As we close out the year 2022, it must be admitted that the performance of gold and silver prices in 2022 has surprised many analysts.

In January 2022, Credit Suisse was forecasting a gold price below $1500 and JP Morgan was targeting a decline to $1520 in the fourth quarter of this year.

Gold, by closing the year at around $1800, is almost at the same level as it was at the beginning of 2022. Silver even managed to close the year up a small +5%, after a summer plunge to $17.

The performance of precious metals is all the more remarkable in the face of sharp declines in equity and bond markets. Gold is outperforming the indices by more than +20%.

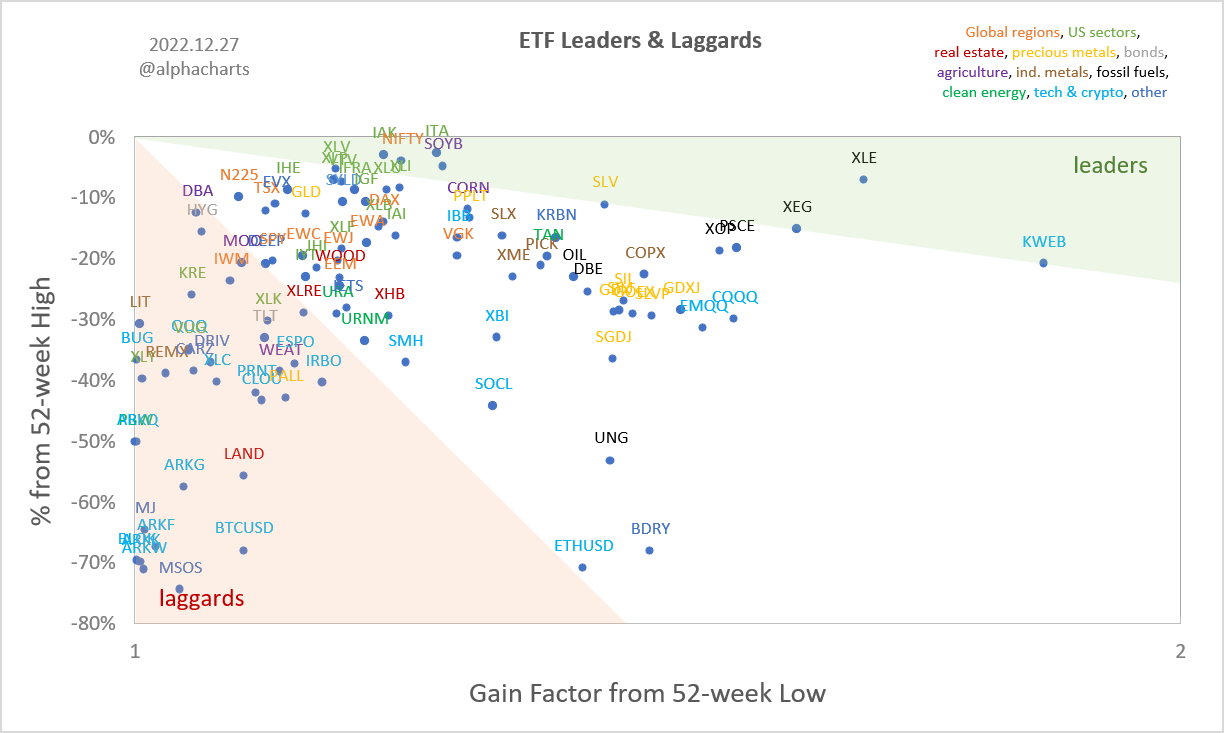

And this outperformance is even more significant when we look at certain market segments: on the following graph, the ETFs furthest to the left are those that finished the year the worst. Those at the bottom have the most catastrophic performance. Among these ETFs, cryptos, technos, and real estate related stocks are the worst performers.

Growth stock portfolios, ex-stars of the markets during the years of free money, are ending the year at their lowest.

This week, we even saw margin calls that affected Tesla stock (down -10% on Tuesday to an annual low). It is rare to see this type of correction in a traditionally very quiet week. This heralds more stress to come in the investment sector related to tech stocks and cryptocurrencies. The purge seems far from over, and just because the fall was terrible, with record oversold indicators, doesn't mean the rebound (if it happens) will be powerful. Investors in cryptos are having the same kind of bitter experience as they did with mining stocks in the bear market that began in 2011. Those who were around in 2012 remember it: the rebound of the GDX index between January and July had raised quite a few hopes in the goldbug community. But the RSI indicator had hit a low, the GDX index had been divided in half, and some stocks had corrected by almost -70%...

In the following months, the GDX index fell again and was divided not by two, but by four. Stocks that had lost 70% corrected even more in this new descent into hell. If mining companies that hold real assets can experience such a slide, one can easily imagine an identical scenario, even more painful, for companies that are drowning in debt and whose promises of results were made in a context of free money.

If one were to make a single bet for next year, it would be this: 2023 is likely to be the year in which the debt burden is finally considered by investors. Even if the Fed decides to change its strategy and pivot by cutting rates, the violent hike of the last few months is likely to permanently change investors' perception of a company's or a government's debt level.

