Let's start this weekly bulletin with a little chart analysis.

The price of gold is in its consolidation phase, which started at the 3rd top (1st top in 2020, 2nd top in 2022, 3rd top in 2023).

There is support at $1,950 which also corresponds to the test of the uptrend started in October 2022:

Gold's failure to hold above $1,950 would confirm the rare pattern of a longer-term triple top. This pattern is statistically unlikely: in a consolidation phase, triple tops are usually followed by a faster and less "deep" consolidation than the first two tops.

Silver, always much more volatile than gold, is already testing the consolidation channel it broke through a month ago:

It is as if gold and silver are waiting for the resolution of the US debt ceiling talks.

Although there is no doubt that an agreement will be reached, it is mainly the conditions of the increase that will be scrutinized. A U.S. default is an option ruled out by almost all analysts, which explains the very low level of fear in the markets: the VIX index does not indicate any concern about the outcome of this new debate on raising the debt ceiling.

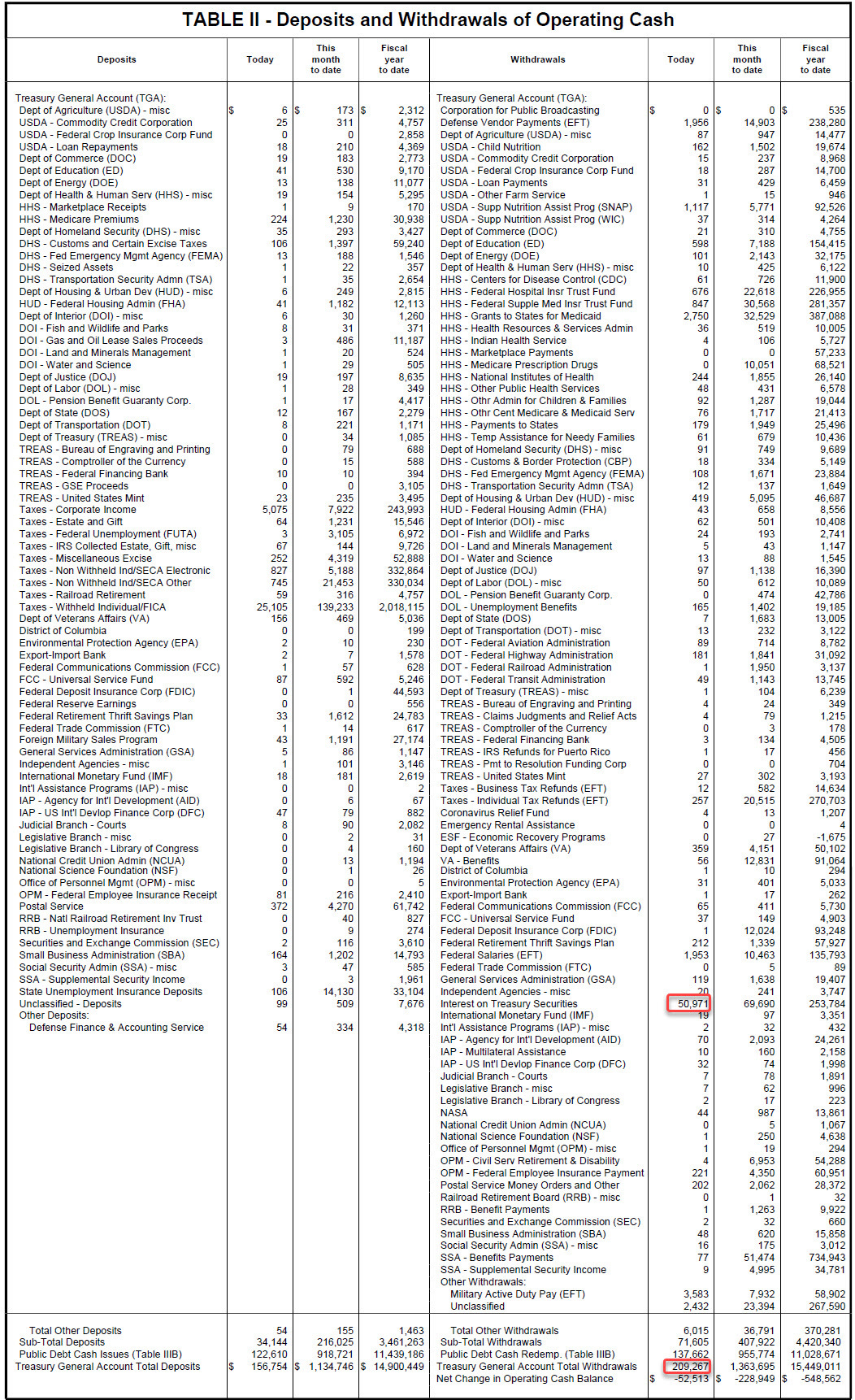

In the general indifference of the markets, the US government is living on its last official reserves. There is virtually nothing left to run the country and no serious negotiations on raising the ceiling have begun. The country is $32 trillion in debt and has only $87 billion left in its coffers as of May 17, after cutting its reserves by a record $51 billion a day on May 16.

