At the end of its meeting on Wednesday, the Fed kept its key rates between 5.25% and 5.50% for the third time in a row. The market is now anticipating a clear monetary policy pivot in 2024.

The downward trend on the TNX was broken last week, and the MACD reversal failed to materialize:

The Fed hints at several interest rate cuts in 2024.

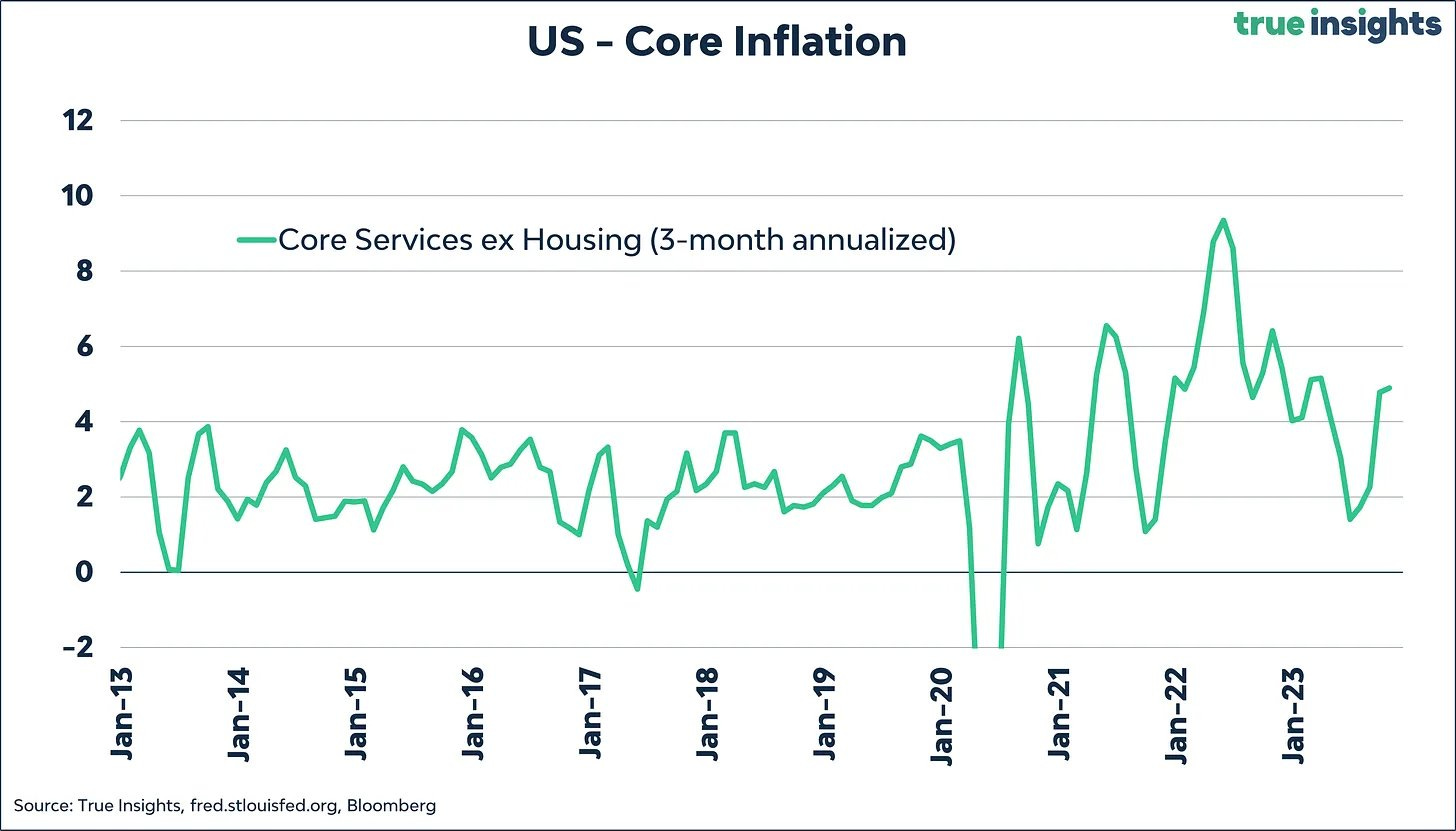

This change of perception on rates comes at a time when inflation persists at high levels.

In fact, one of the Fed's most closely watched indicators is on the rise again.

