Trump's second term is off to a flying start.

In just a few days, the new president's first decisions are already making themselves felt.

On a visit to Colombia to explore mining sites, I noticed that Trump's first foreign policy decision was precisely about that country.

Colombian President Gustavo Petro initially prohibited the landing of two US military aircraft, each carrying around 80 deported Colombians, citing the need to guarantee dignified treatment for these people. In response, US President Donald Trump introduced emergency tariffs of 25% on all Colombian imports, threatening to raise them to 50% within a week if Bogotá did not reverse its decision. At the same time, travel bans and visa cancellations were imposed on Colombian government officials, while tighter customs controls were applied to travellers and goods from Colombia. Faced with these economic and diplomatic pressures, the Colombian government finally agreed to accept the deported migrants unconditionally, bringing the crisis to an end.

The crisis is far from over for everyone. The cancellation of visa appointments at the US Embassy in Colombia has exacerbated tensions between the two countries. This measure illustrates the lasting effects of recent decisions, the repercussions of which continue to affect Colombian citizens.

However, the real threat raised by Trump was the possible invocation of the IEEPA (International Emergency Economic Powers Act).

The IEEPA, adopted in 1977 in the United States, gives the President enhanced powers to impose economic sanctions in the face of exceptional and extraordinary threats to national security, foreign policy or the country's economy.

In practical terms, the IEEPA allows the President to freeze the financial assets of individuals or foreign entities, restrict money transfers, prohibit commercial transactions with specific entities and sanction entire economic sectors, such as energy or technology. Sanctions can also include suspending access to certain technologies or limiting imports and exports.

To activate IEEPA, the President must declare a national emergency, justifying that the threat is of exceptional gravity and magnitude.

IEEPA has been used against several countries and entities, such as Iran after the 1979 hostage crisis, Russia following the annexation of Crimea, China with restrictions on companies like Huawei, and North Korea due to its nuclear activities. These sanctions can freeze billions of dollars in assets and exclude targeted entities from the US financial system, or even from the international SWIFT network, thus complicating international transactions.

In the Colombian context, if Donald Trump were to threaten to use the IEEPA, this could lead to the freezing of Colombian assets in the US, a halt to money transfers between the two countries and a ban on trade with key sectors of the Colombian economy. Such a blockade would have considerable repercussions, particularly on remesas (remittances) from the USA, essential for many Colombian families.

I was able to observe this threat in real time on the ground. On Sunday, the tension was felt immediately: in the department of Antioquia, where I am, although credit card transactions had not been officially suspended, they were no longer accepted in hotels and restaurants. Everything had to be paid for in cash. I was lucky enough to find a few ATMs that still accepted my card. In an instant, the American president can decide to cut off access to electronic transactions, and this risk is very real in the country! On the ground, the need to find an alternative to the current payment system became clear in the space of a few hours. Physical gold is no longer simply an investment; it is now the ultimate protection, ensuring the smooth running of the economy in the event of a sudden breakdown in the traditional financial system.

It was probably this threat of economic collapse due to the interruption of transactions that forced the Colombian president to give in.

Will this tension change the country's perception of the United States?

From my initial discussions on the ground, anti-American sentiment seems relatively low-key in Colombia, far less so than in Ecuador, Bolivia or Venezuela, and probably less pronounced than in France. Although the country is not totally aligned with the American model, the particularly influential Colombian diaspora maintains strong economic and cultural ties with the United States.

Against a backdrop of growing rivalry between Washington and Beijing, Trump needs Colombia, which remains a strategic partner in South America. As China continues to gain ground on the continent, nibbling away at its market share and political influence, maintaining a close relationship with Colombia represents a crucial issue for the United States.

Analyst Xavi Ruz has published a particularly revealing map on this subject:

I think Trump deliberately chose to target Colombia in this initial showdown to weaken the position of the current Colombian president, who is classified as far left. The next presidential elections, scheduled for next year, represent an opportunity for Trump: he would welcome the replacement of the incumbent president by a conservative candidate, in a dynamic comparable to that recently seen in Argentina.

However, this aggressive negotiating approach entails certain risks for the United States.

Paradoxically, the direct threats of taxes on Colombian imports and the interruption of electronic transactions have highlighted, in a very concrete way, the risk of Colombia becoming too dependent on a trading system dominated by the United States.

It is precisely this risk that is now prompting many BRICS countries to explore alternatives to the dollar system. Without denying their trade relations with the United States, these countries are seeking to diversify their economic dependencies and, above all, their foreign exchange reserves.

