Will the slowdown in the US economy accelerate?

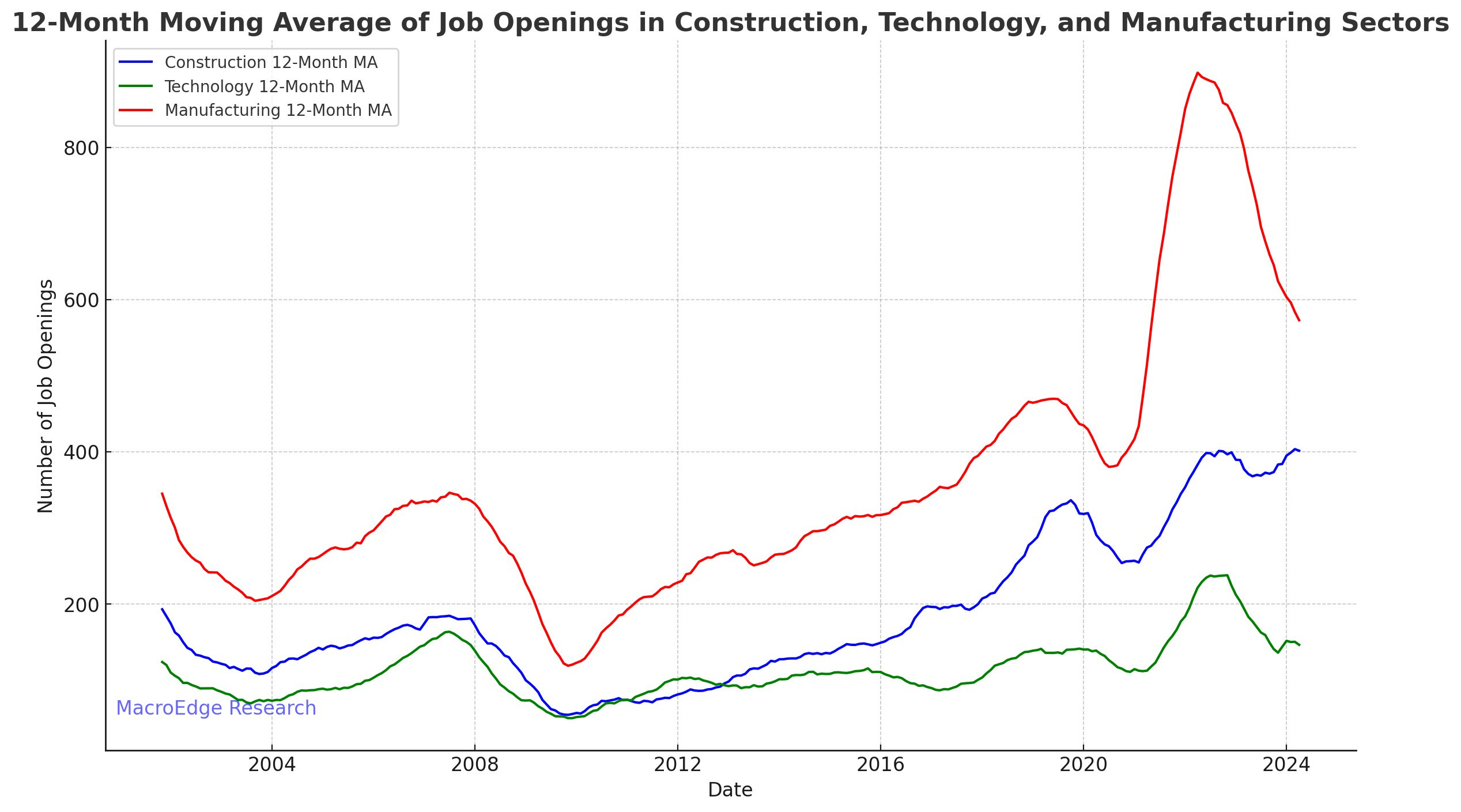

On the employment front, the manufacturing sector is in marked decline, while the construction sector remains relatively buoyant:

The construction sector is under perfusion and benefiting greatly from the vast support plan for the US economy.

But many observers are questioning the reliability of the employment figures.

The fact that the US economy has created jobs for 41 consecutive months is a supportive factor for the markets.

However, a closer look reveals that a record number of these jobs are part-time.

