The latest U.S. inflation figures are well above predictions. The consumer price index (CPI) rose by +3.7% year-on-year in December, a figure three times higher than the previous month. Inflation appears to be accelerating, exceeding the pace recorded at the same time last year.

The "Core CPI" data, which exclude food and energy, are even more worrying. The annual increase stands at +3.8%, up +0.5% on the previous month.

The "Super core CPI", which excludes housing costs from the Core CPI, reached an even higher level, standing at almost +5% annualized for the month of December.

How could inflation take off again so suddenly after such an historic tightening - in terms of speed and amplitude - of rates by the Fed?

According to economist Daniel Lacalle, it's not so much rates that influence inflation levels, but rather the net liquidity present on the markets.

Last June I wrote in my article that higher rates would not solve the problem of inflation: high-income earners benefit from high yields, preserving their purchasing power despite rising prices.

"The Fed's rate hikes are having a direct impact on the financial services component, which is increasingly weighing on inflation figures! Raising rates to fight inflation is now fuelling that inflation."

The rate hike failed to bring inflation down, as the "pumping" of liquidity into the system was maintained and even increased.

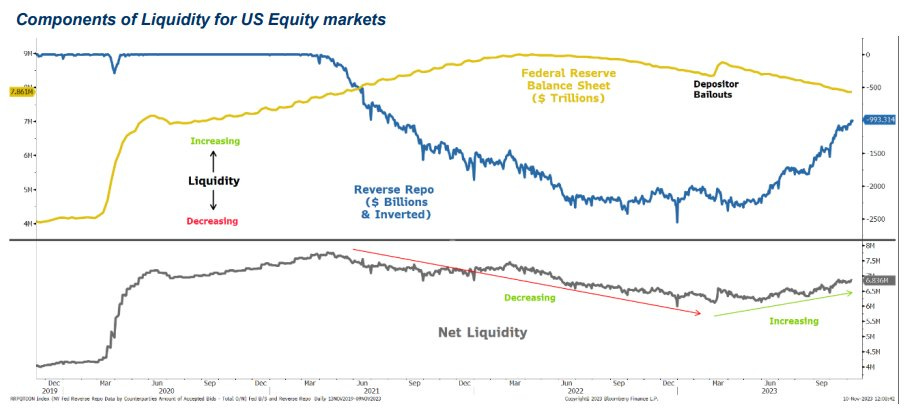

Even though the Fed's balance sheet is also shrinking as a result of the rate cut, banks have been able to draw on Reverse Repo reserves, leading to an increase in net liquidity since the start of 2023. The measures taken by the Fed following the collapse of Silicon Valley Bank have also given the banking sector privileged access to liquidity:

This liquidity has encouraged "reflation", which is responsible for maintaining consumption and access to credit in the country. It helped to sustain strong demand, leading to a faster than expected return to inflation.

Another factor to be taken into account in explaining the return of inflation is the support provided by public procurement.

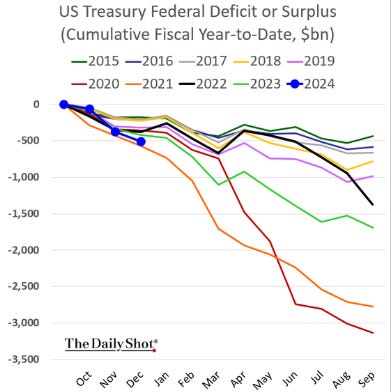

The U.S. Treasury has just released a record figure for the December deficit: with $130 billion in a single month, the U.S. begins fiscal 2024 on the same trajectory as at the height of the Covid crisis. Before the Covid-19 pandemic, a difficult December resulted in a $20 billion deficit. It's clear that the U.S. budget has gone completely off the rails in recent years:

Although the Covid era is behind us, massive government support for the US economy has never ceased, and the deficit continues to grow. In these conditions, the return of inflation is hardly surprising.

