The Fed has now decided to raise its key rates by 0.75%, at a time when all economic figures point to a global recession.

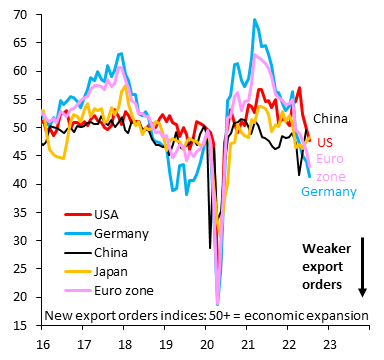

Apart from China, which is trying to bounce back from its last lockdown, all countries are experiencing a significant drop in exports:

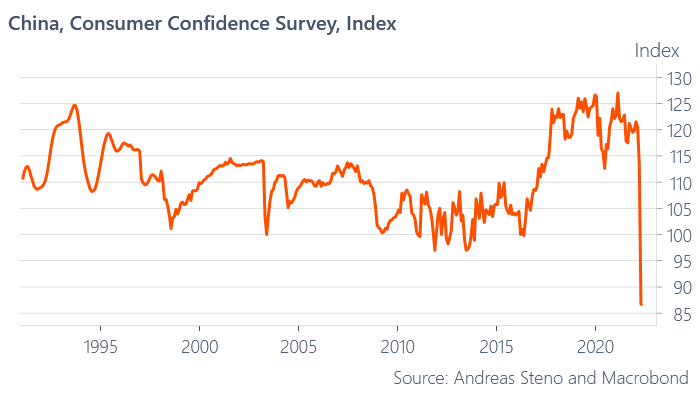

In China, although industrial activity seems to be picking up, it is the property market that is causing concern. Builders are in turmoil, as the halt in construction programs has triggered a veritable strike in the payment of mortgages. In this tense context, Chinese consumer sentiment is literally collapsing, on a scale never seen before, even during the last financial crisis.

It will take considerable energy for China's political leadership to turn things around by the end of the year.

