Just over a year ago, I wrote in my bulletin that physical gold had become more reliable than Treasury bills.

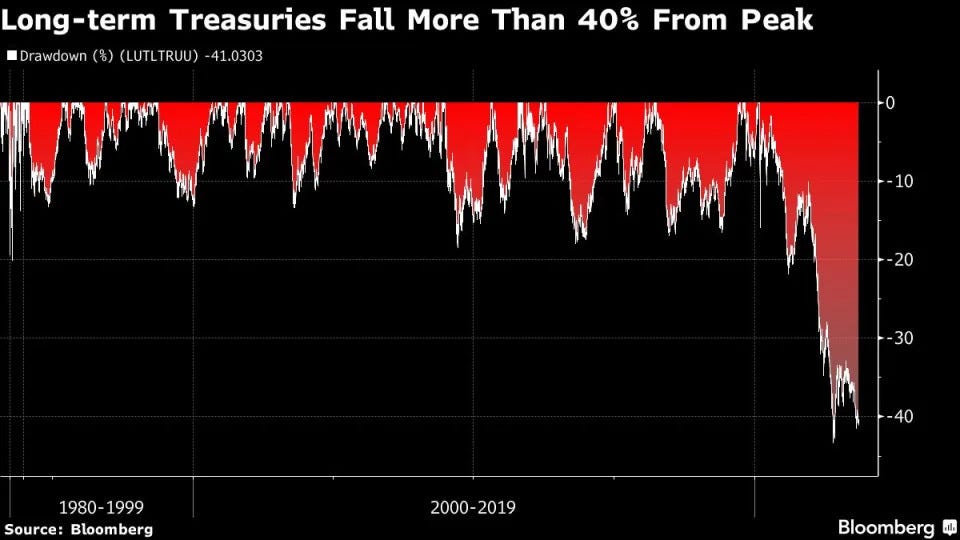

U.S. long-term bonds were already coming under increasing pressure from monetary tightening, and the historic drop of over 50% we saw last year exceeded forecasts:

At the time, unrealized losses seemed manageable as long as the securities were held to maturity. However, I pointed out that the risk of a credit event could lead to massive selling. The erosion of bank deposits and the rise in corporate defaults were already heightening concerns, as was the shift towards gold as a safe haven.

It took thirteen months for this idea to make its way into the mainstream press. This week, MarketWatch is reprinting an article from Barron's based on the latest Bank of America memo, which confirms exactly what I wrote last year.

According to Bank of America, gold could replace Treasuries as a safe-haven asset in investors' portfolios. The article points out that gold has gained over 30% this year, supported by falling interest rates and central bank purchases. The reasons for this rise, according to the bank, are linked to concerns about US debt, exacerbated by the elections, which could make gold even more attractive in the future.

J.P. Morgan is not entirely of this opinion: although gold may appeal to more investors, not least because of rising global debt, the bank recommends using it as a hedge rather than a substitute for Treasuries, stressing the strength of US assets. Phew! America's largest bank is not (yet) recommending replacing Treasuries with gold!

What if JPMorgan is wrong? What would happen if foreign investors' enthusiasm for US debt began to wane?