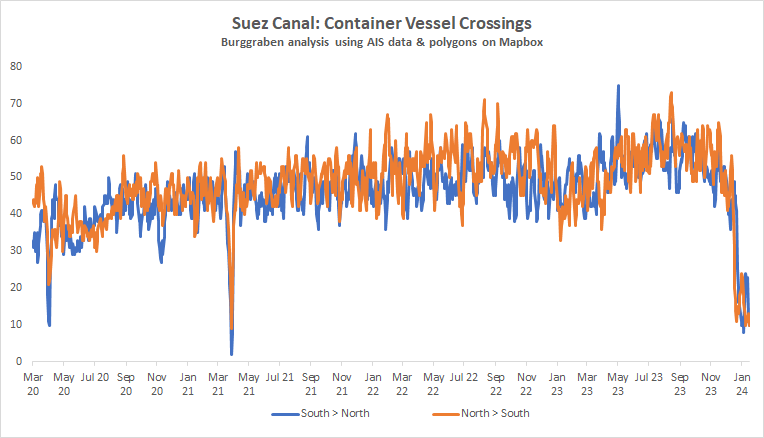

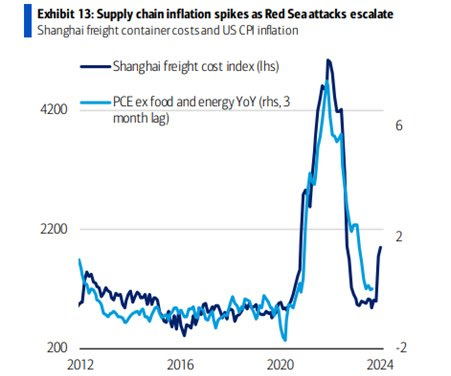

An additional factor is contributing to the acceleration of inflation at the start of this year: geopolitical tensions in the Red Sea are once again disrupting the supply chain from Asian ports.

With cargo ships unable to transit through the Suez Canal, the route between Asia and Europe now takes a much longer route. Virtually no containers pass through the Suez Canal today:

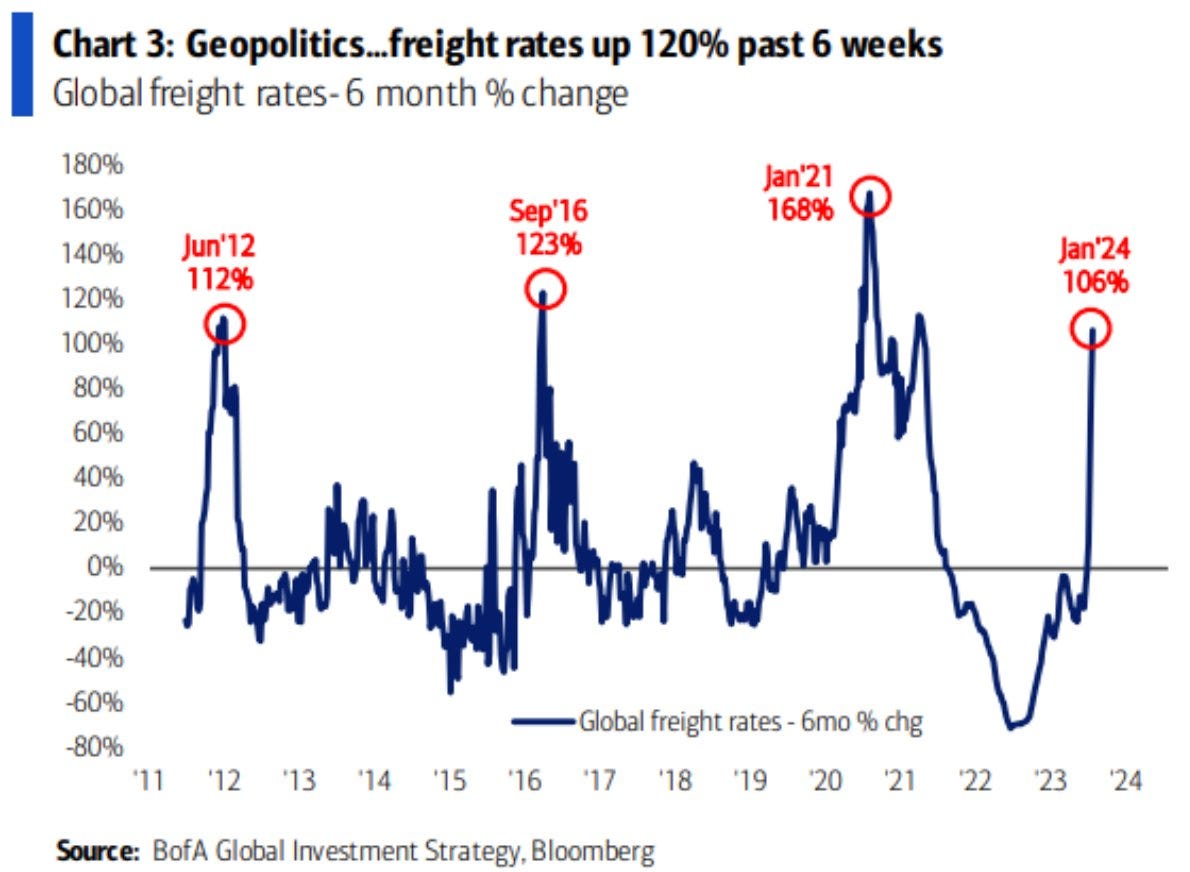

These tensions have led to a dramatic increase in shipping costs:

Increases in shipping costs are closely linked to the PCE index excluding food and energy, which measures core inflation. This indicator, which is closely scrutinized by the Fed, does not look set to fall in the coming weeks:

This resurgence in inflation comes at a time when some commodity markets remain under pressure.

