As I predicted in a recent article, inflation seems to be picking up again in the United States. Although forecasts suggested a year-on-year increase of 1.6%, September's Producer Price Index (PPI) actually rose by 2.2%. In addition, August's readings were revised upwards from +1.6% to +2.0%. The PPI index climbs for the third consecutive month. These figures point to a resumption of CPI growth in the coming months.

The inflation slowdown was only transitory...

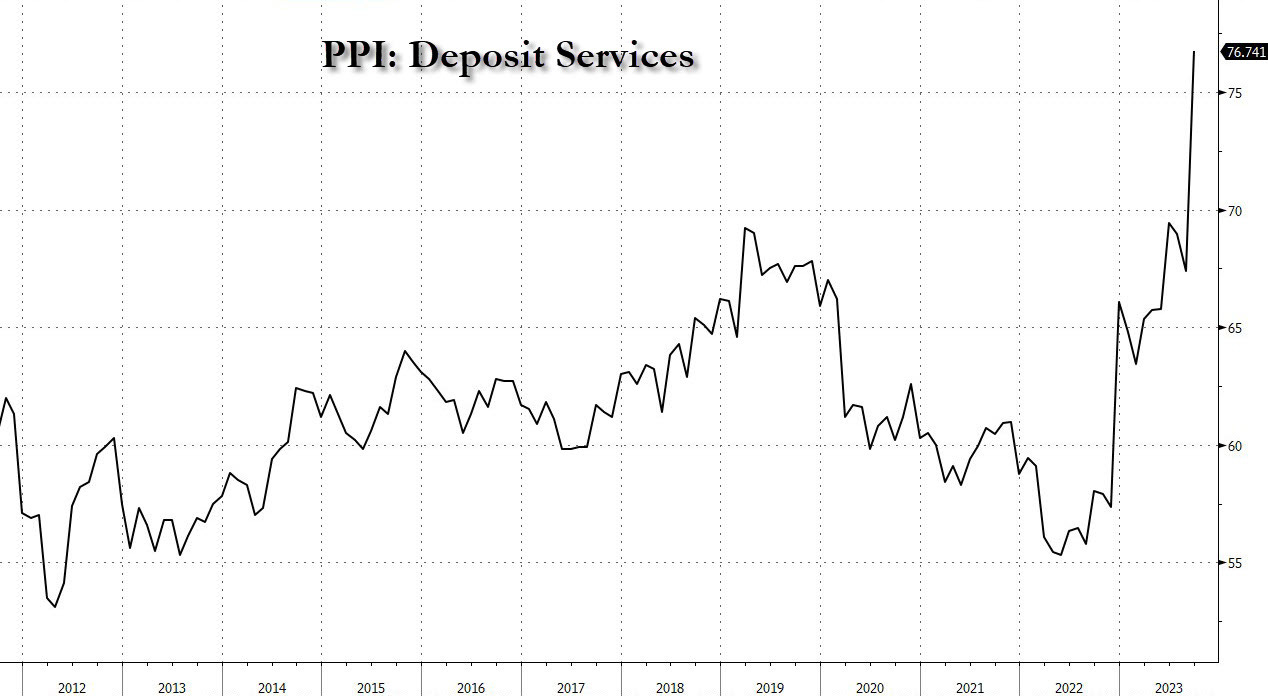

Let's take a closer look at what's behind the rise in this CPI index. Of all the components responsible for the renewed rise in prices paid by producers, the Deposit Services category:

What are Deposit Services?

Deposit Services are services related to savings accounts, current accounts, term accounts and other types of deposits. They are generally provided by banks and financial institutions.

The rise in interest rates has logically led to an increase in service costs. These services have risen by over 50% since the beginning of the year, and these new costs are largely responsible for the rise in inflation.

In other words, the Fed's rate hikes over the past year are now fuelling the very inflation they were designed to combat!

Excluding food and energy, the core producer price index rose by 2.7%, 0.4% more than expected. This is the first increase in the Core PPI index since April 2022.

Those who expected inflation in the United States to fall sharply may well have underestimated the resilience of the consumer and the staggering level of government spending that is underpinning activity.