The Zerohedge website details the record spending on May 16:

On that day, the government collected only $34 billion and had to pay $50 billion in a single day for interest on debt issued... in total, expenditures exceeded revenues by $52 billion... If the erosion of reserves continues at this rate, the June 1 fateful date announced by Janet Yellen, corresponding to the total drying up of reserves, even seems rather optimistic.

The tension surrounding this countdown is not panicking the markets and does not seem to be putting pressure on the dollar.

The U.S. currency has not broken its downward support (the DXY index is holding above $100), which is limiting gold's rebound for now:

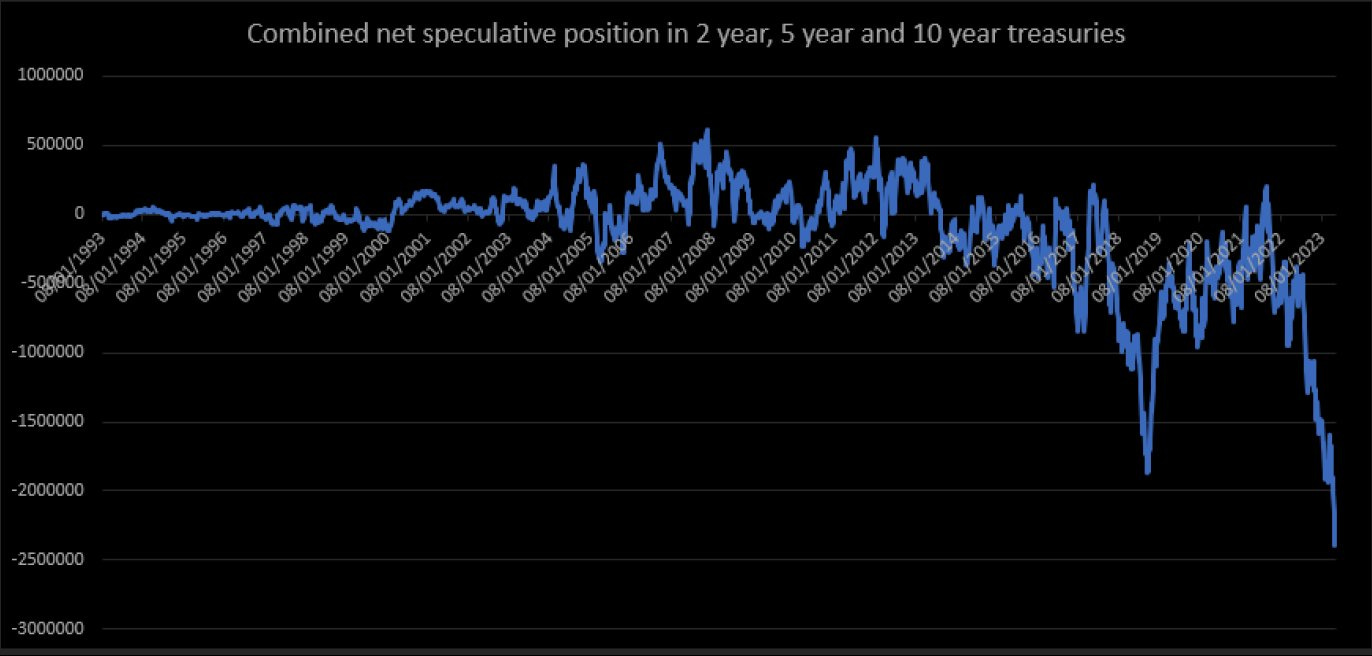

On the bond markets, the number of short positions on government bonds reached a record high, implying a very high level of hedging in the face of the uncertainties of the coming weeks:

The market has never been so bearish on these products.

Any resolution of this crisis should cause a major technical short squeeze on the bond compartment.

This short squeeze will be severe, but there are other dark clouds looming!

The resolution of the debt ceiling will trigger a massive wave of new Treasury auctions in the following weeks. And since the discussions have been delayed, the US Treasury will have to issue a huge amount of new debt at once, probably around $700 billion in a few days, the equivalent of TARP!