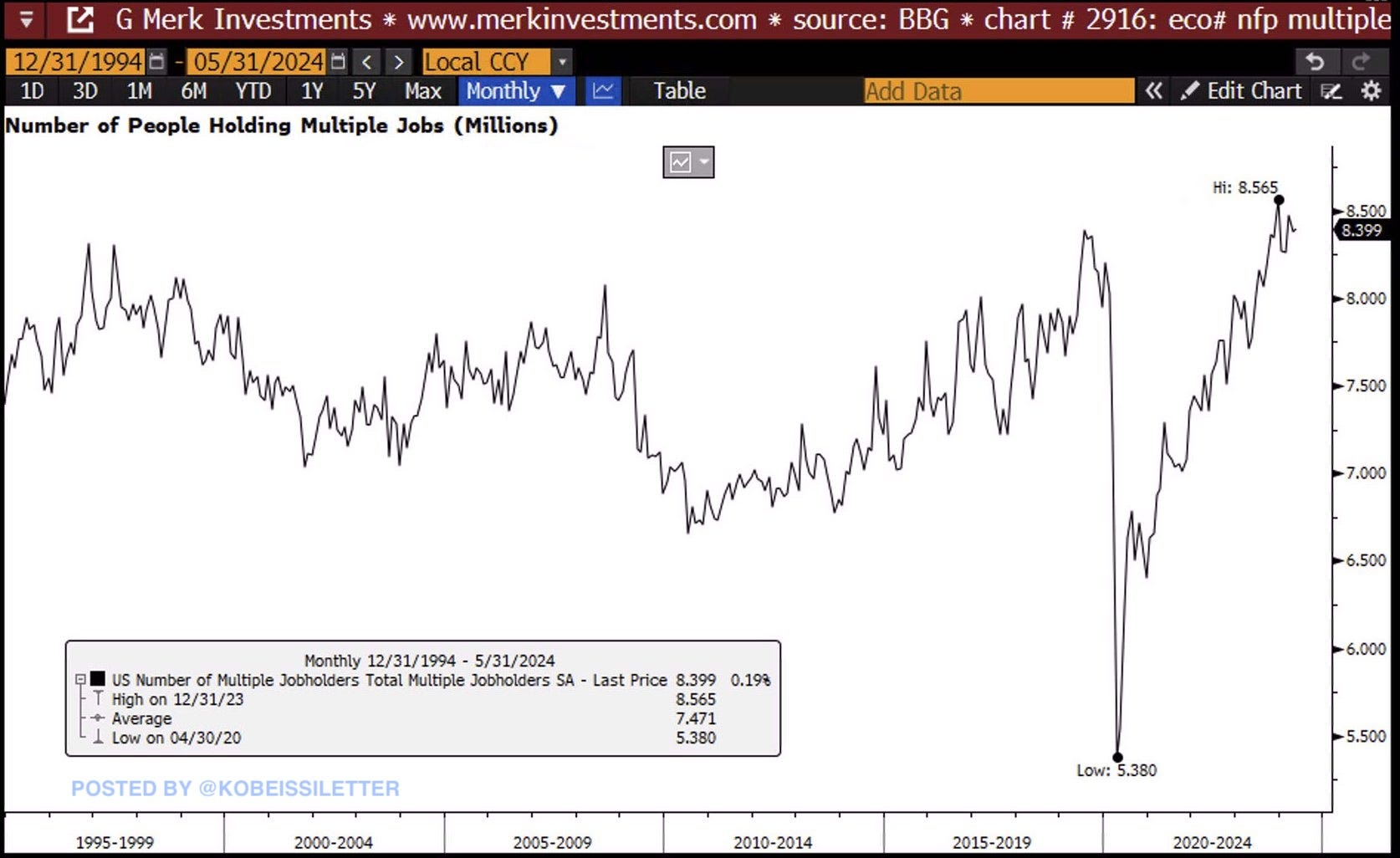

Millions of Americans work multiple jobs to meet their basic needs:

In May 2024, a record 8.4 million people held multiple jobs simultaneously, marking an increase of +3 million compared to the lowest recorded during the pandemic in 2020.

