Is the inflation peak behind us?

The German Consumer Price Index (CPI) has finally come down from the previous month... but it remains at very high levels: +10% compared to last year.

Energy costs are not falling enough to bring the (still too high) inflation figure down significantly.

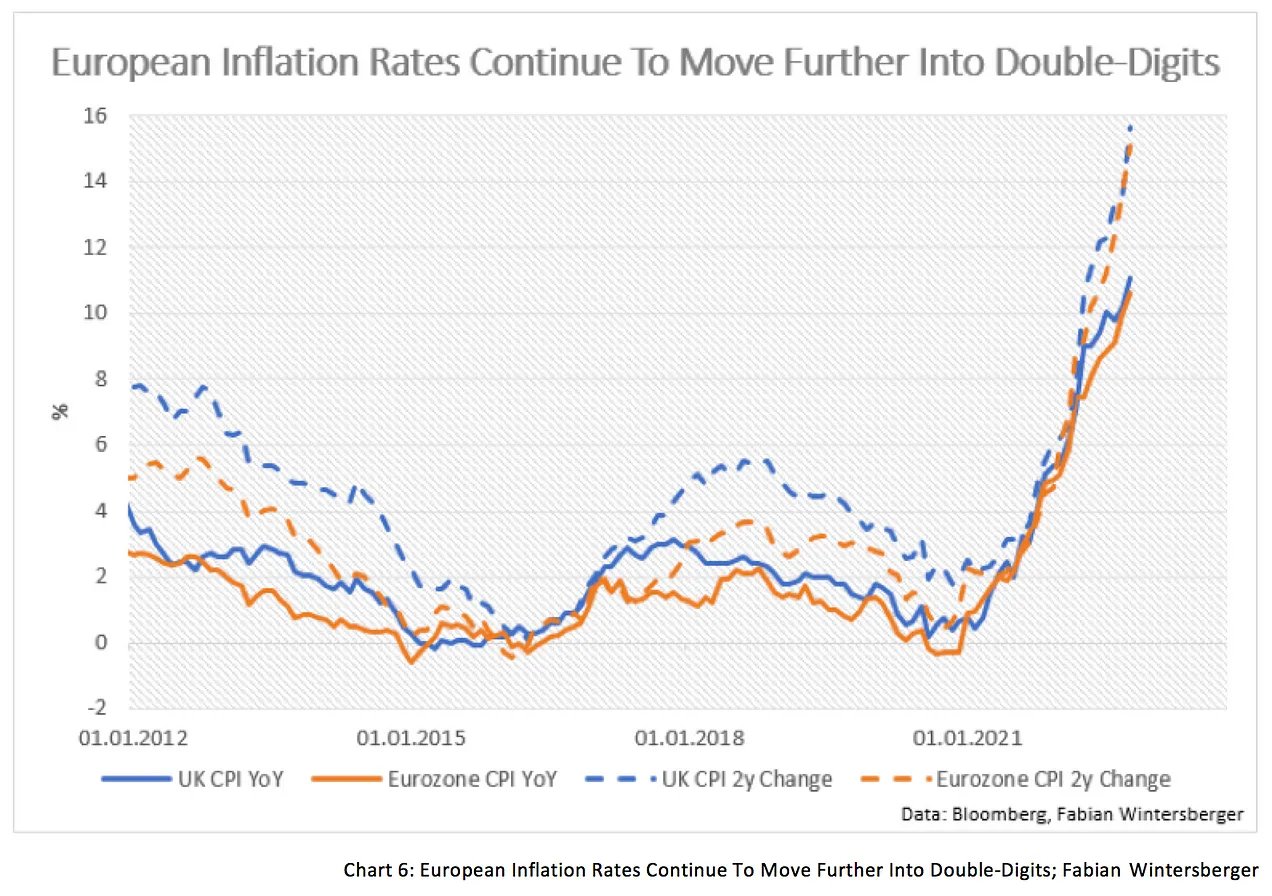

Inflation continues to surge in Europe, with consumer price indices in double digits.

In two years, the inflationary wave has already destroyed 15% of purchasing power on the Old Continent.

