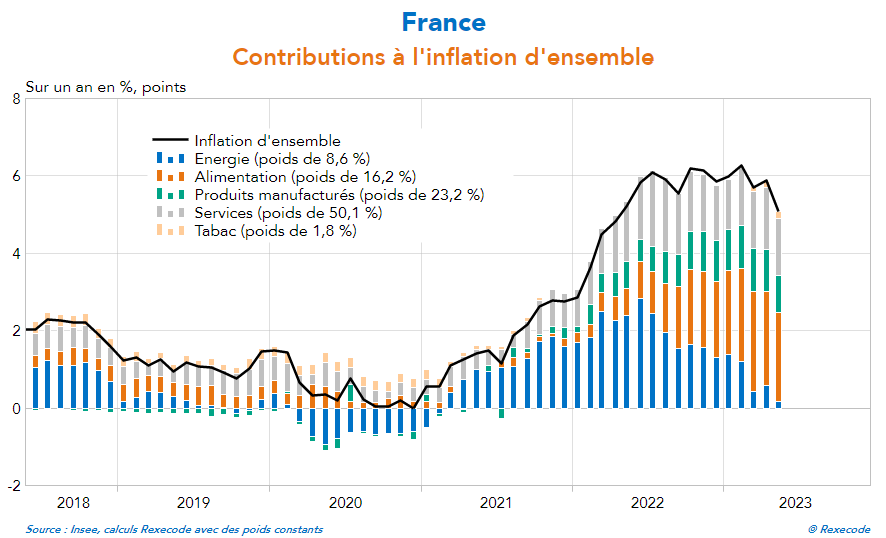

In France, inflation has finally eased thanks to the collapse in energy costs, although food prices continue to soar:

While France can finally look forward to an easing (albeit minimal) of inflation, things are markedly different in other countries where the battle against rising prices is in full swing.

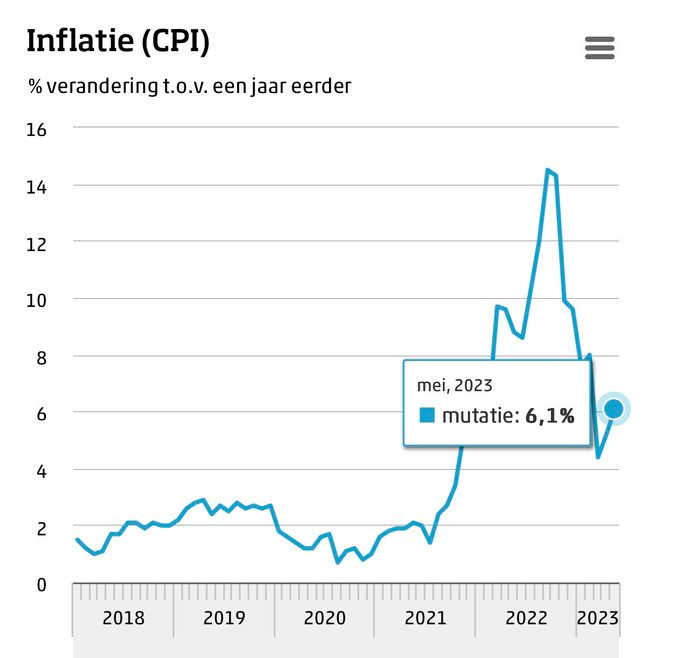

In the Netherlands, for example, the CPI index picked up again last month.

In annual variation, the +6.1% recorded in May is admittedly lower than the +14% at the end of last year, but these figures are still far too high, especially considering the collapse of oil, natural gas and electricity prices in the country.

As in the Netherlands and Great Britain, we are wondering whether the recent fall in inflation seen in the United States in recent months is sufficient and sustainable.

Firstly, because there are sectors where supply problems have still not been resolved. This is the case for most metals, as we have discussed in our previous bulletin. Other commodities are also experiencing an unprecedented supply shock. American wheat is likely to be hit by the historic drought in the Great Plains of Kansas. In Spain, a heat wave is jeopardizing harvests of certain agricultural products, with a direct impact on olive oil prices, which are soaring to all-time highs.

The Core PCE inflation figures published in the US last week reveal another reason why inflation is not coming down as quickly as expected.

For, although there has been a noticeable drop from the peak at the end of 2022, we are still far from being back to the level we were at before the first inflationary surge.

The US economy has moved from a supply-induced inflation shock to "entrenched" inflation.

