Forget about the pension reform debate: inflation is the main topic this winter in France.

A study published by "60 Millions de Consommateurs" predicts a new 20% increase in food prices by June, after an annual increase of +60% on certain products such as meat. The magazine does not foresee an end to inflation.

France is catching up with its European neighbors. The inflationary wave that hit the UK last year arrived in France with a few months' delay, due to the support measures put in place by the French government which ended in January 2023. The increase is more dramatic in 2023 because it was less pronounced in 2022.

Will inflation fall back or has it gotten out of control? That is the question all economists are asking.

Before exploring in detail the new indicators related to this inflationary wave, we have to admit that the efforts to fight inflation are far from having had the desired effects. Perhaps these efforts have simply not been enough?

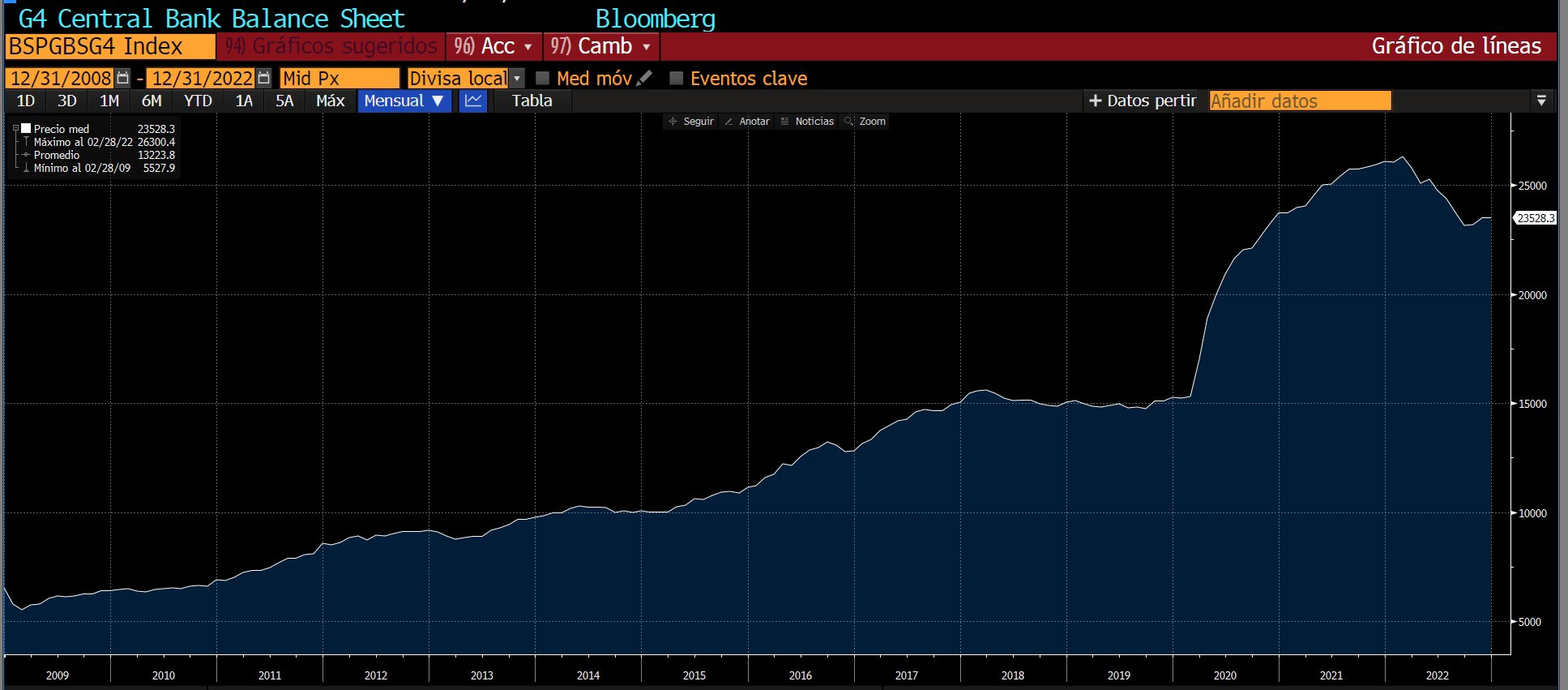

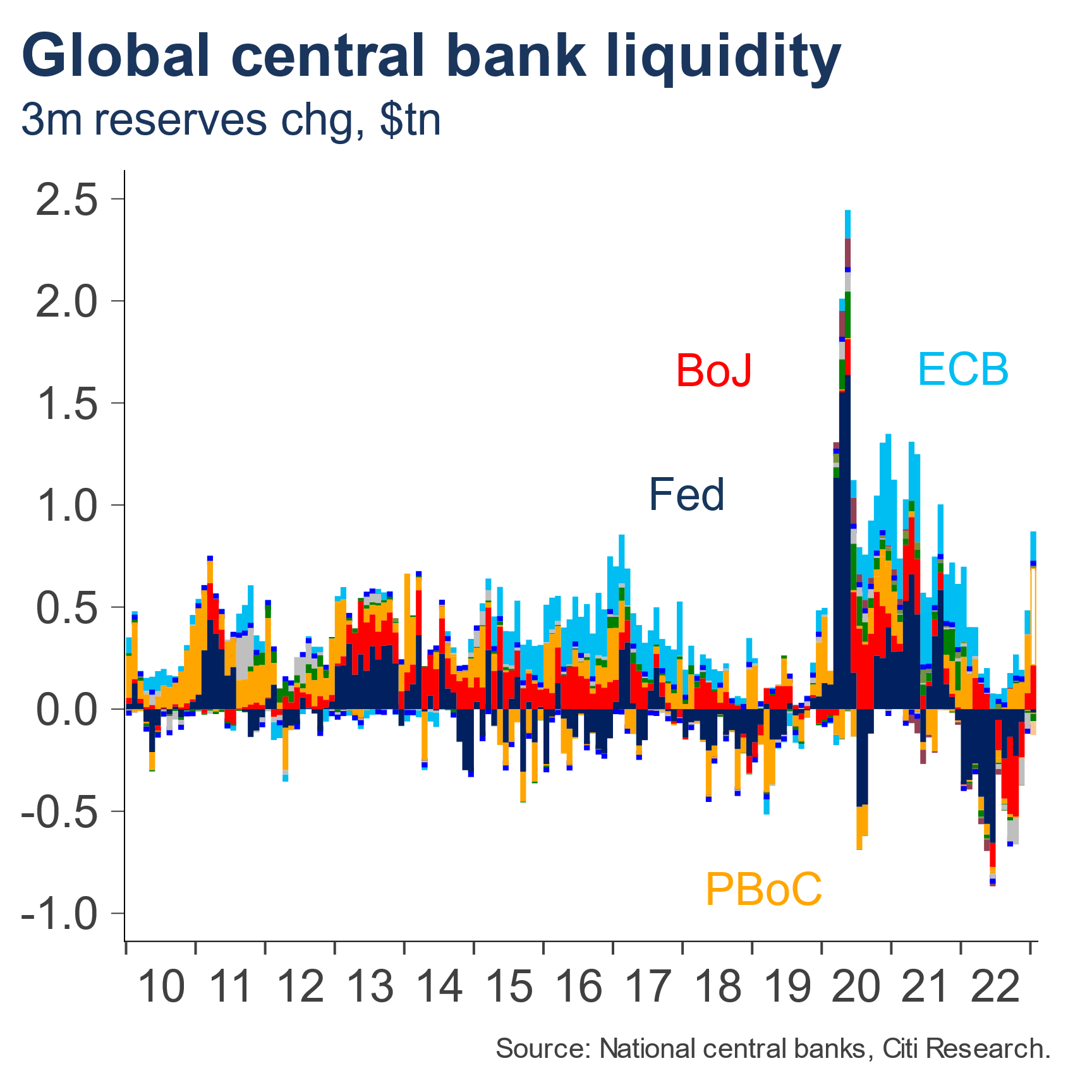

In particular, central banks have not reduced their balance sheets significantly enough. The total balance sheets of the G4 central banks (Fed, ECB, BoE, BoJ) even increased again after Japan's recent intervention:

After buying a record amount of Japanese bonds, the BoJ resumed its liquidity injections and maintains an ultra-accommodating monetary policy, at the same time that the Fed is trying to reduce its balance sheet. The Chinese central bank has also had to inject massive amounts of liquidity to support its banking system.

For central banks, financial system instability and access to liquidity remain more important than fighting inflation.

In the US, efforts to balance the budget are still not very effective. After all, the debt ceiling has already been raised 72 times and the current debate is clear: the federal government will not balance the budget without borrowing more money to finance its deficit. If it really wanted to fight inflation, the US government would balance its budget as soon as possible. A balanced budget policy would, of course, have immediate social consequences. Here again, the fight against inflation takes a back seat to the urgent need to maintain the country's social equilibrium.

Central banks have exploded their balance sheets to avoid liquidity crises, while governments are spending more and more to avoid social crises. Reversing these monetary and fiscal policies to fight inflation seems very difficult today.

The slowdown in inflation in the United States is due to the decline in energy prices. In Europe, the price surge is also expected to pause in June due to the decline in natural gas prices.

The rebound in commodity prices, underpinned by sustained consumption, should rekindle inflation in the United States.

