US markets are currently close to their all-time highs. Let's take a look at the reasons for this trend.

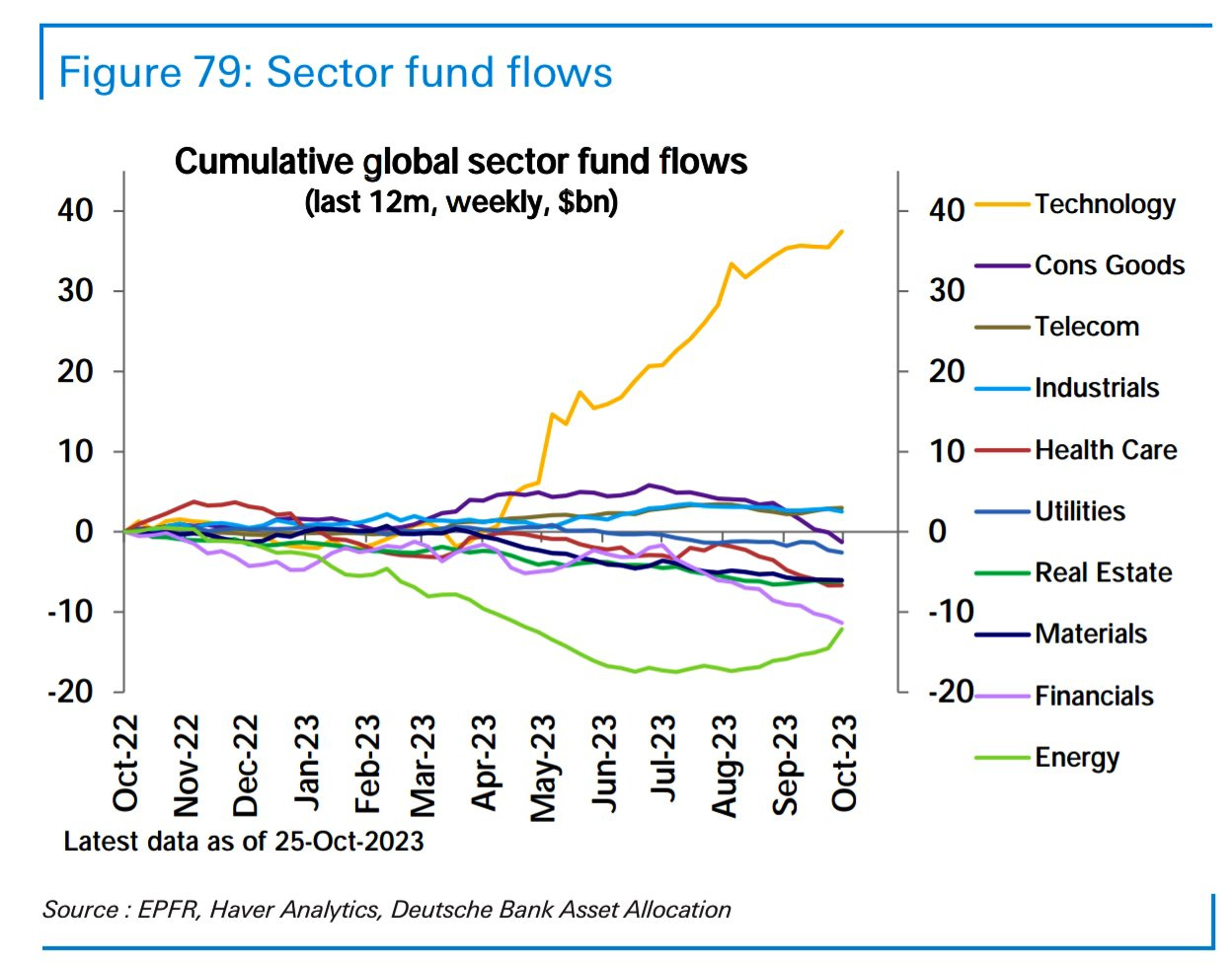

First of all, the sector benefiting most from this rise is undoubtedly the technology sector, which has seen a record influx of new investors since last April. The technology sector alone accounts for the performance of the US stock market, despite a pullback in other sectors such as real estate, energy, commodities, consumer goods and healthcare.