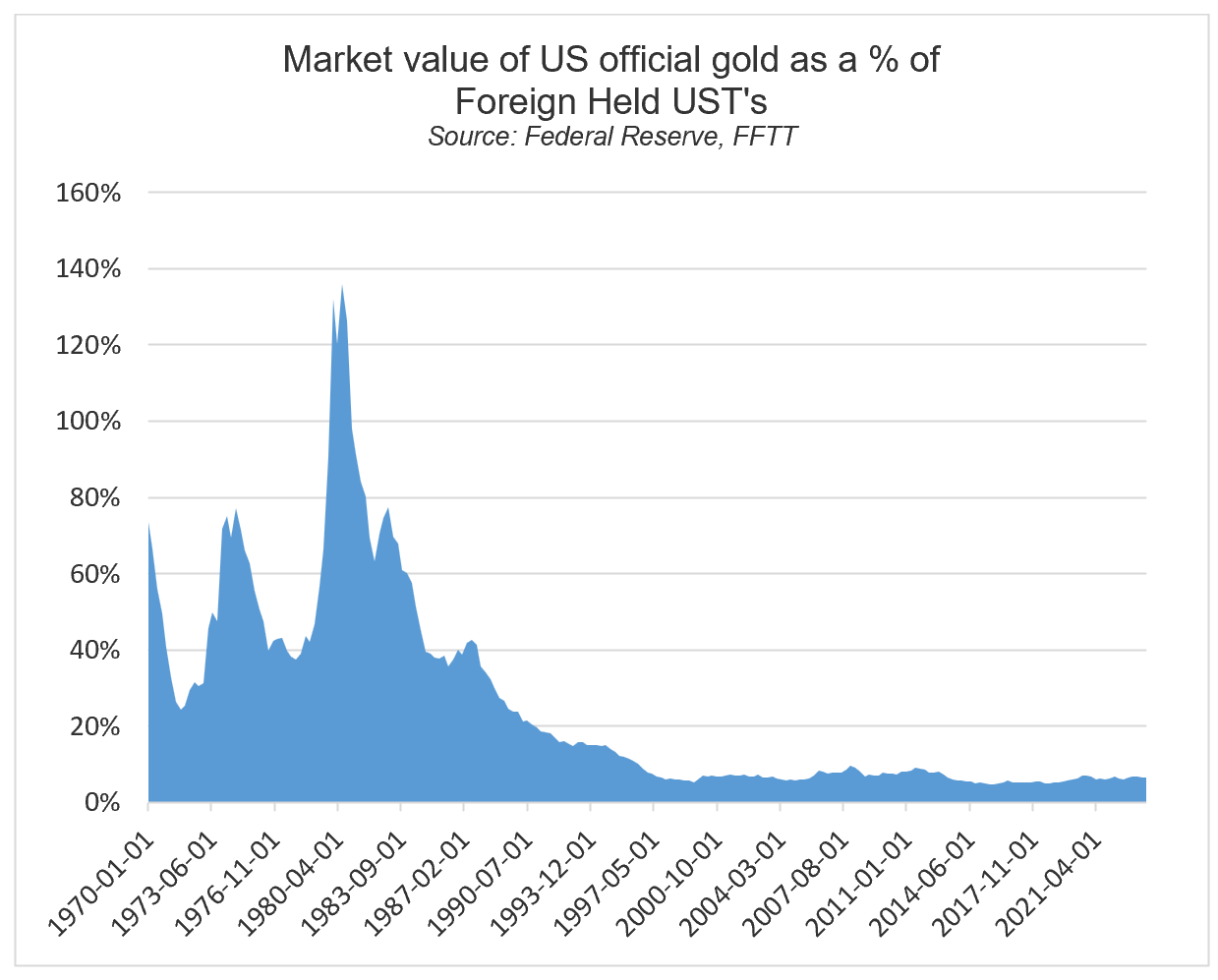

Analyst Luke Gromen has estimated that the price of gold is likely to rise by a factor of 3 to 5 if mistrust of Treasuries increases.

At $2,700 an ounce, the market value of official U.S. gold represents 8% of U.S. Treasuries held by foreigners. Prior to 1989, in the era of unipolar U.S. domination, this percentage was never less than 20%, with a long-term average of around 40%. In 1980, it even reached 135% (a veritable gold bubble). A move away from American unipolarity implies a rise in gold of 3 to 5 times its current level:

U.S. debt is driving gold higher, and the biggest U.S. banks are admitting it.

So, gold is no longer a barbaric relic?

Remember what Bloomberg's renowned economics reporter Joe Weisenthal said on April 5, 2021:

GOLDBUG MACRO IS DEAD

— Joe Weisenthal (@TheStalwart) April 5, 2021

I'm officially calling it. Goldbugs have had enough time to make their case. They failed. It's over.https://t.co/Pl5nZqsNJq pic.twitter.com/gXAlgCHUZk

Joe Weisenthal felt that the 'Goldbug Macro' theory, which warned of dollar devaluation and inflation caused by excessive money creation, was losing its relevance. He noted that, despite huge budget deficits and a spectacular increase in the Federal Reserve's money supply, gold had only risen by 10% in ten years. He also pointed out that inflation remained moderate, contradicting the alarmist predictions of this current trend. In his view, gold had failed to fulfill its traditional role as a safe-haven asset in times of economic crisis.

Three years on, gold has risen from $1,700 to $2,700 since that article was published, while inflation has made a stunning comeback, forcing the Fed to adopt an aggressive rate hike policy in an attempt to limit the damage.