The latest PCE report (which measures the level of consumer prices) shows that when incomes rise rapidly, so does spending, so inflation remains well above the Fed's target.

Core PCE inflation remains firmly anchored at over 5%.

Inflation is high for one fundamental reason: nominal spending growth is outstripping that of production capacity in the economy. Although it varies from month to month, nominal spending growth has remained around 6% for the past six months.

Americans are spending more than the real economy can supply in goods and services. This is fuelling rising inflation.

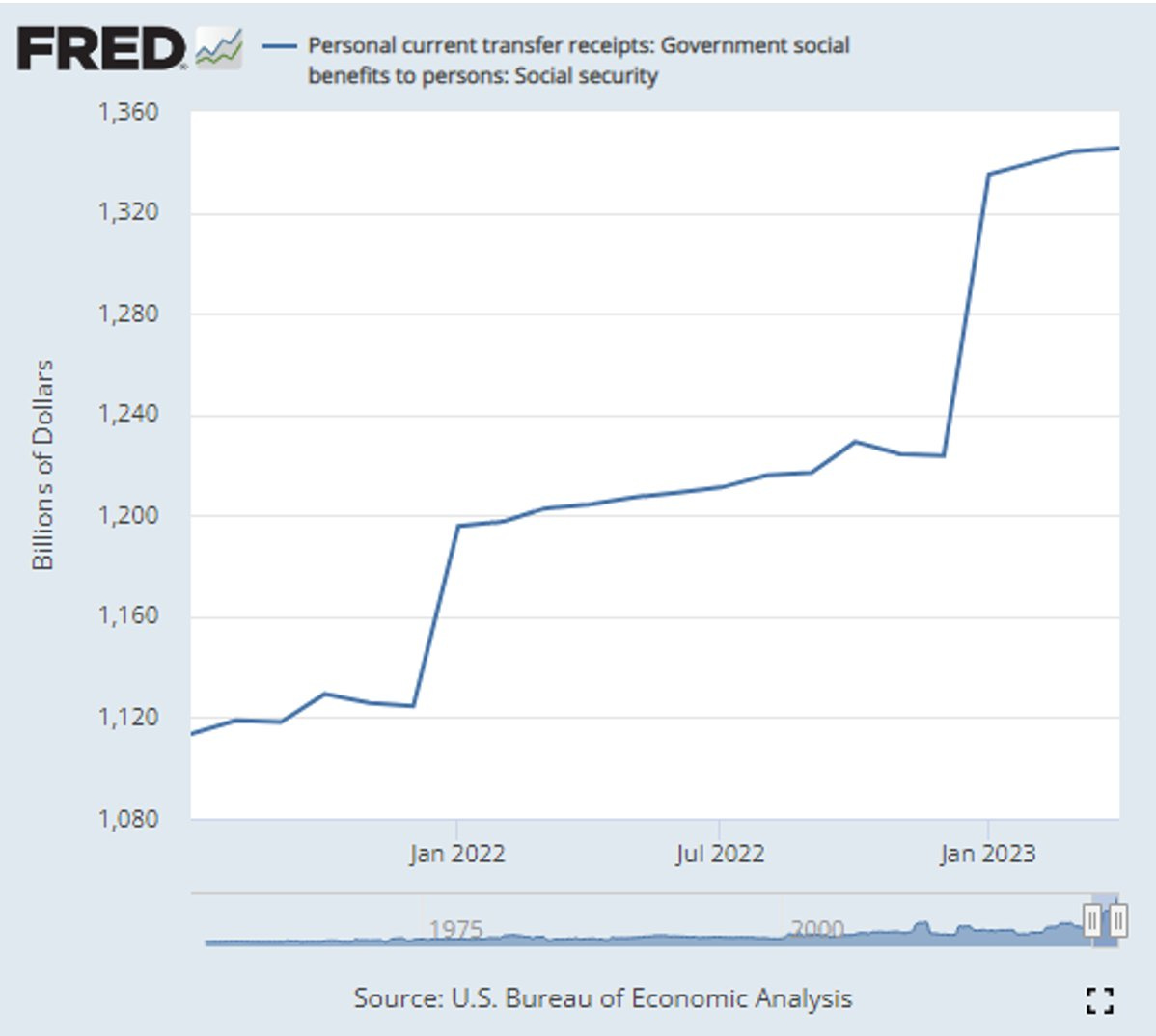

Two items are helping to maintain American purchasing power:

Firstly, welfare benefits continue to rise, even after the sharp increase seen during the Covid crisis.

