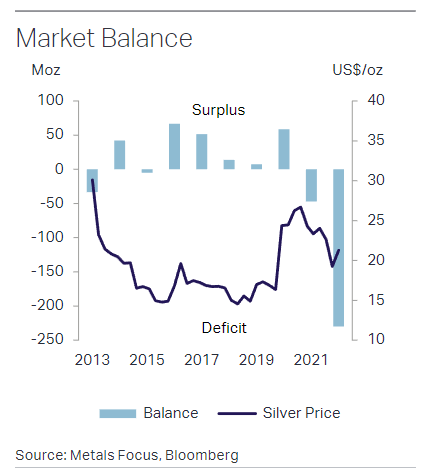

The supply remains stable compared to last year. On the other hand, demand for physical silver has dramatically skyrocketed. The deficit was barely 50 million ounces last year. This year, the deficit has exploded to 237 Moz. In other words, silver demand exceeds supply by 7,393 tons. A colossal figure!

It is mainly investment demand that has caused this deficit to explode, even though demand for industry and jewelry has also increased:

Despite this glaring imbalance between supply and demand, the price of silver fell between 2021 and 2022.

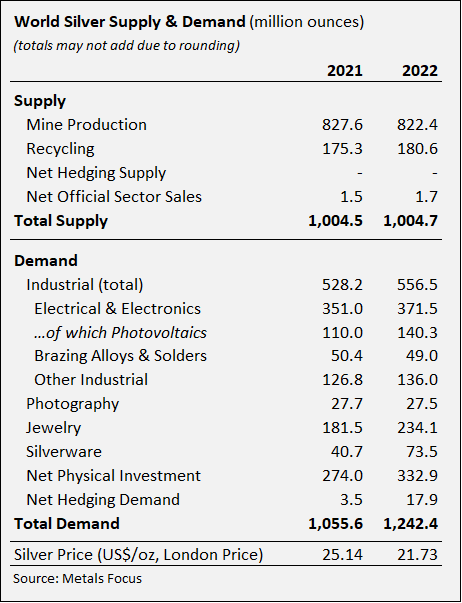

The price of silver does not respond to the fundamentals of supply and demand, it is the result of speculative bets on the futures markets, which are predominantly bearish. Most investors "short" silver for specific reasons: some funds use these bearish positions to bet on the coming recession, and some banks to protect their large short positions... The paper silver market has become so disconnected from the physical market that it takes more and more leveraged positions to control the spot price.

The open interest (the number of futures contracts which are currently open in the market) is larger each month than the amount of physical silver available for delivery. In the chart below, we can see that the volume of contracts is up to 15X the volume of silver available for delivery in recent months. And the rollovers of these contracts are increasingly massive: with seven days to go before the current month's contract expires, there is still the equivalent of 12X the volume of silver available for delivery.

Each end of contract expiration is more and more chaotic and results in more and more important physical deliveries, more and more complicated rollovers or more and more massive cash settlements.

Every month, the paper market is on the verge of breaking down, because the physical demand is too high and the silver price is still too low to reduce the pressure on the paper market for the moment.

Demand is 18% higher than supply, and the 2022 deficit erases in one year the entire surplus accumulated since 2013.

The gold market is also experiencing a complete disconnect between the physical and paper markets.

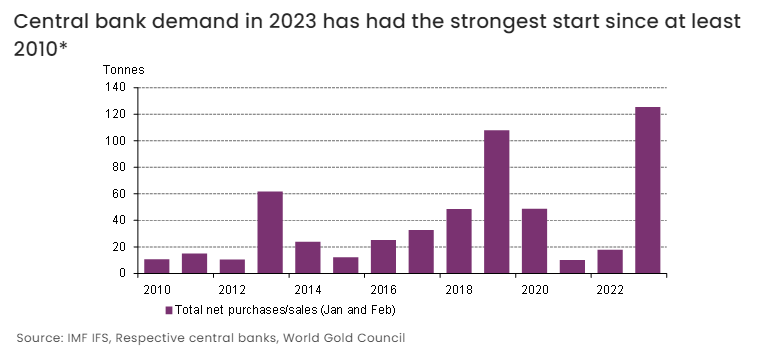

Last year, central bank demand for gold hit a record high. These purchases continued in January and February, marking the strongest start since 2010.

This craze for physical gold is now spreading to the retail level.

