The major economic event of the week was not the sharp fall followed by a historic rebound in the markets.

True, the indices displayed extreme volatility, but that in itself is not the most worrying signal. What really caught analysts' attention was the sharp rise in US interest rates - a move that runs counter to what is usually observed in this type of situation.

Normally, when equity markets fall sharply, investors flock to U.S. sovereign bonds, mechanically driving yields down. This is the classic “flight to safety”: fear of risk pushes capital into Treasuries, driving their price up... and, consequently, their yields down.

This time, however, the scenario is reversed: equity markets are falling, but long rates are rising - an unusual phenomenon that signals a potentially deeper loss of confidence. This suggests that the bond market, too, is beginning to doubt the US's ability to contain inflation, maintain fiscal stability or manage the consequences of a global slowdown against a backdrop of rising trade tensions.

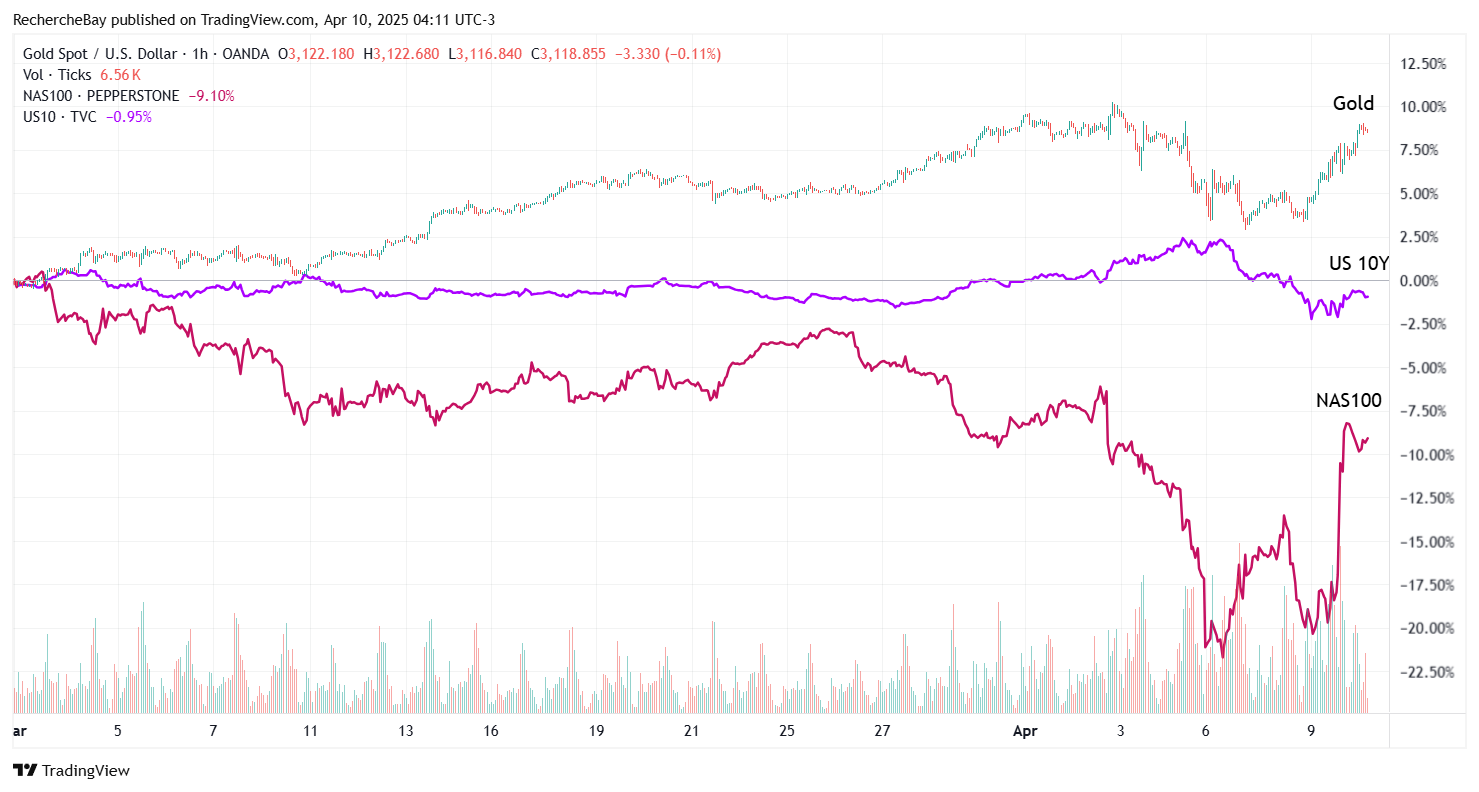

On April 6, against a backdrop of trade disputes over tariffs, the yield on US 10-year bonds surged spectacularly:

In the space of just three days, US long yields soared: the 30-year yield jumped 60 basis points to approach 5%, while the 10-year climbed 50 basis points to 4.5% during the session. At the same time, the 40-year yield in Japan - from the world's largest bond market - rose by more than 30 basis points, reaching a level not seen since 2007.

Such a rapid rise in yields had not been seen since 1982. The only recent comparison that comes close is the British bond crisis of 2022, which occurred during Liz Truss's short stint as head of government.

The main reason for these tensions is the markets' growing mistrust in the ability of governments - particularly the United States - to continue financing their debt. With massive Treasury bond issues planned ($39 billion in 10-year bonds, followed by $22 billion in 30-year bonds), the question is becoming increasingly pressing: who is still going to buy this debt, in a context where major players such as China or the BRICS bloc countries seem to be turning away from Treasuries?

The sudden destabilization of the bond market has forced Donald Trump to backtrack on his tariff policy.

According to Marko Kolanovic, former chief strategist at J.P. Morgan, it wasn't the fall in equities that prompted the US president to reconsider his stance on tariffs, but rather the shock seen on the bond market.

The previous week, Trump had announced major tariff hikes, targeting US allies and adversaries alike - even going so far as to mention taxes on territories as unlikely as the penguin-populated Antarctic Islands. He seemed ready to let the equity markets crash, convinced that this tough strategy would pay off in the end.

But the backlash from the bond market would force the White House to back down. Yields on U.S. Treasuries soared, stoking fears of an imminent financial crisis that could prompt the Federal Reserve to intervene. According to Kolanovic, “When the bond market collapsed, their whole narrative collapsed. Their first excuse was, ‘Oh well, it worked for bonds.’ … The bond market probably forced their hand.”

Under pressure, Trump finally decreed a 90-day freeze on “reciprocal” tariffs for all countries that had not yet retaliated, while increasing those targeting China to 125%. This about-face triggered a spectacular rally in equity markets - the Nasdaq climbed over 11% at one point, while the S&P 500 and Dow Jones indices also recorded significant gains.

However, Kolanovic warned that this euphoria could be short-lived: quarterly earnings releases, expected in the coming days, are likely to reflect uncertainty over Trump's trade policy and rekindle volatility.

Gold has emerged as the big winner from this particularly tumultuous episode on the markets. The bond mini-crash we've just been through has caused a real earthquake: equity markets have stalled, and gold, caught up in the general panic and margin calls, has undergone a slight correction.

But as soon as Donald Trump announced the suspension of tariffs, markets rebounded with vigor. In the immediate aftermath, the price of gold climbed $100 in a single day - a spectacular move, especially as interest rates were simultaneously on the rise:

Gold has just demonstrated its role as a safe-haven asset in both stock market crises and bond storms. Above all, it has confirmed that its most remarkable performance comes once the dust has settled.

In a market that has become extremely unstable, gold now acts as a genuine shock absorber in the midst of chaos. This is a notable change: in 2008, as in 2020, gold was itself highly volatile. Today, it has become an anchor, a lifeline to which investors cling in an increasingly choppy sea.

U.S. Treasuries, supposed to be the ultimate refuge in times of crisis, appear to have been swept away by the market swell, while gold remains afloat.

