Over the past two weeks, the Bloomberg Commodity Index, which tracks commodities, has risen by 10% after recording an almost continuous decline since June 2022:

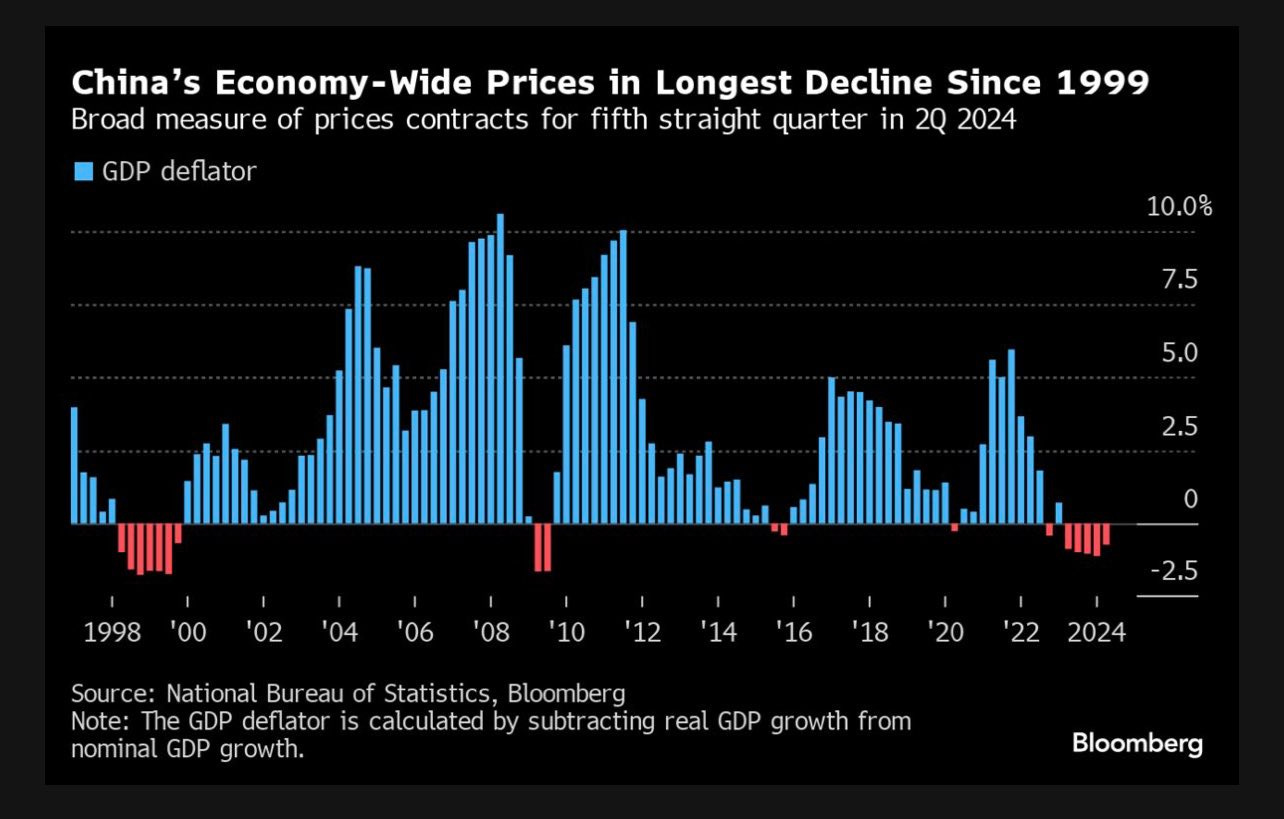

The strong bearish positioning of commodity funds over the past two years is mainly due to the unprecedented slowdown of the Chinese economy, a situation unprecedented since 1998:

The rebound in commodities is probably due to some funds beginning to cover their short positions, following the announcement this week of China's stimulus package. This plan concerns both the real estate sector and the Chinese stock market.

China plans to inject at least 500 billion yuan ($71 billion) of liquidity directly into the stock market.

The scale of this support plan is astonishing, and has prompted many skeptical reactions as to its timing: why intervene now in the face of a sharper-than-expected slowdown, after suggesting that no intervention would be made?

The rate cut in the United States could be part of this context. The Fed would act proactively, anticipating an economic slowdown, while China's central bank seems to have been forced to react after the fact, rather than taking preventive measures.

China's money printing could indeed support the markets. It remains to be seen whether this will be enough to curb fund selling in commodities.

