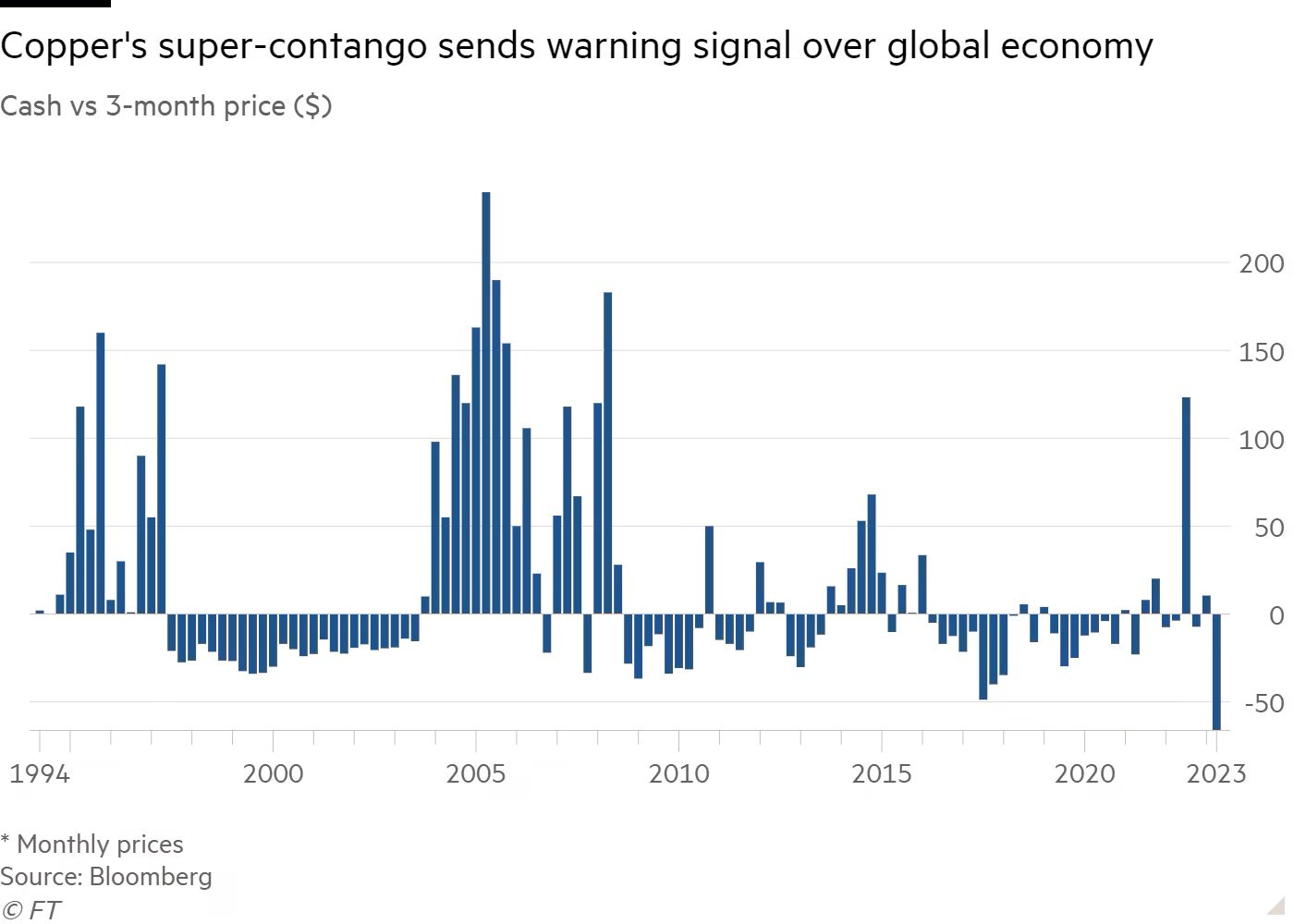

"Dr. Copper" continues to send increasingly strong recessionary signals. Copper prices have been in free-fall for several weeks, driven by renewed speculative bearishness on futures.

The "short" movement on futures is so strong that the contango on copper is at an all-time high. The gap between the 3-month price and the current price has never been so wide.

Investors anticipating a recession took advantage of the break of the bear flag to add new short positions. Copper, now clearly in a downtrend, is attracting more and more speculative shorts.