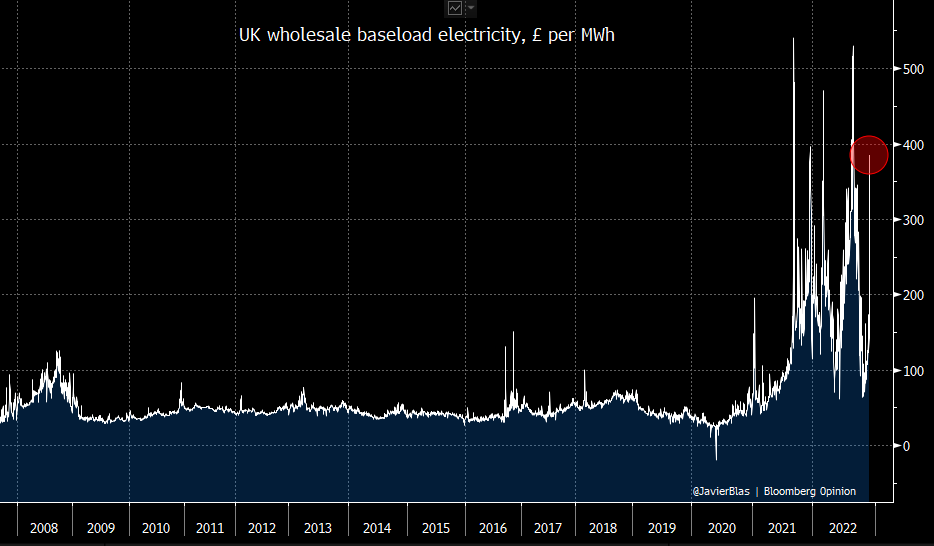

The price of electricity is even rising again: in the United Kingdom, the price per MwH is once again over 400 pounds:

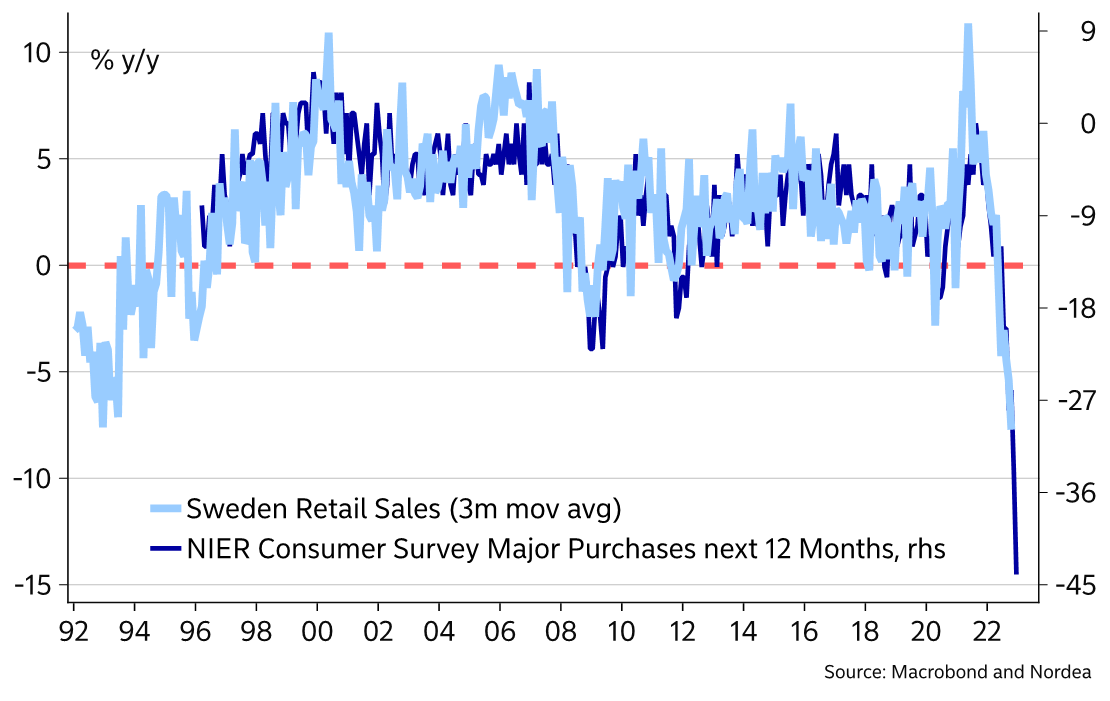

Excessive energy prices are beginning to have a clear impact on consumption and on European industrial competitiveness. In Sweden, consumer confidence is at an all-time low, while retail sales recorded their largest monthly decline:

But it is the future of European industry that worries business leaders.

Joe Biden's stimulus plan (Inflation Reduction Act - IRA) to reindustrialize the country gives the United States a clear competitive advantage over a deteriorating European industry. In many European countries, the question of relocating energy-intensive factories is becoming increasingly important.

The US is less affected by the surge in energy costs and the peak of inflation seems to have passed since September.