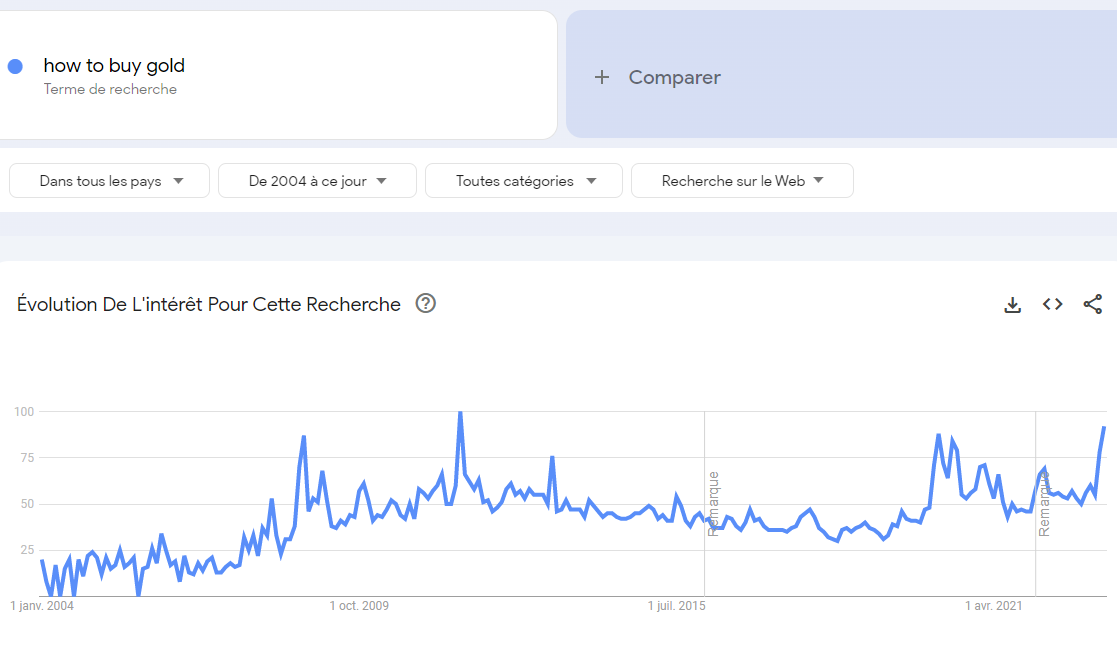

Searches worldwide for the phrase "how to buy gold" are reaching a peak comparable to 2008 and 2020. The banking crisis has passed, savers are starting to wonder...

