Is the price of gold linked to other markets? Conversely, is the price of gold independent of market trends? This question is all the more important as gold is often perceived as a "safe-haven" asset, capable of behaving independently of other markets. In this paper, we will focus on the short-term, medium-term and long-term correlations of the gold price with other markets.

Gold's long-term correlation with the markets

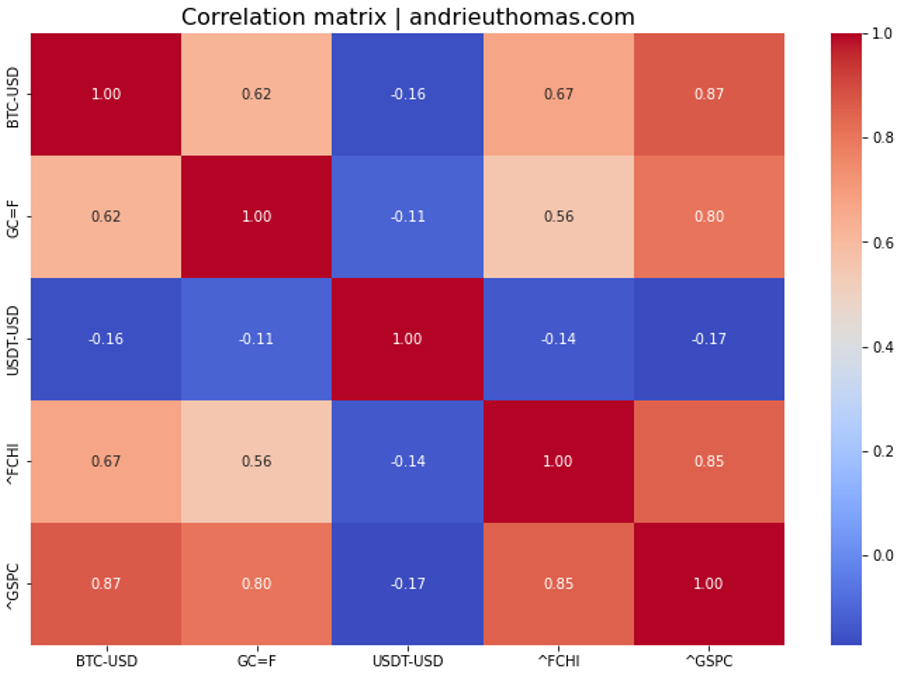

To begin our discussion, we have calculated the correlation matrix over the last five years (2018-2023) between the price of gold (GC=F), of the S&P 500 (GSPC), the CAC 40 (FCHI), the dollar (USDT) and bitcoin (BTC). A correlation coefficient close to -1 or +1 means that the two assets evolve symmetrically, while a coefficient whose value is close to 0 implies no link between the two assets. We're talking here about the price in dollars.

In the case of gold, the price of the yellow metal has a long-term correlation of +62% with bitcoin, -11% with the dollar, +56% with the CAC 40, and +80% with the S&P 500 over the period studied. To the uninitiated, these may seem like exorbitant values, reflecting the fact that gold is not independent of other markets. First of all, then, it seems appropriate to analyze these correlations in order of importance and determination.

Why is gold market-sensitive?

Indeed, the most important correlation in the gold price comes from the S&P 500. The price of gold is almost 80% correlated with the latter, which is considerable and could be a case of determination. But the details of the study of this correlation deserve to be put forward. We have already shown that gold often grows in tandem with the financial markets, resulting in a strong positive correlation. But we also observe that gold prices tend to rise during corrective phases in stock markets, implying that the correlation is often only valid in one direction, that of the bull market.

Even so, gold's high correlation with traditional indices is often a source of criticism. This would imply that the price of gold is linked to the liquidity available on the market, and therefore that gold would be allocated in a portfolio in the same way as equities. However, if we do indeed observe a logic of allocation and liquidity, another explanation for this correlation would necessarily come from the role of the long-term supply of yellow metal.