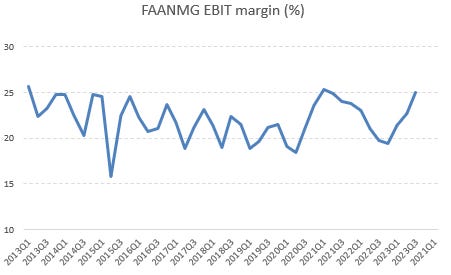

Investment has focused mainly on a handful of companies grouped under the acronym FAANMG (Meta, formerly Facebook, Apple, Amazon, Netflix, Microsoft, Google), which have just published exceptional results: in the last quarter, FAANMG sales reached a record level, equivalent to that of the last quarter of 2021. Sales growth is particularly remarkable compared to the previous year, but what impresses most are the profit margins of this group of companies.

Earnings before interest and taxes (EBIT) for the quarter reached 25%, recording significant growth and reaching all-time highs:

FAANMG have considerable cash reserves, and their profitability increases as returns on this liquidity rise.

US companies with substantial cash reserves benefit greatly from rising interest rates. While the US government is running up debts and the burden of public debt is increasing, these large companies are benefiting, as the government is in a way remunerating them through positive interest rates.

ExxonMobil, for example, holds $30 billion in cash equivalents, which represents a considerable source of income for the company, particularly if interest rates rise. In addition, the company has issued $37 billion in long-term fixed-rate debt at low rates. The return generated by their assets now exceeds the interest costs of their debt, and this gap widens further as rates rise.

Banks are having to cope with the low rates to which they committed prior to the Federal Reserve's policy change. For companies, on the other hand, this represents an opportunity to continue repaying very low interest rates, while growing their cash with particularly attractive yields.

Companies with no cash reserves are not in the same situation. Some sectors, notably real estate, are feeling the impact of rising interest rates. Commercial real estate is in the doldrums, and the recent bankruptcy of WeWork is likely to exacerbate the situation. However, the growth sector, including startups, is also feeling the full brunt of rising financing costs. When we talk about the strength of technology stocks, we're mainly referring to large caps with cash reserves, not start-ups whose growth model has collapsed since the rise in rates.

Small companies are also much more sensitive to this rate hike.

Small caps are recording new lows compared with large tech stocks, as can be seen on the IWN/NAS100 chart:

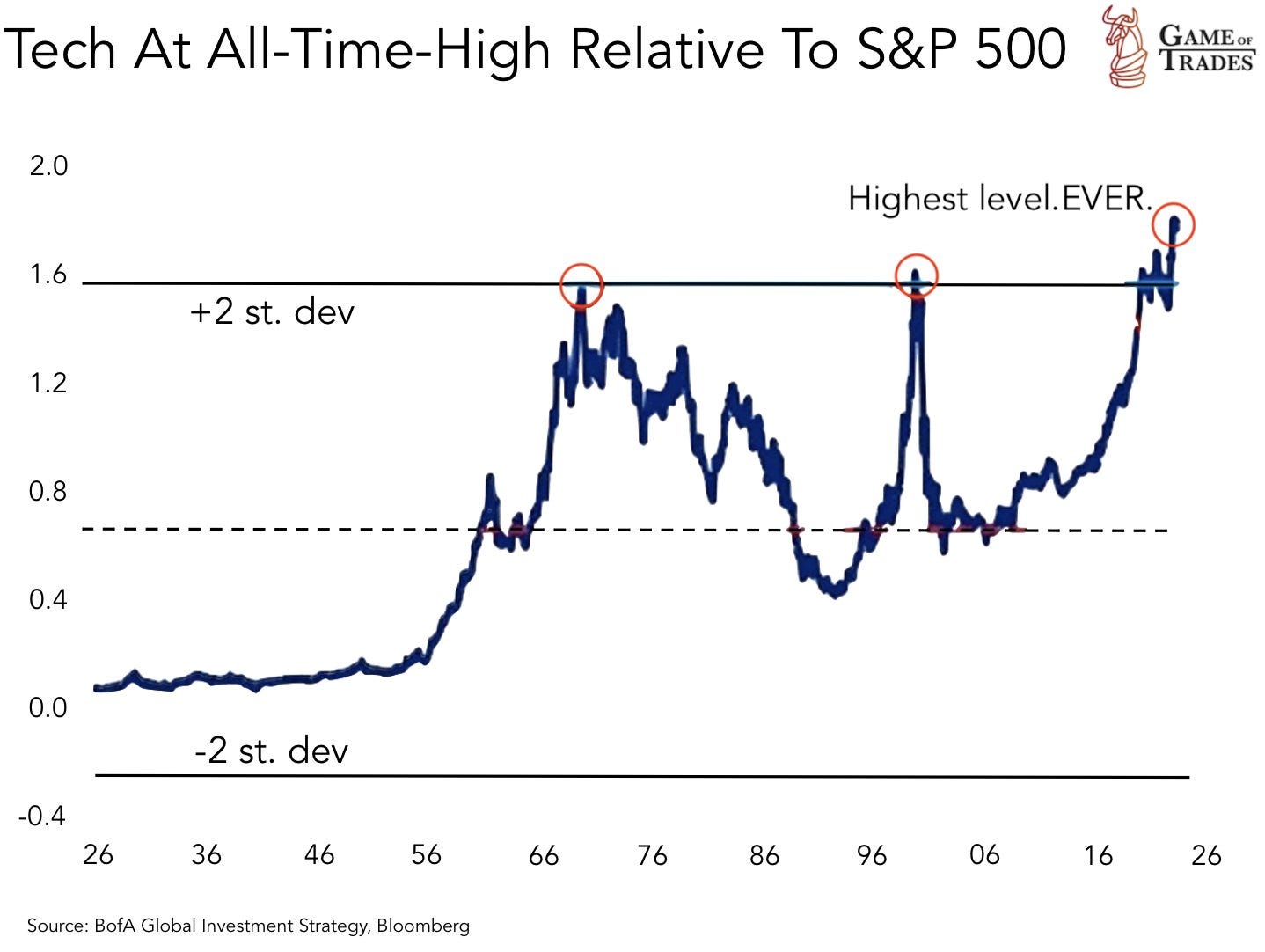

The ability of companies to increase their margins, even in times of economic slowdown, depends to a large extent on their cash reserves. It is precisely this situation that is propelling FAANMG to record levels relative to the rest of the market:

Only large-cap technology stocks are benefiting from rising interest rates.