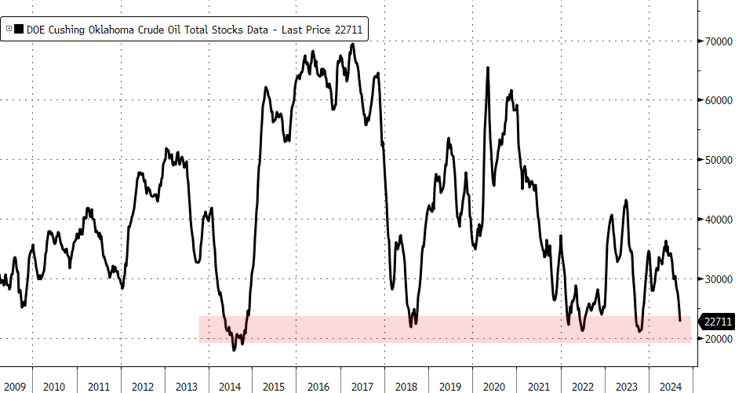

Funds are largely positioned to sell oil in anticipation of a global recession. Yet US crude inventories are at record lows:

It would now take a sudden economic event to prevent a massive short squeeze.

More and more observers are taking this possibility seriously. What if we were actually close to an economic shock far more significant than the soft landing advocates would have us believe?

The Richmond Fed's manufacturing employment index plunged to 21 points in September, reaching its lowest level since April 2009.

The index is in contraction for most of 2024, and is even below the levels seen during the pandemic:

US industry is showing signs of slowing down, and the Fed's intervention may come too late... This is clearly prompting speculators to take bearish positions on oil.

This is no doubt why most commodities are reacting so little to this change in China.

Precious metal prices continue to rise, signalling an increasingly obvious loss of control by central banks in the face of the situation.

Silver metal, meanwhile, has set one record after another.

The price of silver is currently experiencing, with a certain general indifference, one of the most spectacular bull markets of all time, with an increase of +36% in 2024 alone:

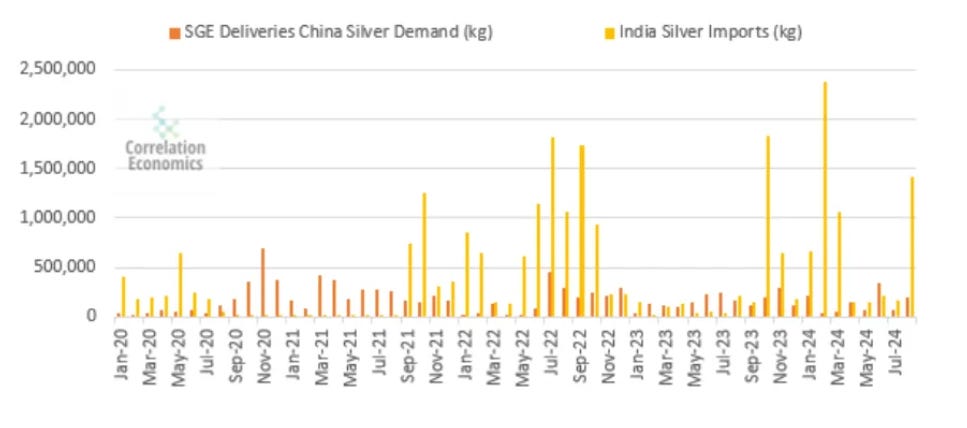

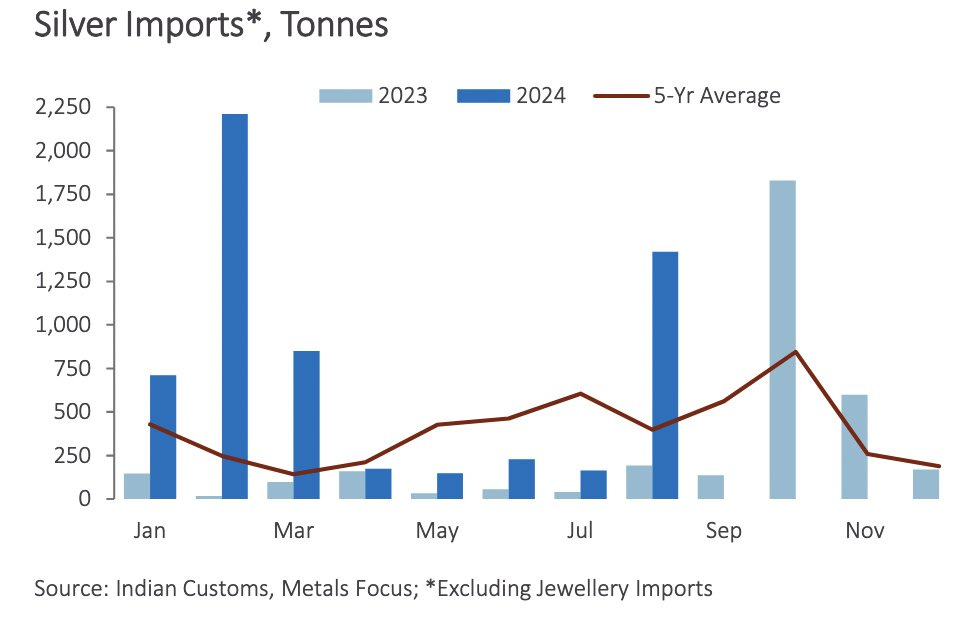

Silver prices are underpinned by strong physical demand from India. Following changes to the taxation of precious metal imports in July, the country predictably recorded a significant increase in demand for physical silver in August:

In fact, I wrote about it in my article from July 26:

“India reduced import duties on gold and silver from 15% to 6%, a move designed to stimulate demand and reduce smuggling. Lower local prices have already led to an increase in demand for jewelry, and shares in jewelry manufacturers climbed as much as 10% after the announcement.

