Stagflation in the United States, Monetary Crisis in Japan

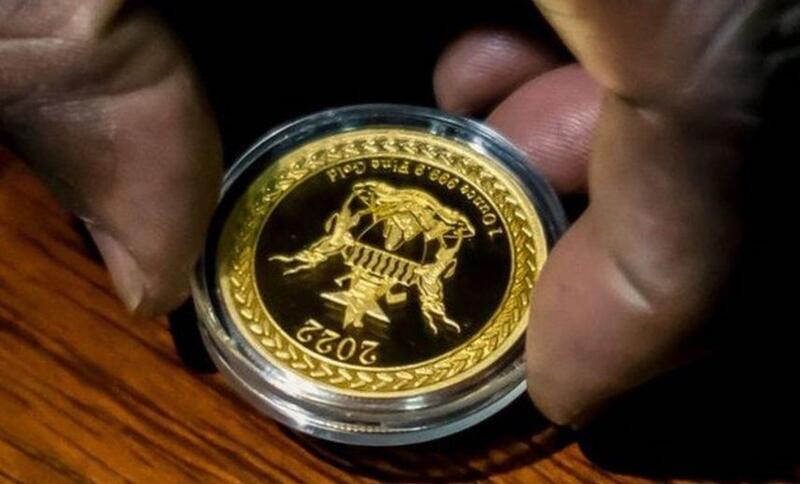

China is trying to slow down the gold-buying craze, while economic pressures in Japan and the United States keep gold as an attractive asset despite high stock market valuations.

Read article