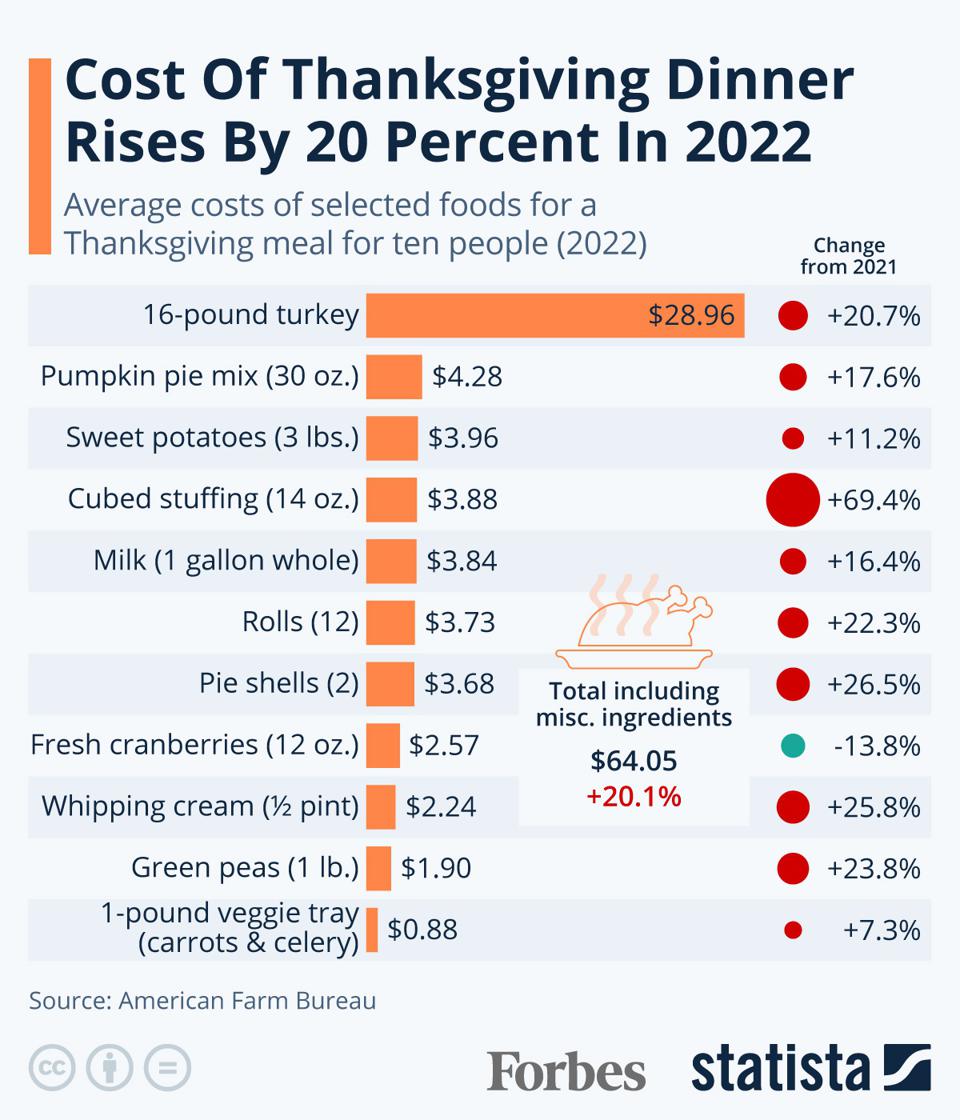

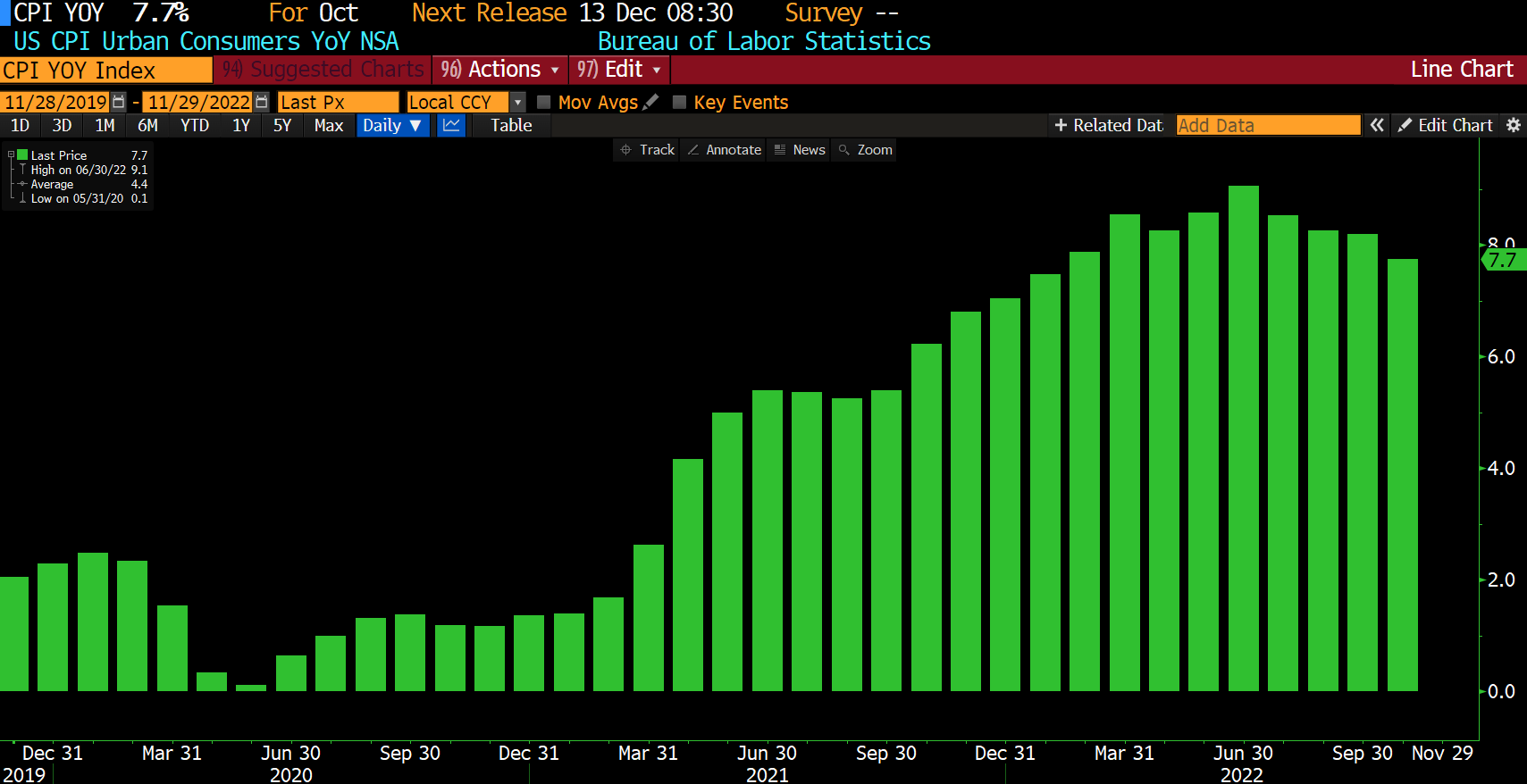

On the other hand, the U.S. CPI remains far too high (+7.7%) to signal the end of the inflationary wave. For example, the price of Thanksgiving dinner has increased by 20% compared to last year:

But the ebb in the monthly CPI increase suggests that the peak of this wave has been passed:

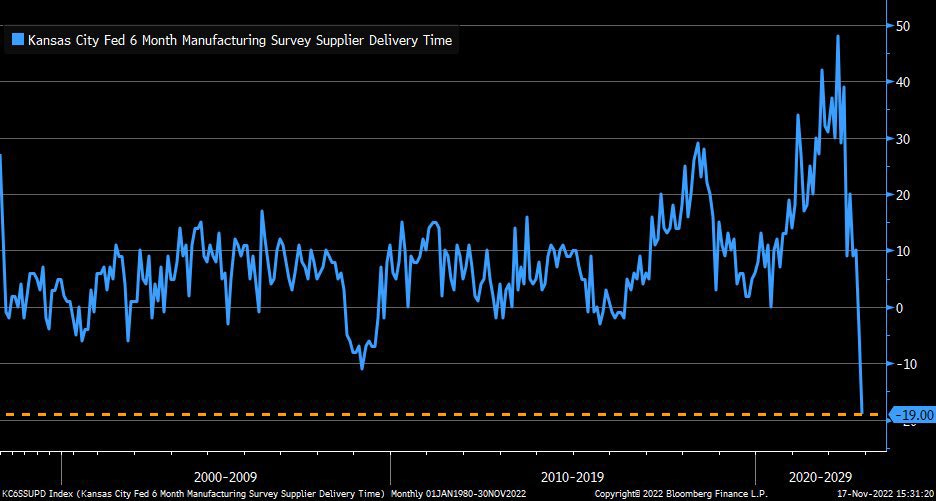

The supply chain bottleneck has even been completely resolved. Delivery times are at an all-time low. The U.S. has gone from a bottleneck to an inventory flow problem in just a few months.

However, signs of an economic slowdown are starting to show in the country.

