The news broke on Friday, after the markets had closed: Moody's has downgraded the outlook on its US credit rating.

Treasury Secretary Janet Yellen criticized the rating agency's decision, reiterating that the dynamism of the US economy did not justify such a negative outlook.

It is true that many observers have underestimated US stimulus plans and their effects on the economy.

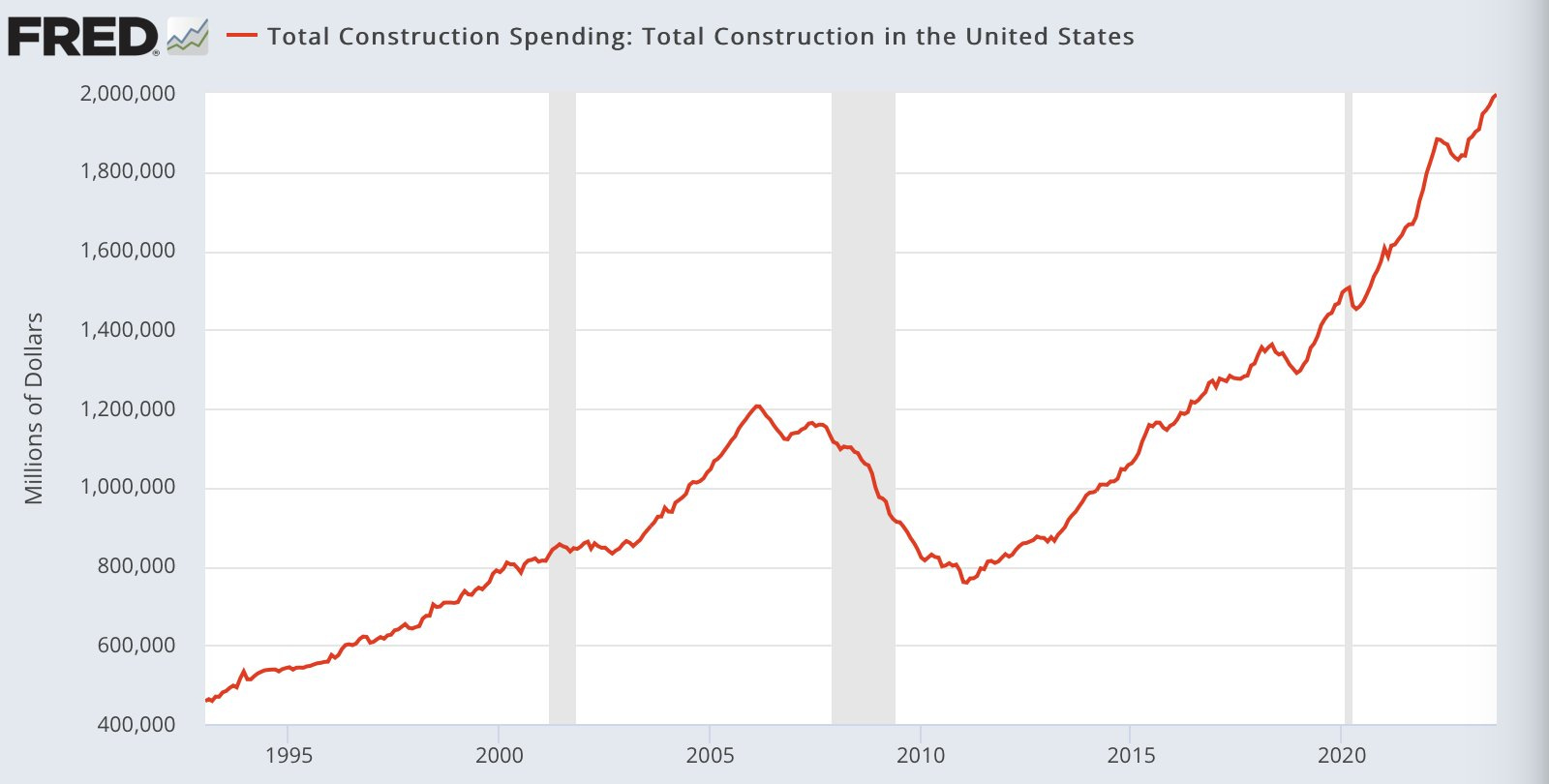

The construction sector has experienced an impressive boom in recent months:

Since the turn of the century, the US construction sector has tripled in size, and its growth has not been hampered by the Covid crisis, mainly due to financial support from public spending.