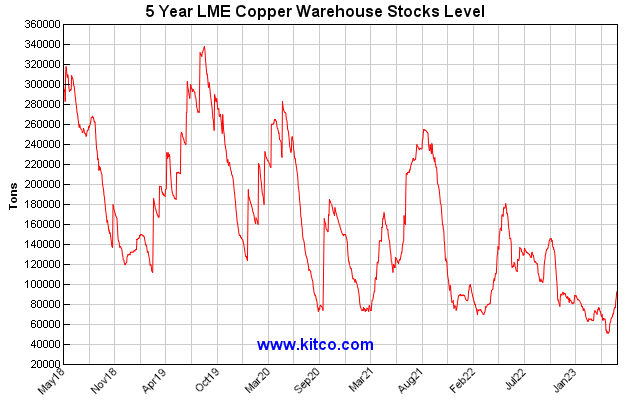

These "paper" sales are taking place against a backdrop of tension on the physical market. Despite the fall in copper prices, LME restocking remains weak:

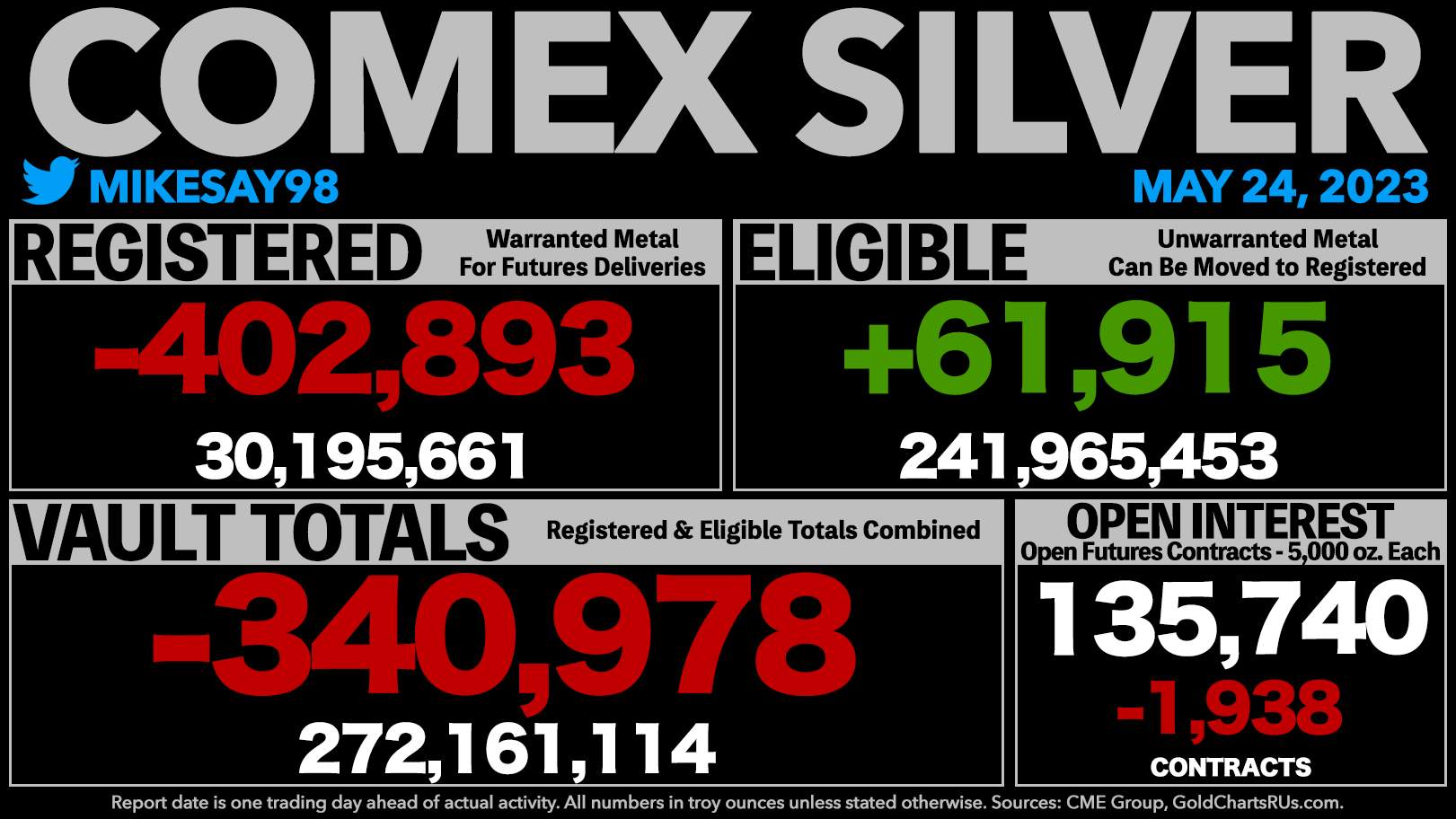

The "paper" silver market follows copper's correction. The grey metal has returned to its consolidation channel, reversing the breakout of the beginning of the year:

The downturn in silver prices continues to drain the COMEX vaults. In a single day, 400,000 ounces left the COMEX's available stock:

The fall in prices gave one participant the opportunity to take delivery of a record amount of silver on the Shanghai