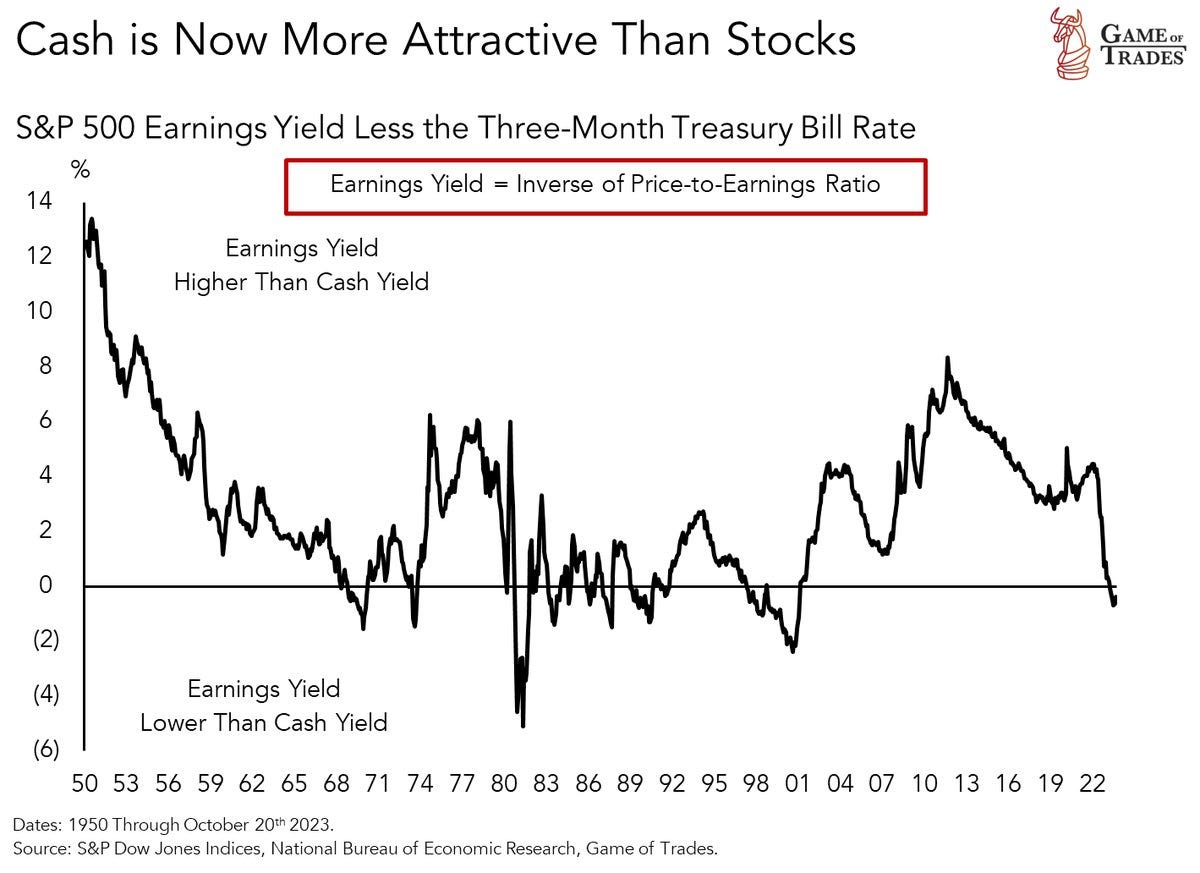

For the rest of the market, as interest rates are very high, equities are not yielding enough relative to cash: earning yields on equities are no longer competitive with short-term bonds. In other words, holding cash yields more than holding equities!