Core services, excluding housing inflation, rose by 0.44% month-on-month to an alarming 5.3% annualized. This far exceeds the overall rate of 3.1% and represents more than 2.5 times the Fed's inflation target.

The upturn in this indicator shows the extent to which inflation remains an enduring phenomenon that monetary authorities will find very difficult to tackle.

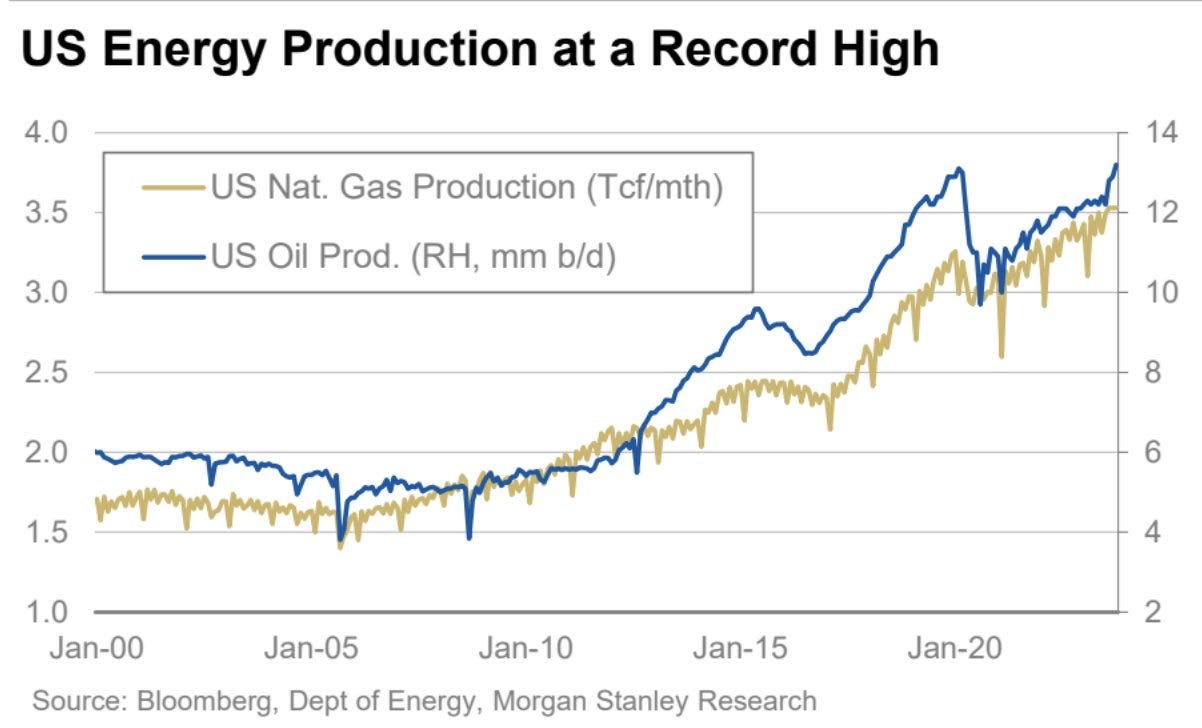

Despite a significant fall in inflation thanks to lower oil prices, some sectors of the US economy are still facing very substantial price rises compared with the previous year.

Record oil production in the USA is one of the factors contributing to the recent fall in oil prices in recent weeks:

Prices retreated to a key support level before rebounding during the session, in response to the Fed's speech:

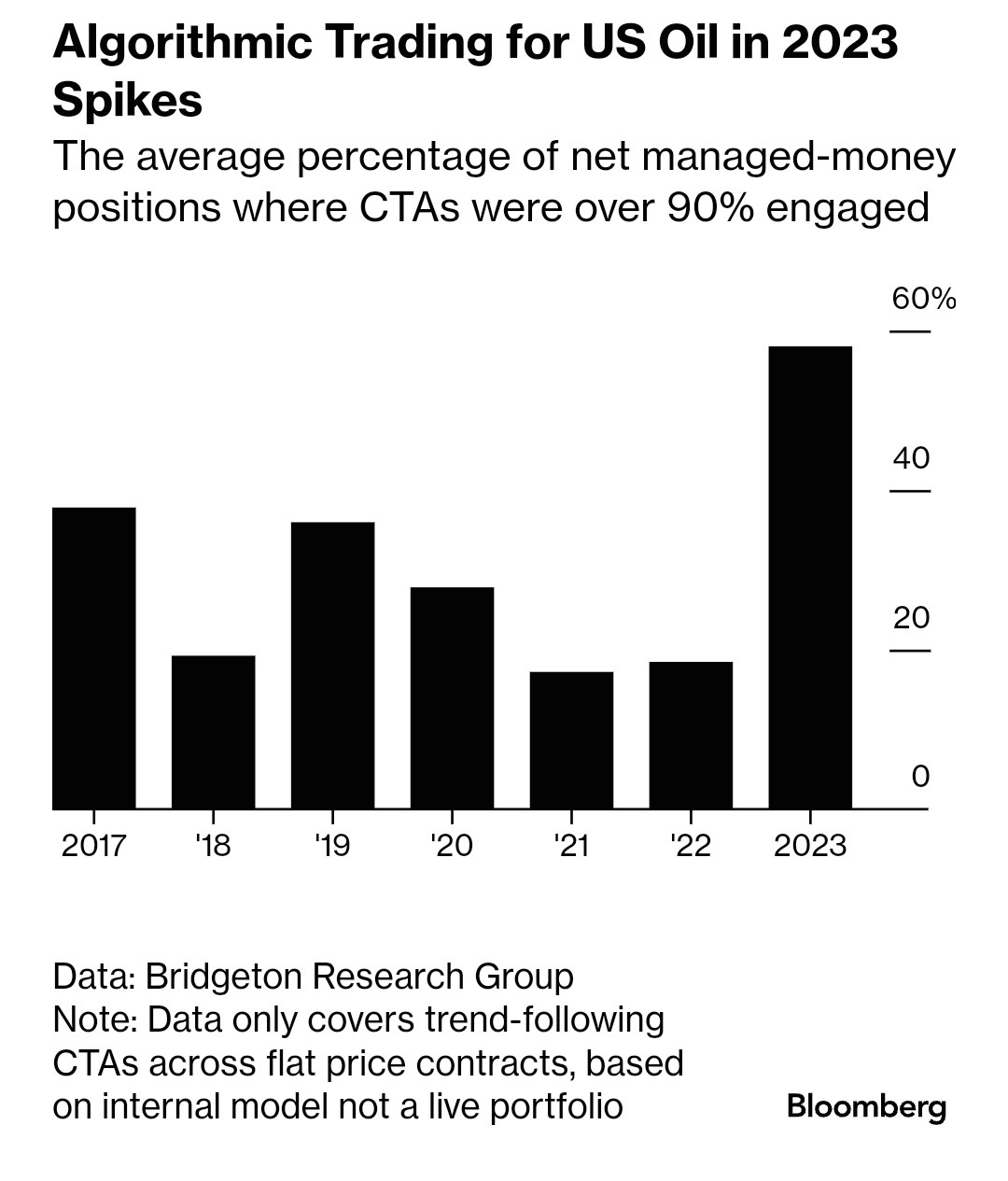

Volatility on oil markets is amplified by a significant increase in the number of contracts traded: the oil market is attracting more and more speculators, who are taking increasingly large positions on derivatives markets.

As is often the case with commodities, the expansion of the paper market is increasing short-term volatility.

In the event of a recovery in oil prices, the recent falls in food inflation levels seen in recent weeks could come to an abrupt halt.