market: according to analyst Bai Xiaojun, 144 tons of silver were delivered on the Chinese market in a single day:

Bets on a possible future recession are driving futures prices down, accelerating the rush to physical metal stocks.

In any case, such a recession is a long way off for the time being.

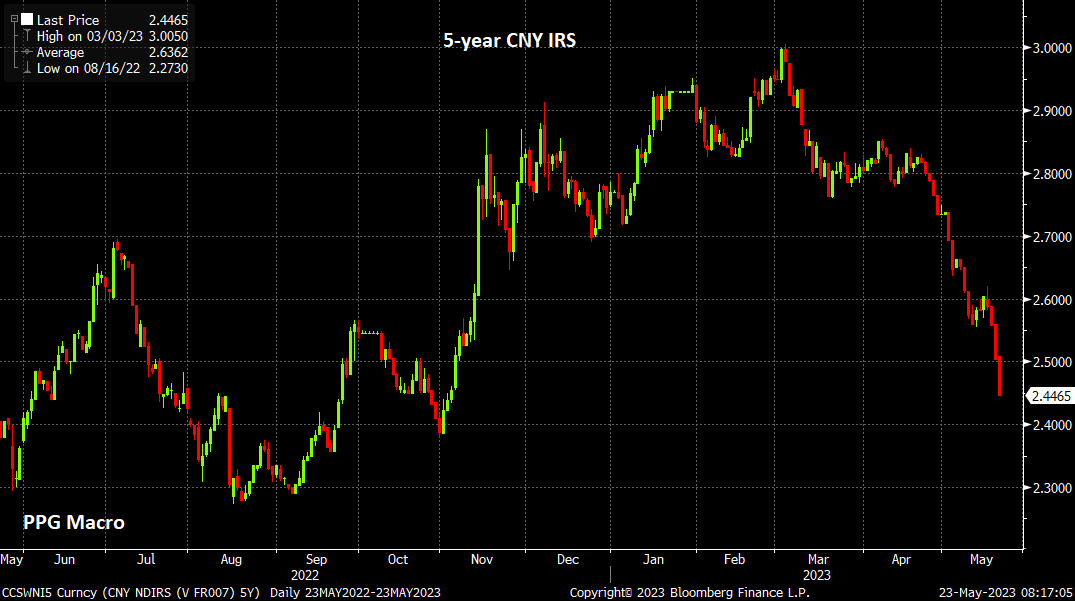

Chinese interest rates have fallen sharply, which should help to stem the housing market's slide:

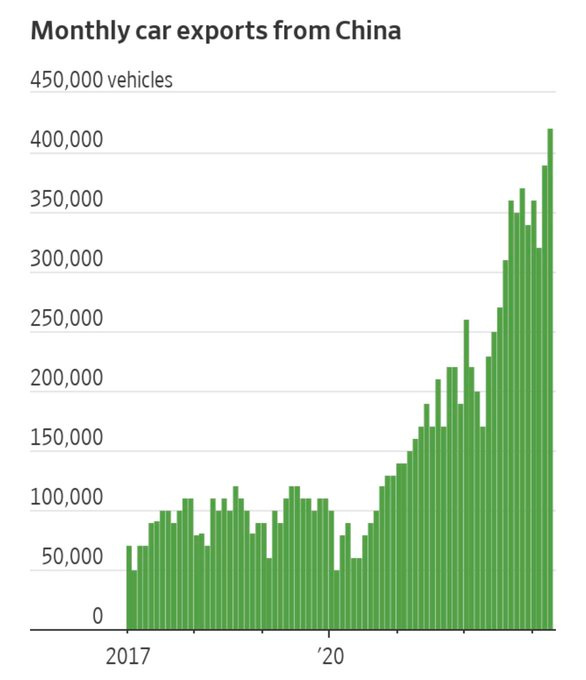

This lowering of rates is helping to support China's recovery. This month, the country became the world's leading vehicle exporter, with nearly 450,000 cars sold worldwide:

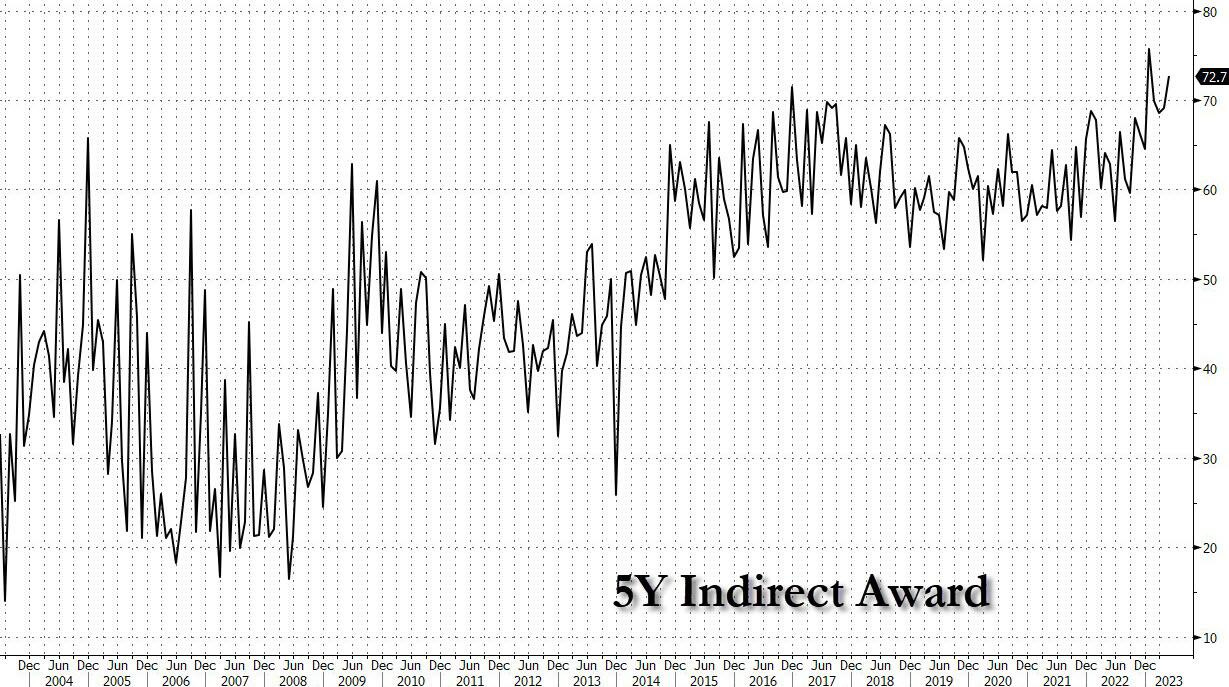

The fall in the Chinese 5-year is one of the main reasons why the US dollar has soared in recent sessions. With US yields the highest in the world, it's only logical that there should be an influx of capital into Uncle Sam's country. On Wednesday, the US 5-year auction attracted a record number of participants. With 72% of bids placed by "indirect" participants, it was the second most popular auction after last January's record:

The success of these debt issues is all the more remarkable given the current tense debate on raising the debt ceiling.

Those who flocked to this Treasury auction can't imagine for a minute that the United States might default on June 1! The political "drama" unfolding on the other side of the Atlantic continues to leave investors unmoved.

The predominant feeling is that the US recession is not about to hit.

Even if certain indicators point to a slowdown, the shock to American consumption that should have been caused by the rate hike is not yet palpable... on the contrary!