I've met many managers over the past three years who also question the Goldbug Macro approach. “Laurent, you've been telling the same story for years. Your macro approach doesn't work!”

Today's gold denial stems mainly from the mistakes made by many economists. First they were wrong about the 2008 financial crisis, then they downplayed the impact of post-crisis monetary policies, and then they were wrong again about inflation being transitory.

Most economists now believe that Donald Trump's economic policy is doomed to failure, and that the tariffs the Republican candidate wishes to introduce will not have the desired effect on the country's economy. While they may be right on this point, their message is now inaudible, because they've been so wrong in the past.

Donald Trump's success is essentially due to the wreckage of these economists.

Trump would certainly never have won his first term and would not currently be the Republican Party's nominee if these economists hadn't been so spectacularly wrong about the Great Financial Crisis and transitional inflation.

Most of these economists continue to downplay the consequences of inflation-fueling monetary and fiscal policies.

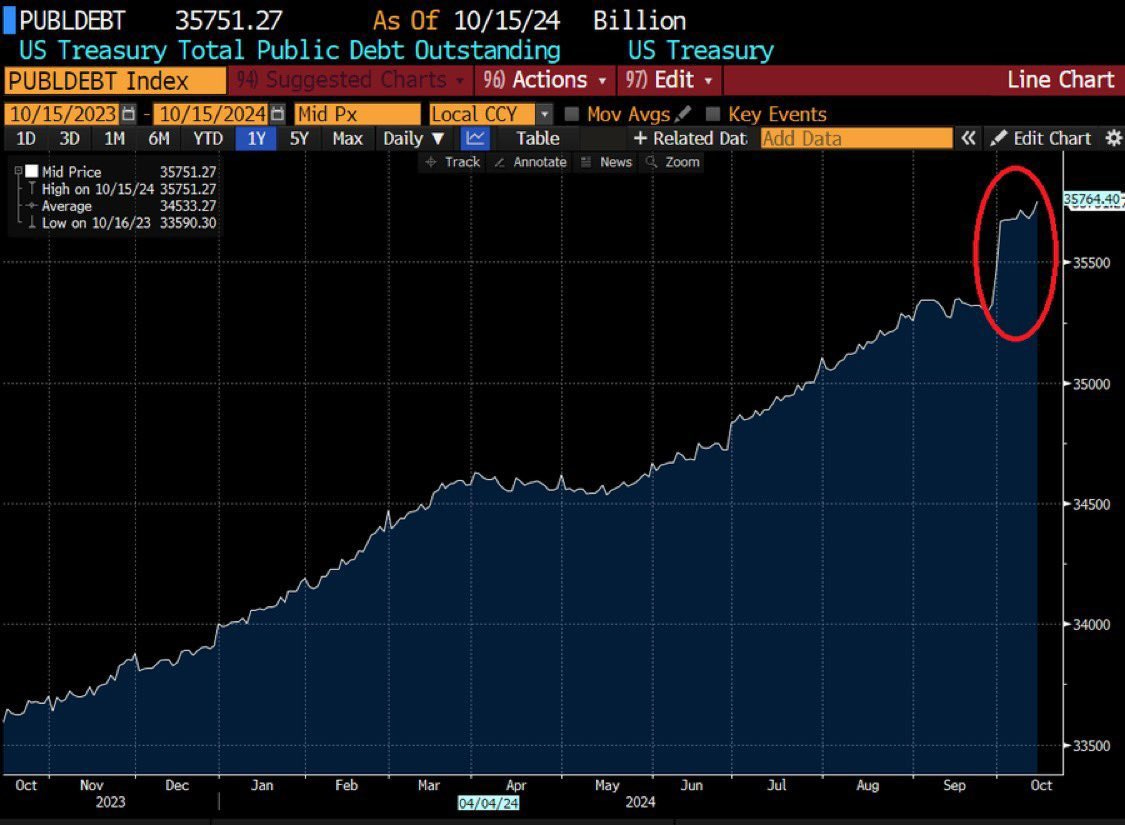

The US national debt has risen by $473 billion in the last three weeks.

It now stands at $35.8 trillion:

Perhaps JPMorgan is right, and this headlong rush into financial cavalierism will have no impact on the safe-haven status of Treasuries after all. Perhaps the fact that it comes from the world's greatest economic power won't harm the value of its bonds. A similar strategy, applied by a company, would bankrupt it in a matter of months, but the situation may be different for the United States.