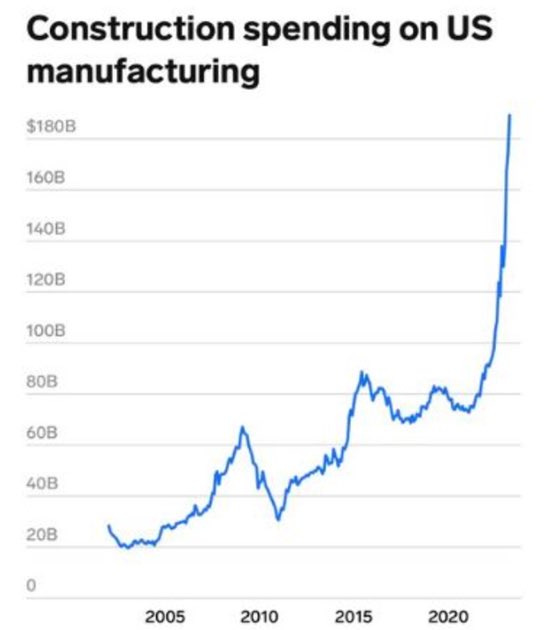

Under government impetus, the country has embarked on a phase of massive reindustrialization, and construction spending in the manufacturing sector has exploded since 2020:

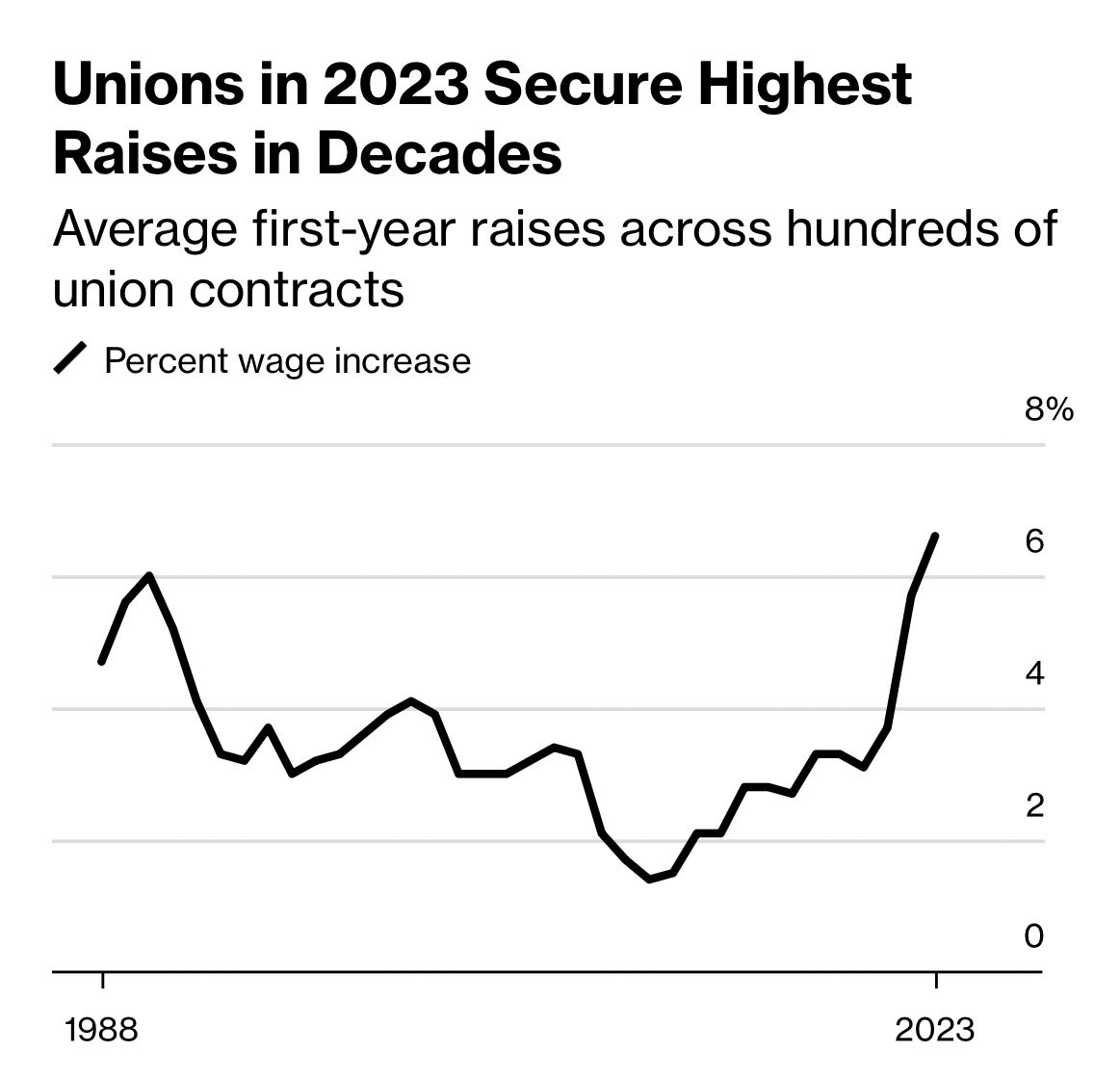

This movement was associated with a significant increase in salaries, even though this was lower than the rate of inflation over the same period:

The US economy benefited fully from this boost in public spending.

But this stimulus has come at the cost of a record rise in the public deficit.