The supply of physical gold is a determining factor in the long-term behaviour of gold, since demand from "liquidity" can only be supplied at a certain minimum cost by the market. Under these conditions, it's worth considering the fact that the rise in gold’s production costs would be independent of that of the indices, and that despite this, the price of gold and the S&P 500 would be fairly symmetrical. Another explanation would be that the cost of production depends on major economic variables, such as inflation and interest rates, which are also determining variables for the S&P 500. In any case, available liquidity does seem to influence the price of gold during bull markets. It should be noted that this phenomenon of long-term asset correlation is generally common to all markets, since it is the major economic variables that act on all markets.

Through the S&P 500, gold also appears to be correlated with the CAC 40, and even more so with bitcoin. Nevertheless, the opposition between the dollar and the gold price is very weak (-11%), contrary to what theory might suggest.

Medium-term correlations (one to two years)

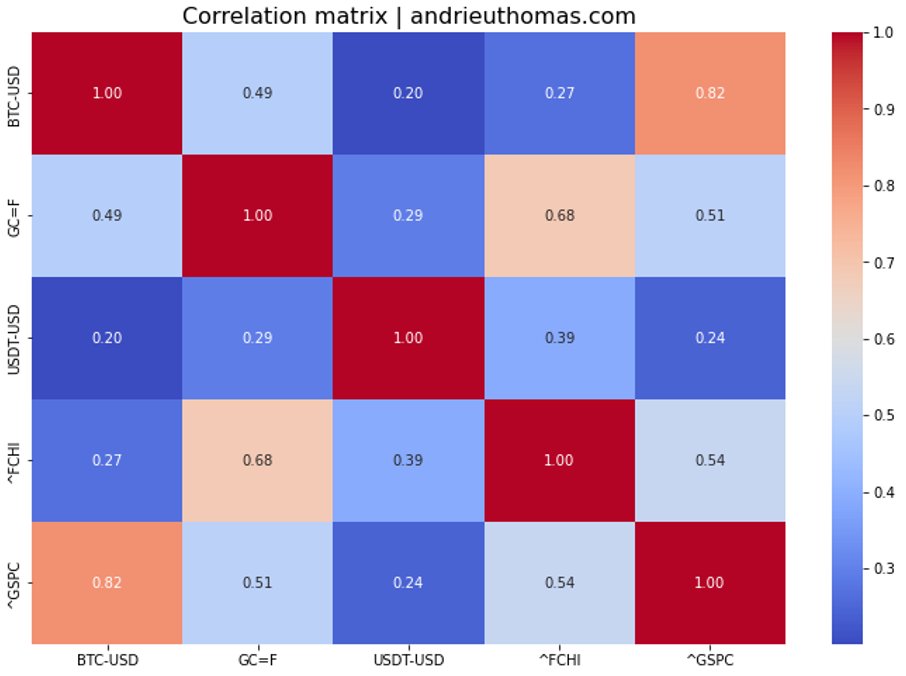

We then studied the medium-term sensitivities of the gold price. Correlations were measured over the period from January 2022 to July 2023. In this case, the gold price is less correlated with all markets. Gold is +49% correlated with bitcoin, +29% with the dollar, +68% with the CAC 40, and +51% with the S&P 500. This shows that the correlation of gold prices to indices is not necessarily decisive (since the correlation to the CAC 40 is stronger than that of the S&P 500, which cannot be theoretically supported). Nevertheless, a correlation with stock market indices remains.

Similarly, the bitcoin price correlates fairly well with the gold price over the medium term. Finally, there is a positive correlation between the dollar and gold. This means that increases in the value of the dollar generally translate symmetrically into increases in the price of gold. Although this correlation with the dollar is weak, it's its positive value that is surprising. In the medium term, the gold price therefore seems to have a trajectory that is generally more independent of other markets.