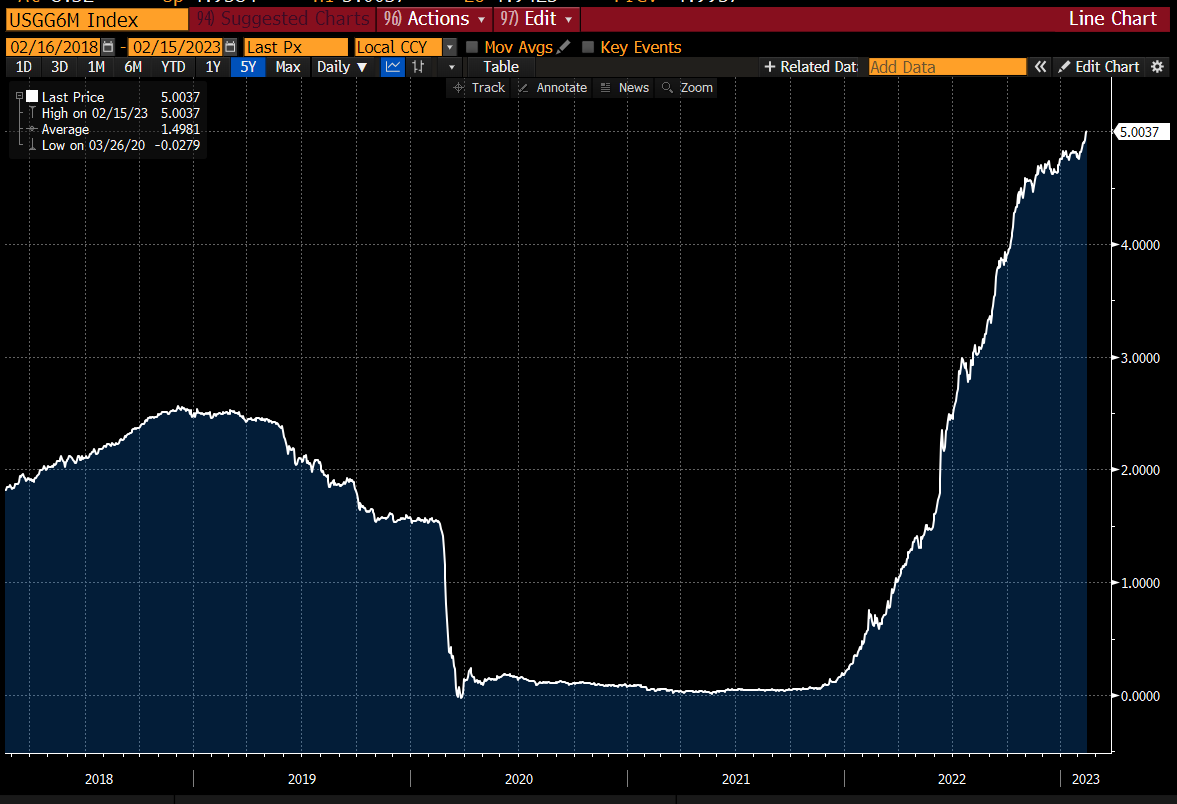

Retail sales confirm that the U.S. consumer engine is still running at full speed. Good consumption figures are pushing up U.S. short-term rates:

The rise in rates is accompanied by a resumption of inflation expectations, and this without crude oil prices rising!

What will happen in the U.S. when energy prices start to rise again?

The pause in inflation is solely due to the ebbing of energy prices. Natural gas prices have collapsed, but the negative daily divergence in the UNG index indicates a strong rebound in the very near term:

The Fed is therefore far from having succeeded in controlling inflationary pressure and will soon have to deal with a probable resumption of the rise in energy prices.