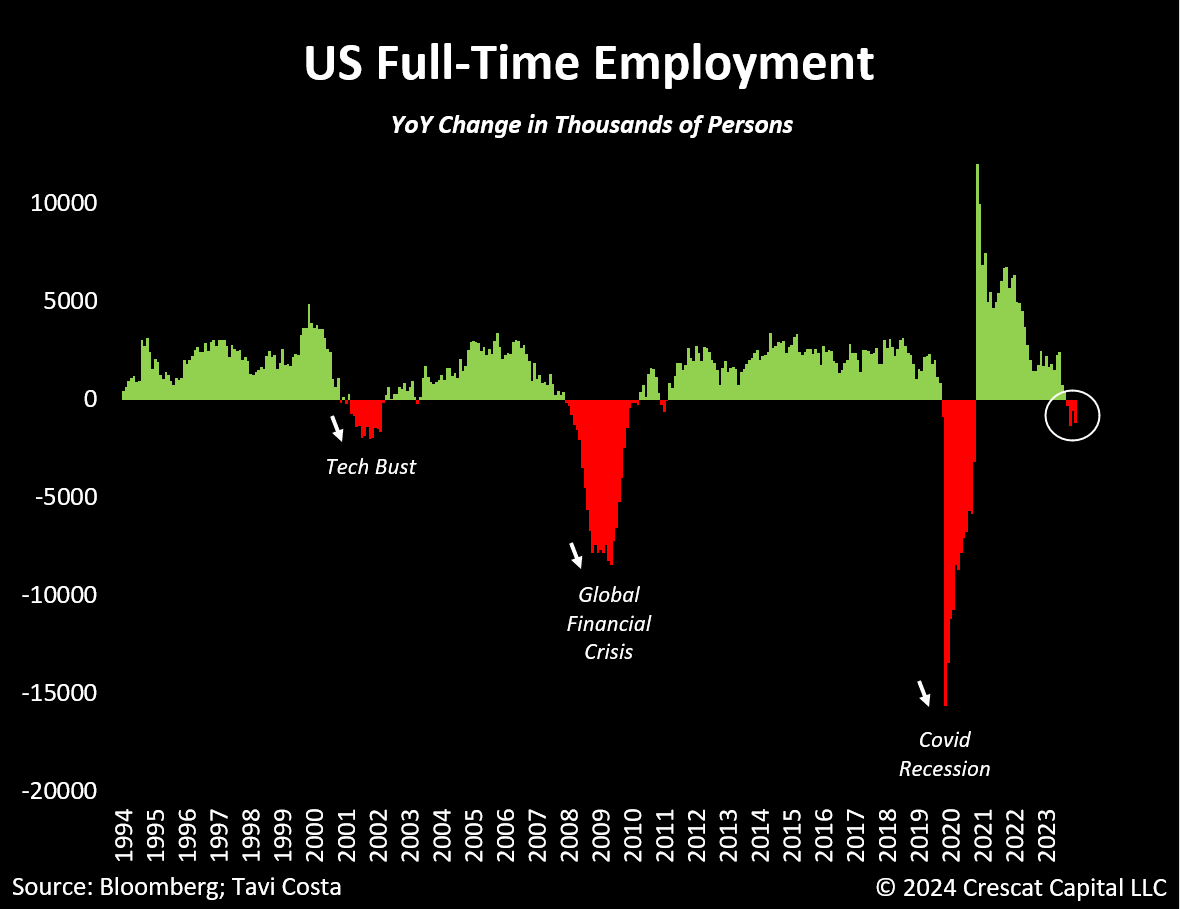

Part-time employment exploded with an increase of +286,000 in May.

Meanwhile, full-time employment fell by -625,000 last month:

For the time being, the rise in part-time employment masks this underlying trend.

That said, another recent phenomenon complicates the analysis of raw US job market data.

According to a new study conducted by Qualtrics among Generation Z Americans, 60% find traditional 9-to-5 jobs exhausting, and 43% say they don't want to work in this type of job.

The phenomenon of quiet quitting, which is gaining ground in the US workplace, is primarily affecting the younger generation. Many segments of the job market remain largely unaffected by the economic downturn, mainly due to a shortage of motivated candidates. The traditional concept of the "daddy job" is no longer popular. Against this backdrop, US employment figures are certainly less representative of the country's true economic situation.