Raising the debt ceiling to an unlimited amount is an assurance that government support is not about to dry up.

If the headlong rush to fiscal policy had been halted by not raising the debt ceiling, this would probably have had a major effect on lowering inflation. The shock to the economy as a whole would have had a real impact on inflation.

If monetary policy is restrictive while fiscal policy is not, it is logical that the fight against inflation will be more difficult.

Another factor supporting consumption is that high interest rates are now enabling more and more Americans to maintain their purchasing power despite rising prices. Even if consumption by low and middle-income earners is marking time (as confirmed by Target's results), American high-income earners have largely maintained their consumption levels. The middle classes are consuming less, but the richest are not. The luxury goods industry is doing wonderfully well!

High savings yields have enabled high-income earners to maintain substantial purchasing power. Savers have converted their bank deposits, which were yielding nothing, en masse into bond-backed savings instruments, which are yielding over 5% a year. The Fed's rate hike restored a certain level of return on savings. They were thus able to maintain a high level of savings and continue their buying spree, despite a general rise in prices.

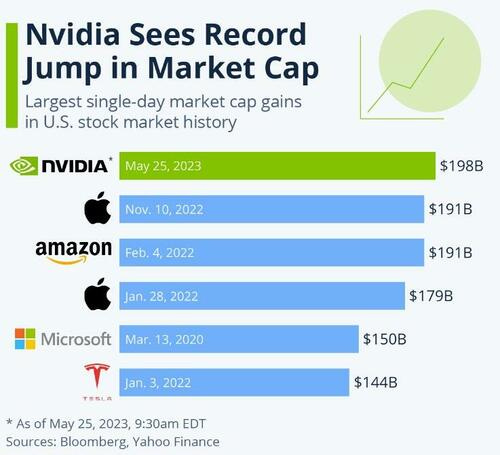

Savers can also benefit from a new speculative bubble on the financial markets, this time in the artificial intelligence sector.