Short-term correlations (six months)

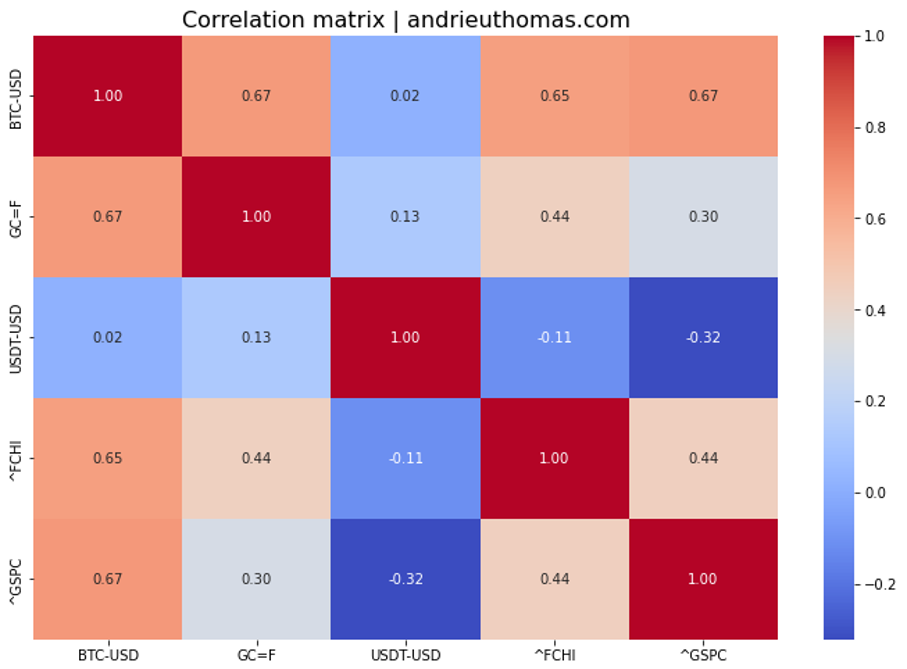

Finally, we studied the behavior of the gold price in relation to short-term markets. Over six months, the gold price is +67% correlated with bitcoin, +13% with the dollar, +44% with the CAC 40 and +30% with the S&P 500. What is striking here is the low correlation with the S&P 500 and the high correlation with bitcoin. This would suggest that the gold price reacts little or not at all to market declines in the S&P 500, but is more sensitive to declines in bitcoin. This would seem to be fairly well verified graphically, but once again, the correlation is not absolute.

As a result, we can affirm that gold is more sensitive to the mechanics of short-term portfolio allocations and demand adjustments. Here again, gold's correlation with the CAC 40 remains stronger than with the S&P 500, which is difficult to justify.