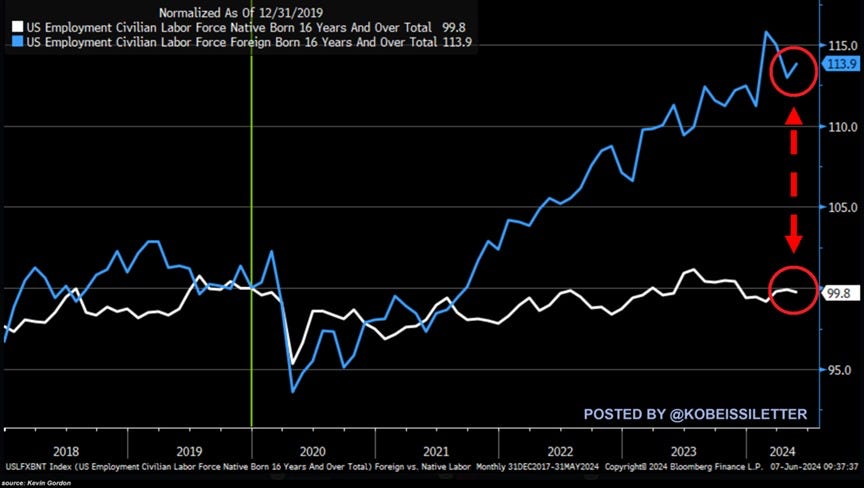

In particular, there are marked contrasts depending on the nationality of the workers. Since 2021, the healthy job market has particularly benefited foreign workers:

Several analyses can be drawn from these figures:

The US government's support measures in the construction sector have mainly benefited low-skilled jobs, of which new arrivals on American soil are often the first beneficiaries.

The increase in part-time work has probably also affected a significant proportion of this population.

What factor has profoundly transformed the structure of the US job market? Inflation.

The rising cost of living is forcing employees to hold down several jobs, or to gradually resign from a position that no longer guarantees a sufficient income to maintain their standard of living. Real wages have fallen over the last five years, with a much greater impact on the labor market than expected.

Employment figures must therefore be analyzed with great precision, taking into account inflation data.

The Fed seems to have abandoned its fight against inflation and the markets are now expecting a rate cut before the next US elections.