However, some observers warn that this colossal expenditure in a pre-election period presents an imminent risk of market and asset collapse, not to mention a funding crisis in the weeks or months ahead.

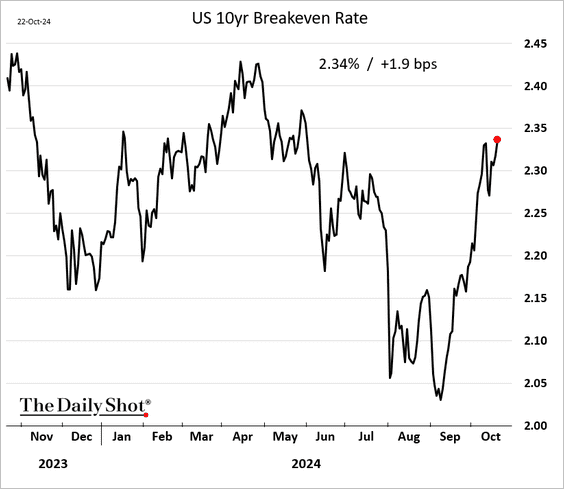

Even if JPMorgan is right, and the risks of a crash have been averted, a consensus is increasingly taking shape: this fiscal policy is paving the way for a definite surge in inflation from early next year. This is no longer a mere hypothesis, but a reality, as capital flows are already on the move.

The inflation problem is far from solved, and its return to the headlines is not far off.

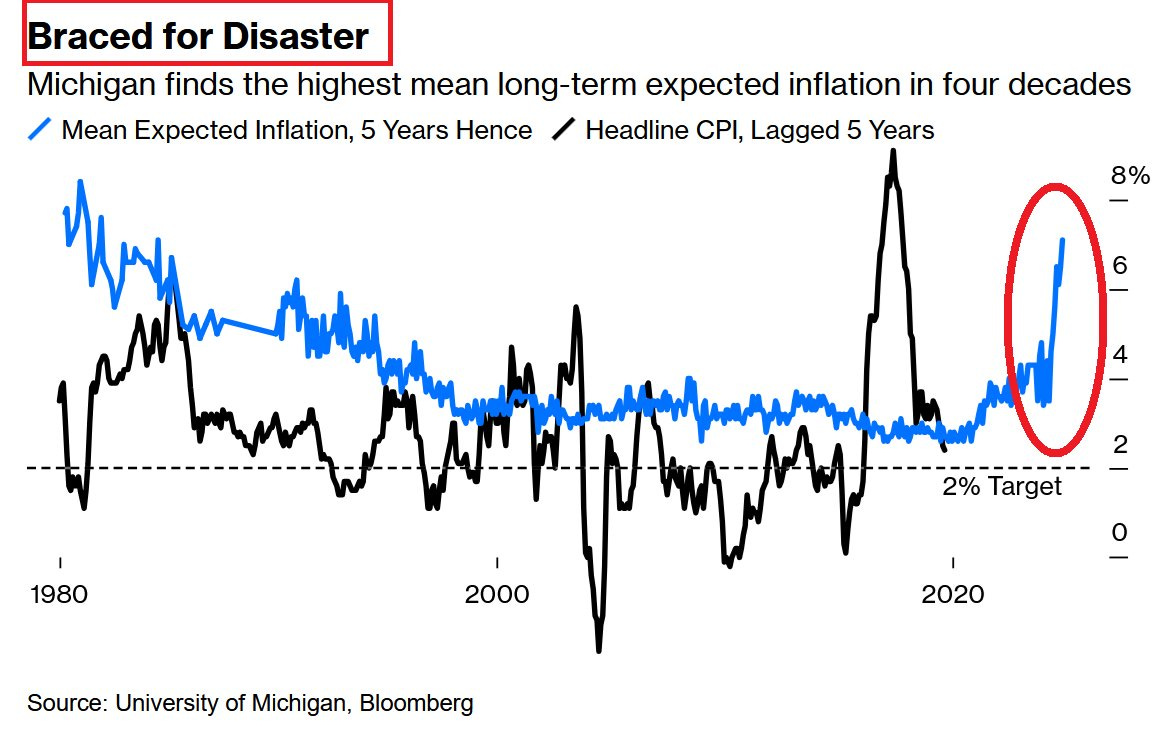

Long-term inflation expectations in the US have reached their highest level since June:

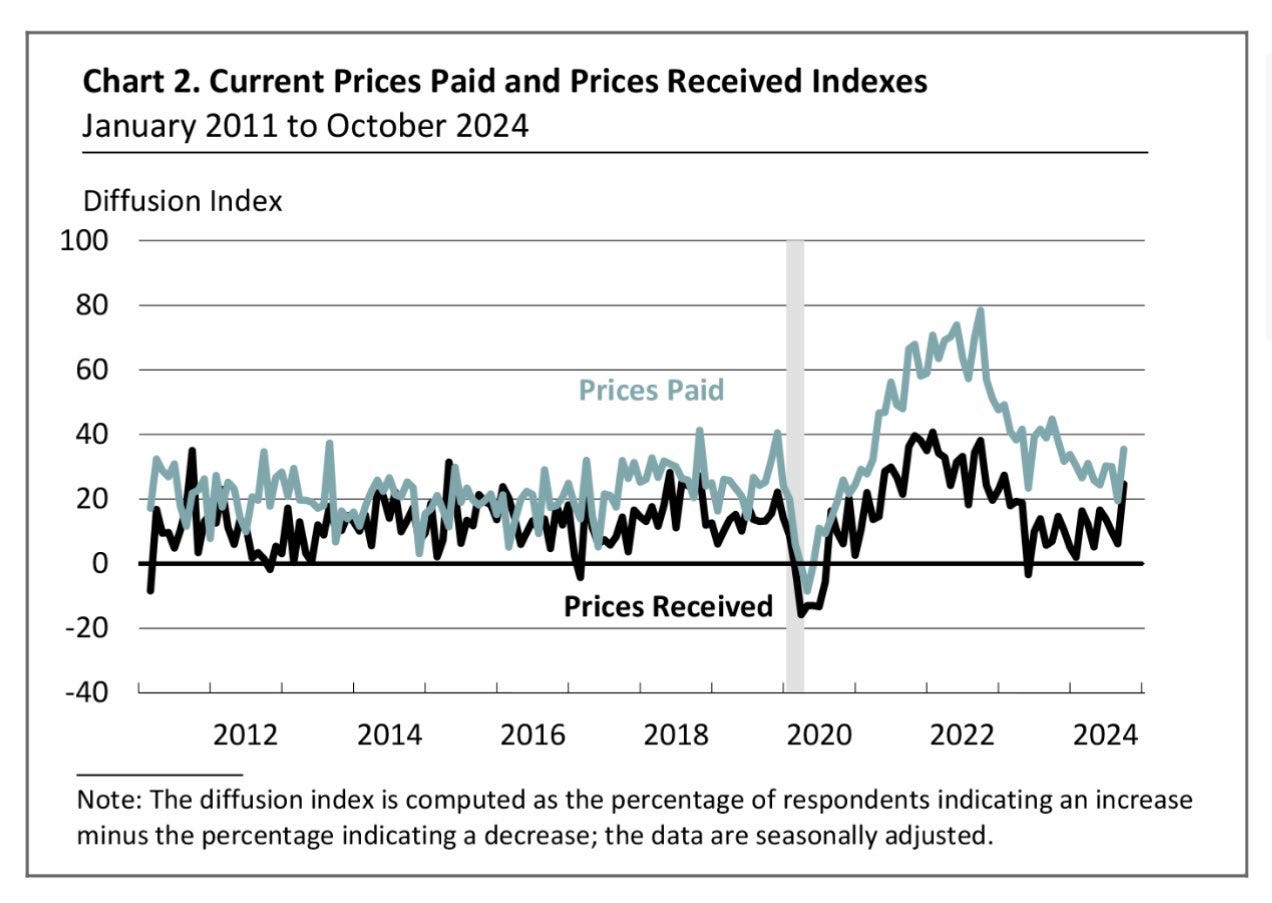

In October 2024, the Philly Fed's Prices Paid index rose sharply to 35.4 from 19.5 in September. The report reveals that price increases continue for both inputs and business goods and services. The Prices Paid index gained 16 points, highlighting persistent inflationary pressures this month:

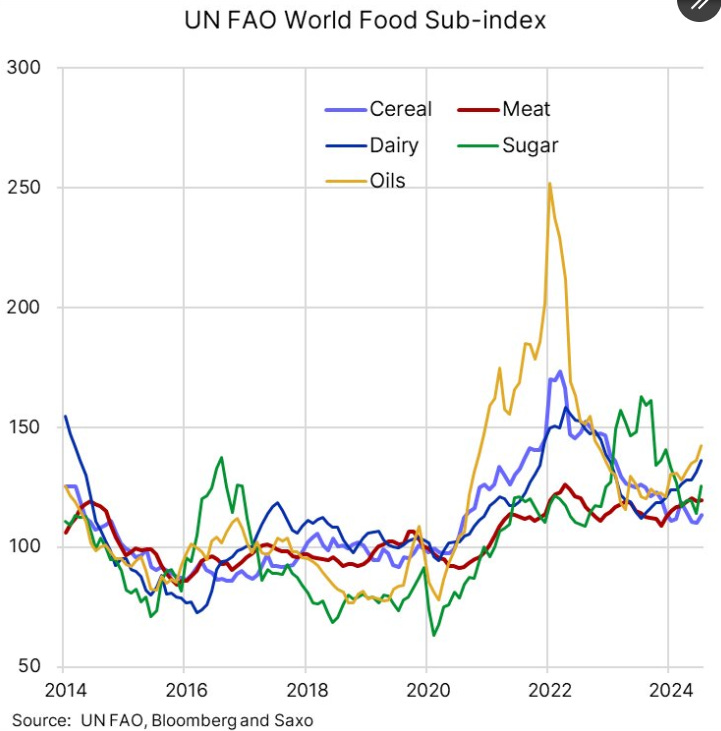

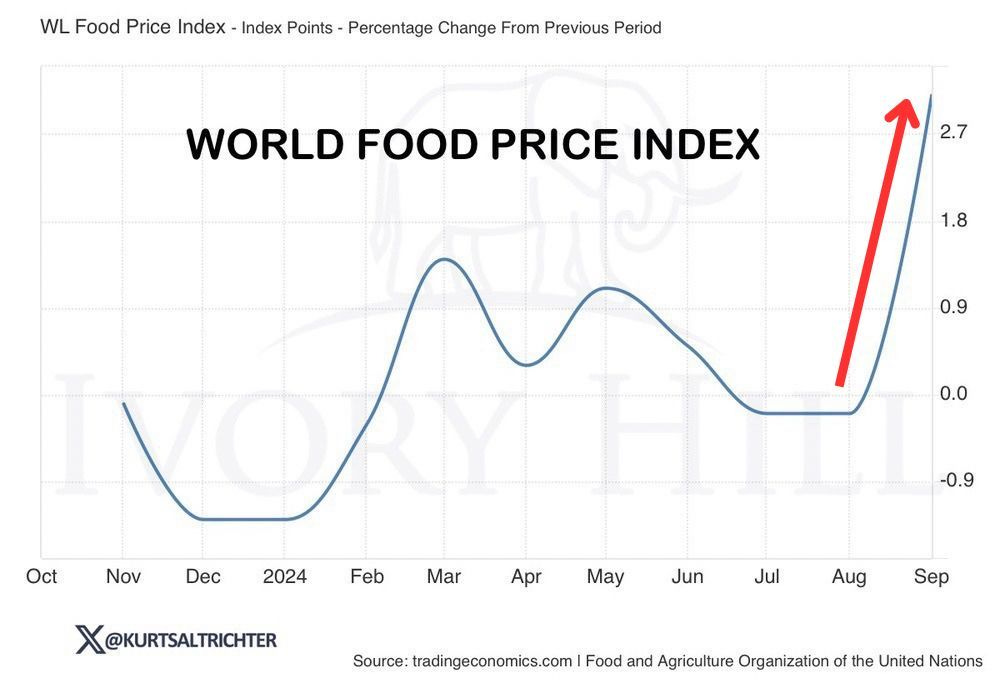

Last month, global food prices saw their biggest rise since March 2022, according to UNFAO, with prices up in all five major categories. Sugar jumped 10.4%, followed by vegetable oils (+4.6%), dairy products (+3.8%) and cereals (+3%). Overall, the World Food Price index was up 3% on August and 2.1% on the previous year:

Inflation is on the rise again, and this time it's foodstuffs that are starting this new cycle:

US consumers' average inflation expectations for the next five years have reached 7.1%, a level not seen since the 1980s. This indicates that the average American expects inflation to soar in the years ahead:

This change in perception is particularly worrying: inflation expectations logically fuel the upward price cycle, as they increase the speed of capital flows.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.