This change will take place under all scenarios. With or without a recession, and regardless of the severity of the recession, in all cases, debt will become an important variable in the valuation of an asset.

2023 will be the year when the first question people ask when valuing a company will no longer be, "What is the growth potential?" but rather, "What is the debt burden relative to expected earnings?"

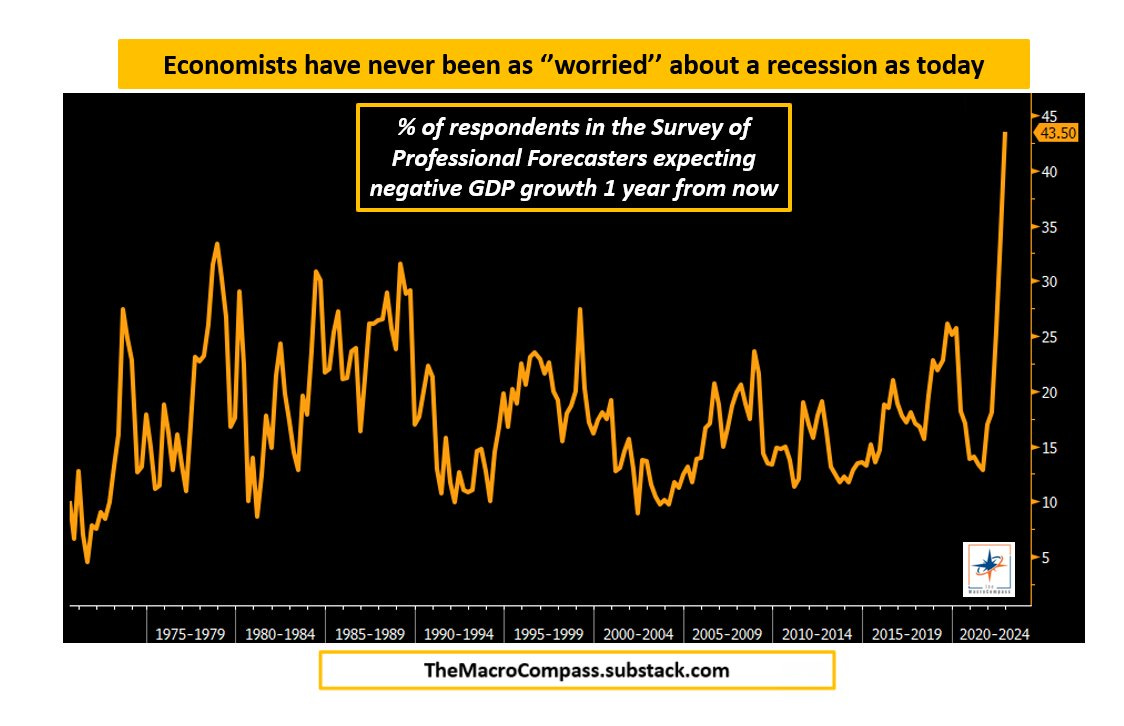

A recent survey of economists supports the likelihood of a U.S. recession in 2023. Forty-four percent of professionals surveyed expect negative GDP next year:

Under these conditions, one can imagine the burden of the debt on the accounts of companies, but also on those of governments deprived of fiscal resources.

But even without a recession, the debt burden is not about to lighten.

If the United States avoids a recession, economic activity will not be sufficient to support the increased debt burden.

Growth forecasts for SP500 companies are in free fall:

With interest rates rising at the end of the year, the burden of debt is likely to be a real problem for companies that will not have enough growth to meet their commitments. With this level of debt and rising interest rates, the country does not need a recession to cause another wave of business failures.

A simple slowdown instead of a recession might even be the worst-case scenario: it would not prompt the Fed to change its monetary policy, allowing the damage to corporate debt loads to set in deeper and longer, at a time when investors will be looking more closely at these debt-related metrics.

The acceptance of deep economic damage would be postponed, requiring even stronger monetary easing action!

Even before the recognition of the damage linked to the rate hike and the acceptance of a new quantitative easing program, gold is still on its $1800 support while the dollar has only slightly corrected against the other currencies, and the Fed has raised its rates from 0% to almost 5% in a few weeks!

Despite these performances, I found more than ten analysts who have a short-term bearish view on gold prices: for these observers, the recession is no longer in doubt and the margin calls it will trigger will also affect the precious metals sector.

According to these analysts, gold will resume from the beginning of 2023 its recently broken downtrend, below $1760:

Silver is the big surprise of this year-end. After the very strong correction of this summer, who could have predicted that silver prices would go back up to around $23-24. To end 2022 with a rise, even slight, was simply unhoped for!

The silver/gold ratio took advantage of the last few months to break its consolidation channel, which began in 2021:

The power of silver's rebound has surprised many, even its most ardent supporters. Moreover, this rise took place in a much calmer market than during the silver short squeeze period. This is a good sign for the future.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.