In the United States, the consumer price index (CPI) rose by 0.6% in August and by 3.7% year-on-year. This is an acceleration on the 0.2% monthly increase and 3.2% annual gain published in July. The year-on-year increase is higher than the economists' forecasts. In other words, August's CPI exceeded expectations. The Fed is not done fighting inflation.

Last month, oil prices broke the downward trend they began a year ago. They have just beaten a record for the year 2023 and are slowly moving back towards $100:

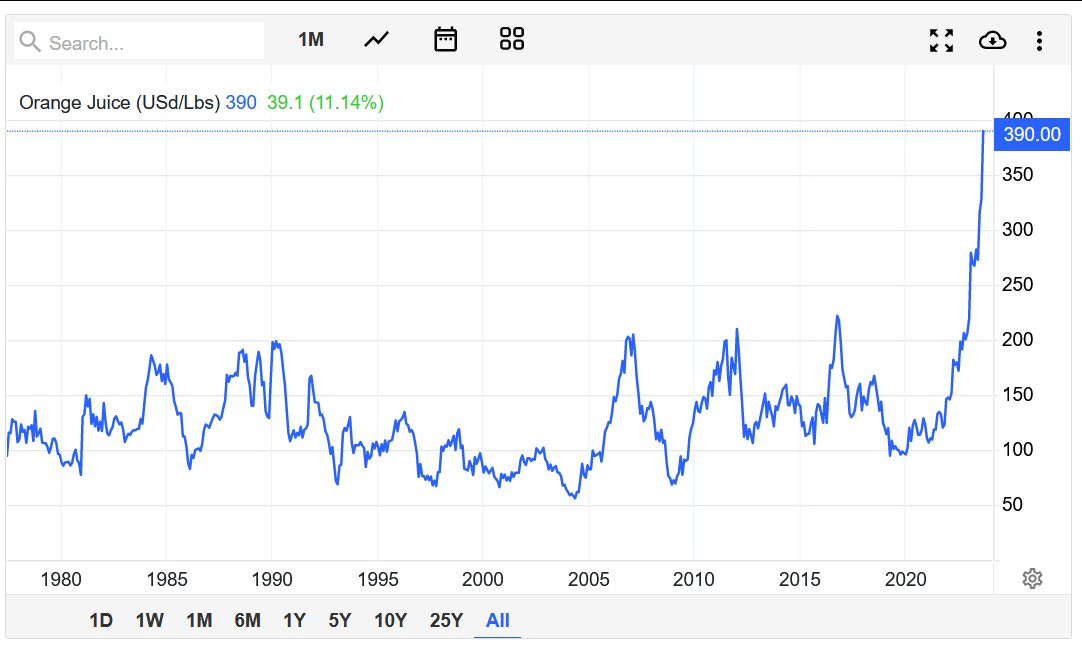

It is in agricultural commodities that price rises have been most remarkable.

Orange juice prices have soared in recent months:

Livestock prices also set a new record:

Meat prices are likely to rise again in the United States and around the world.

Sugar is also setting an all-time high:

The surge in cocoa prices is even more spectacular this year:

In July, retail price inflation stood at 7.44%.

Annual food inflation was 11.51% (cereals +13%, vegetables +37.34%, tomato prices are even up 1400% in three months!).

Flour prices, which had fallen sharply after peaking in 2022, are now rising again. Although the WEAT index has not yet risen significantly in the United States, the increase in flour prices is much more marked in countries where currencies are depreciating against the dollar. In India, prices are unable to return to their pre-2022 levels:

In the wake of this new bout of inflation, food prices soared. And, as in the first inflationary phase, the United States is on the verge of exporting inflation, not least because of the strength of the dollar.

If prices rise in the United States, with the collapse of most currencies against the dollar, they are likely to rise even higher elsewhere in the world.

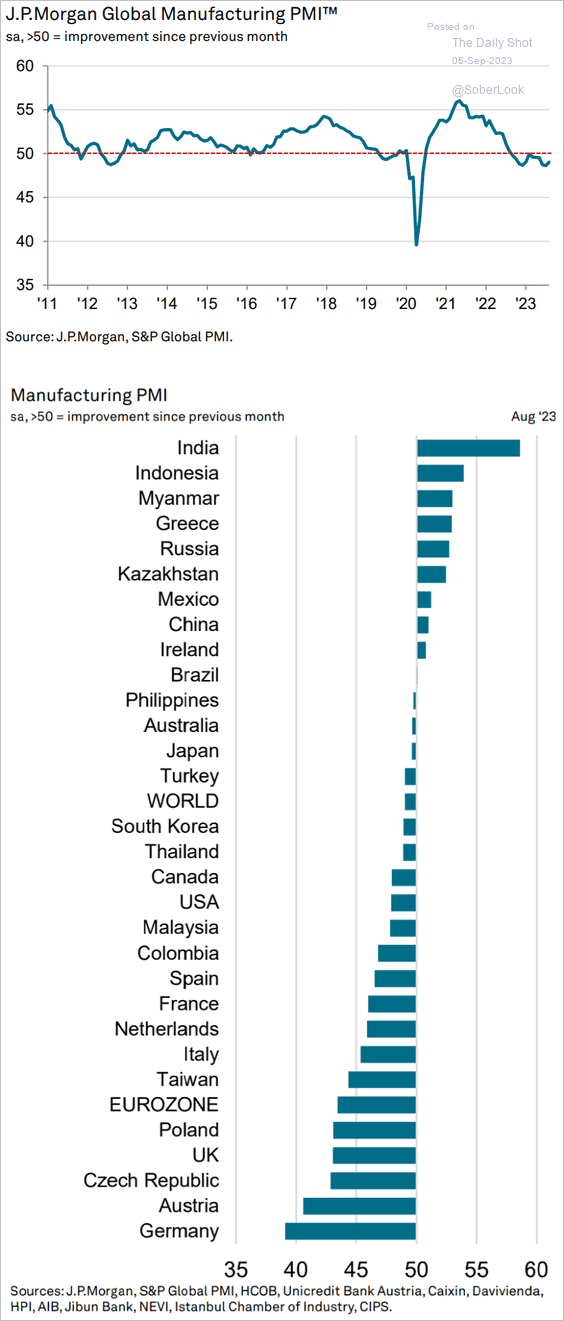

And this time, the rise in inflation is taking place at a time when activity is slowing all over the world.