The war in Ukraine and the sanctions against Russia in 2022 acted as a real wake-up call for many states. Colombia, for its part, has become aware of the systemic danger of economic and financial dependence on a single country. This awareness has been demonstrated by the speed with which cash payments have replaced electronic transactions in the country.

Trump's tax policy could further accelerate the de-dollarization of these countries' reserves.

Even if the American president threatens to impose new taxes on imports from countries that do not use the dollar for their transactions, this strategy will logically and inevitably fail to reverse the trend.

The gradual reduction in these countries' dollar reserves reflects a strategic desire to limit their economic vulnerability to a system dominated by the United States. On the contrary, these measures could reinforce their determination to diversify their monetary dependencies.

Trump's presidency thus logically begins with a significant drop in the DXY index, which assesses the strength of the US dollar against the world's major currencies:

The dollar's decline is deliberately encouraged by the new US administration.

Scott Bessent, recently appointed U.S. Treasury Secretary after Janet Yellen, is a renowned investor and founder of hedge fund Key Square Group. At 62, he has amassed a fortune in excess of $500 million.

Donald Trump's appointment of Scott Bessent as Secretary of the Treasury marks an important turning point in the direction of US economic and monetary policy.

Bessent is a staunch defender of gold, which he sees as a central component of the global financial system. Unlike his predecessors, who favored dollar-centric monetary policies and Federal Reserve interventionism, he believes that a major global monetary realignment is imminent. This vision suggests that he anticipates upheavals in the global financial order, potentially linked to a questioning of the dollar's dominant role and the emergence of alternatives, such as increased gold reserves at central banks.

His approach could have profound implications for US economic policy, influencing debt, interest rate and foreign exchange reserve management strategies, with a direct impact on global financial markets.

In this same dynamic, Donald Trump Jr. recently promoted a book entitled The Ultimate Guide To Gold For The Trump Era in a tweet that has already been viewed over 560,000 times. This public stance highlights the Trump circle's growing interest in gold as a strategic asset in the face of monetary uncertainty.

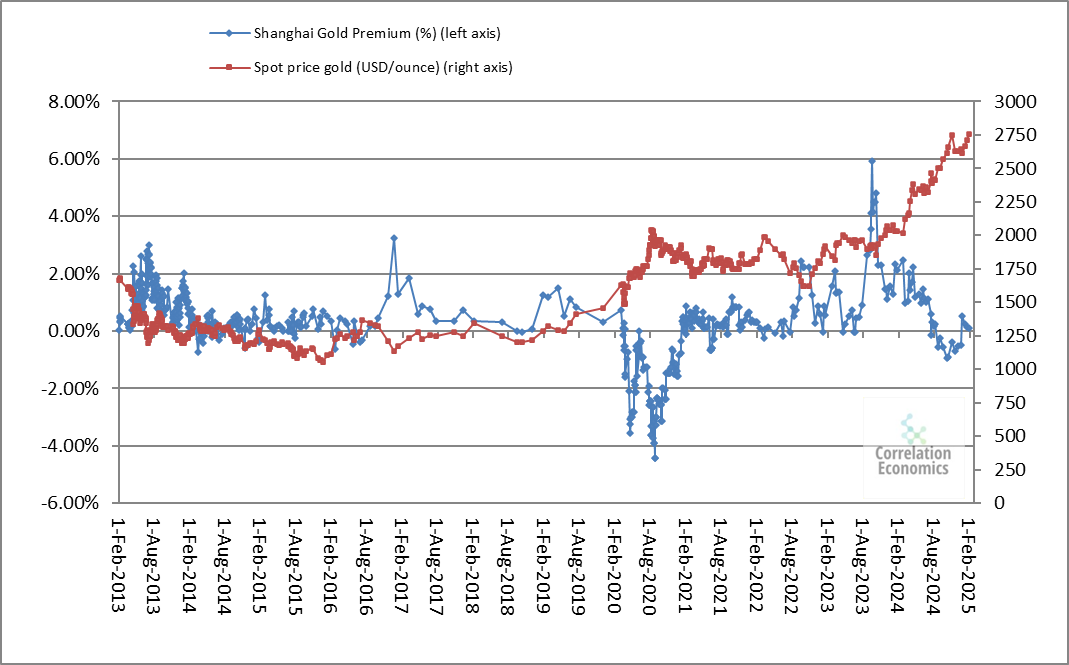

The dollar's decline continues to benefit gold, which is once again approaching its highest levels. Despite a record gold price in Chinese yuan, the Shanghai premium remains positive, offering an additional short-term bullish signal. In other words, even at high prices, Chinese demand remains strong, confirming the upward pressure on the precious metal:

Chinese demand is growing, as is demand in the West.