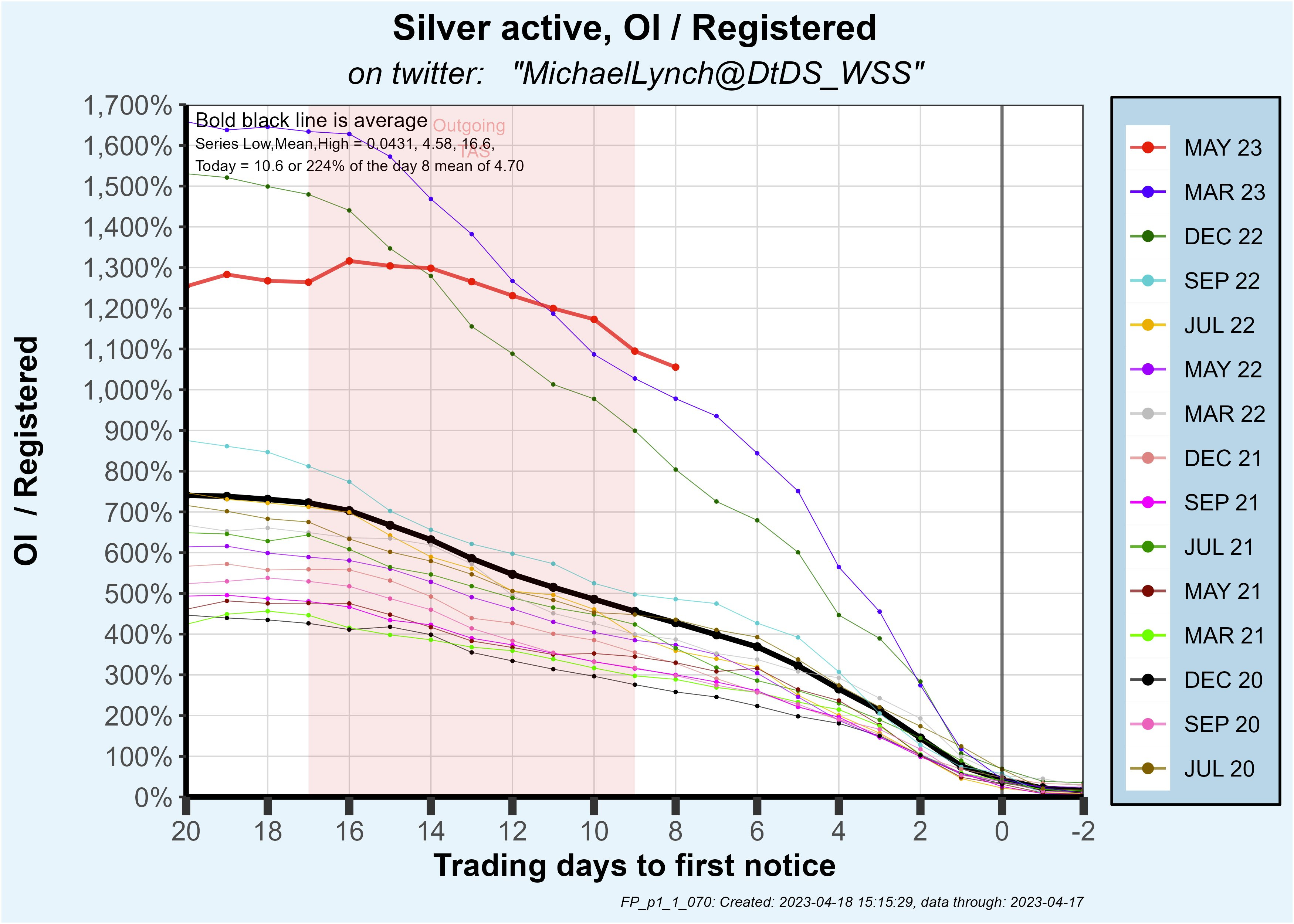

Another precious metal coming out of the shadows this week: platinum.

The platinum chart shows a very significant test of the resistance line that has held back the metal's price surge since 2021.

Will this third test in two years be the right one?

A surge in the price of platinum above its resistance line would be excellent news for silver.

In December 2008, platinum had given silver the signal for the great bull run of the following years:

We see the same signal in this third test of resistance:

As for the dollar, it is unable to resume its upward trend. The rebound is still very fragile:

What elements are currently influencing the dollar?

The de-dollarization of trade is a fashionable theme.

According to the IMF, the dollar's share of central bank reserves has gone back down since 2015 and now represents only 58% of reserves (vs. 72% in the 2000s).

Even if the dollar is challenged as the international reserve currency, can we really talk about the de-dollarization of trade?

This theme is fueled by recent news: after the speech of Brazilian President Lula in Beijing last week, it is the latest contracts signed in renminbi by Saudi Arabia and France for Chinese equipment that are driving the debate ... There is even a rumor that Airbus sales to China were signed in Chinese currency and not in dollars, but this obviously remains to be verified.