This surprise decision effectively reduces the price of an ounce of gold by almost $300 in India.

Under these conditions, demand for precious metals in India could pick up again after a slowdown in 2023.”

Not surprisingly, silver has benefited from this tax reform. Indeed, silver is much cheaper than gold, and the gold/silver ratio remains stuck at very high levels:

Silver still has plenty of upside potential relative to gold. In 2011, for example, it was more than twice as expensive as gold.

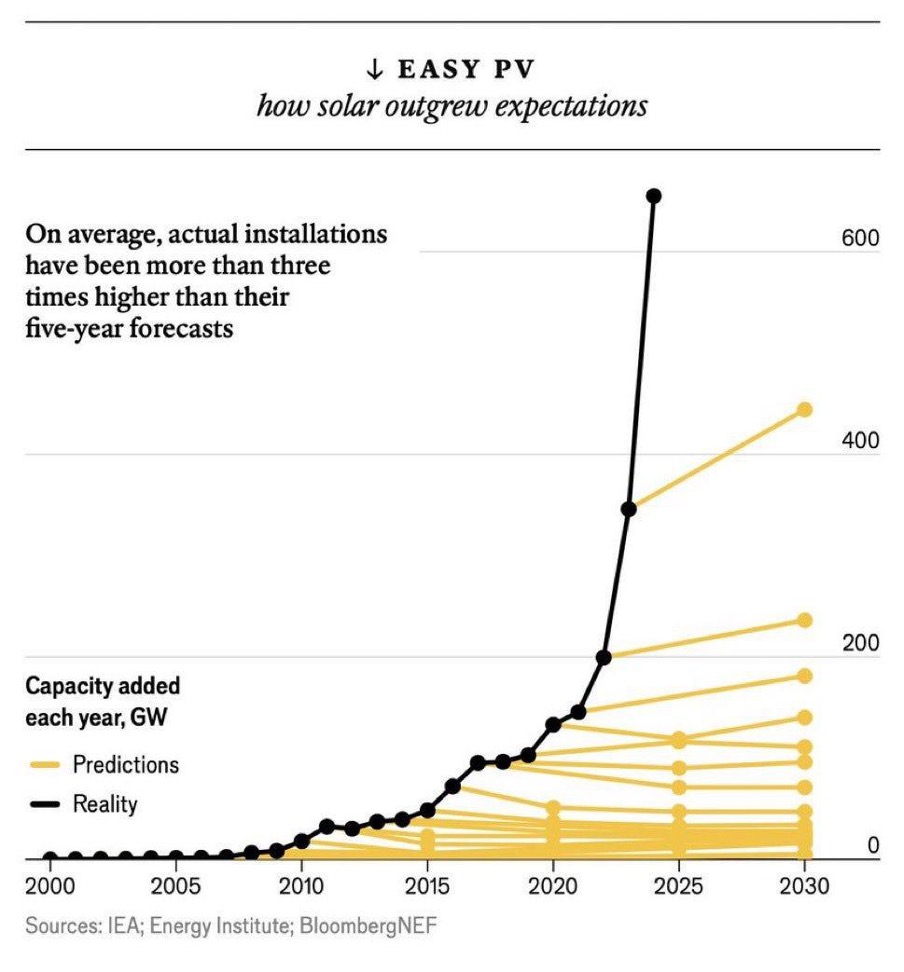

Another factor driving up the price of silver is industrial demand, particularly due to the booming solar panel market. This is encouraging Indian industrialists to hoard the metal as long as it remains affordable.

Forecasts for solar panel installations have greatly underestimated actual demand in recent years:

Silver demand figures are clearly underestimated: the physical silver market is already in deficit. So it's only logical to see a scramble for available stocks in a country like India, which is investing heavily in the development of this energy source.

Good luck to bullion banks still massively short on silver futures!

The greater the depletion of LBMA silver stocks, the greater the risk of these bearish positions. In the end, it's the physical market that determines prices. This time, physical demand is not coming from speculators: demand from a country like India could quickly deplete physical metal stocks in London, especially if traders seek to limit their losses by taking additional short positions to contain price rises. This headlong rush only accelerates the situation further, and keeping prices at affordable levels only intensifies the rush to the physical market.

India has already significantly increased its silver imports compared to last year:

India imported 1,421 tons of silver in August, an increase of 641% on the previous year, bringing the year-to-date total to 6,148 tons. It's colossal!

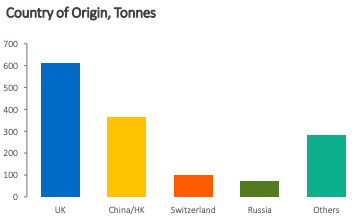

Where does India get its silver? Mainly by taking delivery of contracts on the Chinese and London markets:

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.