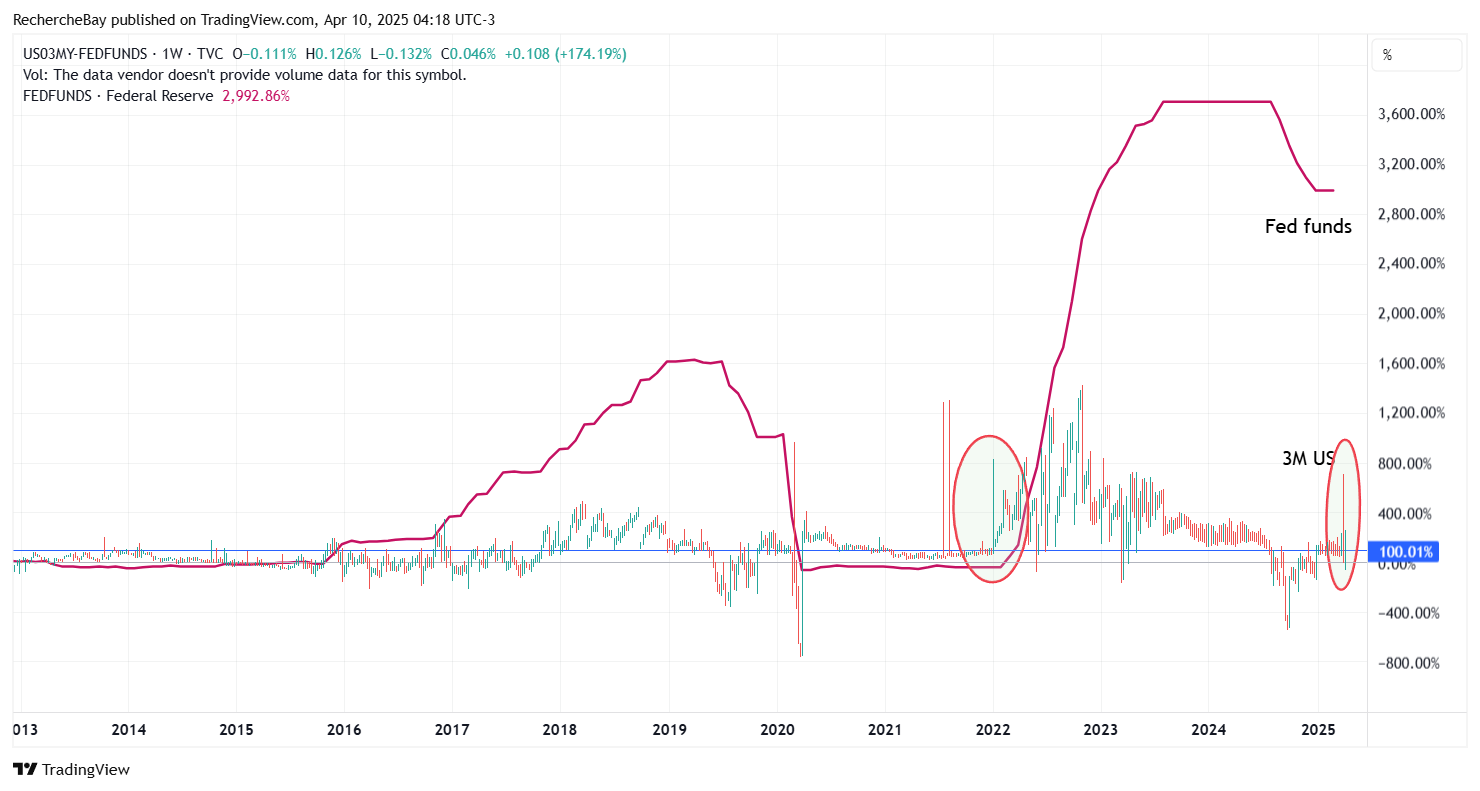

Trump's reversal was not enough to bring interest rates down. On the contrary, short-term rates have resumed their ascent, making the prospect of monetary easing by the Federal Reserve even more remote:

Even more worryingly, the spread between the 3-month rate and the Fed's key rate - an indicator often closely scrutinized - seems to be moving back into positive territory. This type of configuration, observed notably in 2022, had preceded a series of rate hikes:

This renewed tension on the money market reinforces the idea that the Fed may not only delay an eventual accommodative pivot, but that it will be forced to maintain a more restrictive posture than expected, despite the recent market turbulence.

Against this backdrop, it's hardly surprising to see the premium on Shanghai gold futures back in the green. This increase in the premium for gold in China is a strong signal: it reflects tension over local supply, but above all anticipates a new phase of bullishness for the yellow metal in the short term.

The situation on the US bond market remains far from stable. Yields continue to climb, and uncertainty remains over the Treasury's ability to finance its debt without triggering further upheavals.

Gold, for its part, continues to climb, buoyed by this growing instability - and above all, by the increasingly imminent prospect of a face-off with the US debt wall. As this critical point approaches, the role of physical gold as the ultimate protective asset becomes ever more apparent.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.