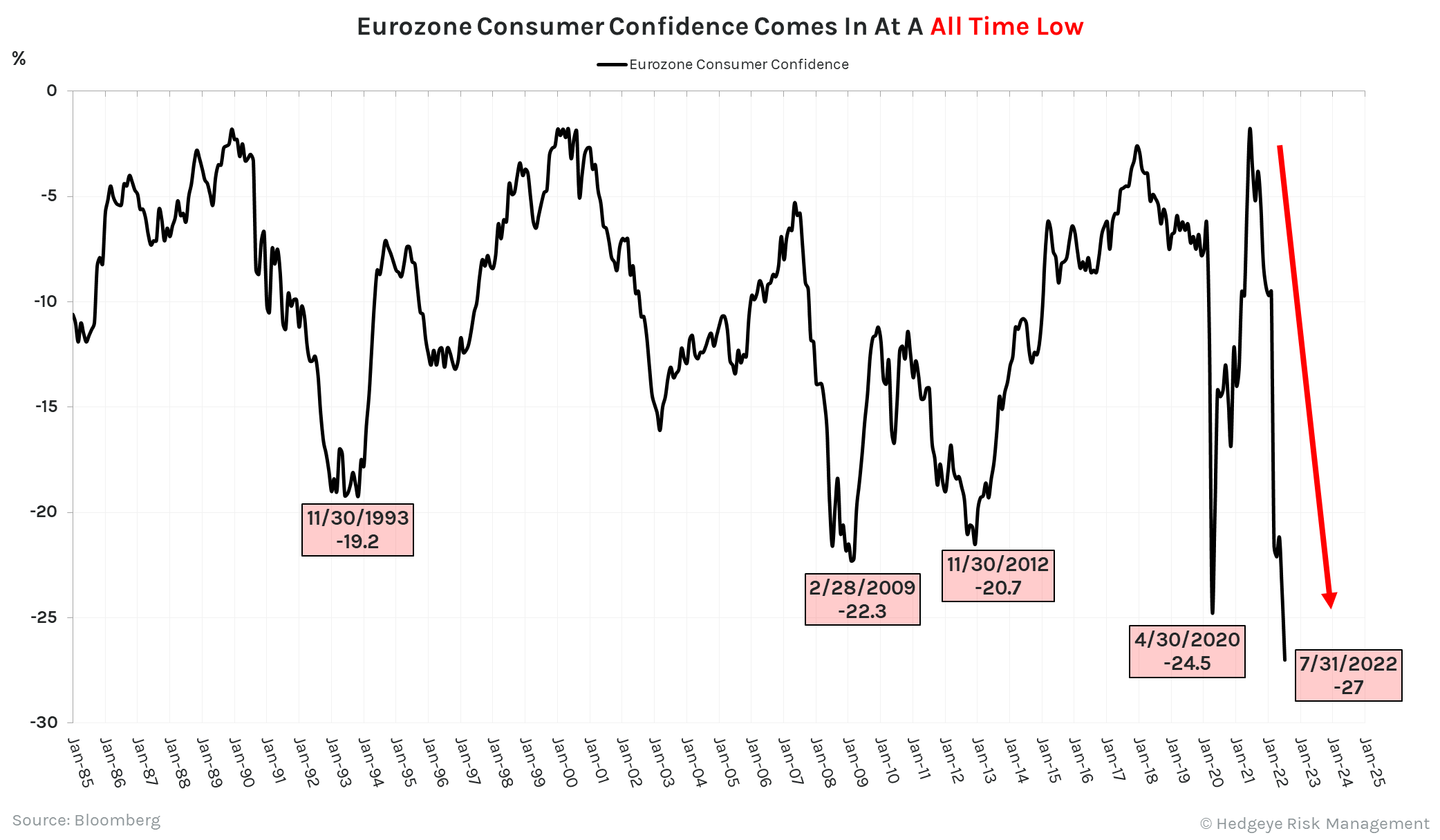

Consumer confidence is also plummeting in Europe, at a record pace...

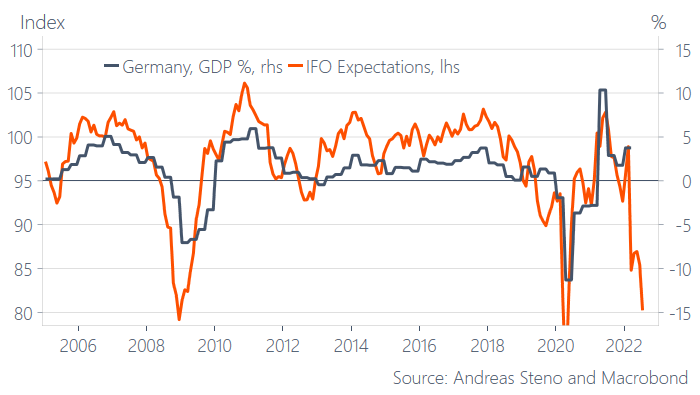

In Germany, the IFO announces a deep recession. According to this index, which anticipates the GDP figure, we can expect a pronounced drop in growth on the other side of the Rhine by the next quarter.

The recession is probably already underway in Europe, where the first figures for industrial activity already confirm the slowdown. Registrations across the continent were down 15.4% in June compared to last year (-18% in Germany).