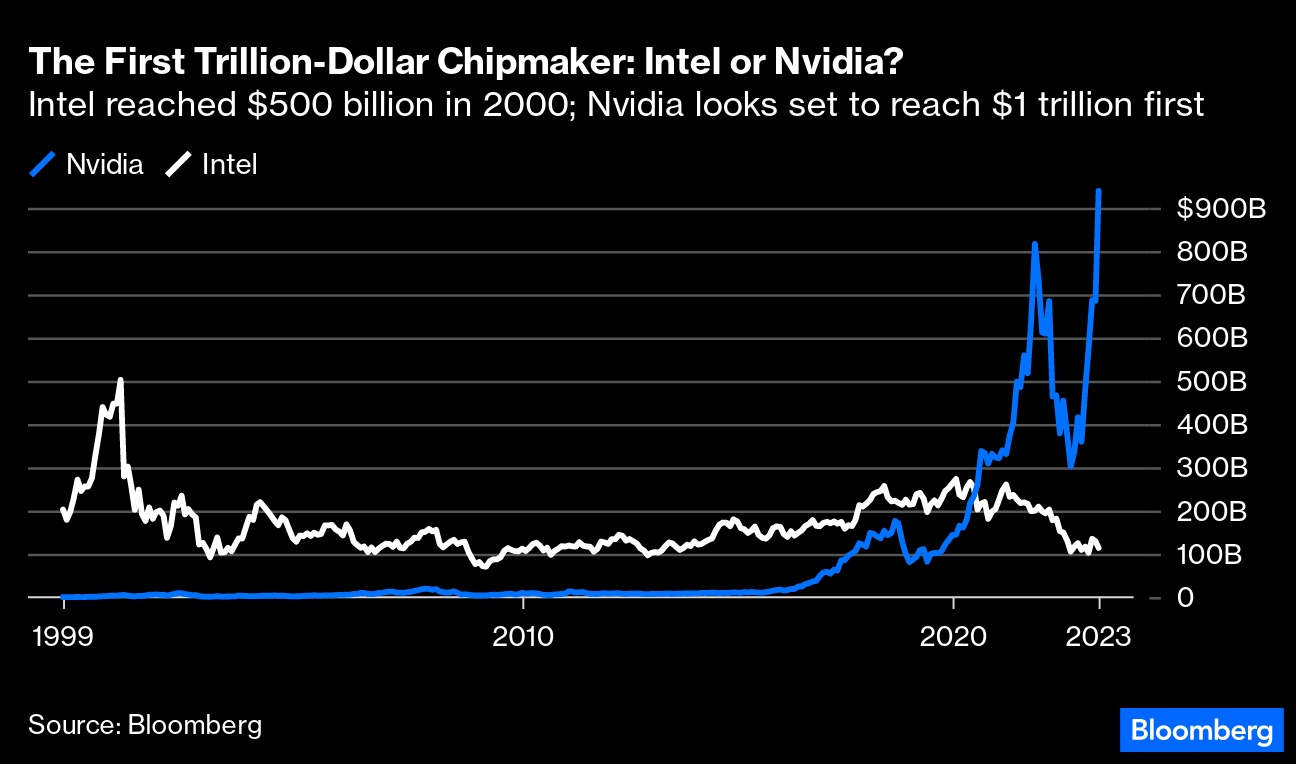

Nvidia has been the main beneficiary of the new "mania" phase in telecoms stocks. On May 25, Nvidia saw its market capitalization rise by $198 billion in a single session, beating Apple's all-time record.

In March 2000, Intel was the center of attention, reaching $72 per share and trading at fourteen times sales and sixty times earnings. Today, the share price is $27. NVDA currently trades at thirty five times sales and one hundred and eighty times earnings. The speculative madness of the Internet bubble of the 2000s now seems insignificant compared to that surrounding Artificial Intelligence stocks.