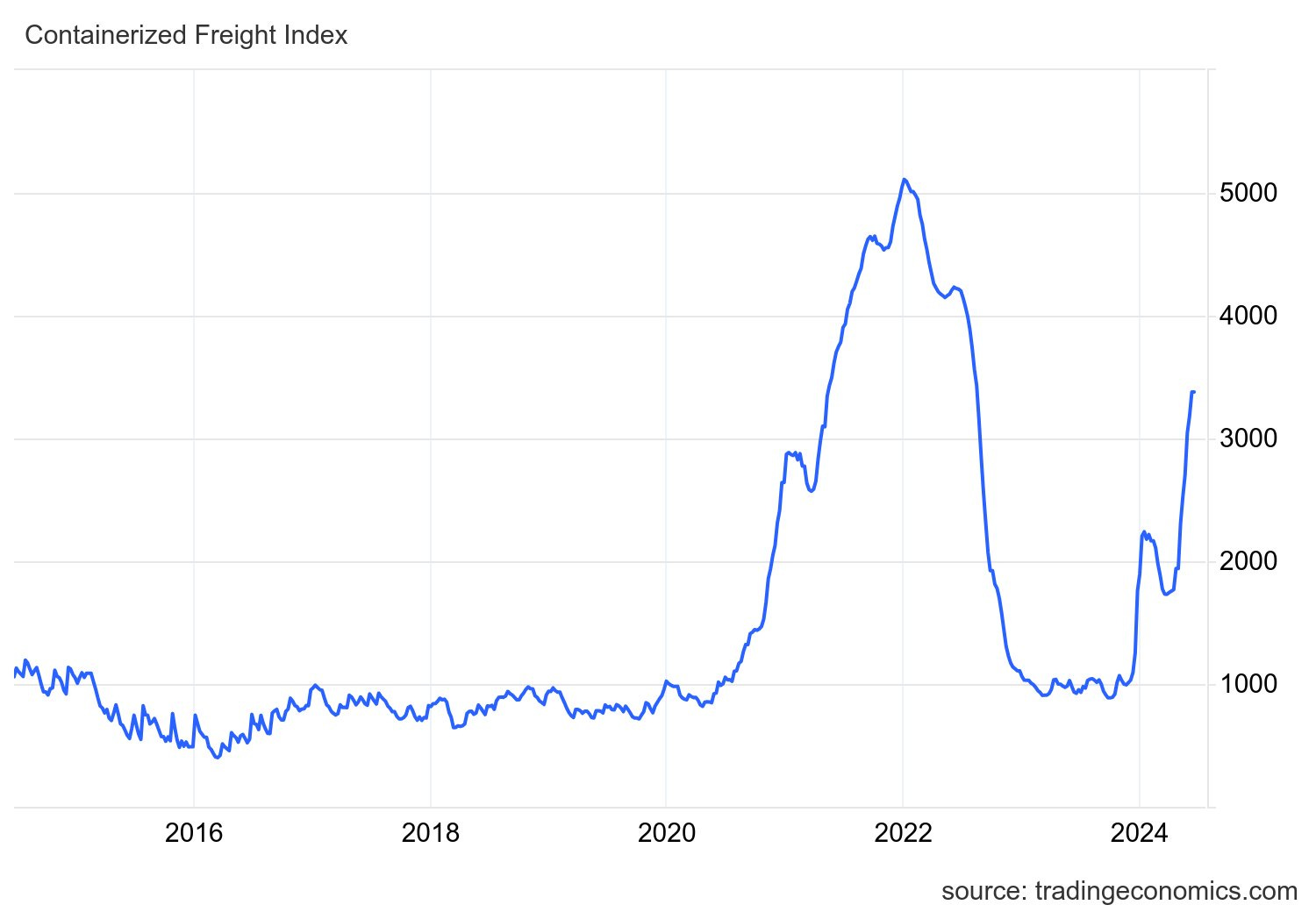

However, signs of a resurgence in inflation are becoming clearer: rents are on the rise again, and shipping costs are rising sharply, pointing to higher prices for producers in the months ahead.

Production line bottlenecks remain unresolved. In a recent interview, Airbus CEO Guillaume Faury explains that engine shortages are now becoming a sticking point:

"That is a new situation that we were not expecting."

"Airbus is missing parts everywhere."

Supply chain problems are once again intensifying, accompanied by threats of a sustained upturn in inflation.

Inflation, for example, has considerably clouded the analysis of US employment figures.

The entry of the US economy into recession is likely to be much less predictable if we rely solely on the analysis of employment figures.

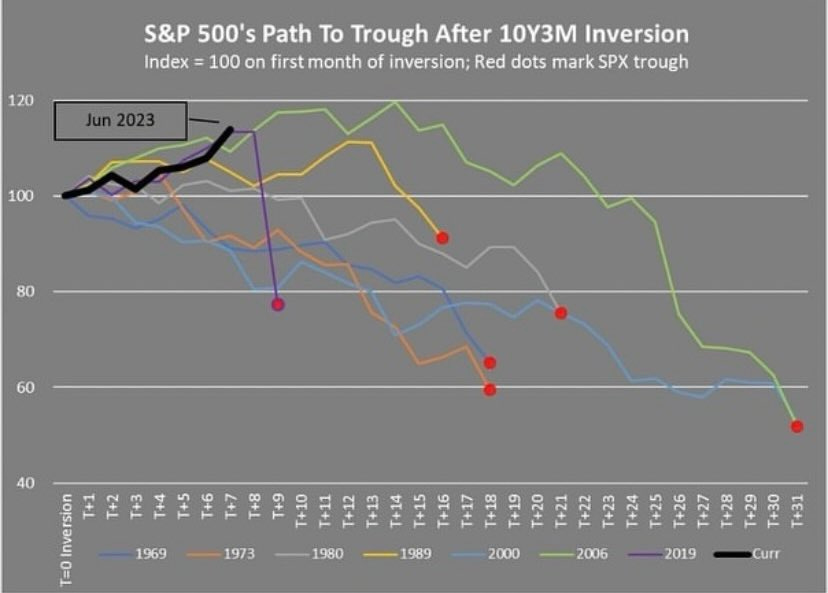

There is another, more effective tool for detecting the US economy's entry into recession: the inversion of the yield curve.

Yield curve inversion has always coincided with periods of recession. We have already observed an inversion of the yield curve in October 2022. The longer the period of inversion lasts, the deeper the recession that follows.

Not since the post-war period have markets enjoyed such prolonged support with such a sustained inversion of the {10-year/3-month} yield curve!

If history repeats itself, a recession would be even more damaging to the markets than previous recessions.

This week, Tavi Costa published a very interesting chart of the 2-year/30-year yield ratio:

This chart is particularly interesting, as it highlights how close we are to breaking bearish support on this yield ratio.