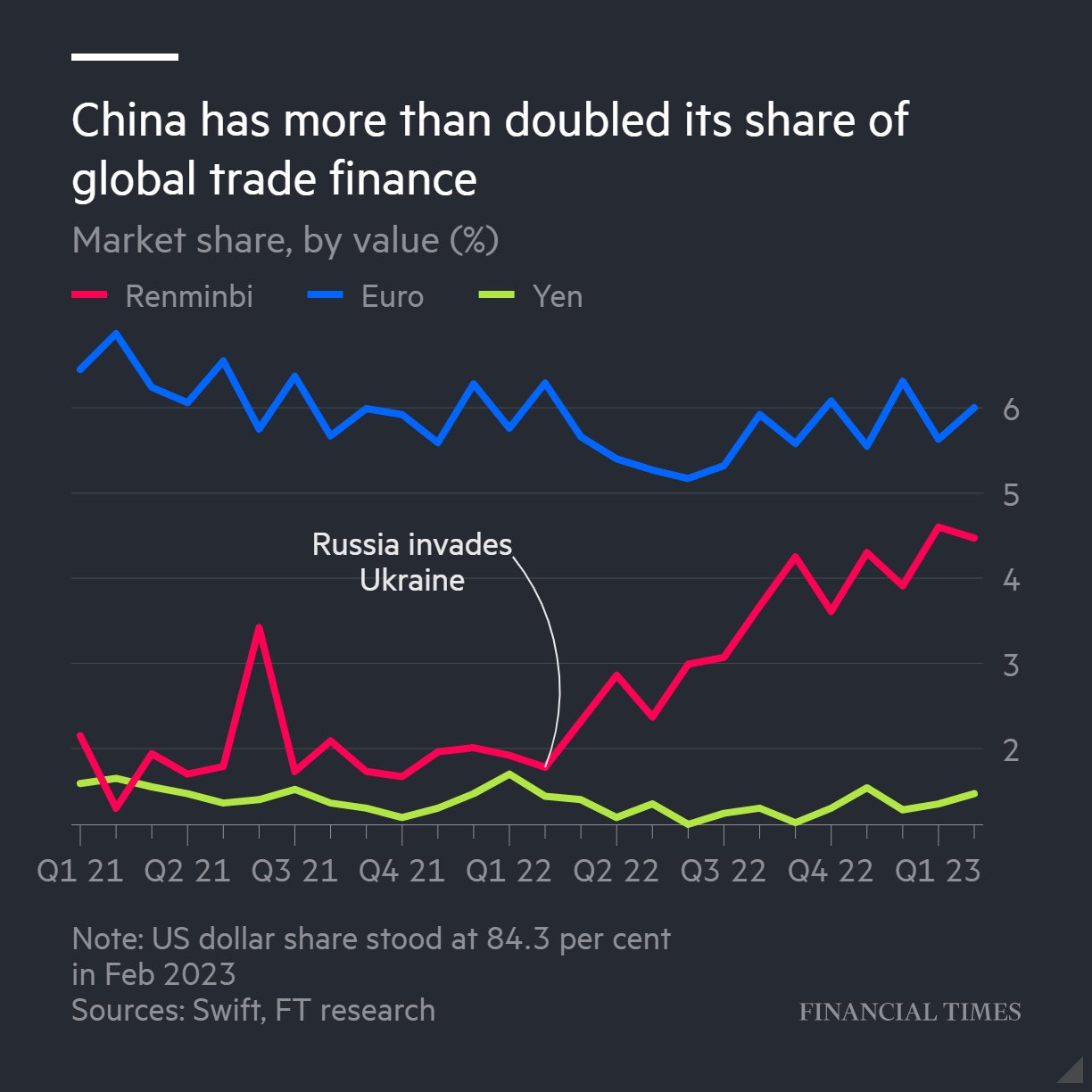

Since the beginning of the conflict in Ukraine, the share of Chinese currency in trade has doubled...

That said, the movement is still negligible compared to the preponderant share of the dollar and the euro in global trade.

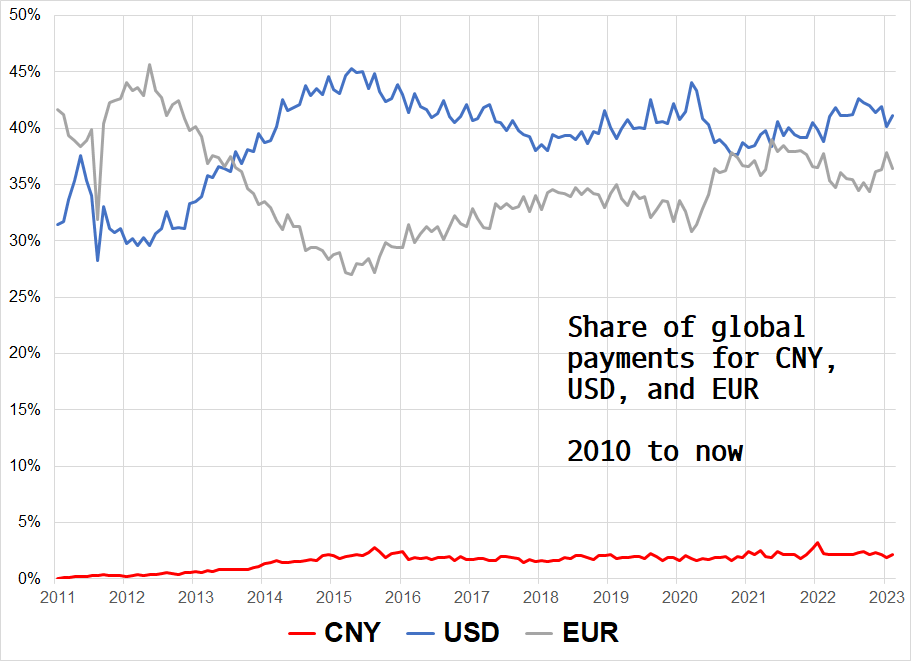

If we look at the data from the SWIFT transaction system, we can see that there has been no significant change in the use of the dollar or the euro in trade:

De-dollarization has begun outside the SWIFT system and its analysis is likely to be the subject of much controversy, at least in the early stages of the movement.

A loss of the dollar's importance in foreign exchange reserves combined with a de-dollarization of trade would be very bad news for a U.S. government that must continue to finance a growing deficit. With a decline in foreign demand for dollars, the very functioning of the US economy would be threatened.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.