Will the United States avoid a recession?

Some indicators continue to support the thesis of a soft landing for the economy.

The strong performance of Fedex, which many observers see as a sign of consumer resilience, confirms that consumer spending is holding up well in the U.S. for now.

If the U.S. had entered a recession, Fedex stock would not have rebounded to the top of its uptrend channel.

We will try to analyze the reasons why consumption is holding up and see how this situation is unfortunately, not sustainable.

Consumption is holding up, thanks to several factors:

First, Americans are making massive use of the credit facilities offered by the credit agencies: 36% of adults now have more debt than savings, an historic figure. Total credit card debt has reached a record $986 billion, up 15% from last year (+7% in the last quarter!). The increase in inflation has therefore been directly reflected, by percentage, in household debt. Americans are fighting inflation by taking out more consumer credit. 46% of them are unable to pay off this debt from month to month, thus deferring more and more money. Interest on credit cards is now approaching a record annual rate of 25%... It is difficult to imagine how this cycle could continue with such high rates. This massive reliance on credit seems mathematically unsustainable in the long run.

Another explanation for the resilience of American consumption is that the government continues to stimulate the economy by increasing its spending.

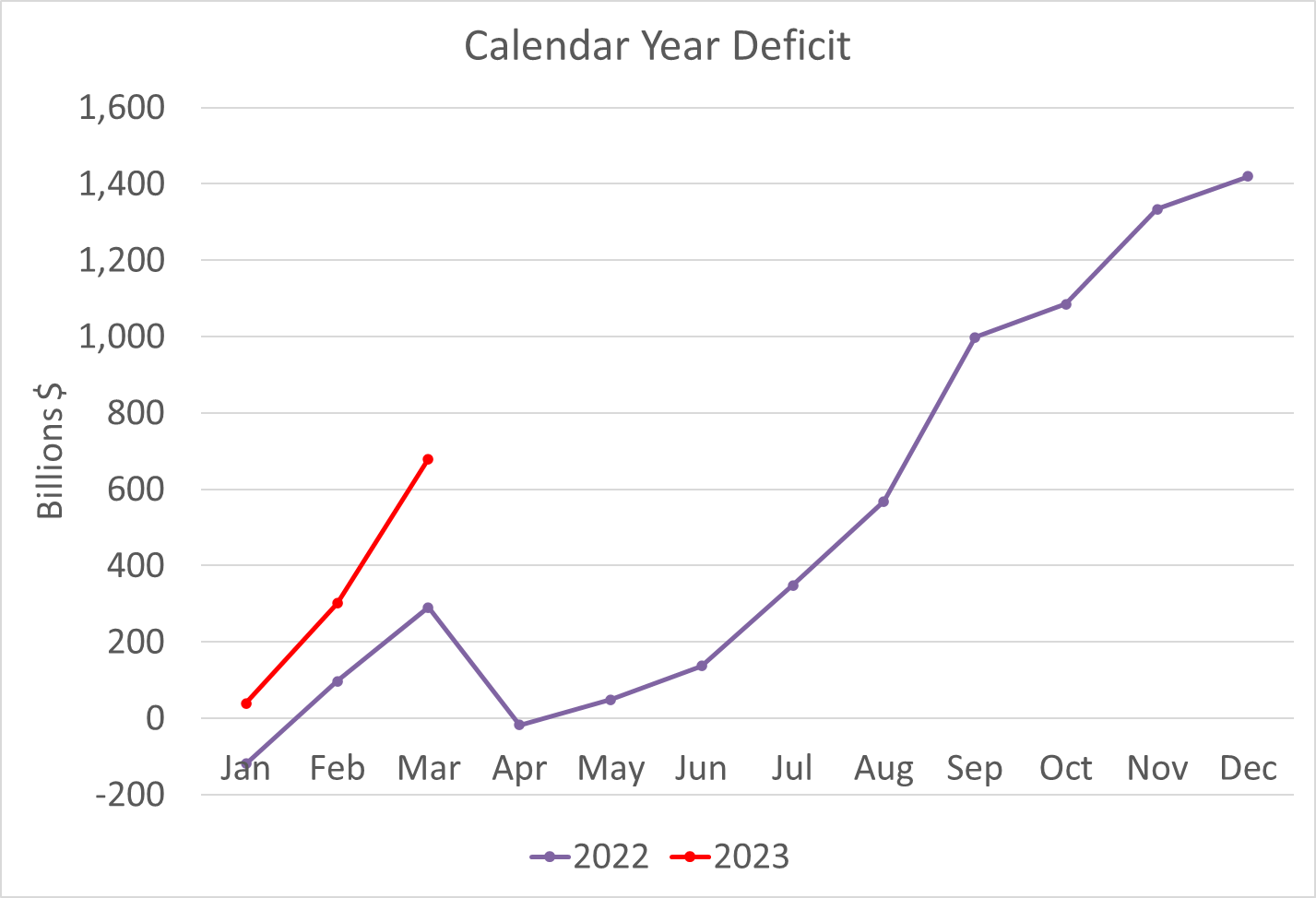

While revenues have stalled at the beginning of the year, the US deficit is exploding to record levels:

This support is no longer sustainable over time. The debt wall will very quickly impose budgetary restrictions on the government, and the spending promises are not in line with the level of the deficit. Every day, the government is taking on an additional $6 billion in debt. The national deficit has grown by nearly $400 billion in a single month, or more than $1,000 per capita, which represents a $5,000 shortfall for a family of five! Such a level of deficit would be untenable for a head of family, so can we trust such a poorly managed government? By the way, with a $50 billion deficit last month, the situation in France is also worrying. Like the United States, the country is in the red. Government support measures to boost consumption will logically reach their limits and it is very likely that economic activity will also suffer from the consequences of the debt wall towards which the United States is heading at high speed.