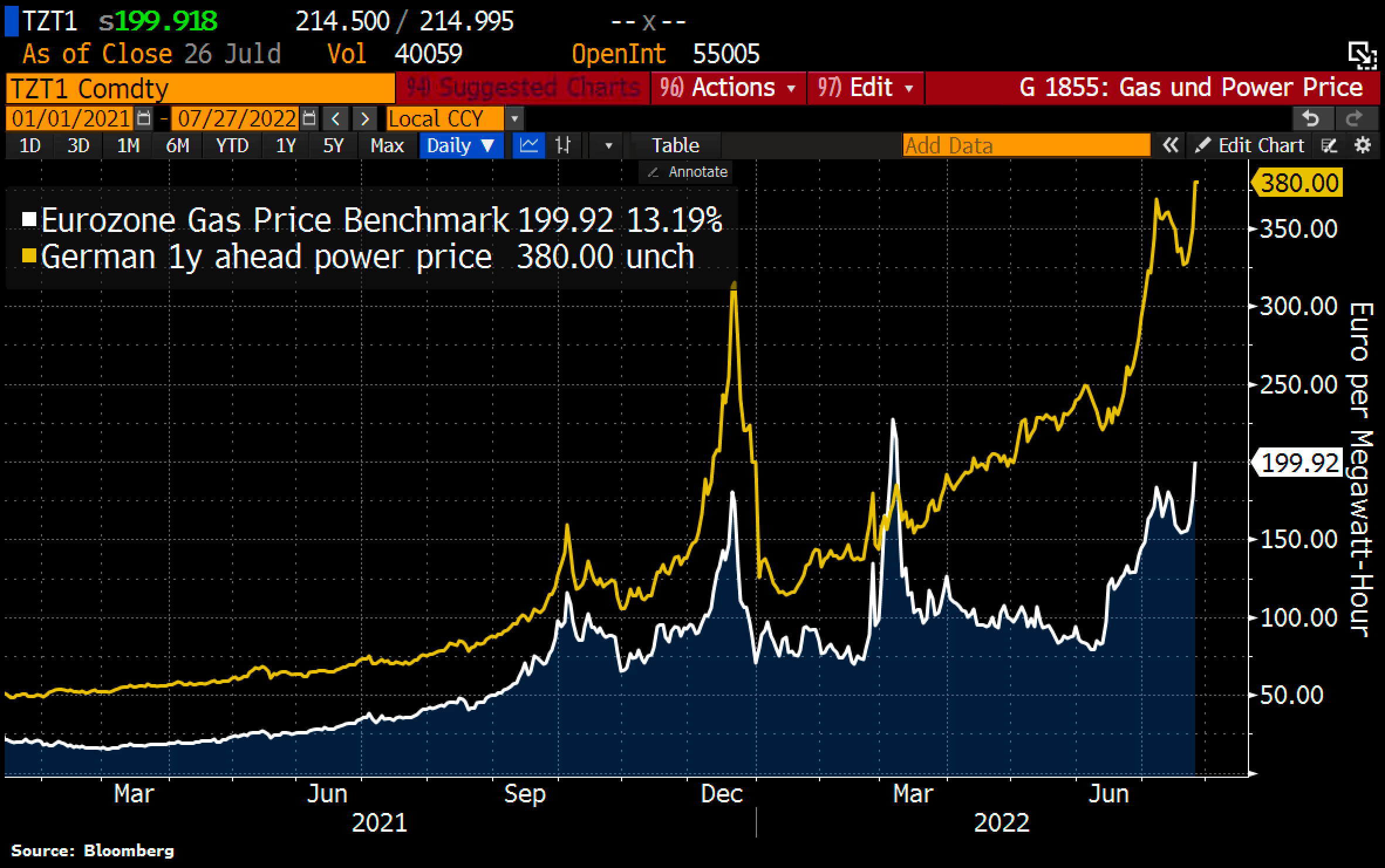

The energy crisis and inflation are squeezing corporate margins at a time when demand is falling significantly. The outlook has been further revised downwards. The cause: a worsening energy crisis. After gas prices, electricity costs in Germany are once again soaring to new heights:

If no solution is found in the short term for energy supply in Europe, this situation could turn the coming recession into a real economic depression this winter.