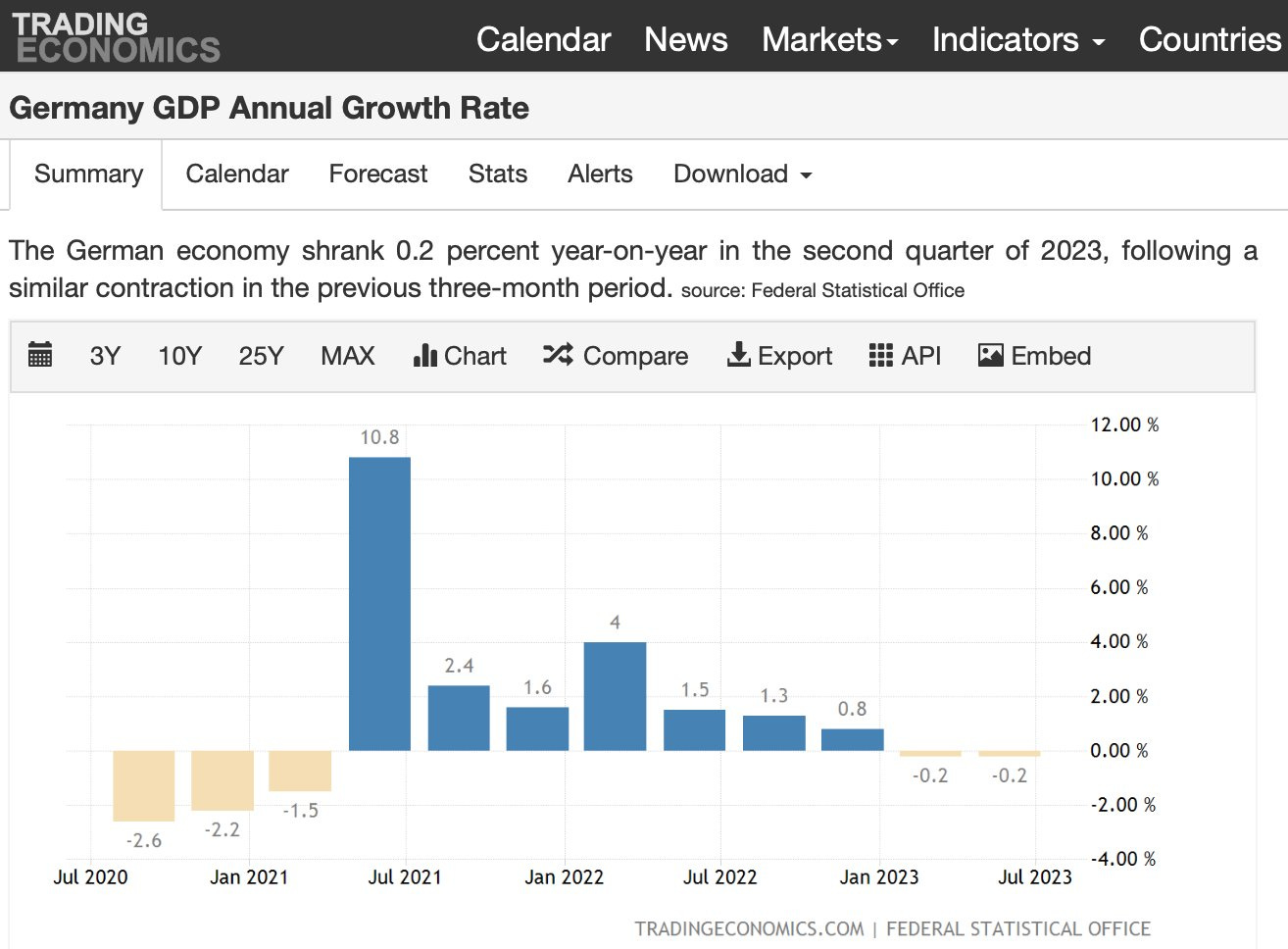

The slowdown in economic activity is particularly dramatic in Germany.

The latest figures for industrial orders are down sharply by -11.7% on the previous month (the expected fall was -4.3%).

The PMI manufacturing index is also in free fall. Germany posted the worst PMI figures in the world. The decline in German industry weighs on the global PMI index, which contracted last month:

Under these conditions, Germany's recession is likely to be prolonged and even deepened:

Following in the footsteps of the chemicals and automotive sectors, the construction industry is now running out of steam in Germany:

Like its European neighbors, Germany is facing a resurgence in inflation, encouraged by the fall in the euro since mid-August:

The ECB's mission is becoming very complex: inflation is far from under control, and Europe is losing its German industrial lung.

Europe is plunging further into stagflation, which promises to push gold in euros higher over the coming quarters.

In monthly variation, gold in euros is drawing a bullish flag, with the 2020 high (€1,750) now providing downward resistance in the current consolidation:

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.