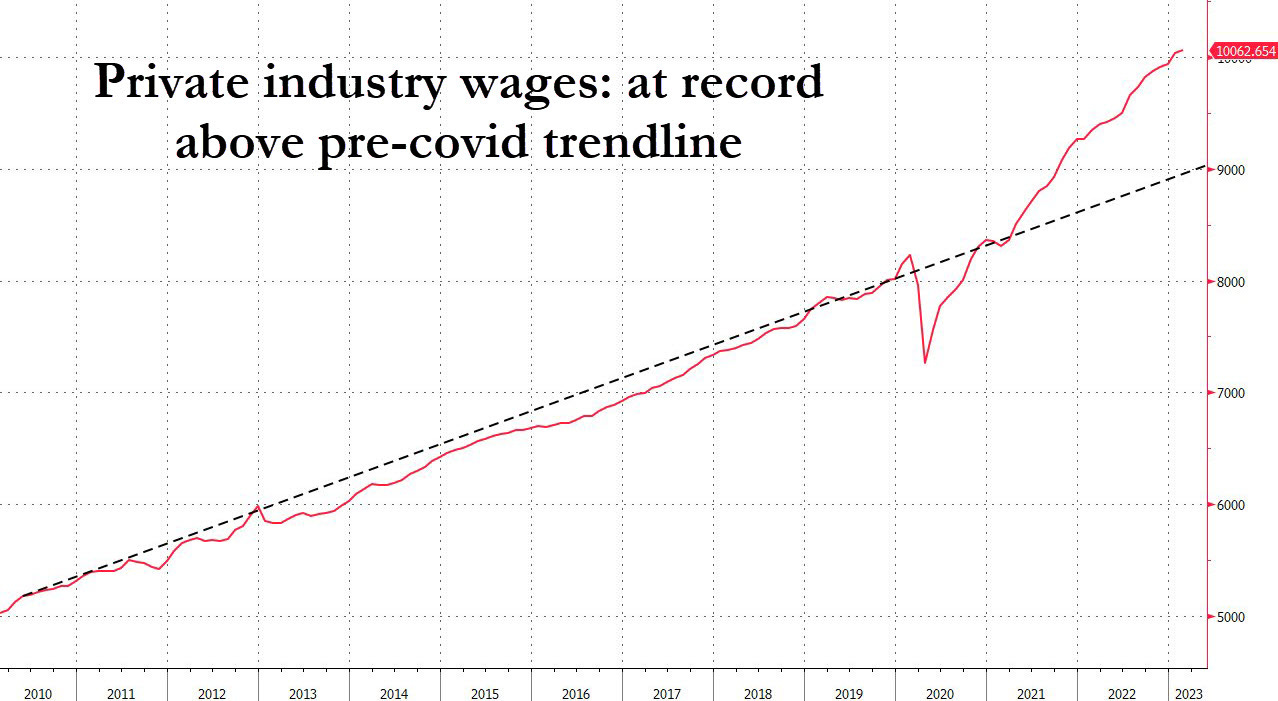

The third reason for the resilience of U.S. consumption is to be found in wages, which have risen very significantly since the start of the inflationary surge. Unlike in Europe, US wages are keeping pace with price increases, thanks to a very tight labor market supported by robust consumption. The latest U.S. employment figures seem to indicate an easing of these tensions. But this has not yet been reflected in wage levels, which have risen in recent weeks at a much higher rate than before the Covid crisis:

Inflation does not affect consumption because consumers are able to increase their income. It is precisely this inflationary spiral that the Fed is trying to break by acting on rates, without really succeeding so far.

Rising interest rates are decimating an essential sector of the US economy: the real estate market is going through an even greater crisis than in 2008, with commercial real estate being the most at risk.

Office vacancy rates are at an all-time high:

Faced with this increase in supply, there is another concern: transactions are collapsing. Real estate rates, which have doubled in just one year, are no longer affordable for properties that have not yet been priced down.