For example, cocoa prices are currently at a 46-year high due to supply concerns:

Overall, the market does not seem to be taking on board the risk of supply disruptions in raw materials. Yet this risk is one of the key factors that could radically alter the inflation picture.

It is extremely difficult to anticipate these future shortages.

The resurgence of inflation will certainly complicate the Fed's task when it comes to making the decision the markets have been anticipating for several weeks: stock market performance is explained exclusively by the Fed's promise of a rate cut.

The long-awaited pivot is the factor that is keeping the markets at such a high level, pushing back the fear of facing the potentially high cost of refinancing public and private debt, currently impossible to refinance with such rates.

The uncertainty created by this new inflationary upturn, which could lead to higher US rates for longer than expected, has rekindled speculation on the level of the dollar.

The US currency has already recovered almost half of the decline seen just after the last Fed meeting:

The dollar remains at high levels and gold is still holding up at around $2,000.

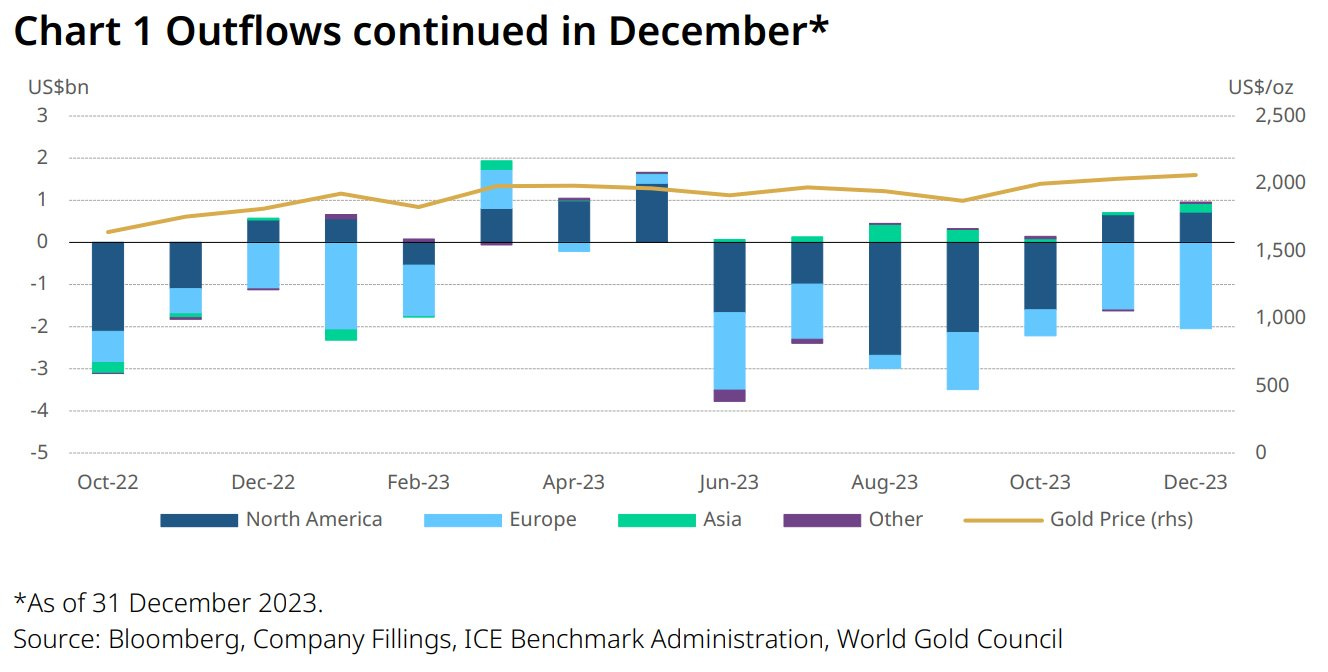

This is all the more remarkable given seven consecutive months of outflows from gold-linked ETFs:

Paper gold is being sold off, especially in Europe, but the purchase of physical gold persists and continues to support gold prices.

The relative stability of the dollar at a time when the greenback is rebounding vigorously logically boosts the yen gold price:

The chart of gold in Japanese currency (JPY) is spectacular:

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.