Ross Norman, analyst at Metals Daily, points out that the massive flow of physical gold from London to New York, coupled with a dramatic rise in lease rates, has triggered a wave of short-covering, contributing to the recent surge in gold prices.

According to Norman, this strong demand for physical gold in the USA is due to fears that the Trump administration will impose high additional taxes on gold and silver imports. Faced with this uncertainty, New York traders are opting for physical delivery to secure their stocks.

Norman believes that if these taxes are ultimately not introduced, the gold could be repatriated to London in the coming months. But what would happen if the Trump administration kept it vague or actually imposed these taxes?

In this case, the major London-based precious metals banks would be forced to reposition themselves in the market to replenish their local stocks, which could intensify demand and maintain upward pressure on gold prices.

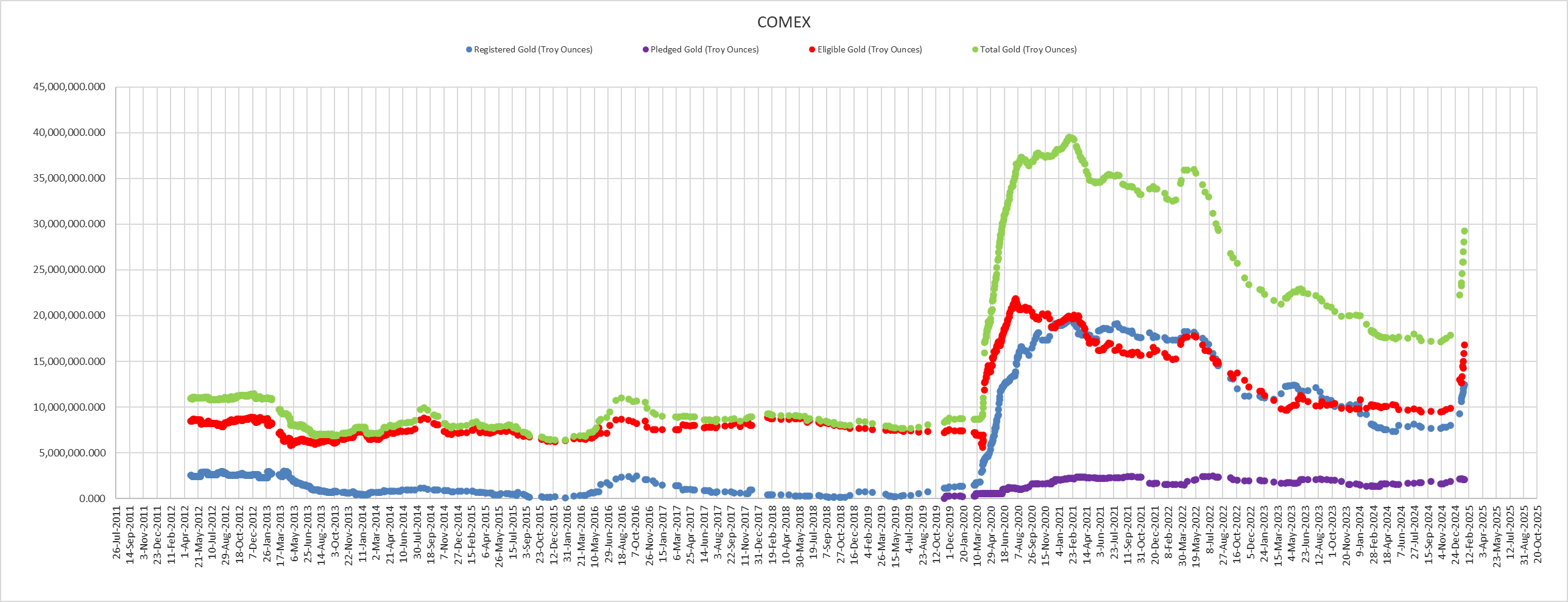

This restocking movement is clearly reflected in the evolution of COMEX stocks, which have risen sharply since the beginning of the year. This build-up suggests that market players are anticipating increased demand for physical gold, potentially as a result of uncertainties linked to the import tariffs being considered by the Trump administration.

If this trend continues, it could put further pressure on the global supply of available ingots, fuelling the upward trend in gold prices:

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.