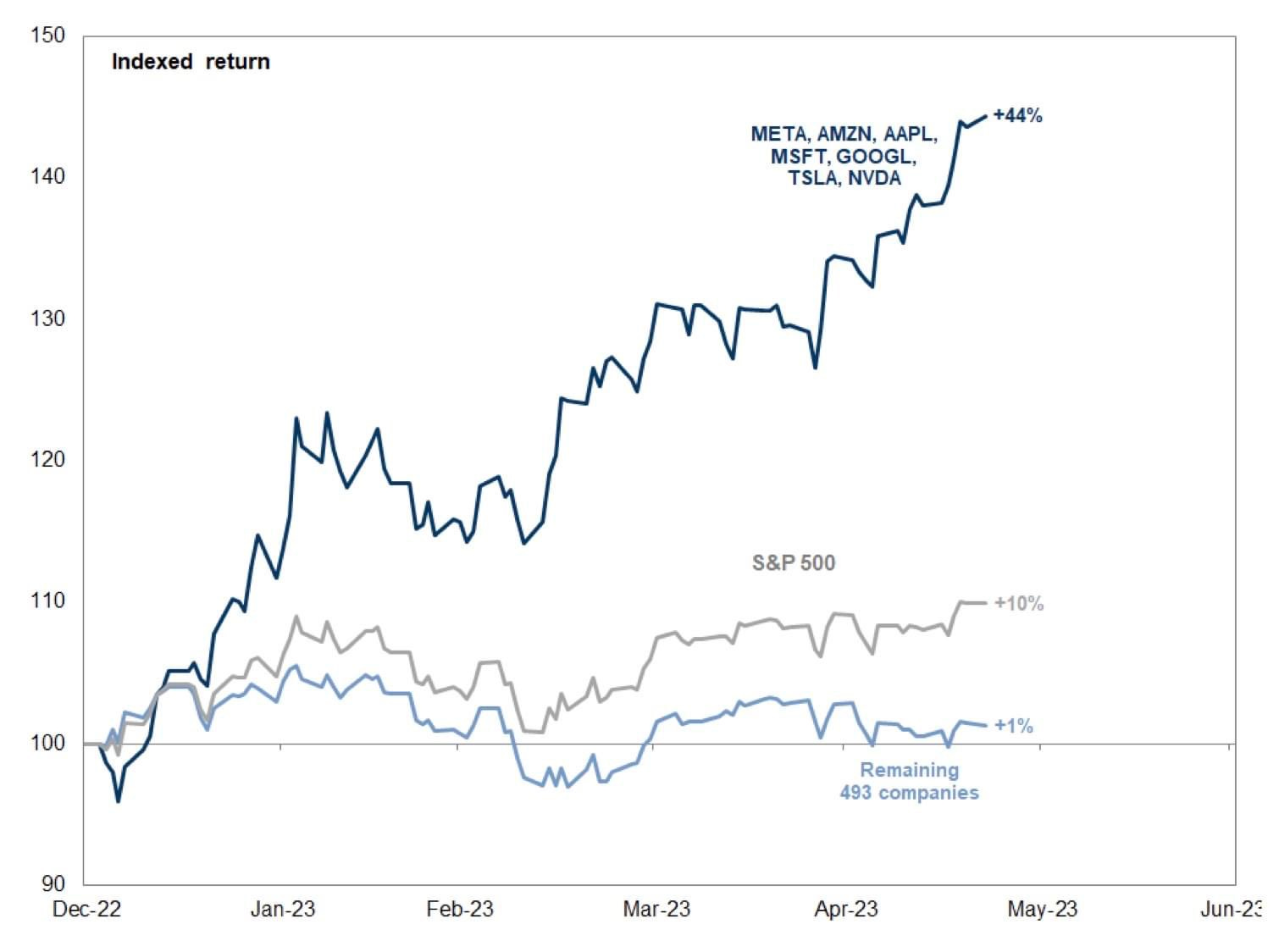

This speculation concerns only a few of the stock's star performers. The other technology stocks remain on the sidelines:

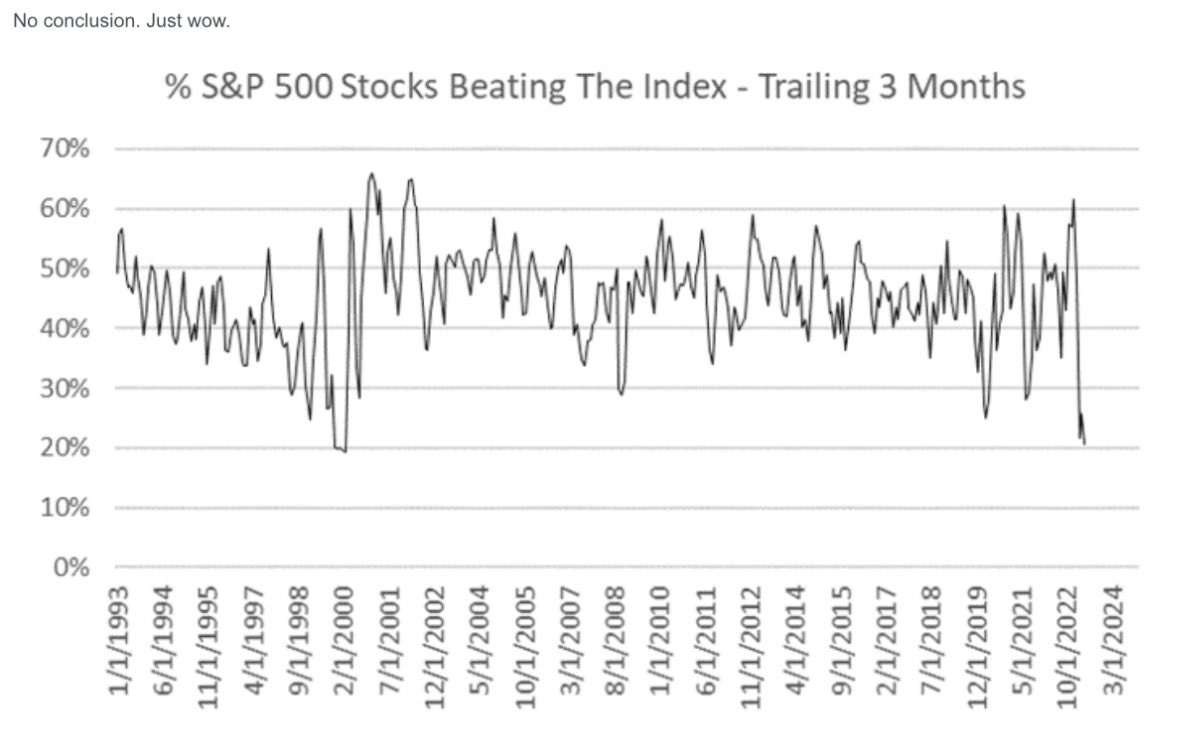

After fifteen years of money printing, it's only logical that more liquidity should fuel an even bigger bubble than in 2000. This time, however, the bubble is concentrated on just a handful of stocks, suggesting that the market may even stall in the face of the tightening craze:

The accommodating monetary policy implemented by the Fed over the past fifteen years has inflated this bubble, which benefits the highest income earners. Rising interest rates have failed to break this trend; on the contrary, they are supporting the savings of these high-income earners and maintaining the inflationary spiral.

The perverse effects of monetary policy on inflation are also reflected in the figures published last week.