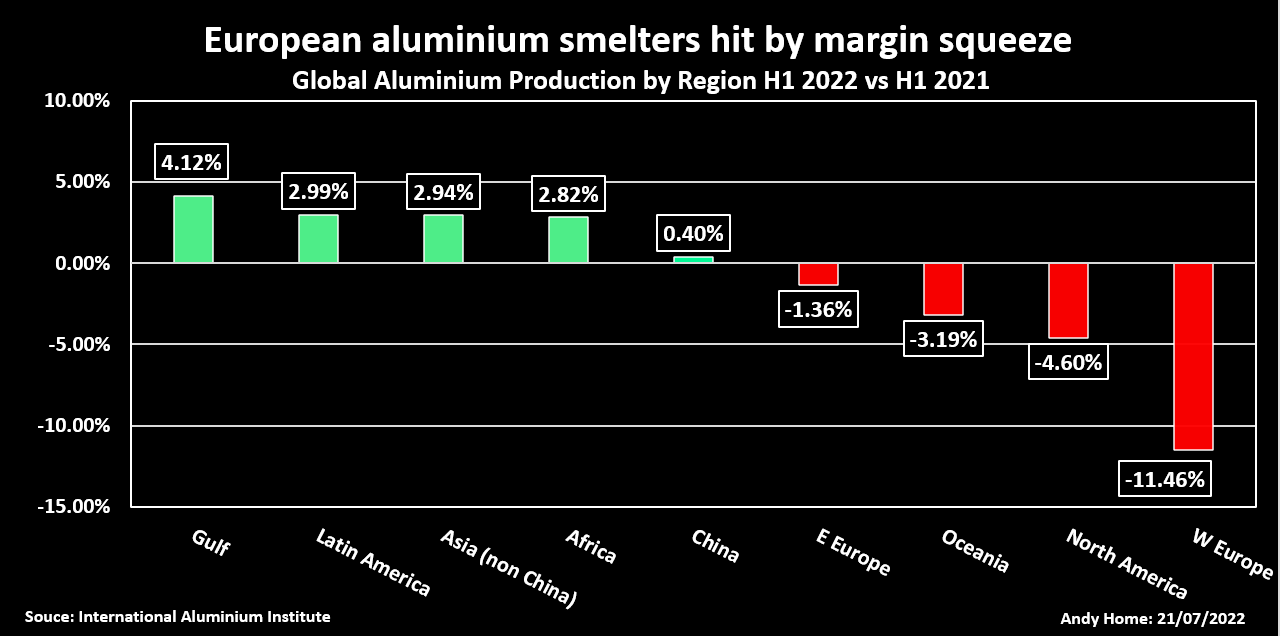

Metallurgical activities are particularly affected: the aluminum sector is experiencing a sharp decline in production because with commodities costs rising and energy costs still high, operators' margins are collapsing, leading to a drop in production:

The energy crisis is also affecting U.K, which is also suffering from a supply problem on its network. A blackout was narrowly averted last week. thanks to a last-minute cheque for £9,724.54 per MWh (more than 5,000% higher than a normal price) issued by the British government to briefly import electricity from Belgium.

In the U.S., the Philadelphia Fed said last Thursday that its regional business activity indicator fell to -12.3 in July, down from -3.3 the previous month. Again, these numbers are a harbinger of an impending recession. While the U.S. government hopes that, despite two semesters of GDP declines, the country can still avoid a recession, on the ground the returns are unfortunately different. The latest warnings from Walmart point to a decline in consumption in the future due to the loss of purchasing power of Americans. For now, demand is holding up better than elsewhere in the world: according to GasBuddy data, U.S. gasoline demand is up 6.3% from last week. July's numbers are well above last month's. Corporate earnings are holding up and so is credit demand, as evidenced by Visa's strong results, for example. On the other hand, the outlook for all sectors is weakening. The message is clear. The U.S. consumer has held up so far, but it may not last...

The Fed is acting too late to fight inflation. This ill-coordinated and overdue rate hike may, on the contrary, accelerate the looming recession.