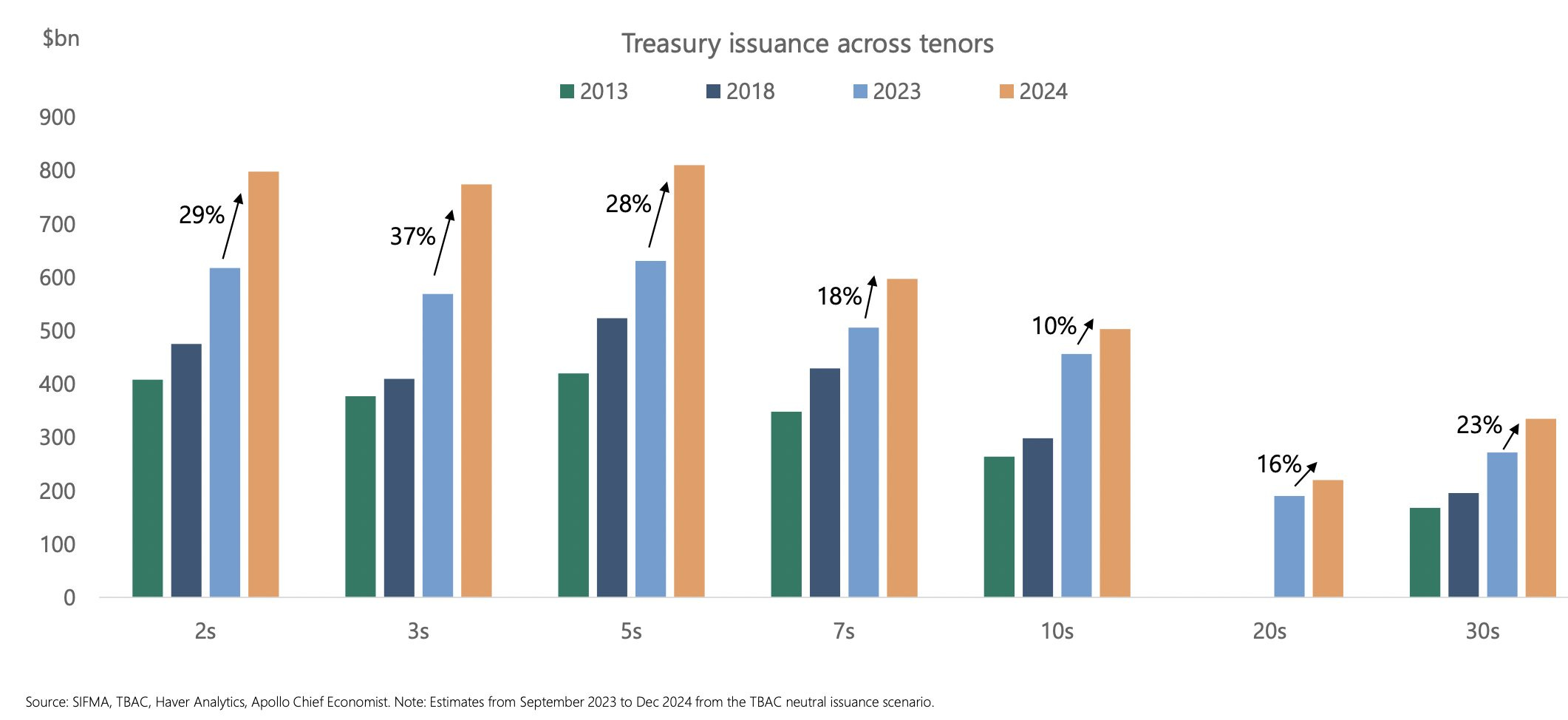

Moody's highlights the explosion in the cost of debt and the risk of a monumental increase in the deficit forecast for 2024.

To finance this cost, the Treasury will have to increase the amount borrowed to refinance its debt by an average of 25%:

Rising refinancing costs could force the Fed to take measures such as cutting rates and relaunching a bond-buying program. At least, that's what the markets are anticipating this week: better-than-expected US inflation figures suggest that the Fed Chairman will adjust his policy, probably signaling the end of rate hikes, according to most observers.

All the more so as the first tangible signs of a slowdown are beginning to appear, particularly in the commercial and residential real estate markets, a topic covered extensively in my articles.

In recent weeks, the transport sector has also shown signs of reversal.

