Japanese 10-year bond yields reached their highest level since 2011 this week:

This means that the value of bonds issued by Japan over the past 13 years has fallen considerably.

This loss on Japanese bonds is compounded by the yen's depreciation against the dollar. The year 2022 marked the end of a 10-year consolidation. Since the marked return of inflation in 2022, the dollar has soared against the yen:

The fall in the yen is spurring inflation in Japan, forcing the Bank of Japan to intervene on the foreign exchange market.

The latest intervention took place at the beginning of May:

The USD/JPY ratio fell significantly on the week. The dollar lost 3.5% against the yen in the first week of May.

However, in the following weeks, the yen continued to plummet against the greenback, undoing all the efforts of the BoJ's intervention:

At the end of May, the Bank of Japan once again appears to be in a bind: to defend the yen, it is obliged to allow interest rates to rise. However, with such a high level of debt, the country has little room for manoeuvre. In this context, depreciation of the Japanese currency seems the most logical outcome.

The US Federal Reserve (Fed) is on the verge of a similar impasse.

US rates are on the rise again:

The yield curve shows no sign of coming down in the short term; on the contrary, we are now back in a cycle of rising rates. This is bad news for all bond and real estate asset holders, who are eagerly awaiting a rate cut. We're not heading that way, at least not in the short term.