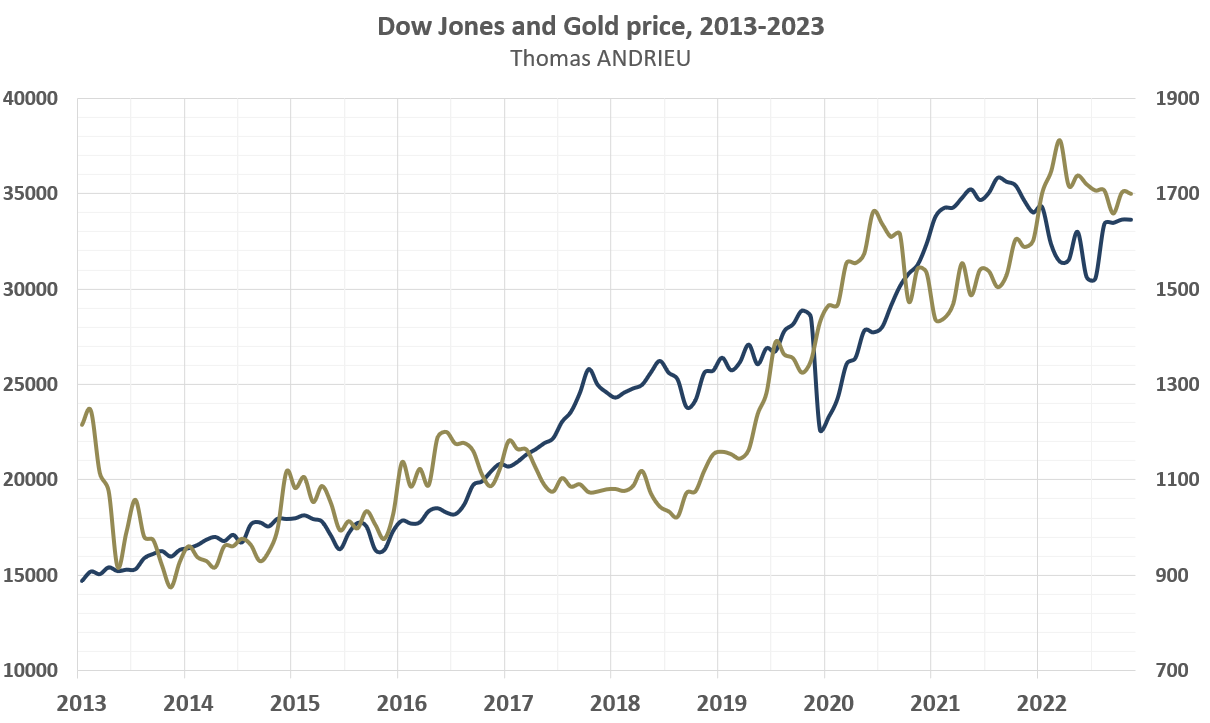

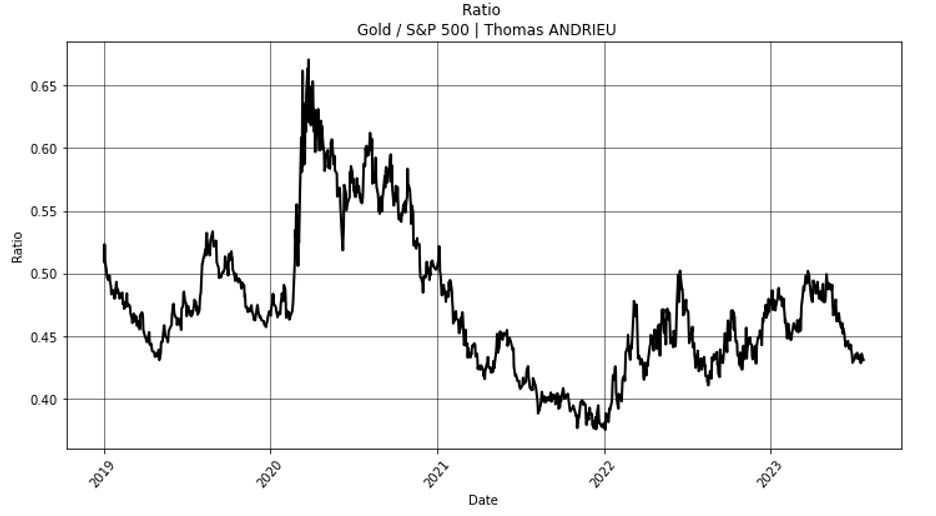

Gold / SP 500 ratio

We have shown that gold and the S&P 500 show a certain symmetry. To better compare the evolution of the two assets, we have calculated the ratio between the price of gold and the price of the S&P 500. Since 2019, the periods in which gold outperformed the S&P 500 were March 2019-March 2020, then January 2022 to mid-2023. Conversely, 2020 and 2021 were more favorable for the S&P 500. Moreover, the gold/S&P 500 ratio has been channelled between 0.4 and 0.5 since 2021. The presence of a channelled ratio tends to support the correlation between the two assets. However, we can clearly see that the value of gold can vary considerably from month to month.

What's more, the volatility of the two assets is not absolutely similar. Between 2018 and 2023, the annualized volatility of the gold price is close to 14.5%. At the same time, the annualized volatility of the S&P 500 is close to 18%. This difference in volatility therefore also explains the relative stability of the gold price versus the S&P 500. However, it is clear that the two assets behave similarly, while corrective periods or crashes in the S&P 500 formally reflect an outperformance of the gold price.