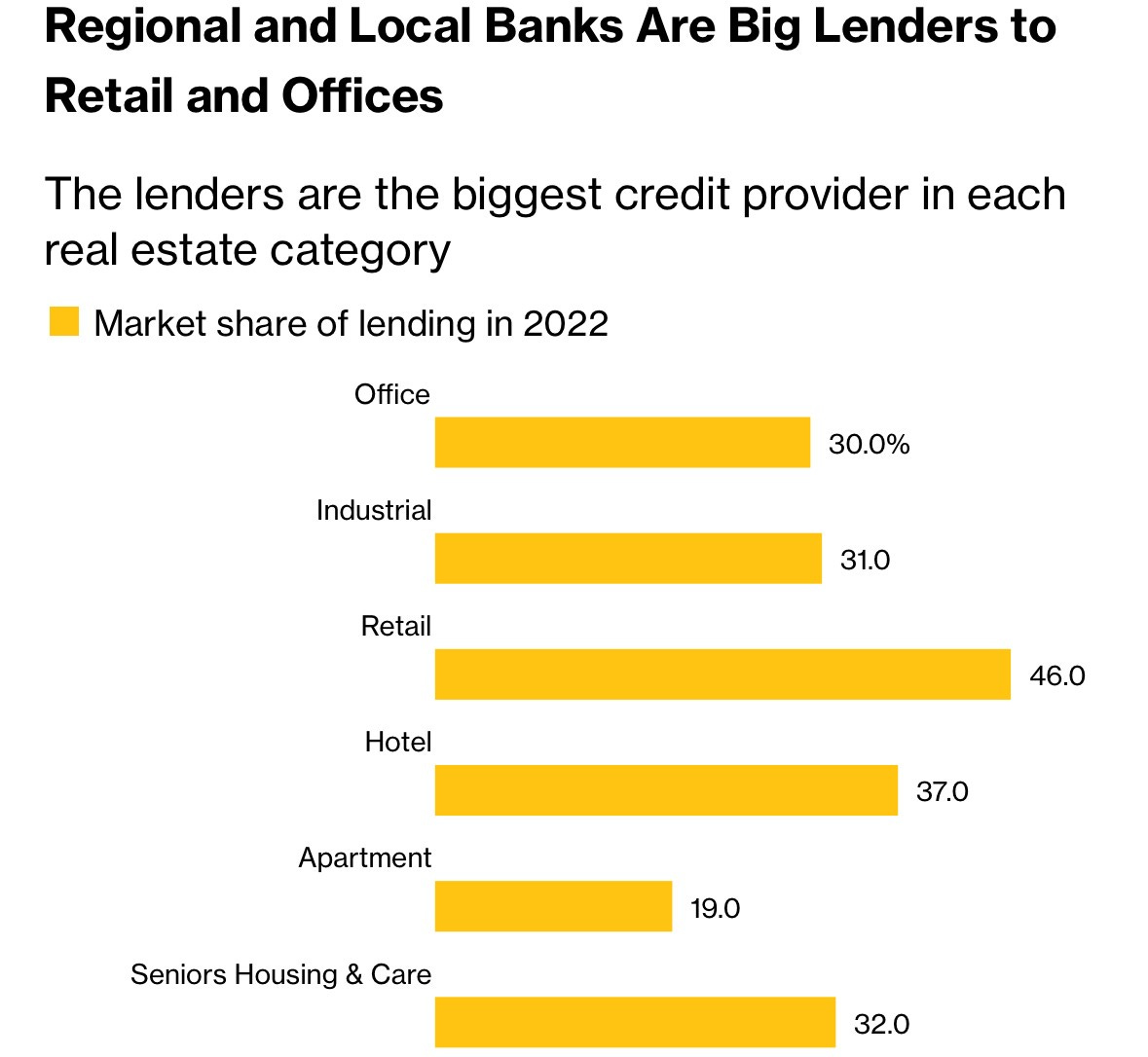

Not only is the crisis affecting new programs, but also the entire sector: $1.5 trillion in commercial real estate loans must be "rolled over" by 2025. With rates rising, the risk of default on loan renewals is high.

This real estate crisis is already having a major impact on regional banks, which are the largest holders of commercial real estate-related bonds and are understandably exposed to defaults in this sector.