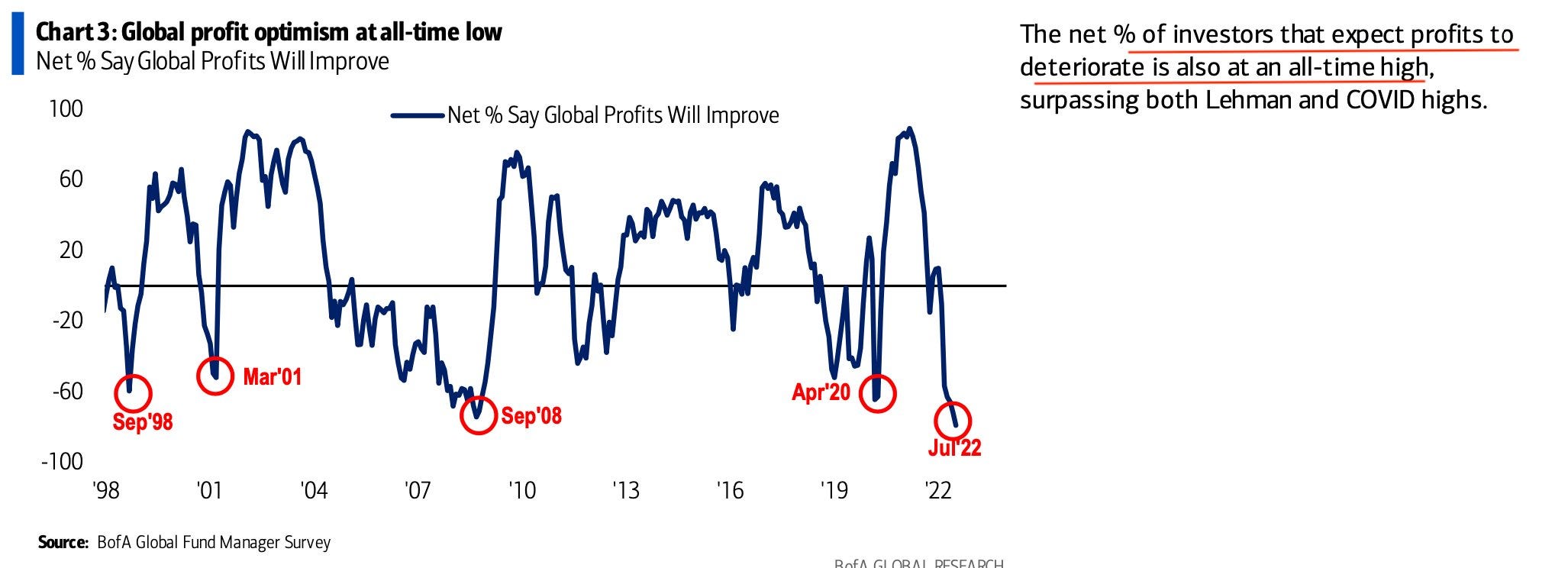

This monetary policy mistake has led investors to bet on lower growth expectations than were expected during the last financial crisis.