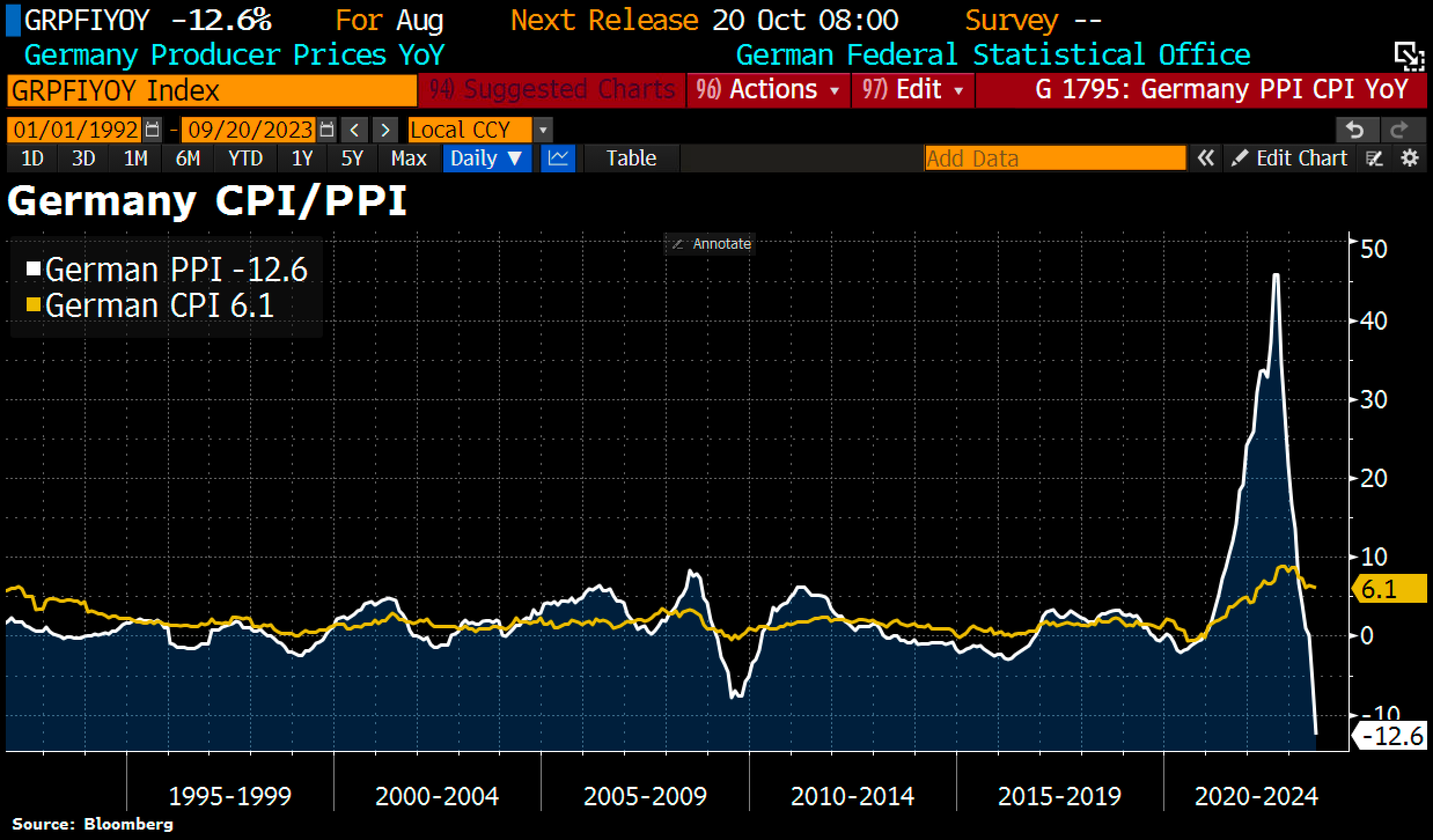

The situation is not the same in Germany, where the PPI index is falling at a historic pace. The correction has been severe since last year's inflation peak:

This downturn can be attributed to a fall in business orders.

Some sectors of the German economy are facing a real economic meltdown. The PMI construction index fell to 39.3 in September, compared with 41.5 in August. This is the lowest level ever recorded. The sector hasn't seen a situation like this since 1960!

As the saying goes, "When construction goes, everything goes". In Germany, the opposite is currently true.

These figures indicate the imminence of a deeper-than-expected recession in the country.

Meanwhile, oil remains at high levels, above $80:

Geopolitical tensions in the Middle East have not led to a price explosion. Iran's involvement in the Hamas attack on Israel is far from being confirmed by the US military. For the moment, the market does not seem concerned by a regional escalation of the conflict.

In any case, geopolitical tensions are having less and less effect on oil and gold prices in the short term. The market is less "reactive" to current events. Participants now know how to cope with and "digest" the volatility caused by these developments on future markets. On the other hand, in the long term, the deteriorating geopolitical context is sustaining price rises to significant levels.

Gold had begun to rebound from its consolidation channel, correcting its oversold situation. For the time being, there is no sign of this rebound continuing:

There's nothing much to report on interest rates either.

The bond market is not really easing. There is no "flight to safety" into Treasury bonds. US yields have remained at high levels since the latest episode of tension in the Middle East.

However, a large majority of analysts expect rates to ease significantly in the coming weeks. Those analyzing the 10-year chart are hoping to see a significant drop thanks to the MACD reversal in progress:

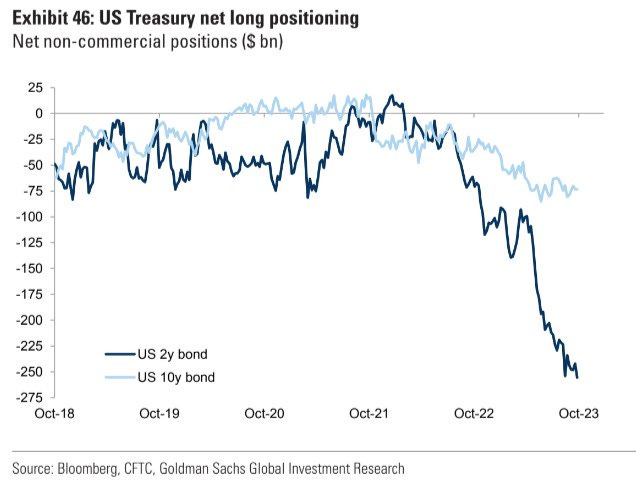

This reversal in rates would technically be encouraged by a massive short squeeze (a historic number of hedge funds are short the 10-year):

An easing in interest rates would trigger a massive redemption of these short positions. The 4.35% support level should be watched this week.

A recent Reuters poll indicates that 19 out of 26 economists believe rates have peaked in the current cycle.

One third of US debt must be refinanced over the next twelve months. Economists predict that the current high level of rates will not allow this operation to take place, and that the Fed will certainly have to intervene to lower the cost of refinancing.

With inflation back on track, this type of intervention is nevertheless difficult to envisage. But time is running out, and the debt wall is closing in.

In addition to the geopolitical situation, there is also likely to be a great deal of unrest on the US debt front.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.