The commercial real estate debt crisis now represents one of the greatest threats to U.S. economic activity, particularly because of the disastrous effects it is likely to have on the regional banking sector.

The ongoing banking crisis is the result of concerns about U.S. regional banks:

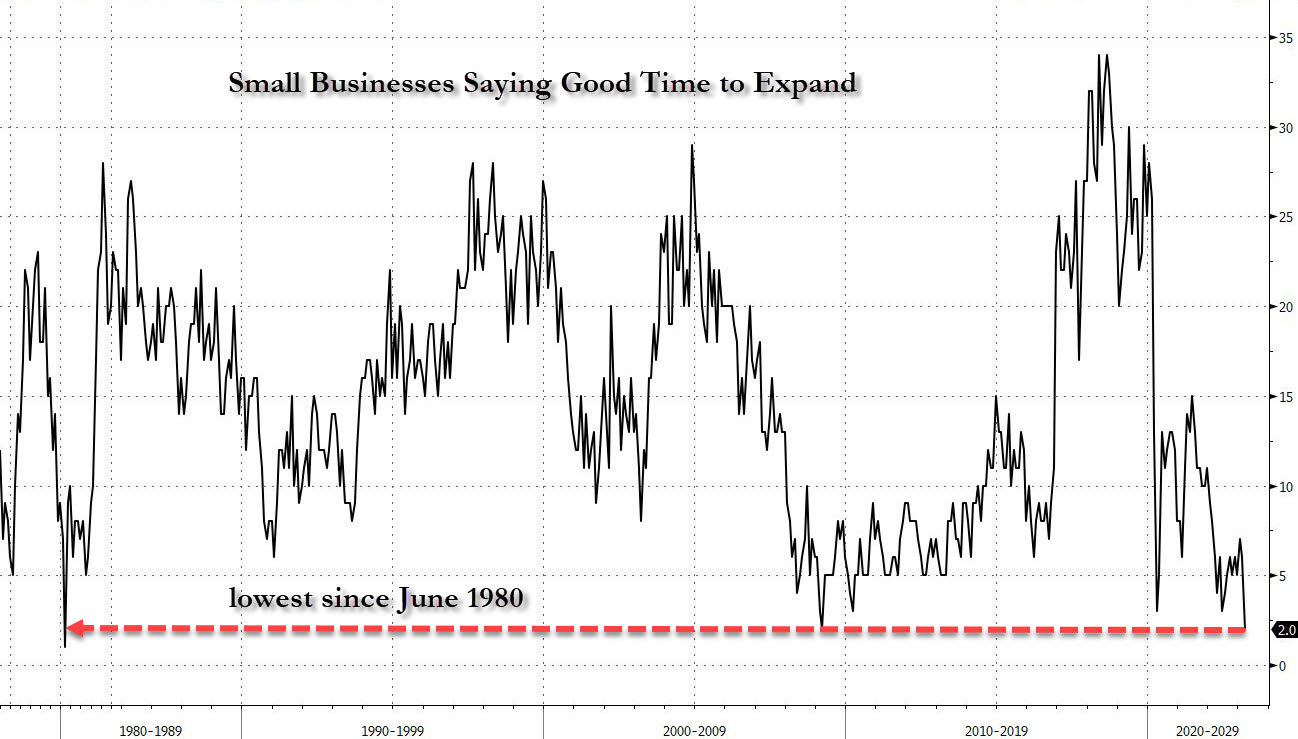

Threats to commercial real estate are profoundly affecting small business forecasts in the United States.

