The gold market is undergoing a major transformation, characterized by a growing divergence between paper gold and physical gold. Until recently, COMEX futures contracts allowed investors to speculate on gold without ever taking delivery. The London market, on the other hand, served as a hub for transactions in physical gold.

An arbitrage mechanism, called Exchange for Physical (EFP), allowed investors to profit from price differentials between these two markets. By buying gold in London and simultaneously selling futures in the USA, investors could transfer ownership of the gold without it being physically moved. But today, this arbitrage doesn't work the way it used to.

There are several reasons for this breakdown. Firstly, logistical constraints are making it more difficult to transport gold, lengthening the delivery process and limiting stock availability. Secondly, confidence in Western financial institutions has eroded, particularly following the confiscation of Russian gold reserves in 2022. Faced with this risk, many investors and central banks now prefer to hold their gold physically rather than rely on intermediaries.

At the same time, the structure of the gold market is changing radically. For decades, the financialization of the gold market enabled the artificial creation of paper gold, thereby increasing supply without the need for physical metal. This mechanism, which helped to contain price rises, was based on a leverage effect that has now been weakened. With the implementation of Basel III rules, banks are required to hold tangible assets against their gold positions, thus limiting their ability to manipulate the market.

This development is gradually weakening the Western monopoly on gold. New financial centers, such as Shanghai (SGE), are gaining in influence, while central banks in emerging countries are accumulating gold outside the traditional financial system. Physical gold is thus becoming a strategic asset, both for governments and for investors seeking protection against economic and monetary instability.

A direct consequence of this paradigm shift is the likely revaluation of gold and silver prices. With the reduction of financial leverage and the rise of physical markets, gold is gradually regaining its true role: a safe-haven asset whose value is less influenced by derivatives and more by real demand.

In short, we're witnessing a major shift. The gold market is becoming more physical, less manipulated and more transparent.

This rush to buy physical gold is taking place against a backdrop of rising inflation.

Inflation in the United States has risen spectacularly, increasing by 0.5% in one month, the biggest increase since August 2023.

Core inflation was expected to fall to 3.1%, but surprisingly rose to 3.3%. This is quite simply the highest inflation ratio since 2023:

The consensus was for overall inflation to remain stable at 2.9% and for core CPI to fall to 3.1%, but instead, inflation surged to a more than six-month high.

Inflation expectations are rising again at the start of 2025:

This reawakening of inflation led to a further surge in the US 10-year yield to its highest levels ever:

The weekly chart of the 10-year rate forms a bullish flag, which could propel long rates to much higher levels:

The return of inflation partly explains the recent rise in rates, but there is also another factor to consider.