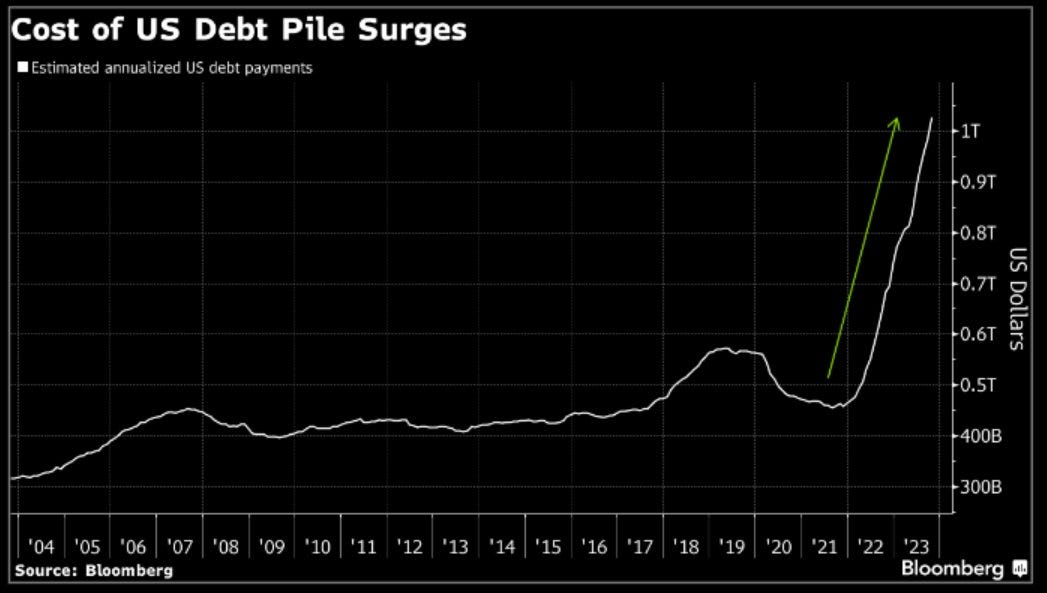

Sponsoring the FAANMG comes at a cost: rising interest rates have led to a significant increase in the burden of public debt. The United States now has to pay over $1 trillion in interest, an amount that has doubled in just nine months. This burden is set to rise considerably further, as most of the debt is short-term, requiring refinancing at much higher costs.

This is the great American paradox: large companies managed to secure their debt before rates rose, and are even able to generate significant returns from their cash. This enables them to mitigate the impact of the current economic slowdown.

The US government, on the other hand, faces an insurmountable mountain of debt, finding itself in the position of a floating-rate borrower caught at the throat.

Note that this situation is specific to the United States. In other countries, such as the UK, the opposite is true: the government has managed to stabilize its debt by using longer-term maturities, while companies and individuals are hard hit by rising rates, mainly due to the prevalence of variable-rate borrowing.

In the United States, companies are not immediately affected by refinancing costs. However, the US government will face a much faster increase in the cost of refinancing its debt, as it has borrowed in large quantities with relatively short maturities.

This situation is mathematically unsustainable, and the difficulties associated with financing US public debt could completely transform the market landscape in the months ahead. The health of the markets is now intrinsically linked to the problem of US public debt. The valuation of FAANMG is maintained thanks to the rising cost of government refinancing. If a solution is found to reduce this burden on the US Treasury (e.g., a rate cut or further debt monetization), this should mechanically lead to a drop in this valuation, particularly if the economic slowdown persists.

Thursday's disappointing auction of the 30-year US Treasury note demonstrates that investors' appetite for Treasuries is waning. The prospect of an avalanche of new auctions in the coming months logically reduces the interest in bond issues, which are set to become ever larger and more closely spaced. The US Treasury has reached an impasse, and at the end of it, there's a wall: the wall of debt.

Following the failure of the auctions, US yields jumped by +4.3% in a matter of minutes, a totally unprecedented movement in what has become a highly volatile market:

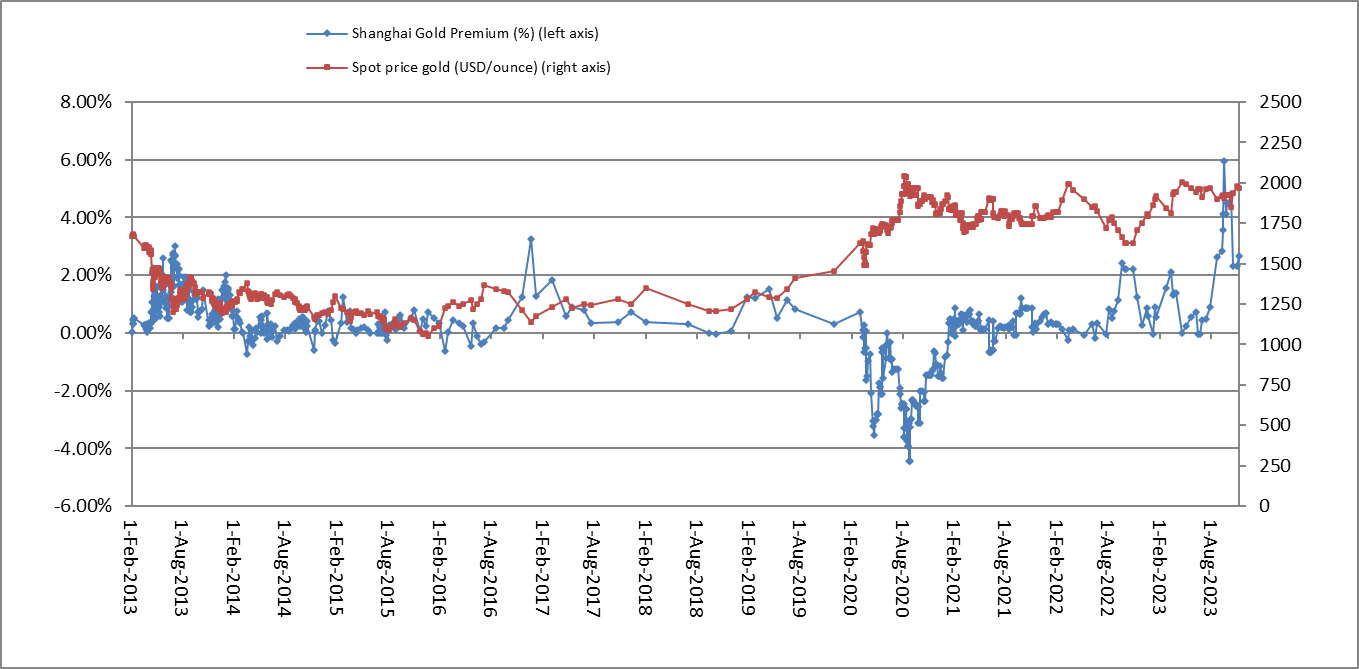

This threat to the US bond market is keeping the price of gold at very high levels.

Gold is also holding up well thanks to sustained physical demand in China. Premiums in Shanghai remain at high levels, even after the recent rise in the price of gold. When an ounce of gold was trading at $1800, these premiums were 6%, and have now fallen back to 2.5%, a significant level compared with the average premiums observed prior to 2023.

This significant premium enables an arbitrage operation that continues to move physical gold from West to East.

China is easing the conditions under which its trading partners can purchase oil and refined petroleum products in yuan.

China continues to buy oil in yuan from Iran, and even enjoys discounts on Russian oil purchases. An article by Politico highlights how the embargo on Russian oil is a failure: not only does it not prevent Russia from exporting, it also offers China a new opportunity to develop a re-export service for oil imported from Russia at a below-market price.

Given that an ounce of gold buys more yuan in Shanghai than in London, and that oil is cheaper in China due to cuts in Russian oil imports, buying oil in exchange for gold becomes a much more attractive proposition in China. As a result, the physical gold trading center is logically shifting to Shanghai, especially as the Chinese currency gains in importance in the international trading system.

We're seeing a new dynamic: thanks to the introduction of yuan settlements following the latest BRICS summit, clearing houses for commodity transactions are moving eastwards. Against this backdrop, the importance of physical metal over paper contracts is growing. As Asian markets gain momentum, it's natural to see the physical market regain importance over the paper market.