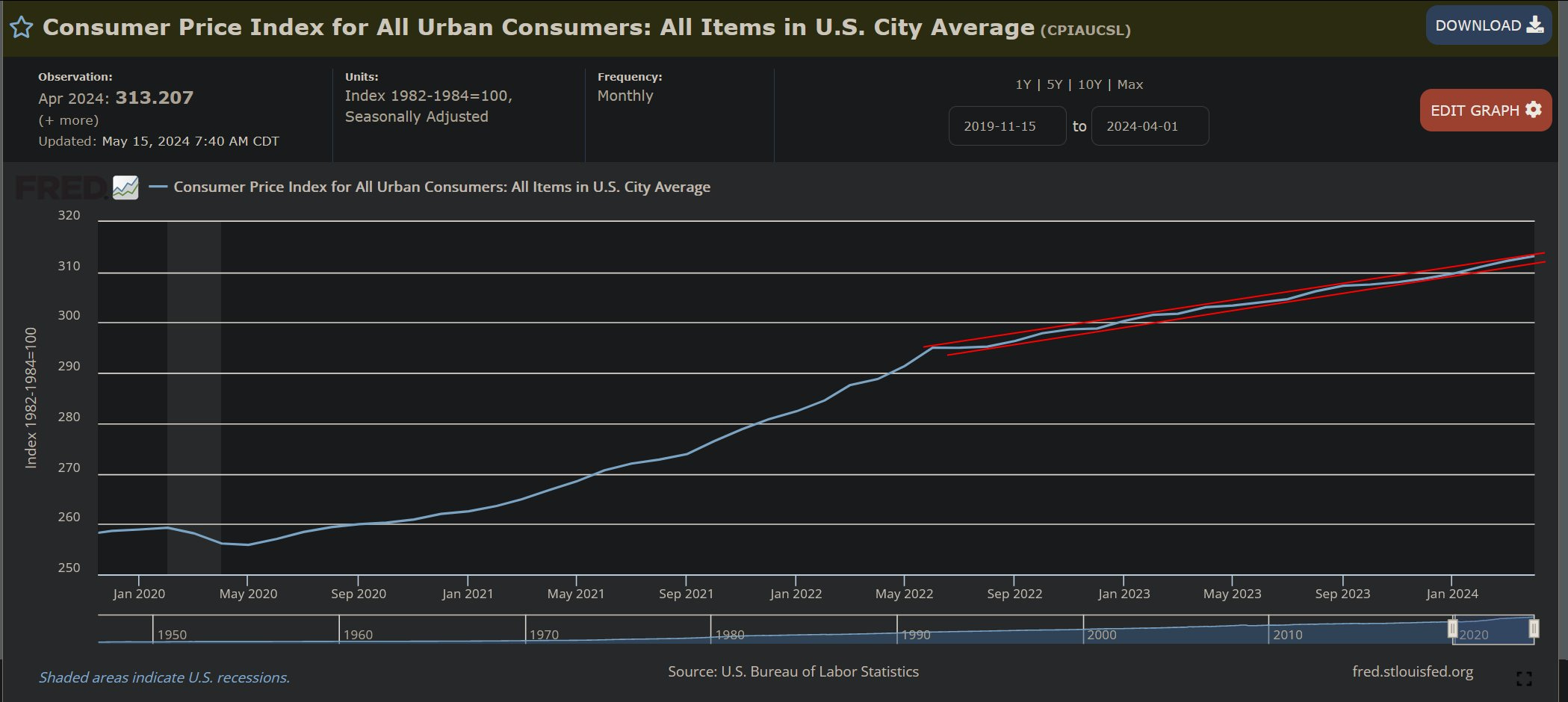

It has to be said that inflation has resumed its cruising speed, albeit at a slower pace than during the first inflationary surge. Unfortunately, this level is still too high for rates to fall in the short term.

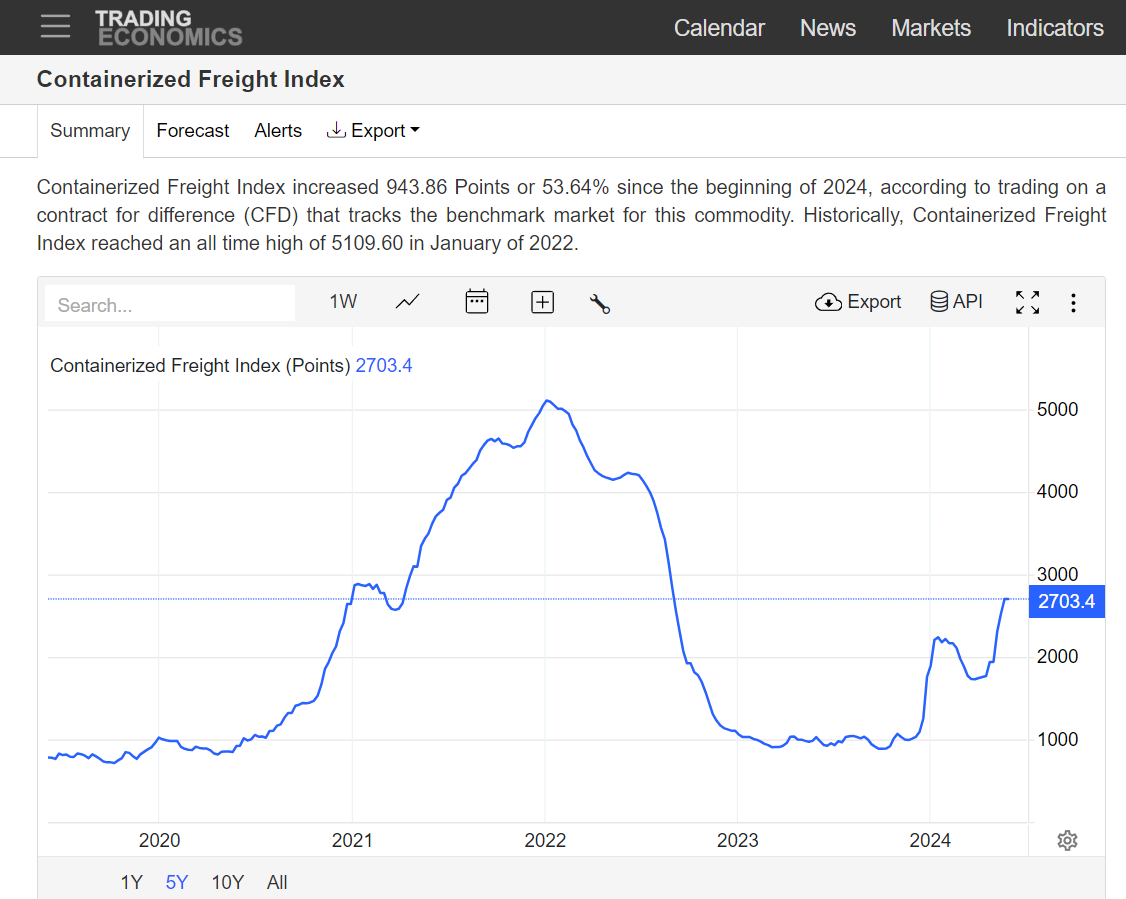

Container shipping prices have risen again in recent weeks. The freight index has almost tripled since the beginning of the year:

With the CPI index frozen at an annual increase of 3.5%, inflation has entered an upward channel, albeit less significant than in the 2020-2022 period, but sufficiently sustained to constitute a real constraint for US monetary policy:

The Fed was wrong to declare the end of its fight against inflation too soon. Margins for manoeuvre are once again very slim.