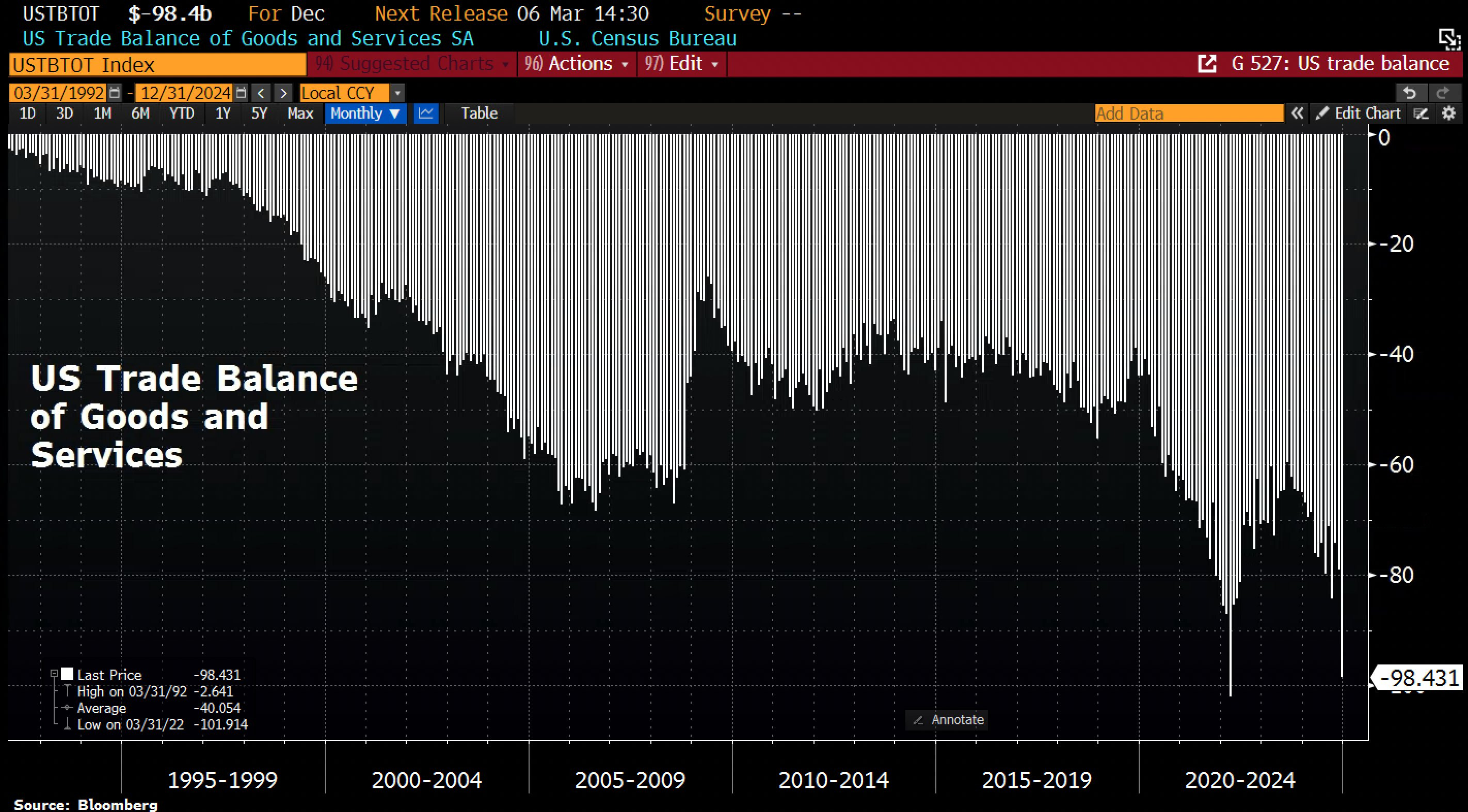

US foreign trade deteriorated significantly at the end of 2024. The US trade deficit widened to $98.4 billion in December, bringing the annual deficit to a staggering $918.4 billion. This was partly due to a 3.5% rise in imports in December, while exports fell by 2.6%. This trend could be linked to companies' expectations of the Trump administration's planned tariff hikes, particularly on industrial products:

Inflation is picking up, with CPI higher than expected. Against this backdrop, the Federal Reserve has little reason to cut rates, as this would exacerbate pressure on prices.

For his part, Trump is calling for a rate cut to accompany his future tariffs. His aim is to limit the economic impact of the price rises induced by these protectionist measures.

This is likely to lead to a confrontation with Jerome Powell. The Fed, determined to fight inflation, could refuse to ease monetary policy despite political pressure.

Markets must therefore anticipate tensions between the White House and the Federal Reserve, with major implications for monetary policy and the economy.

This uncertainty about US monetary policy is very positive for gold.

In just two and a half weeks, the price of an ounce of gold has climbed $155 to reach an all-time high of over $2,900:

Yet, surprisingly, despite the COMEX's run on physical gold and the LBMA's reserves,Western investors did not benefit fully from this meteoric rise. In fact, holdings in the GLD exchange-traded fund fell by 16 tons over the same period, bringing the fund's reserves down to 863 tons - a level not seen since August 2019, when gold was trading around $1,500 an ounce.

The question is: at what price will these investors return to the market, once they realize the missed opportunity?

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.