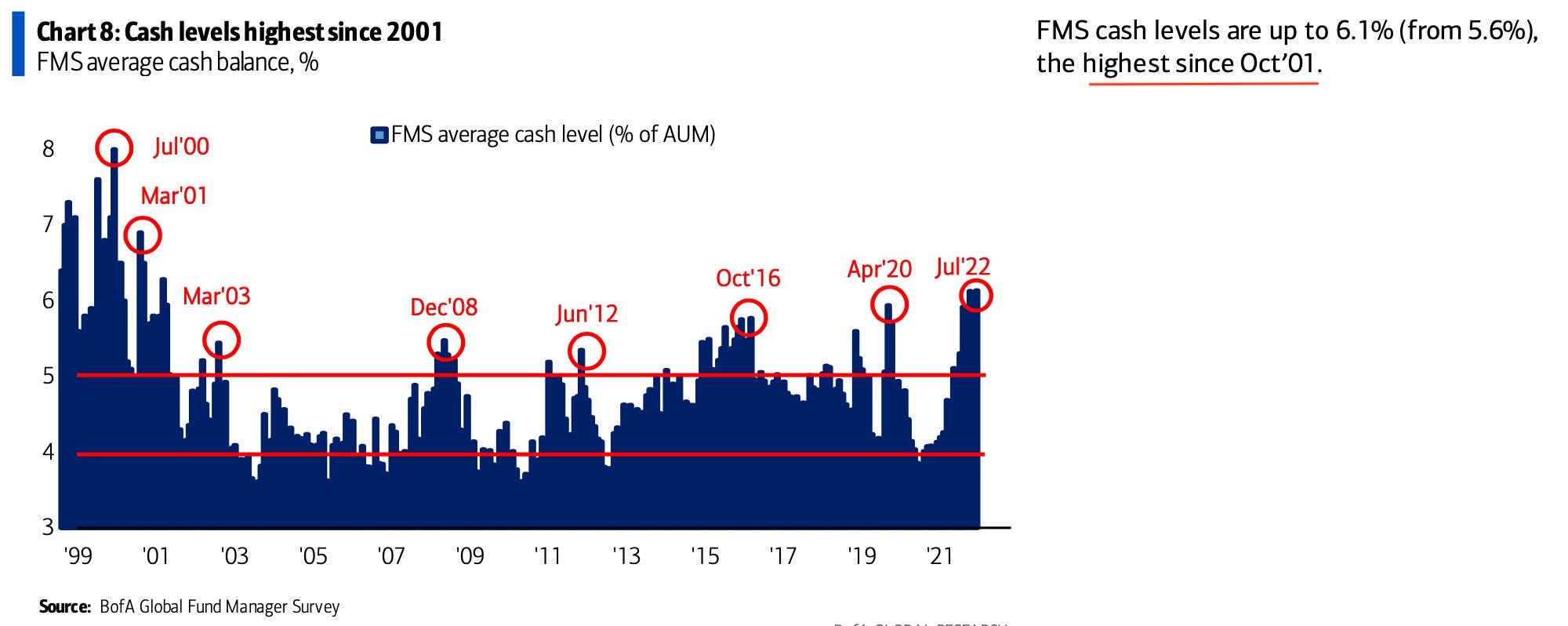

Investors have taken massive refuge in cash positions:

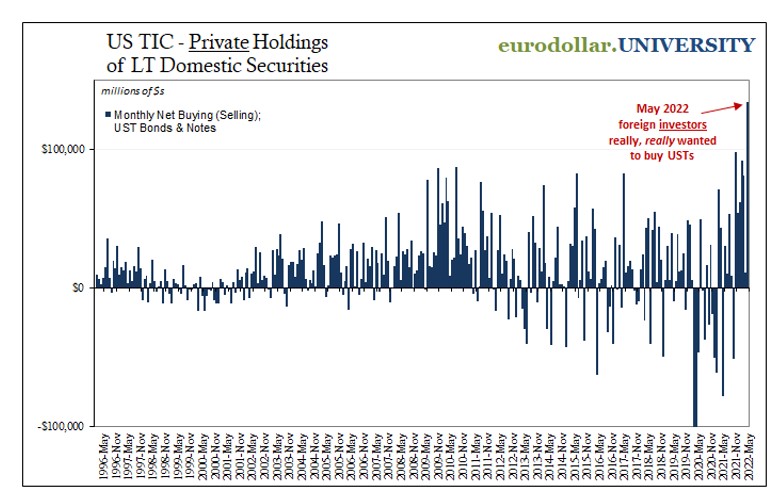

Purchases of Treasury bonds, protected from the effects of inflation, are understandably at a record level by foreign investors:

Even if the liquidity crisis does not reach what we saw in 2008, the crisis of confidence is underway: the Fed's ability to avoid recession is being challenged. The soft landing that the Fed promised when it embarked on its fight against inflation that it did not see coming, may instead turn into a much larger slowdown than expected. Bearish investor positioning is at record levels in the markets. Technically, the indices are likely to undergo a classic short squeeze, especially since trading volumes are very low. However, the volatility of the markets cannot hide the fact that the economic slowdown is now a fact. And it is especially in Europe that the end of the year is likely to be complicated.

Under these conditions, gold serves as a safe haven. Physical demand figures continue to reach record highs. Fear of recession is keeping gold at high levels, while expectations of disinflation should, instead, accelerate the correction.

After the April peak, inflation expectations have returned to much lower levels, which has led to a pullback in rates. Investors are expecting a rapid decline in inflation figures.

It remains to be seen whether these disinflation expectations actually materialize. These numbers are usually linked to new expectations of an impending recession.

But as we explained last week, the physical inventory situation of some commodities makes us cautious about the correlation between inflation expectation numbers and CPI projections. The fragmentation of trade, the energy crisis and the increasingly complex geopolitical situation are likely to change the game. The recession this time would not be accompanied by a significant drop in inflation. Because even if demand collapses in the retail sector, the supply of certain commodities remains complicated. This prospect of stagflation is the very nightmare the Fed wanted to avoid!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.