As a reminder, the Paulson plan, or TARP, is the name given to the rescue plan decided in haste by Congress to save the banks after the bankruptcy of Lehman Brothers.

The American fiscal situation is so tense that it will require a bond issue equivalent to the liquidity injections put in place during the great financial crisis of 2008!

And these new bonds will be issued at very high rates. Attractive rates, of course... but who will pay for this TARP II? What will be the effects of these new bonds on a bond market that has already been heavily sullied? The summer is likely to be very turbulent!

In the short term, it's dead calm (before the storm?).

The miners are pointing to further consolidation in gold in the near term. Sentiment in the sector does not point to a recovery in the very short term, but we know that this indicator is not reliable for predicting long-term movements. In the precious metals sector, sentiment can change very quickly from a depressed state to one of extreme enthusiasm!

On the economic front, it is also quite calm.

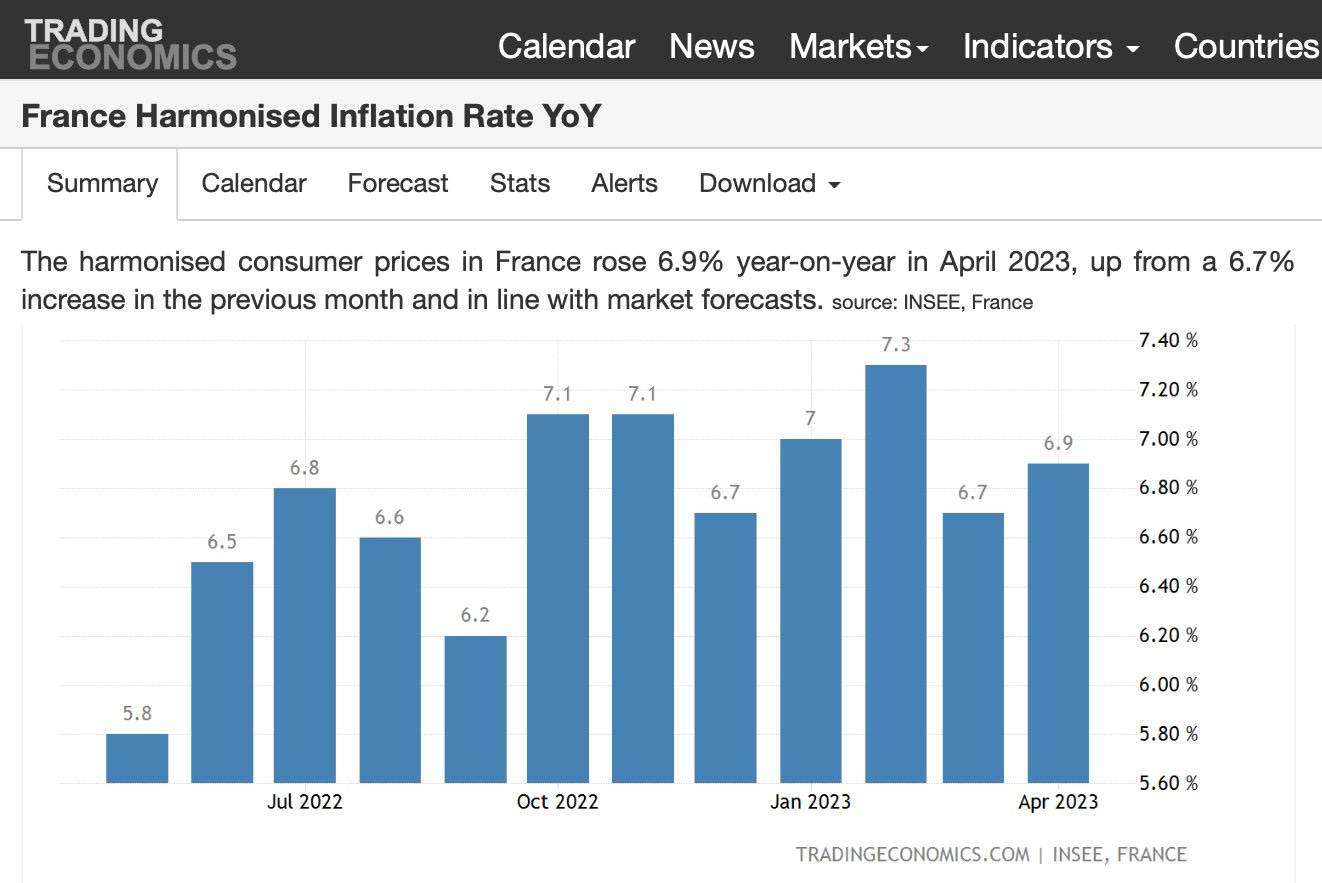

Inflation in Europe is still very much in the news. Countries like France, which wanted to stop the first effects of inflation, are logically catching up with the other European nations. Policies to support rising prices have only postponed the problem of inflation. In France, inflation rose in April compared to March:

Inflation in the United States has largely fallen, thanks in particular to the decline in commodity prices. Inflation remains a concern in services, however, with wage pressures still significant due to a resilient labor market.