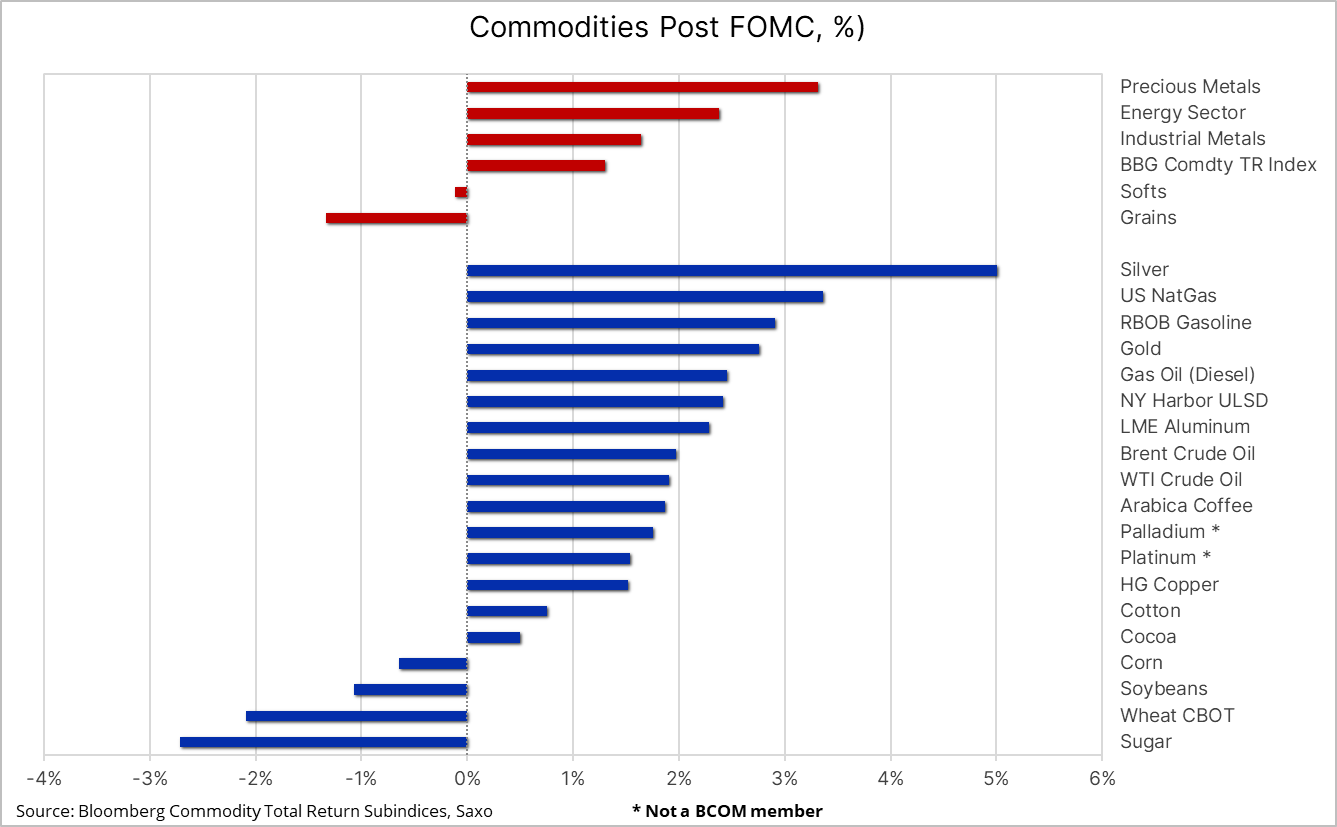

Some commodities have completed their correction period and are entering a new uptrend, anticipating a new cycle of increases.

This is the case for coffee:

Cocoa continues to soar, up nearly 75% since the beginning of the year:

In the metals sector, copper is back in the spotlight:

In the wake of the Fed's speech, virtually all commodities reacted to the fall in the dollar, with silver showing the strongest reaction:

Could the Fed's easing signal rekindle inflation at a time when the first wave of inflation persists in several sectors of the economy?

In fact, the latest Consumer Price Index (CPI) figures hold a few surprises in store.

Car insurance has risen by +19.2%, transport costs have risen by a further +10.1%, and car repair costs are up by 8.5%.

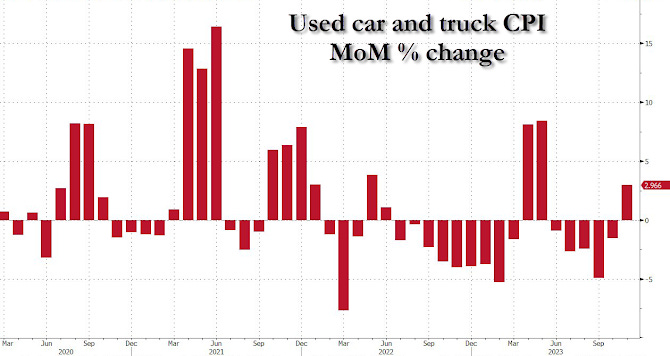

The used car sector also saw a further increase in prices:

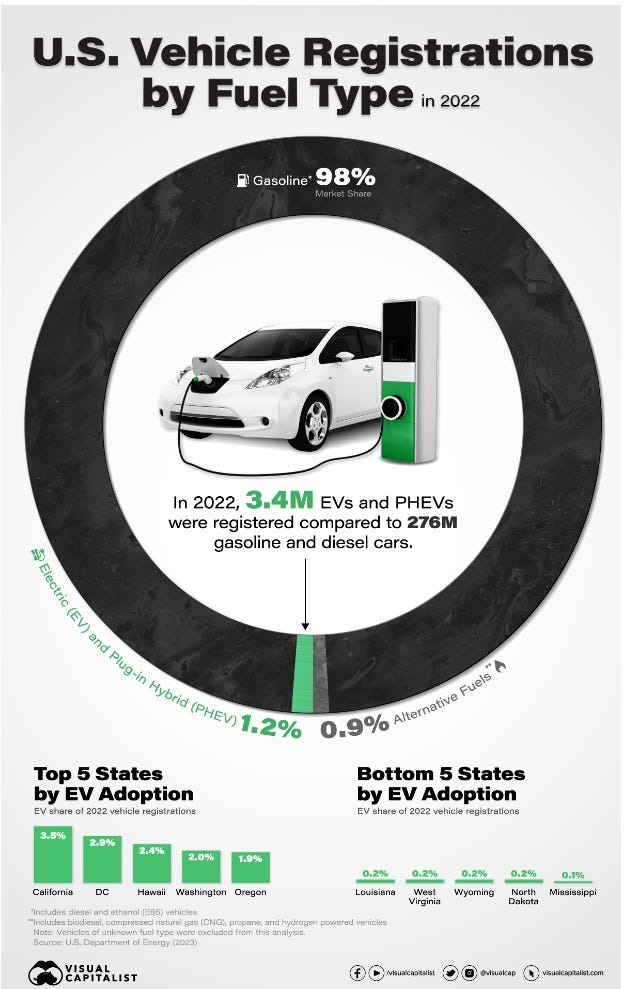

These figures must be put into perspective with the low entry rate of electric vehicles on the American market:

The market for new electric vehicles is not generating the same enthusiasm as in China or certain European countries, which could explain the recovery of the used car market in the USA.

Another sector of the US economy affected by persistently high inflation is residential rents, which rose by +6.9% this month.

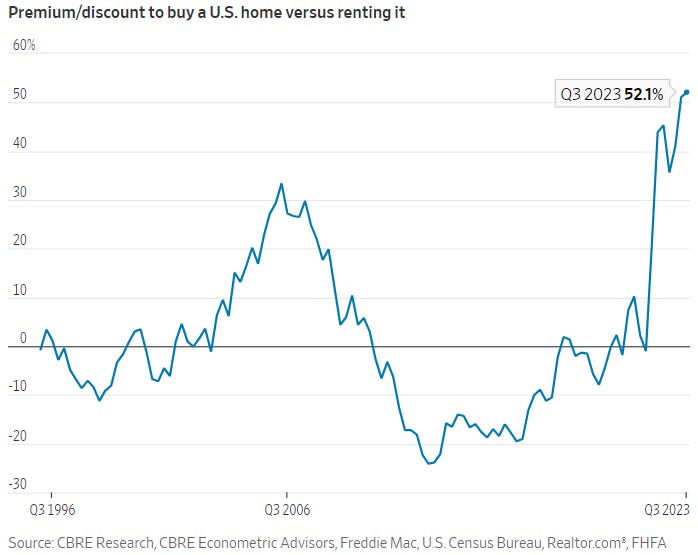

Rents in the US remain high, as the cost of buying a home is much higher in comparison. It is 52% more expensive to buy a home than to rent one in the United States:

With figures like these, it's no surprise that rent levels remain very high across the country.

The Fed's change of tone and the hope of a significant pivot come as certain sectors continue to face substantial inflationary pressure.

Yet the Fed's rhetoric has changed radically in the space of fifteen days. Jerome Powell's more conciliatory stance has led to a further fall in the dollar. This weakening greenback could further reinforce persistent inflationary pressures in many sectors of the economy.

In any case, the gold market is reacting to this new signal from the Fed.

The brief passage of the price of gold support was short-lived. After a sharp correction of around $100 in the space of a few hours during the night of Sunday, December 3 to Monday, December 4, gold rebounded by $50 in the minutes following Jerome Powell's speech on Wednesday, December 13:

The Fed's change of tone offers a different outlook for precious metals: with the dollar falling, fears of recession, lower rates and the threat of renewed inflation that a Fed pivot would bring, gold has every chance of resuming its upward trend as early as next year.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.