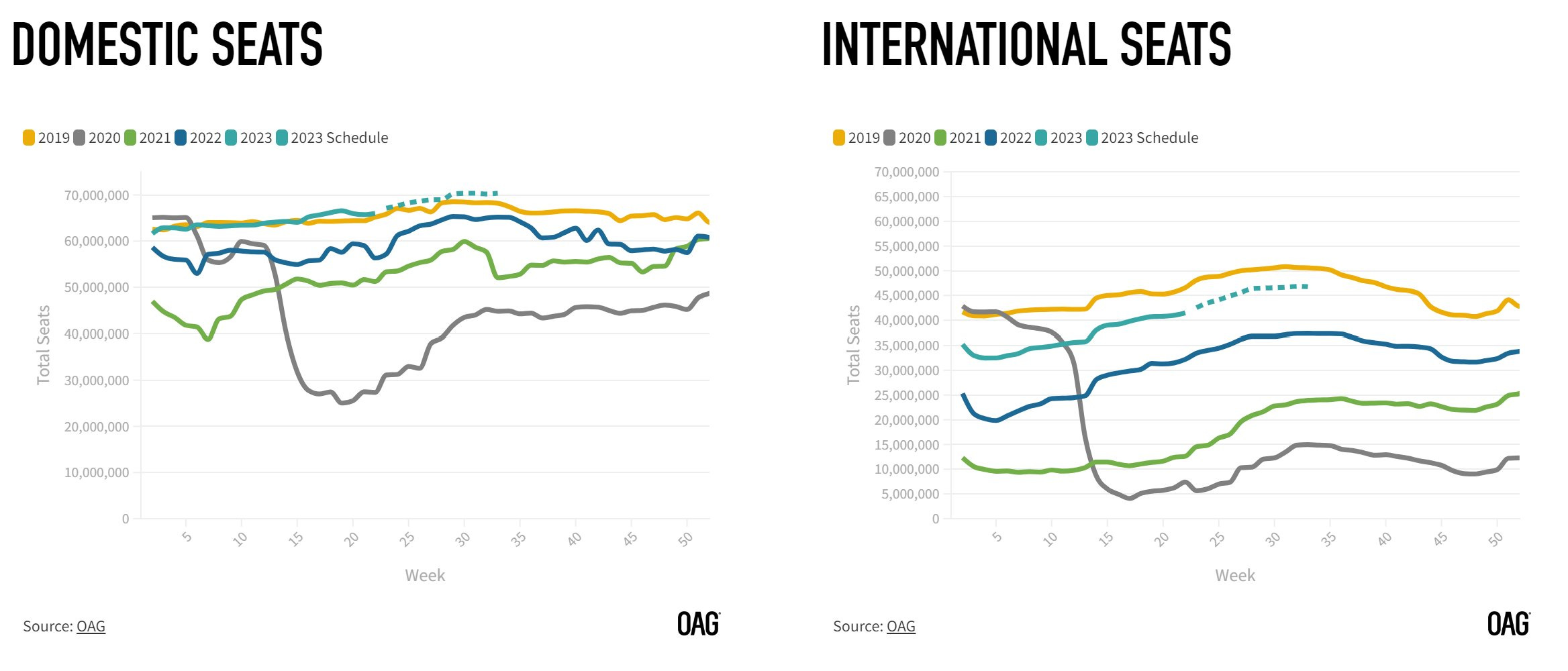

For example, figures released by the airline industry show no sign of an economic slowdown: according to the TSA, a record 2.6 million travelers used US airports last Sunday. This figure is all the more significant given that the previous record dates back to Thanksgiving weekend 2019.

Domestic flights were the main beneficiaries of this resurgence in air travel. Incidentally, this upturn in activity benefits above all the US domestic market.

This increase in passenger numbers is all the more remarkable as it comes on the heels of an explosion in air fares. It should be noted that pilot salaries have risen, notably at Delta Air Lines, which is creating problems at other airlines. Air Canada is beginning to see the beginnings of a serious social crisis, as the wages of its pilots are becoming less and less competitive with those of their American counterparts.

This upturn in activity can also be seen on the roads: last week's demand for gasoline matched that of the Thanksgiving weekend.

Technology stocks have also rallied against this backdrop of a resilient US economy and optimism around the AI technological revolution.