In other words, the end of the rate inversion period is in sight. It is precisely at the end of this period of inversion that the risk of recession becomes more pronounced.

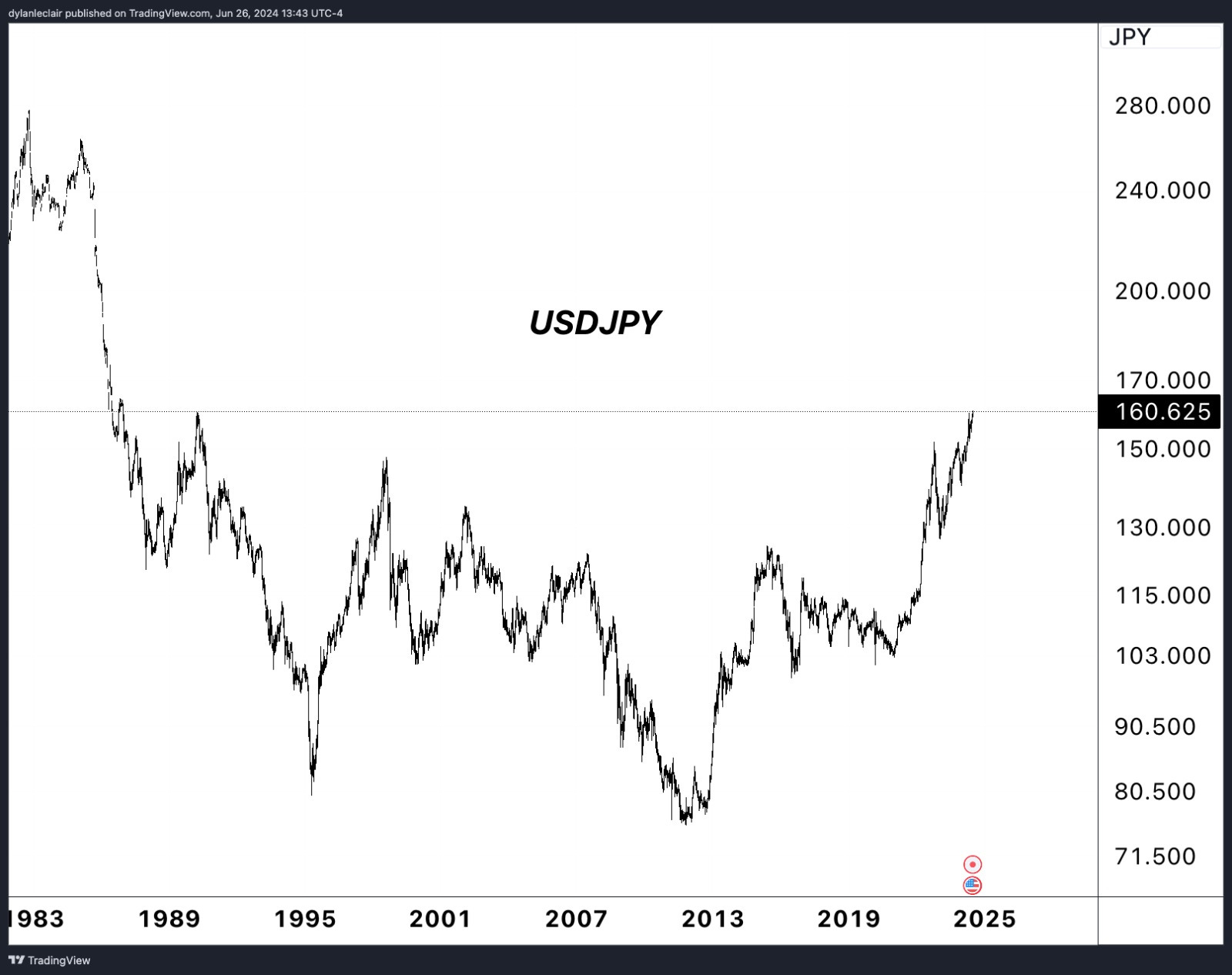

While we await this signal of recession, the dollar continues to set new records against the yen: the Japanese currency has never been so weak against the greenback since 1986!

The price of gold remains under pressure in this context of a resumption of the rise in the US dollar and continues to consolidate after its recent breakout:

The coming weeks are likely to be highly volatile, with the French elections and the Japanese Central Bank's reaction to the yen's weakness likely to exacerbate tensions on all markets.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.