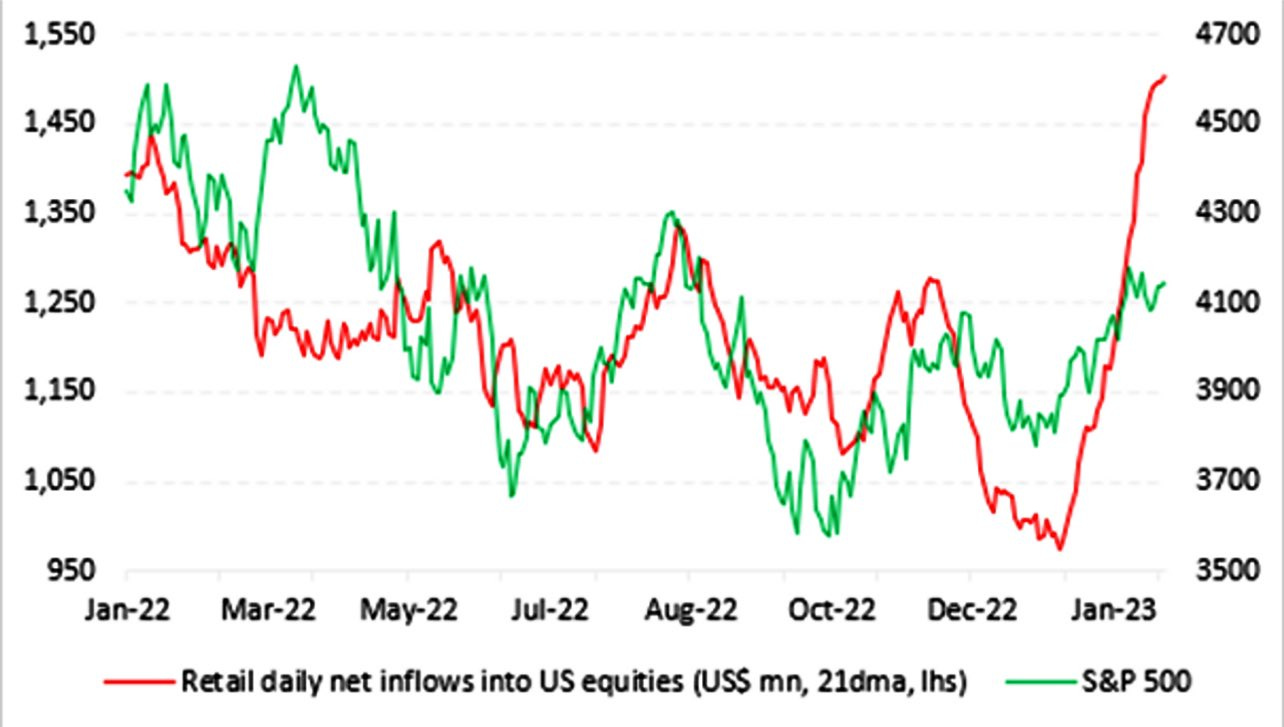

The recovery in retail sales and inflation expectations has caused many investors to return to the markets.

The inflow of new investors has been massive in recent weeks. Since the beginning of the year, individuals have invested an average of $1.5 billion per day in the markets:

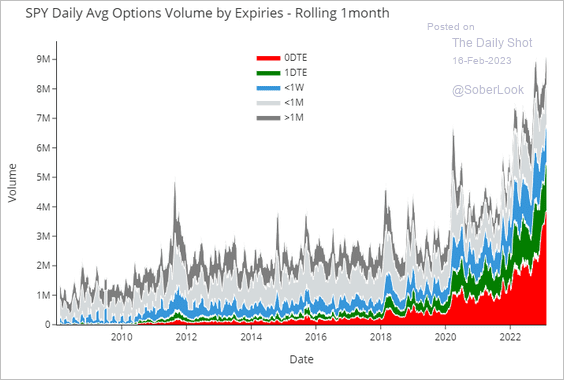

This new wave of investment has been focused on increasingly speculative derivatives. Most of the options subscribed on the SPX index are very short term:

Investors are trying to recover what they are losing in purchasing power by gambling on the markets. They are trying to compensate for the explosion of their lifestyle, which even a second job no longer helps to maintain, with increasingly speculative bets.

In any case, this rise in speculation sounds like a defeat for the Fed in its fight against inflation.

This time, the market rally is not based on growth but on high inflation expectations, which makes this rebound all the more fragile. Add to this the fact that market makers are now in a reverse position to that of December, when short positions were opened en masse. This time, speculation is bullish in the short term... One can imagine the impact that a tightening of the Fed's speech would have on the health of these markets.

A further sharp tightening would be disastrous for rate levels, further exacerbating the ongoing fiscal crisis. Any rate hike would directly threaten the government's ability to finance its deficit.

Tax revenues are already down 9.3% year-over-year. With rate hikes freezing the real estate sector and traditional revenue sources breaking down, the state is the biggest loser in this first wave of inflation.

If the Fed announces tightening, it cannot last too long or it will create a serious fiscal problem at the federal level. The Fed will have to intervene "whatever it takes'' to ensure the country's budget is balanced. Market volatility should logically increase in the coming months, depending on the changes in the Fed's discourse. In this context, a study by Nomura reveals that almost half of the options on S&P 500 stocks, as well as on SPY and QQQ, have expirations of less than 24 hours! Market sentiment is likely to go from one extreme to the other in a very short period of time, depending on the Fed's positioning. We knew the Fed was influencing the markets, but the next few months will likely reinforce that impression.

Gold remains under pressure from the near-term threat of a rate hike. The metal is retreating to its support at $1,800.

Gold is still very high relative to rates, probably because of the US fiscal risk and new inflation expectations. This strength is also explained by the worsening geopolitical context and the stalemate in the Ukraine. The accentuation of the East/West bipolarization is jeopardizing the fluidity of future trade flows. Any threat of new sanctions now acts as a support for the price of gold.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.