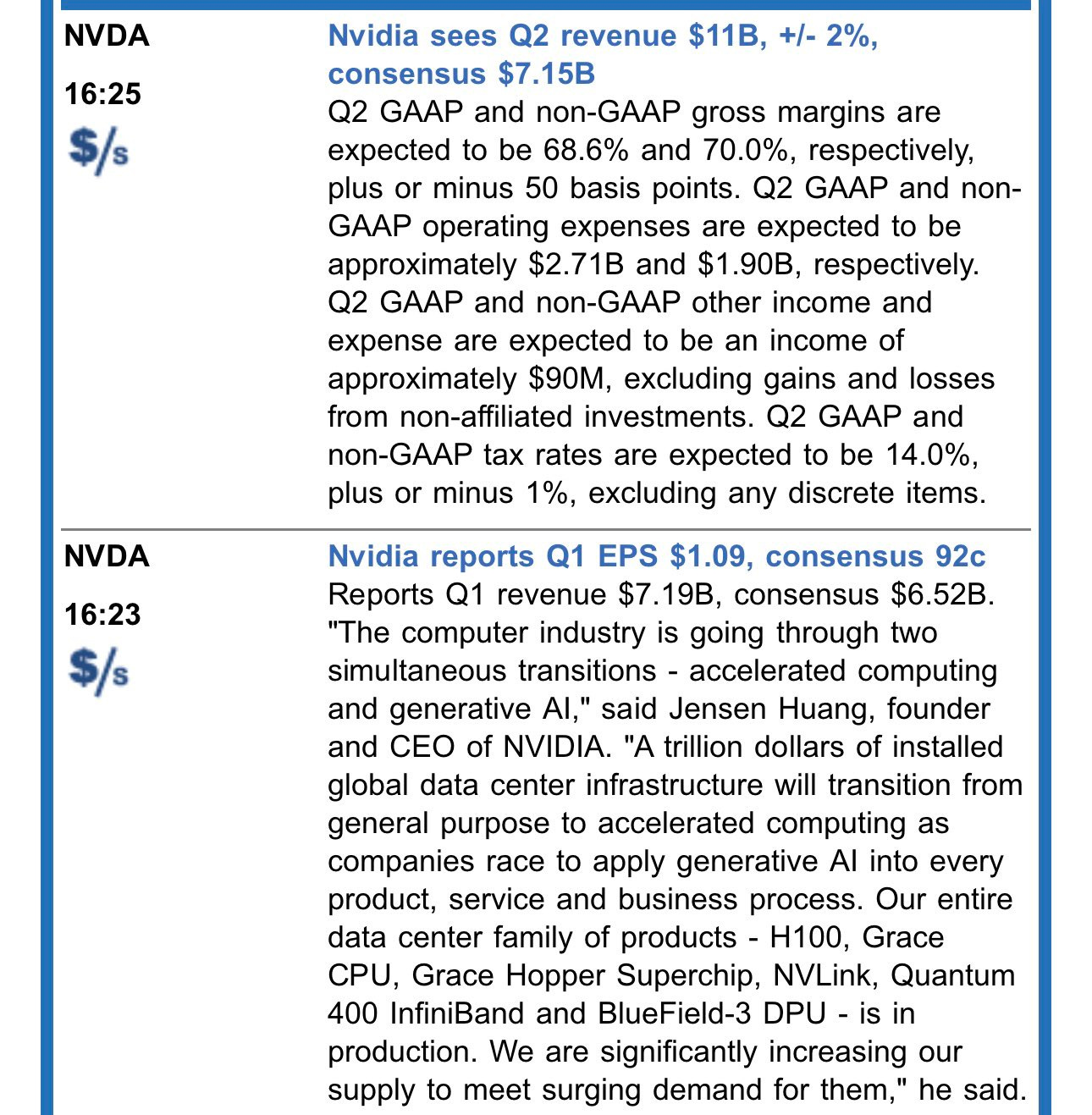

Nvidia has just published an extraordinary forecast for the second quarter:

The Nasdaq resumes its outperformance of gold, on a very long-term trend that has lasted for over ten years. Gold price, however, continues to hold its own.

The Nasdaq's advance seems to have stalled relative to gold in recent months. The Gold/Nasdaq chart has just tested the breakout of the downturn that began in 2011:

Gold would have to really take off against technology stocks to break this long-term trend. Only when this happens will we see a real influx of new capital into the precious metals sector. Today, there are a number of catalysts that could bring about this shift. Investors' infatuation with tangible assets and the gradual abandonment of growth stocks is likely to be the theme of late 2023.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.