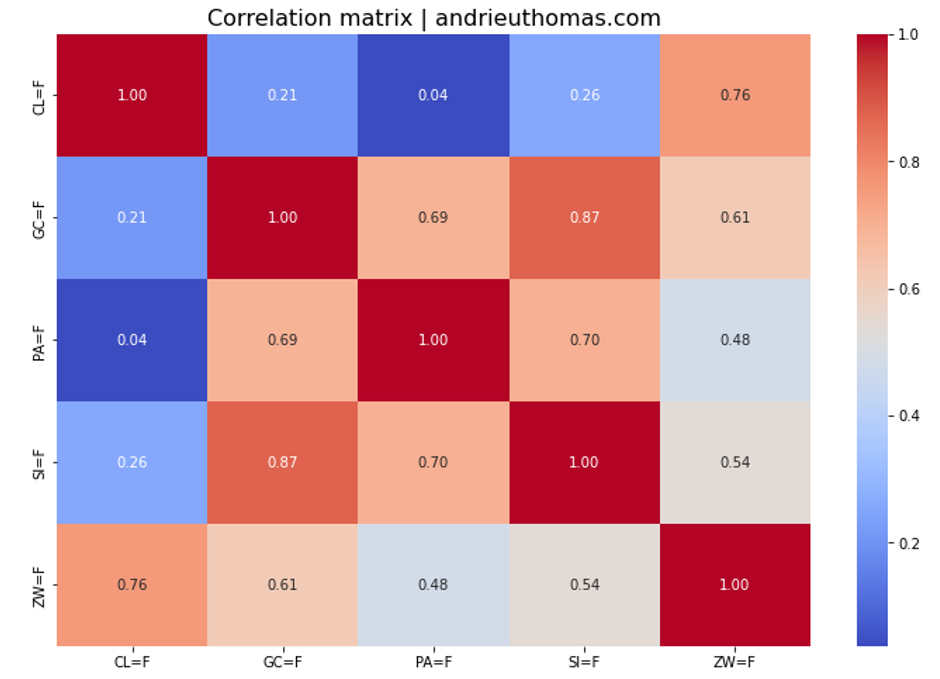

Correlation with other commodities

To conclude this paper, we turn to the link between the gold price and other commodities. Between 2018 and 2023, we have selected five commodities. The study includes silver (SI=F), wheat (ZW=F), palladium (PA=F) and oil (CL=F). As a result, we show that gold prices are +87% correlated with silver prices, +61% with wheat prices, +69% with palladium prices, and +21% with oil prices.

We can therefore affirm that the price of gold is more closely correlated with the price of silver than with that of the S&P 500 over the long term. And the prices of other commodities, such as palladium and wheat, also seem to move fairly symmetrically with gold. Oil, on the other hand, shows no significant correlation. We can therefore see that the price of gold is primarily linked to economic activity, reflected in both stock market indexes and more industrial metals. Once again, we emphasize the role of demand, influenced by liquidity, and of productive (mining) supply, influenced by overall economic activity, in the behavior of the yellow metal.

In conclusion

In conclusion, gold is correlated with most long-term bull markets. In particular, the price of gold has a correlation of almost +80% over the last five years with the S&P 500. Nevertheless, it's important to remember that while available liquidity may explain the variation in demand and the price of gold, it's equally troubling that the cost of producing gold varies in the same proportions. So, above all, we are dealing with the correlation property of all markets in the long term.

In fact, over the medium term, this correlation weakens. French stock markets even seem to be more correlated with the gold price. As a result, gold's behavior is less correlated with most markets over the medium term. Similarly, the S&P 500 does not appear to be an absolute determinant of the gold price. As a result, gold's behavior is more stable than that of stock market indices. Finally, in the short term, the price of gold appears to be more correlated with bitcoin than with the S&P 500. It is therefore clear that gold follows clear long-term trends, but can be subject to portfolio readjustments in the short term.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.