Not since 1980 have small businesses been so reluctant to expand their business:

How could one imagine that consumption will continue to be sustained at a time when Main Street is throwing in the towel?

These threats are not reflected in the stock market, which is supported by the healthy condition of large caps.

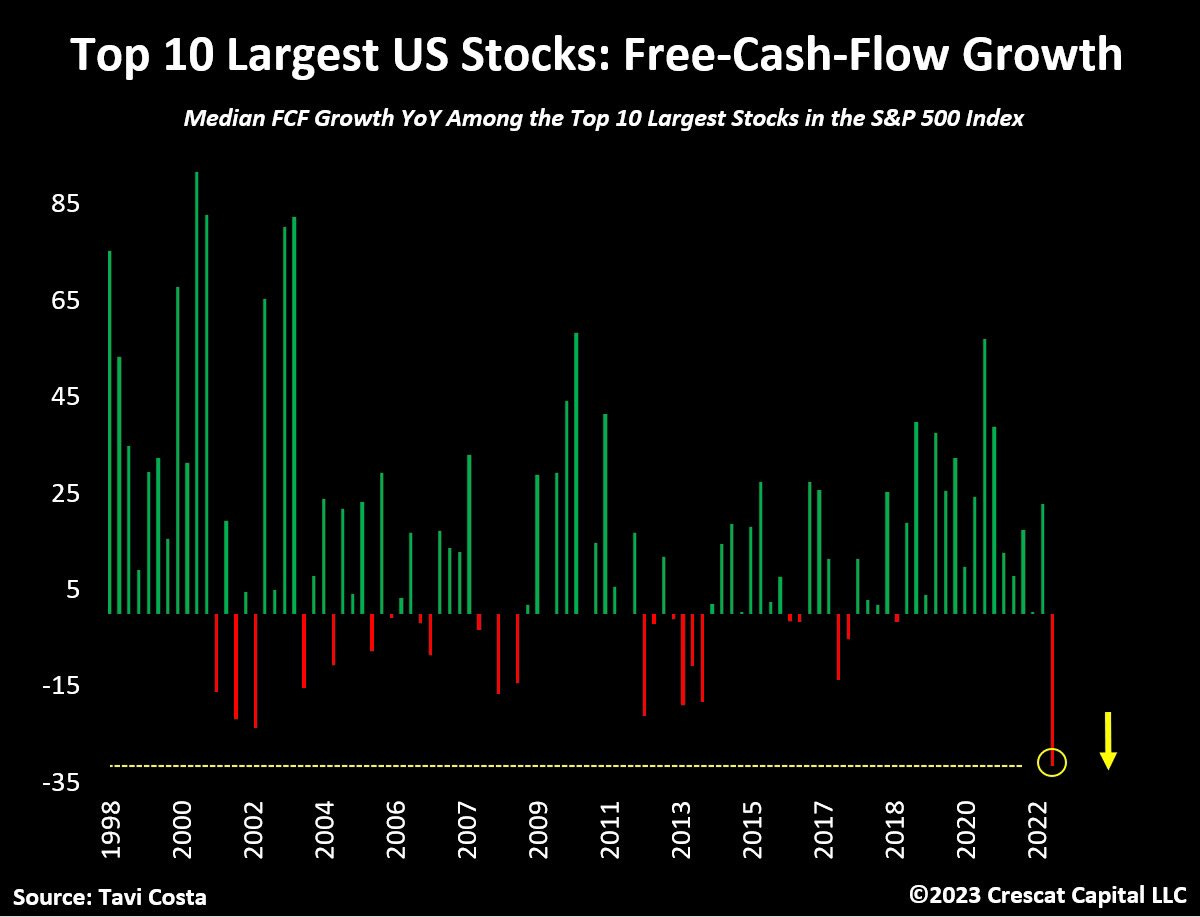

Otavio Costa is one of the few analysts betting on a sharp decline in the stars of the US stock market. According to him, what is happening at the level of small companies will soon be reflected in the activity of large caps. The economist from Crescat Capital also points out that the free cash flow of the ten biggest companies was down significantly last quarter:

An opinion that is far from being shared today. The banking crisis and the threats to activity are not significantly affecting large caps, according to most market analysts.