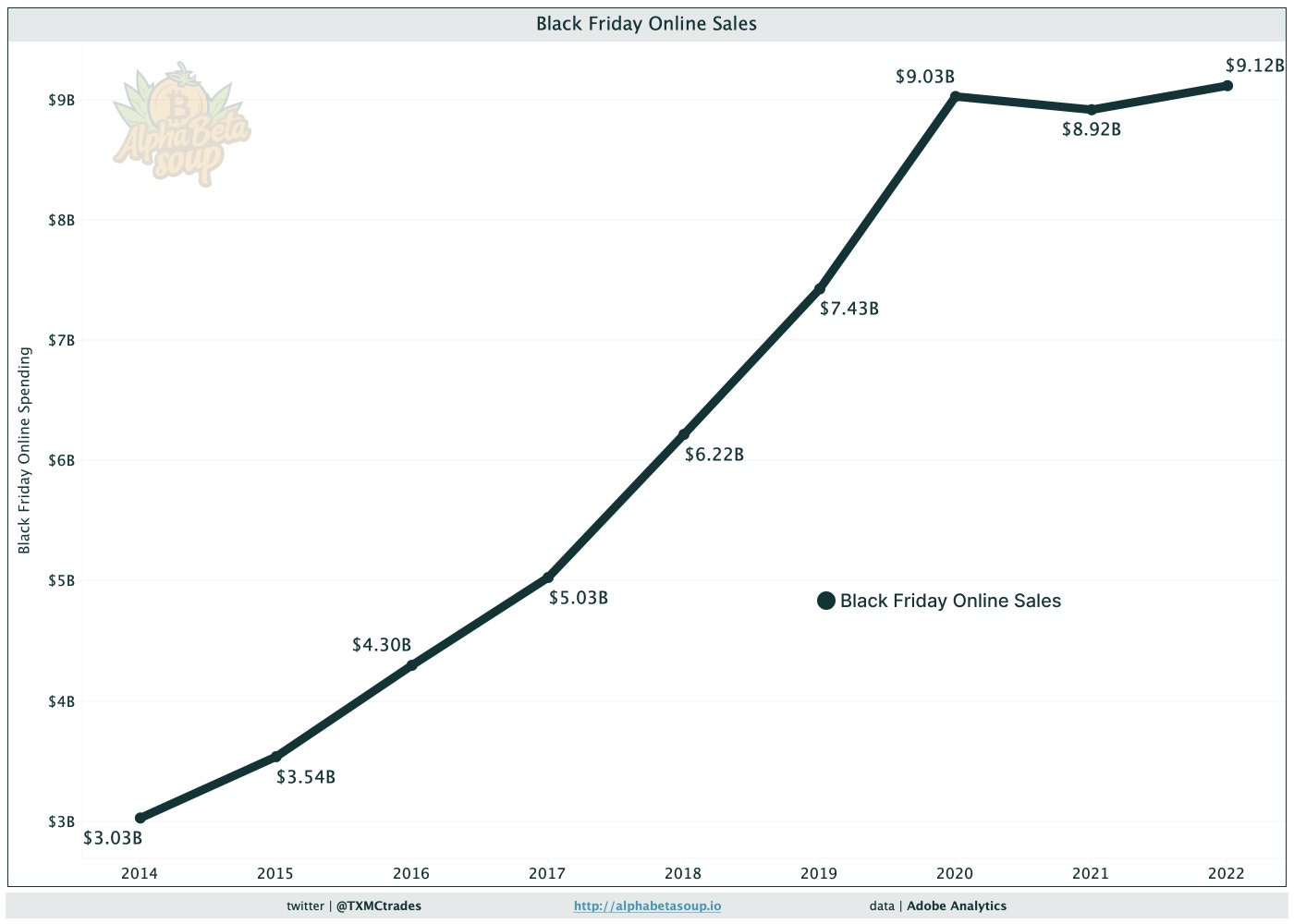

Online sales for Black Friday marked a new record, but these numbers mask the "plateau" phenomenon of sales for two years now:

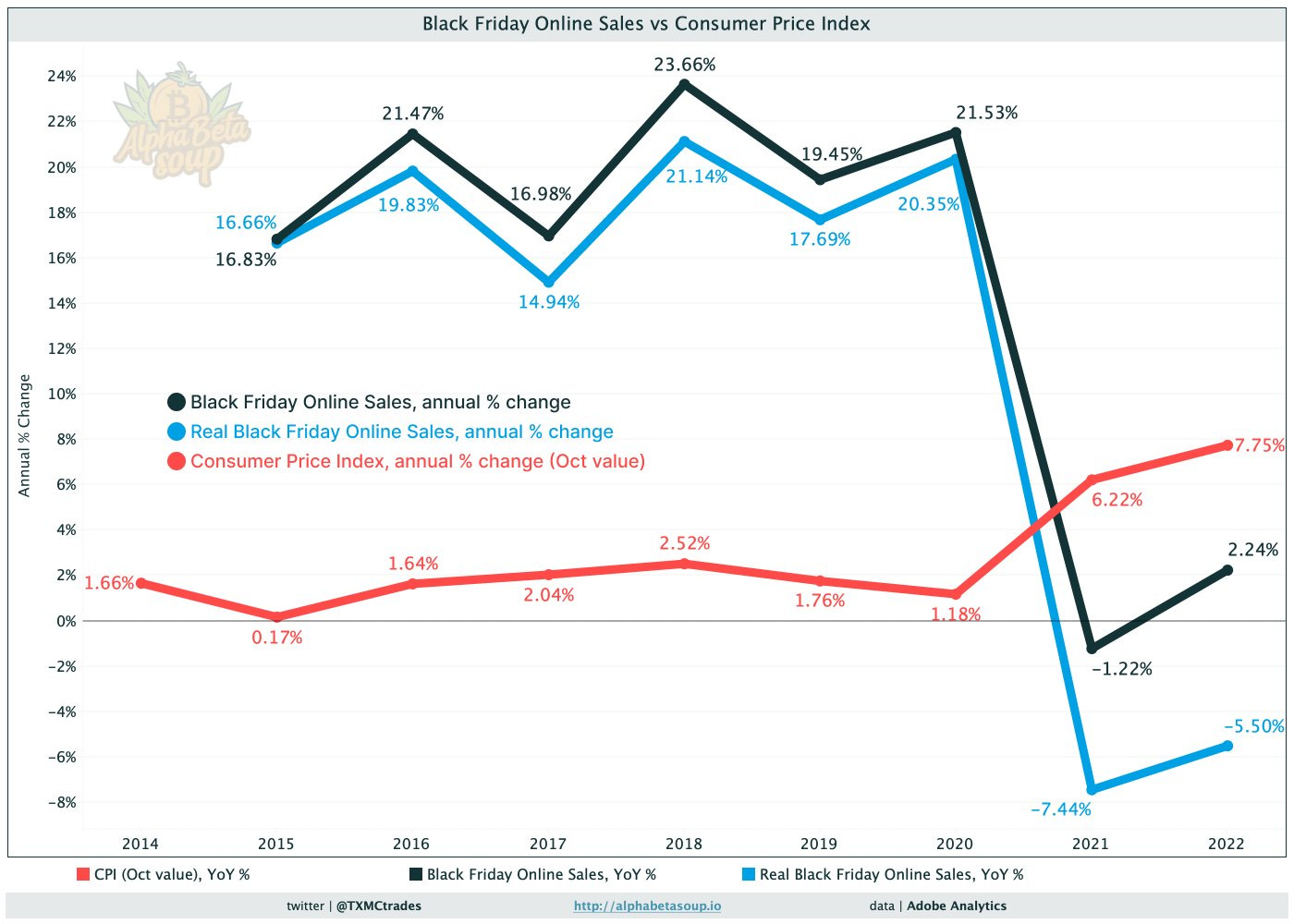

In real terms, Black Friday sales are even still very depressed compared to before Covid:

The impact of inflation and rising interest rates limited the recovery in real sales on a traditionally busy weekend in the US.

The drop in demand is there, but it is not yet a recession, even though most economic indicators are forecasting a recession as early as 2023.

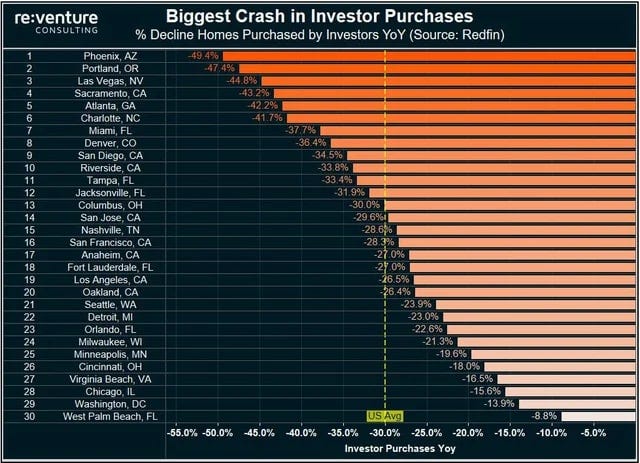

The recession is already underway in the real estate sector, where sales volumes have plummeted in most regions:

This housing collapse has not yet affected retail sales. For the time being, the Fed can congratulate itself for creating a simple economic slowdown. It has managed to contain the decline in demand without it turning into a recession.

To produce this slowdown, the central bank has not only raised rates very sharply in recent months, but has also begun to reduce its balance sheet:

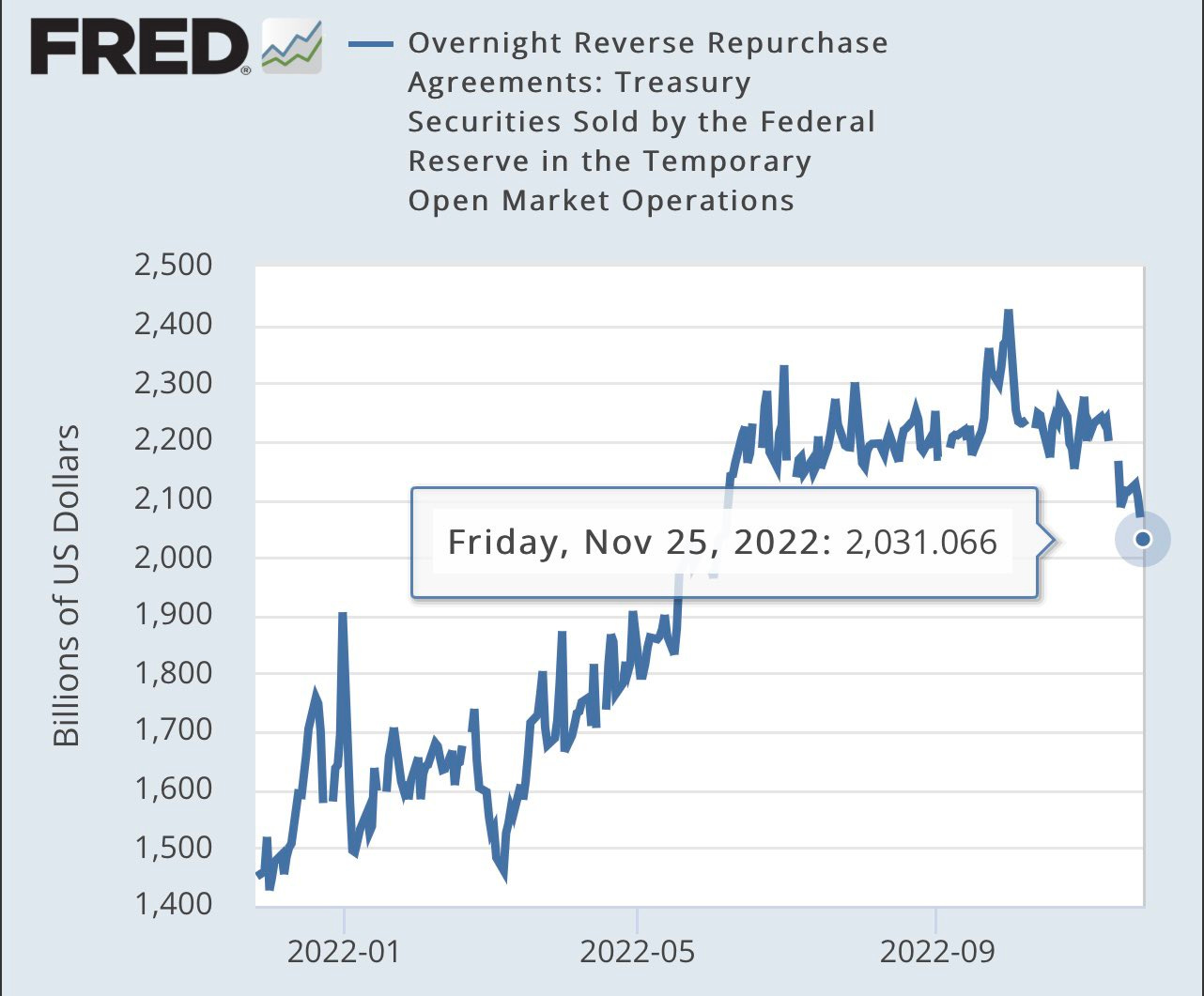

The Fed is withdrawing liquidity from the market, while trying to prevent its restrictive policy from triggering a liquidity crisis in the banking sector. Fortunately, the Fed's Reverse Repo program has allowed banks to tap into a cash reserve that was designed for just such a time.

So far, more than $400 billion have been drawn from this reserve to meet liquidity needs in the banking market:

The Fed's "pivot" will come when a real liquidity crisis linked to this restrictive policy affects the banking sector. There is obviously still room for improvement, which should disappoint all investors who are waiting for the Fed to change direction and slow down its rate hikes.

As a result, markets are likely to remain under pressure in the near term.