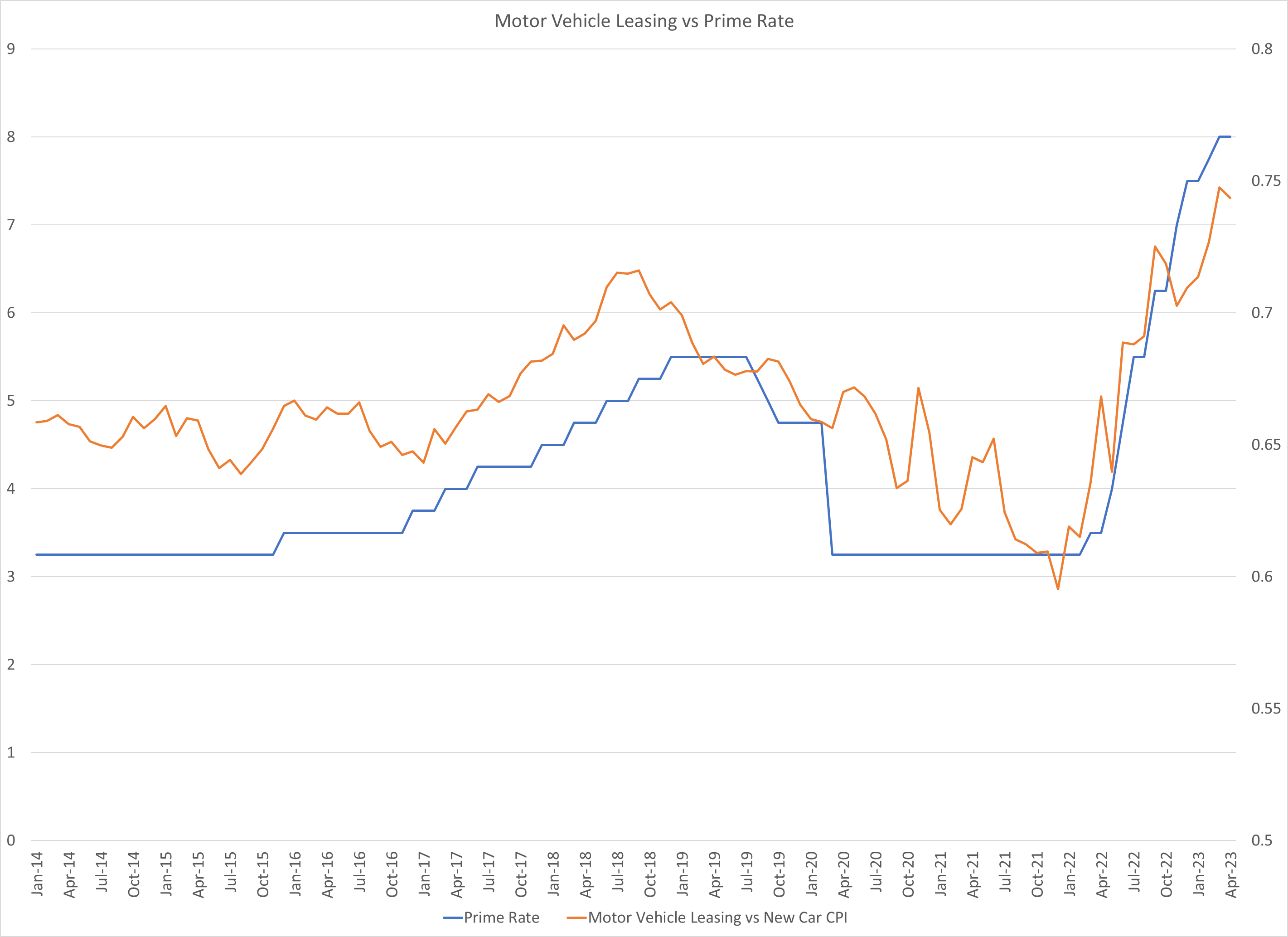

The latest figures for Core Services ex-Housing show why inflation is struggling to recede: imputed costs for financial services and motor vehicle leasing (which are directly linked to interest rates) are up sharply.

In other words, the Fed's rate hikes are having a direct impact on the financial services component, which is increasingly weighing on inflation figures! Raising rates to fight inflation is now fuelling that inflation.

The Fed's failure to combat inflation is the main reason why gold prices have remained at very high levels. The fall in oil prices and the dollar's significant rebound have not led to a significant correction in gold. This came as a surprise to many analysts, who were expecting gold to fall sharply in the face of declining inflation figures. Gold may be telling us that this fall in inflation is only temporary after all...

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.