The Fed's inability to lower rates is putting additional pressure on the weakest banks.

The KRE index, which measures the health of regional banks, is therefore logically on the decline again:

The index has very little margin left to avoid breaking the upward channel it began in 2008.

The KRE index is currently at the same level as before its 2008 plunge. This time, however, the slightest correction could break the positive trend initiated with the Fed's bailout in 2008.

Like the BoJ, the US central bank is also reaching the end of its own impasse. The risk of not cutting rates quickly enough is precisely reflected in the small margin of support remaining on the KRE chart.

Gold acts as the ultimate safe haven in today's bond market.

The yellow metal is the asset that will eventually put an end to the irresponsible inflationary policies and growing indebtedness of governments the world over.

Gold is in fact an indicator of governments' lack of fiscal discipline, as they resort to debt to maintain a lifestyle they can no longer finance. The more the market becomes aware of this situation, the deeper central banks sink into a refinancing impasse, and the higher the price of gold rises in all currencies.

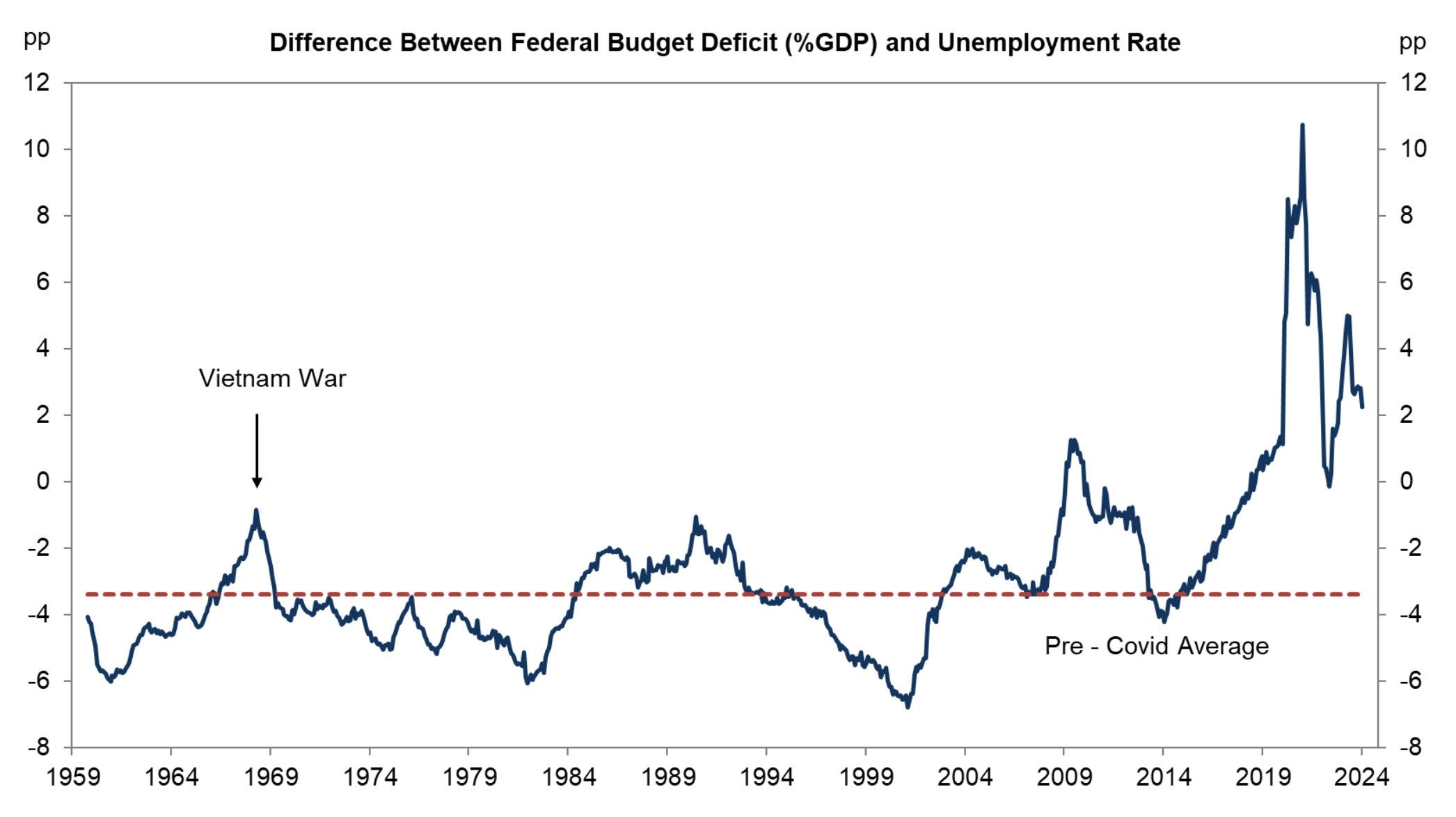

This lack of discipline is particularly pronounced in the USA: government spending is historically high, especially when compared to employment figures. The U.S. is neither at war nor in recession, but the country is spending more than in periods when state support seemed much more essential. The US government is struggling to reduce its spending significantly in the wake of the Covid-19 crisis:

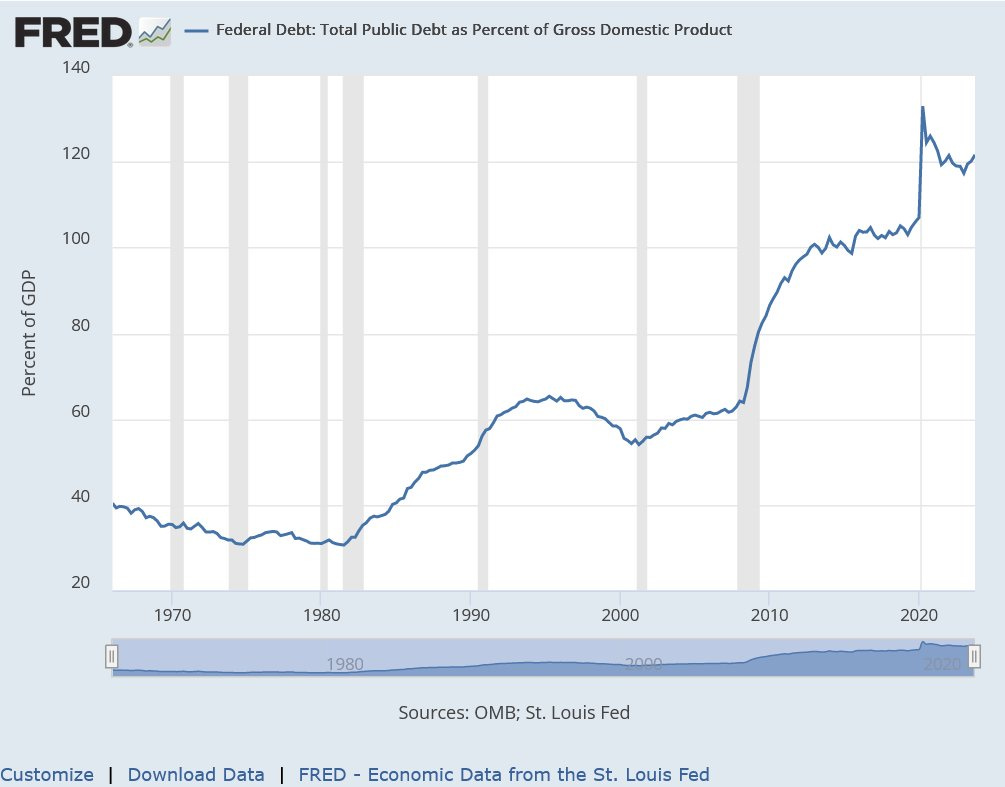

This lack of fiscal discipline comes at a time when the country is finding it increasingly difficult to finance its debt burden.

The debt is now equivalent to 120% of U.S. GDP, and servicing the interest on the debt is already costing the U.S. government more than $1 trillion:

Until the markets see a return to fiscal discipline in the United States, gold in dollars will continue its ascent, and it's likely that any future corrections after the recent rally will be bought back.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.