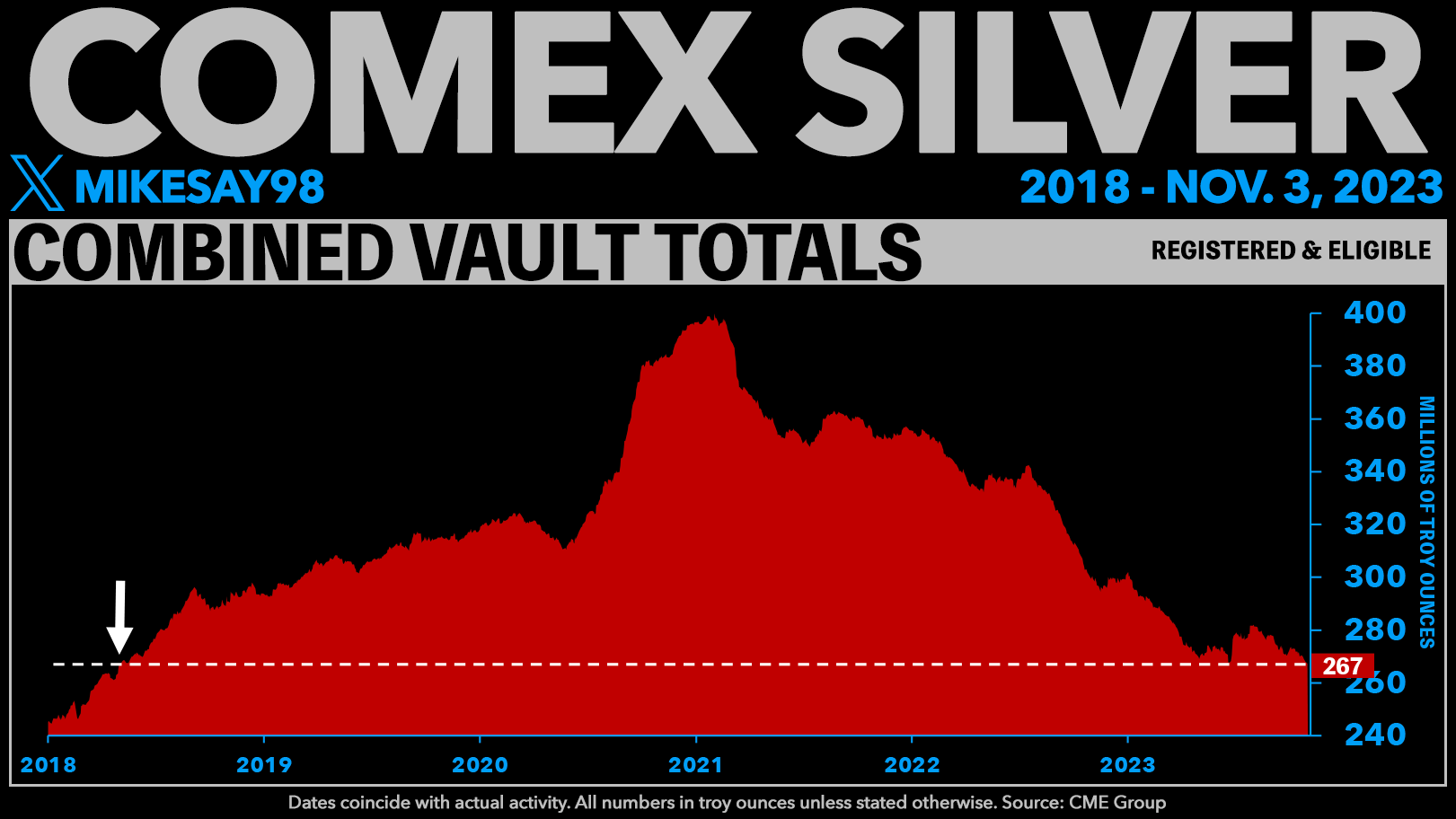

It is essential to note that the Shanghai market is an unleveraged delivery market, unlike the COMEX, which remains a hedging instrument for producers and primarily offers participants a means of speculating on trends in the precious metals market.

This is even more pronounced in the silver market. Recent delivery data on the Shanghai market confirm the pre-eminence of the physical aspect of this market.

According to the latest weekly report, over the course of a week, physical silver settlement reached 776.61 tonnes, with a delivery rate of 26.45%, up +9.3% on the annual average delivery rate. This means that around one in four contracts resulted in physical metal delivery.

That's a far cry from COMEX delivery rates!

With the pace of deliveries accelerating, silver stocks available for delivery on the Shanghai market have reached a new low since 2020.

This reduction in stocks is also occurring on the COMEX: the level of silver held in vaults is at its lowest since 2018.

Unlike gold, silver is not yet strongly influenced by the importance of the physical market. Silver prices remain largely dominated by the paper market, and silver speculators currently have no reason to be optimistic as long as the gray metal remains in its consolidation channel:

Yet silver has a higher upside potential than gold if the market continues to move towards the physical metal. Adjusted for inflation, the price of silver is currently at the same level as in 1976, and well below its 1980 peak:

Taking inflation into account, the price of gold is much closer to its 1980 peak:

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.