Spotlight this week on the situation in the UK. I'm in London right now and I must say that things have changed a lot here since my last visit in November. Inflation in the country is now visible and the impact is already being felt in retail prices, and at a much higher level than in France.

Real wages are collapsing in the UK, leading many economists to predict a recession in the coming weeks. The loss of consumer purchasing power is likely to be reflected in retail sales figures.

Real wages have returned to the lows of the last financial crisis, with inflation now above 9%, the highest figure since 1982.

Prices are rising and wages are falling; this is the largest and most severe squeeze on British consumers since these statistics have been compiled.

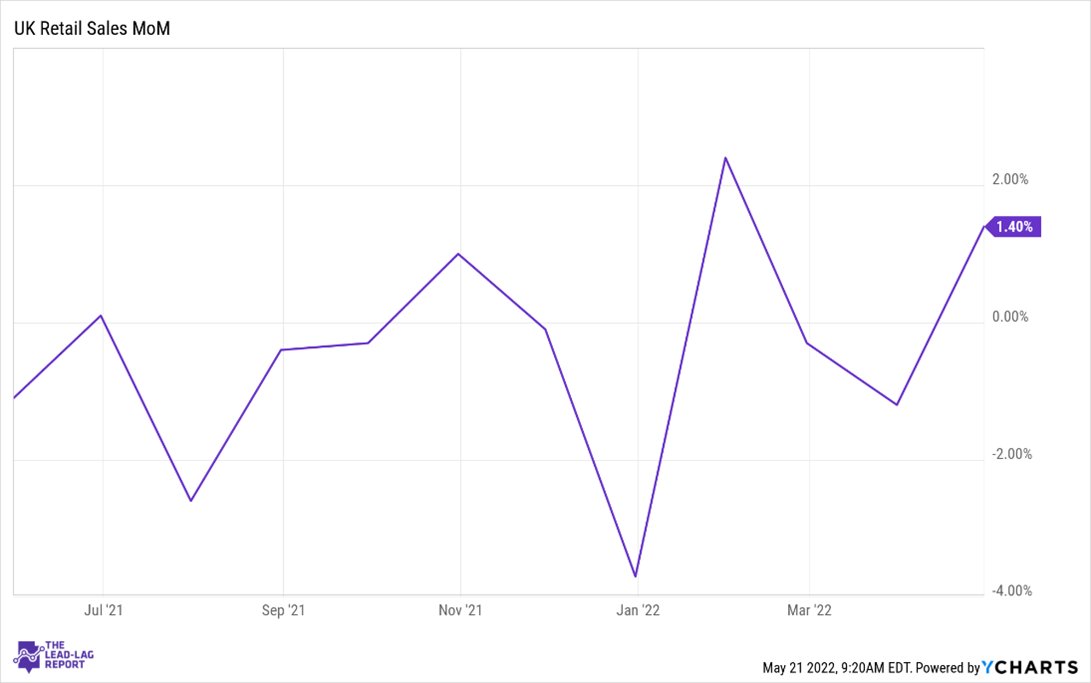

Retail sales remain strong despite inflation, thanks in part to increased use of credit:

The resilience of retail sales, the absence of significant defaults on consumer credit, and the continued good liquidity of the banking system are, for the time being, removing the risk of a short-term recession.

Unfortunately, British optimism is running out of steam, with household confidence collapsing to a level comparable to the last financial crisis:

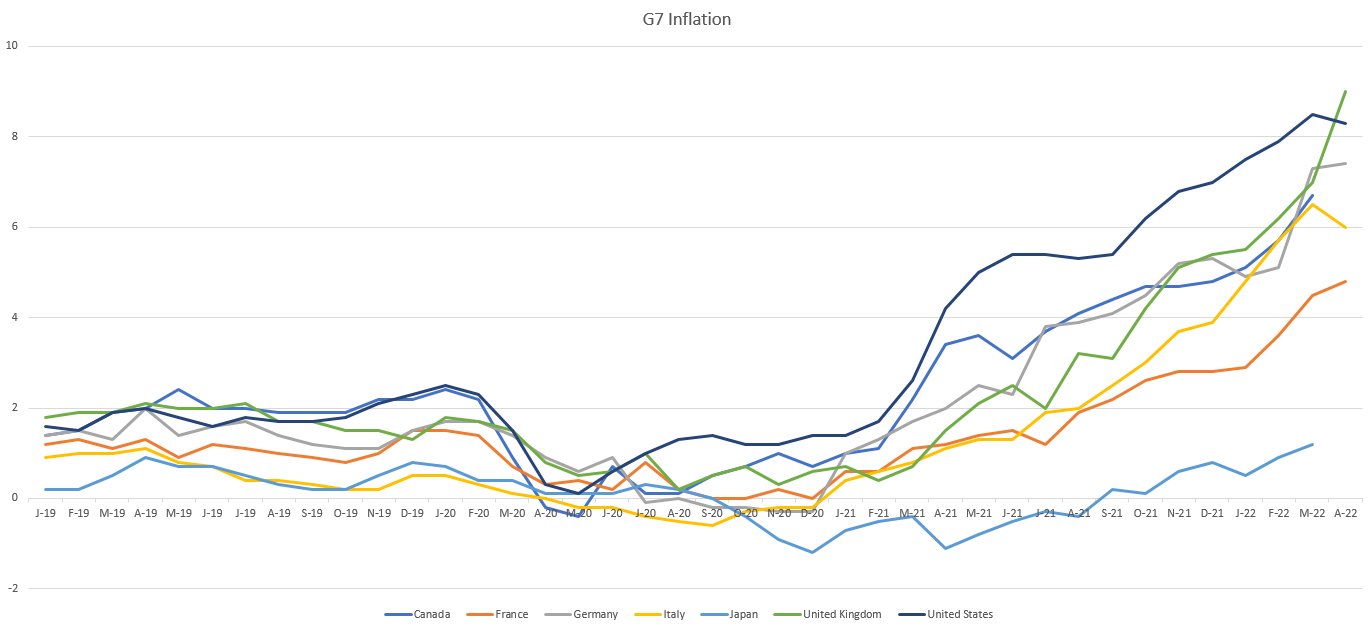

In terms of inflation, the U.K. now exceeds all other G7 countries. This record figure was mainly due to rising energy costs. But since the government decided to freeze prices, inflation is now spreading to utility costs and costs associated with housing expenses.

The inflationary shock is now very visible and is testing British confidence.

Under these conditions, gold in British pounds has moved back above its MA200 support with a MACD cross. The next bullish impulse may propel gold to a new all-time high in the UK.

I took the opportunity of my visit to the 121 Mining Investment Event to survey the British precious metals investment market.

British funds wishing to invest in gold do not buy physical gold, they simply buy "paper" gold via certificates such as GLD. This practice is widespread in Europe, as we know. Buying physical gold is complicated for reasons of liquidity, availability of capital, and the constraints are numerous... But I am quite surprised to note that in London, the global gold trading hub, there are actually few funds invested in physical metal.

For these funds, investing in gold depends essentially on the confidence of the counterparties of these certificates in their ability to deliver physical metal, in case they need to use gold as ultimate insurance to protect their portfolio. For that is the main reason they made this investment. In fact, when I ask these managers why they invest in gold, most of them say "to hedge against many risks". Gold is insurance. In their case, the insurance is rather a contract of trust with the counterparty in charge of maintaining the convertibility of the contract into physical metal.

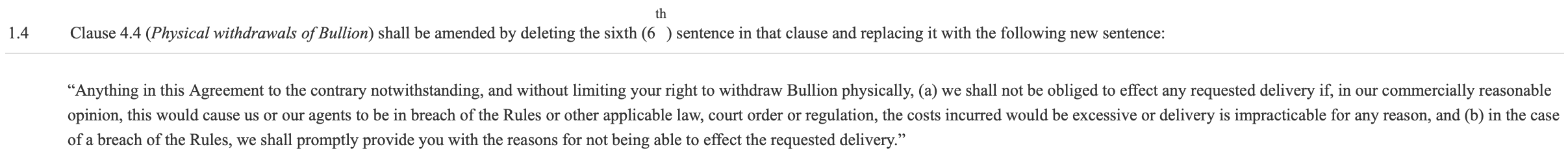

This very detail was the source of heated discussions at the conference in London. The latest 8K notice issued by the issuer of the SPDR GOLD TRUST (GLD) certificate contains a new clarification of the terms and conditions under which certificate holders can request delivery. Clause 4.4 of the notice is now amended with an additional condition:

The delivery of physical gold is now conditional: if for any reason it is no longer possible, the delivery obligation is no longer contractually binding.

At Tuesday's first conference plenary, questions from the audience focused on these instruments. Some participants vigorously referred to these certificates as tools for suppressing the physical demand for metal. Without a legal obligation to deliver a physical gold contract under any conditions, how can one ensure that the purchase of such a certificate actually translates into real physical demand?

Without getting into the controversy, we can simply point out that the difference between the number of certificates and the investment in physical metal is now very clearly marked.

At a time when the situation on the physical stocks of industrial metals and precious metals is becoming more and more tense every week, it is finally quite logical to see so many investors questioning the access to their physical gold.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.