It is as if the level of U.S. equities is the last line of defence to support the economy.

Unfortunately, the good shape of the consumer is not sustainable in such a high interest rate environment, as we have just seen. How could this decline in consumption spare US companies? It is at the moment when the latter start to be affected that some observers will predict a change in monetary policy. According to analysts, this "pivot" would explain the valuation level of large caps.

The debt/GDP ratio is now too high to continue the restrictive monetary policy. The Fed is stuck, it has no choice but to stop its fight against inflation in a context of economic slowdown. Stagflation is now inevitable.

It is precisely this type of stalemate and stagflationary environment that gold loves.

The price of gold in euros broke its all-time record this week, to the general indifference.

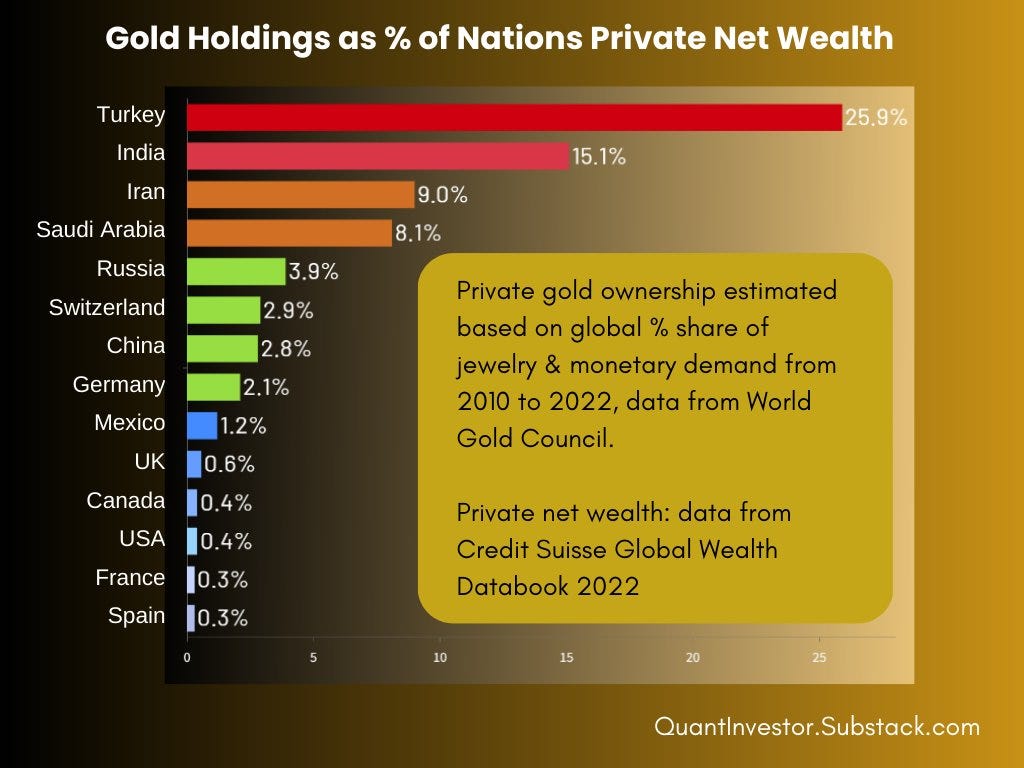

However, the share of savings allocated to gold has never been so low, especially in Europe. This is particularly true in France, where only 0.3% of private assets are held in gold!

The price of gold is already at an all-time high while hardly anyone is talking about it and the movement of allocation towards this type of investment (in countries however, strongly impacted by a stagflationary environment very favorable to the yellow metal) has not yet started.

It is for this fundamental reason that I remain strongly bullish on gold in the long term!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.