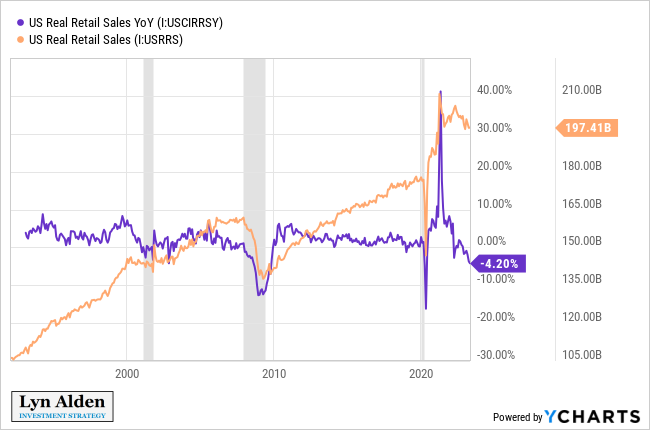

Consumption remains at a remarkably high level, but declines in retail sales point to more difficult quarters ahead.

Has a consumption peak already been reached in the US?

According to economist Lyn Adlen, the downturn in retail sales is more in line with the type of slowdown seen in 2001: the decline in retail sales is likely to bring activity back to pre-Covid crisis levels, erasing the period of consumer exuberance associated with the support measures deployed during lockdowns.

Only a major blowout could make consumers let go.

In 2008, the housing crisis hit consumers hard. Real estate tripped up U.S. consumption.