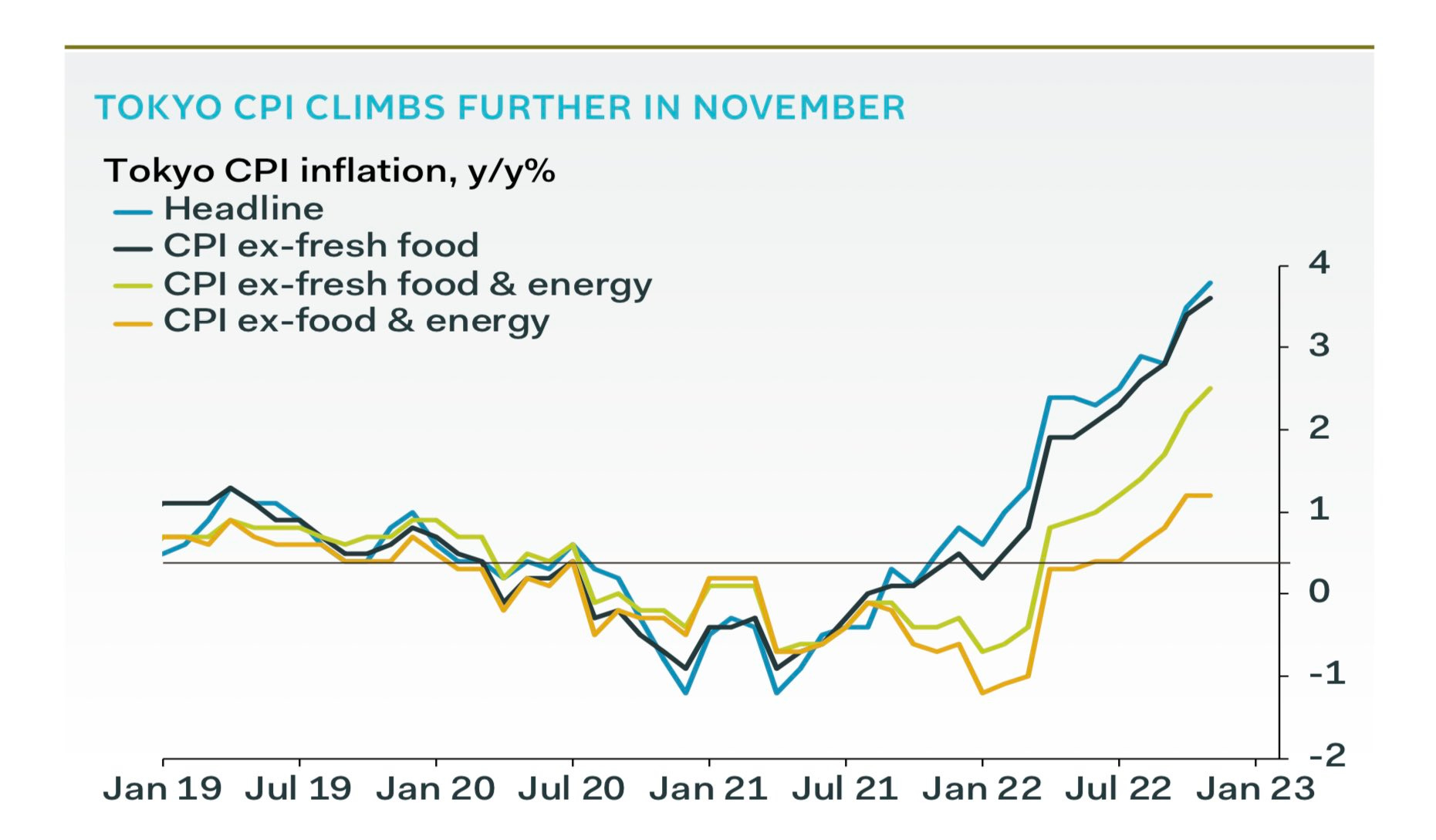

This environment is supportive of the dollar and continues to export inflation outside the U.S., especially to countries whose monetary policy is the opposite of the Fed. This is the case of the Japanese central bank, which continues to increase its balance sheet by buying Japanese government bonds and leaving its rates on the floor.

This divergence in monetary policy between Japan and the U.S. is driving inflation up at a rate not seen since the 1980s:

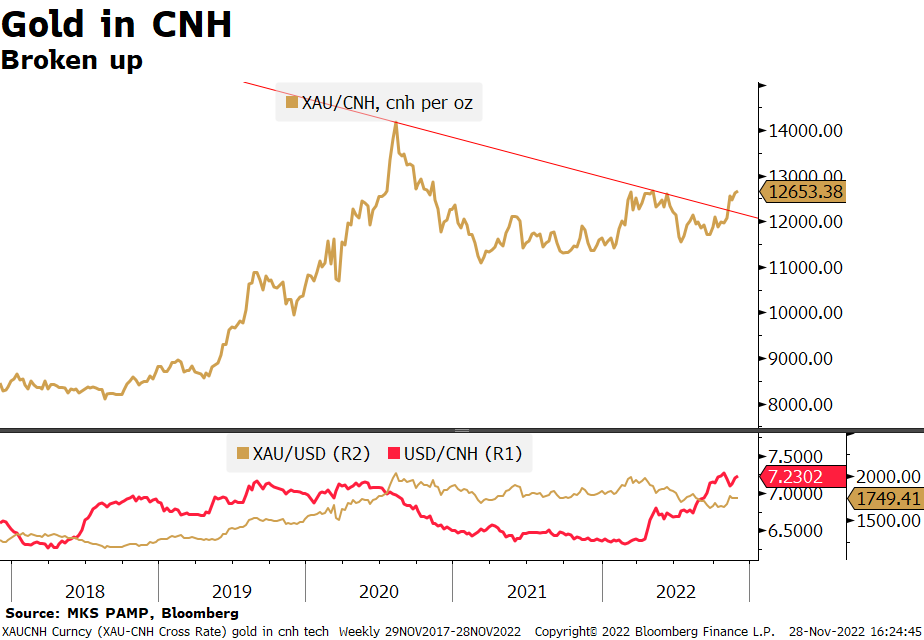

China is also more inclined to relax its monetary and fiscal policies. The fall in the real estate sector, strict health restrictions and demonstrations against the Beijing regime are having a negative effect on activity, forcing the country to put in place a stimulus plan, initially dedicated to the real estate sector. In a tense social context, further fiscal and monetary easing is to be expected, which will undoubtedly import a little more inflation into the country.

Under these conditions, it is logical to see the price of gold in yuan break its two-year resistance, despite a dollar at its highest level against the Chinese currency.

As the year draws to a close, gold is becoming increasingly resistant to the strength of the greenback.

The strength of the yellow metal is undoubtedly due to the mix of risk situations that have fueled the year 2022 and that will not be resolved without painfully impacting currency prices.

There are eight risks:

- The resumption of inflation in Japan.

- Rising social tensions in China.

- The continuing energy crisis in Europe.

- The fall of the real estate sector, in China, and soon in the United States.

- The consequences of the bond crash in 2022.

- The critical situation of physical stocks and the risks of dysfunction of the derivative markets associated with these metals, precisely because of this shortage (this tension affects the whole sector of metals, precious or not).

- The risk of a liquidity crisis in the banking sector, especially in Europe.

- The risk, more recently, of contagion of bankruptcies of crypto-currency exchange platforms.

These risks have been discussed at length in my previous articles and provide reasons to buy physical gold to protect yourself in the current uncertain environment.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.