Wednesday, June 12 was a special day, with the release of the US Consumer Price Index (CPI) and the Fed meeting.

The last time a day like this took place was in 2020. At that time, the price of gold soared, as the market became aware of the imminent arrival of an inflationary wave that the Fed would find difficult to contain.

Four years on, the situation is completely different. The question was whether inflation would finally continue to fall, and whether the Fed would be convinced enough by this fall to lower rates.

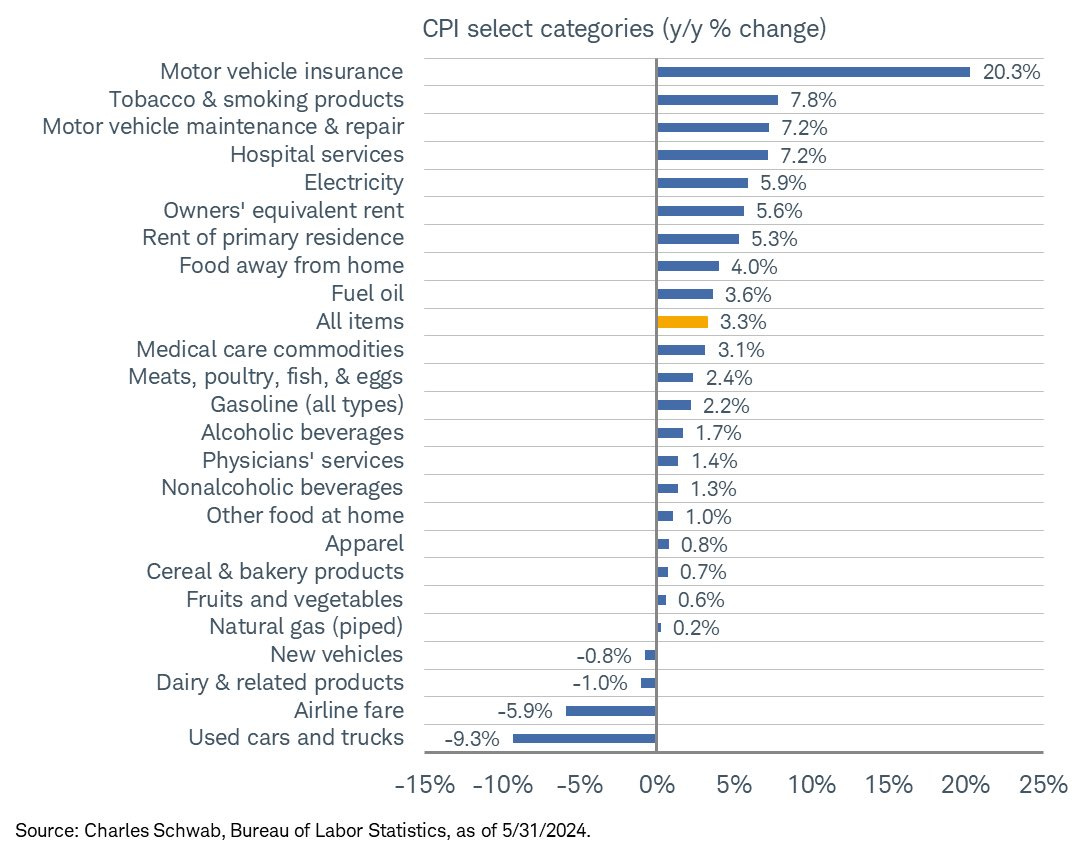

The CPI inflation figure is in, and it's better than expected. Overall, inflation is below expectations. However, looking at the details, few spending items remain in a contained dynamic, and the service sector continues to soar:

Gasoline prices kept the CPI index on track last month.

This is a direct consequence of the fall in oil prices since April:

Thus, oil's behavior is the key to the next inflation figure. Any new geopolitical tension could rekindle inflation, preventing it from returning to pre-Covid levels.

Other news of the day: the Fed has opted to maintain the status quo by leaving rates unchanged.

The Fed's statement suggests a single rate cut in 2024, a far cry from the six to seven rate cuts anticipated at the end of last year...

The Fed also believes that it is prudent not to be too aggressive and cut rates too quickly, which shows that it now perceives inflation to be more persistent than expected. This marks a turnaround from its speech at the end of last year, when it confidently claimed to have inflation under control.

In the absence of a rate cut and with CPI below expectations, gold is logically reacting to the downside, although trading volume remains very low.

Open interest on COMEX futures reached its lowest level since March, returning to the level of March 1, when gold was trading at $2,070:

This drop in open interest looks more like hedging short positions than liquidating long positions.

Since gold broke the $2,000 mark, it has lost all its speculative momentum. This could be good news for further gains. Historically, gold tends to stop correcting when the number of contracts on futures markets reaches low levels, as is currently the case. This low level of activity could pave the way for further upside.