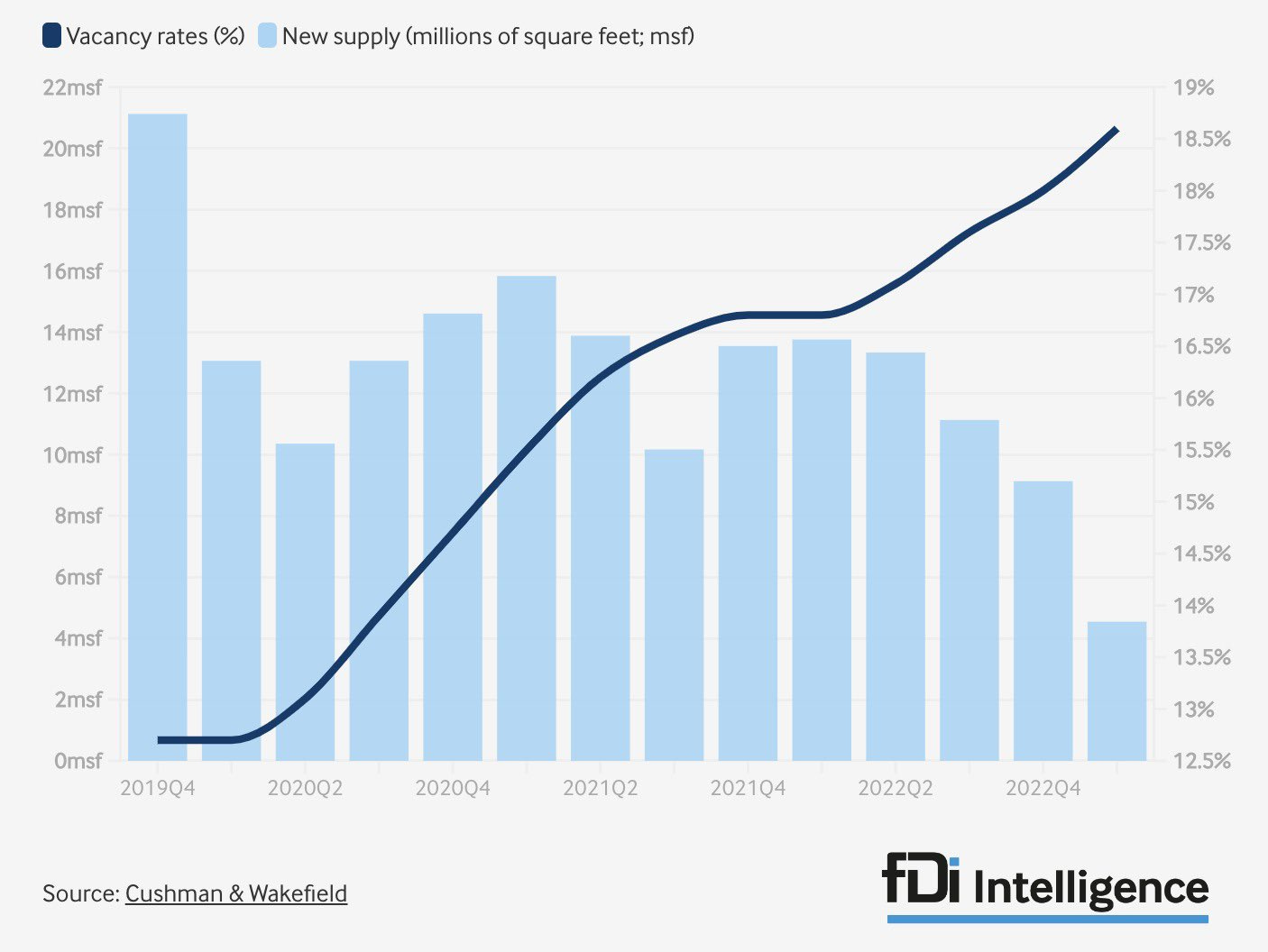

In addition to debt risk, the other risk of blowout is now in the U.S. housing market: according to Morgan Stanley, half of the $2.9 billion in commercial mortgages will have to be renegotiated over the next 24 months, when new lending rates rise by 350 to 450 basis points... In addition, commercial vacancy rates are on the verge of reaching 20%.

This renegotiation is likely to result in significant losses on the assets associated with these commercial real estate products:

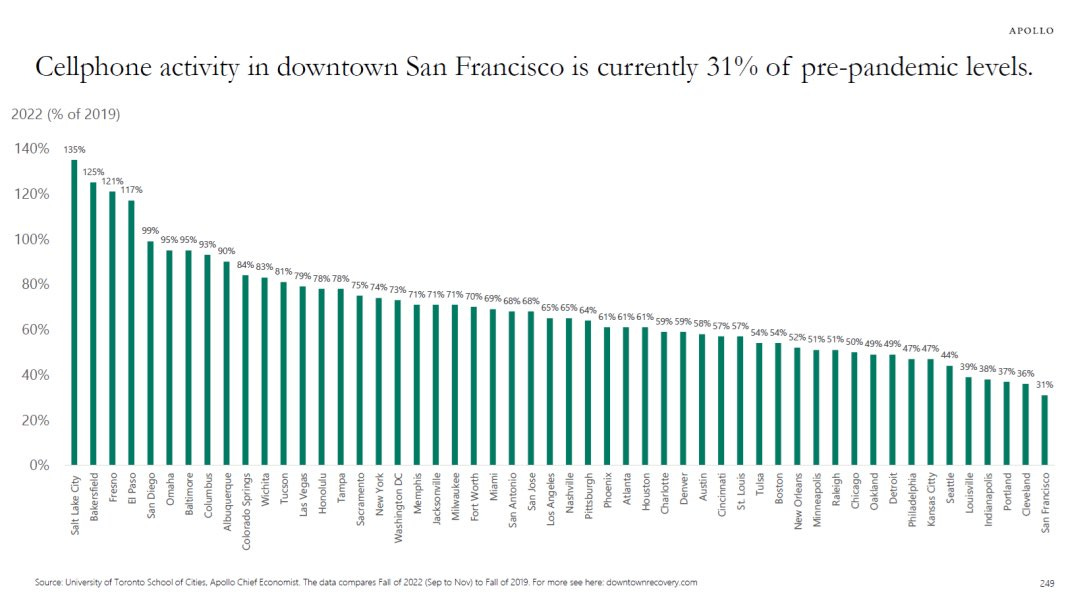

Some business districts are struggling to regain their pre-Covid activity levels. The chart of cell phone activity in downtowns shows a decline in business activity and the pressure that is likely to be placed on commercial real estate in U.S. cities. San Francisco lost two-thirds of the activity in terms of cell phone usage compared to pre-Covid, a sign of a real exodus from downtown commercial areas!

The collapse of U.S. commercial real estate is a threat to the real estate profession, and even more so to the balance sheets of banks. Regional banks are still struggling with losses from Commercial Mortgage Backed Securities (CMBS). But these institutions are not the only ones with this time bomb on their balance sheets.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.