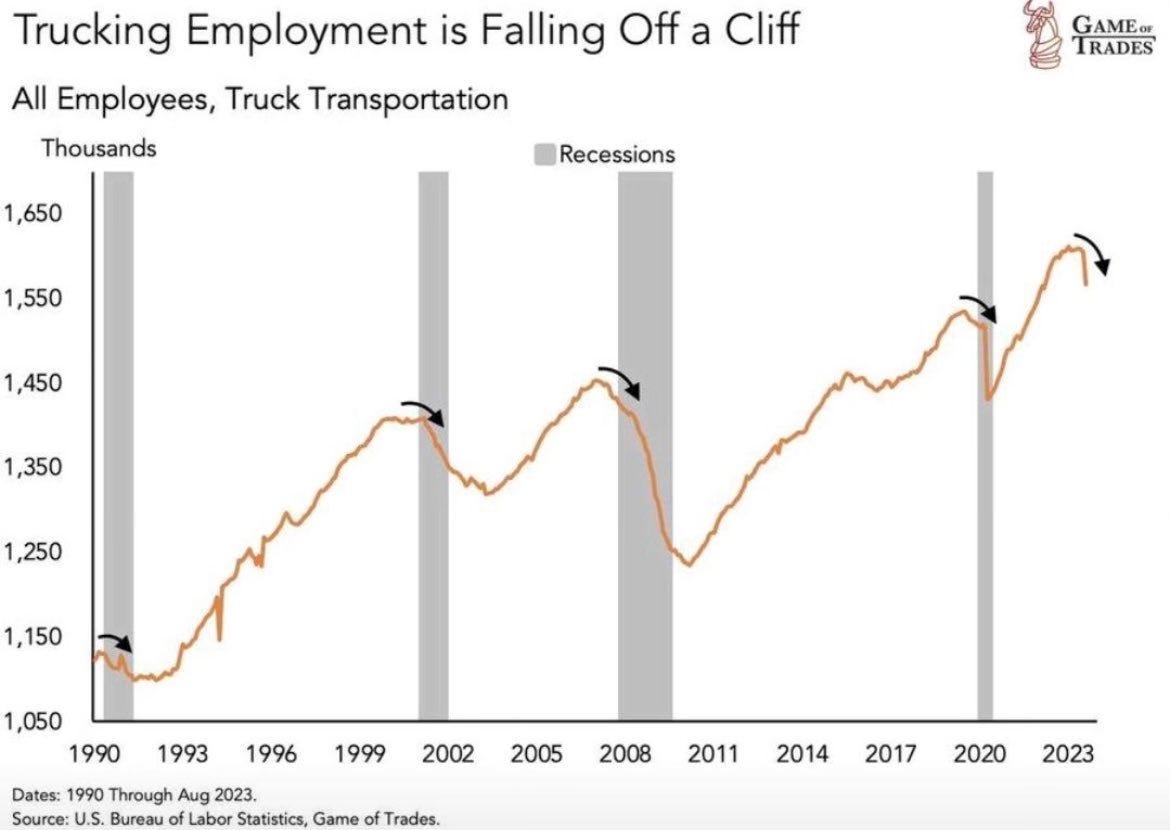

Employment among trucking is declining, at a rate reminiscent of trends seen in previous recessions:

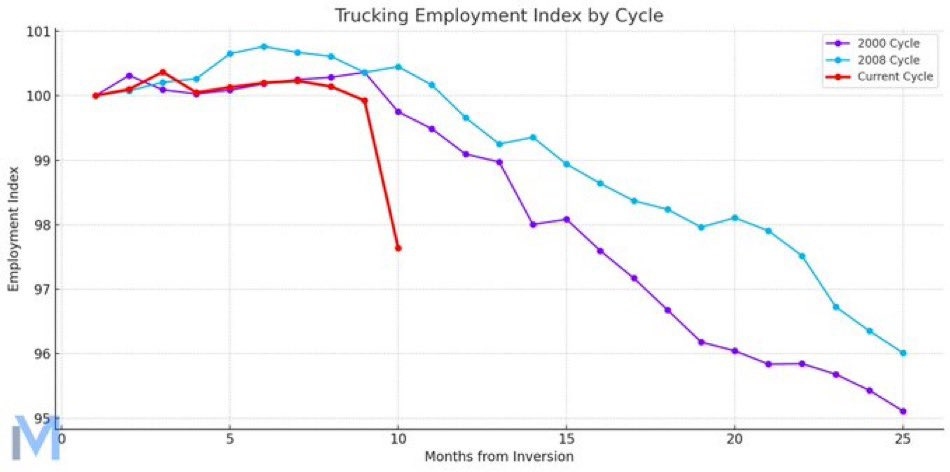

On closer examination, the decline is even more pronounced than in previous pre-recession periods:

If this rise in unemployment in the transport sector spreads to the rest of the economy, it is likely that the Fed will be prompted to pause or even initiate a rate cut to soften the blow of the coming economic slowdown.

This hope of a "pivot" by the Fed curbed the appreciation of the dollar, which had just broken an all-time record against the yen.

Tuesday's decline was the greenback's most significant since the beginning of the year:

The dollar's depreciation is benefiting the price of gold, which is once again closing in on its resistance at $2,000, a breakthrough of this barrier being necessary to confirm a breakout.

The rise in silver prices is also notable at the start of this week. In the short term, the positioning of futures market participants is more favorable to silver than to gold.

Silver is also heading for major resistance at $24:

To trigger the next rise in precious metals and put a definitive end to the long consolidation phase that began in the summer of 2020, gold and silver need to break decisively through their respective resistances.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.