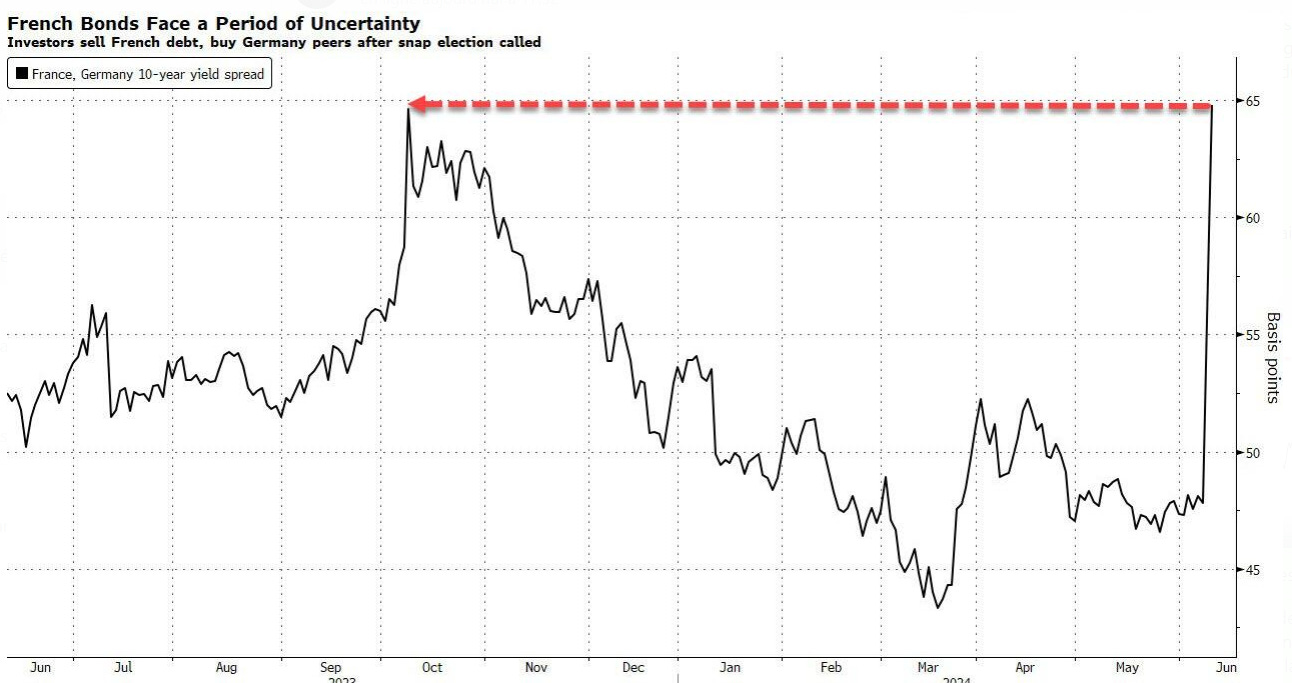

The drop in volumes on gold markets contrasts sharply with the tension observed on European bond markets.

The dissolution of the French National Assembly intensified tensions on the French bond market. This political instability led to a spectacular jump in the spread between the French 10-year and the German 10-year:

The French 10-year is clearly in a new uptrend pattern:

In a single session, Société Générale erased virtually all of its annual gains:

Investors are betting on a weakening of the French bank's capitalization should the French bond sector come under pressure.

Volumes are significant, proof that markets are taking the risk of political instability in France seriously.

Like its European neighbors, France is suffering from a weakening middle class.

The share of wages in GDP has been falling steadily over the past few years, and the enrichment effect of rising equity markets is affecting only one in ten European households. Meanwhile, wage earners are getting poorer, and their savings are declining in real terms due to inflation:

Tensions in France are enabling the dollar to hold on to its bullish support and cancel out its downward movement for the time being. The surprise dissolution of the National Assembly is creating a new dynamic in Europe, easing downward pressure on the dollar:

For the time being, the euro is managing to maintain its position above its support:

The results of the first round of French parliamentary elections in two weeks' time will provide a clearer indication of the dollar's short-term behavior.

The dollar's recent rise against the euro and the fall of gold in dollars have failed to break the first support of gold in euros:

The situation for silver in euros is more fragile. A bearish divergence has formed, threatening to break the uptrend started on May 1:

Bearish silver traders are aiming their first target at a re-test of the silver breakout in euros at €24, which would coincide with a safe-haven trade on the dollar should France become unstable on June 30:

However, the situation on the physical market complicates matters: stocks in China are at record lows. It's hard to speculate on the COMEX when stocks are disappearing in Shanghai!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.